[[[ Few words from the Editor-in-chief:

Thank you for your patience with regard to our Stock Trading Alerts. I’m thrilled to announce that they are back, and I’m excited to announce that starting today, our Stock Trading Alerts have a new author – my fellow CFA Charterholder from Canada, Matthew Levy, CFA. Matthew has extensive experience with the stock market, and I’m very happy that he joined our analytical team. Thank you for your patience once again.

Sincerely,

Przemyslaw Radomski, CFA ]]]

Dear Subscribers,

My name is Matthew Levy and I’d like to welcome you to my new Stock Trading Alerts newsletter. A few words about me - after graduating with a Bachelor of Science in Economics from the University of Victoria in 2010, I developed a passion for helping clients meet their financial freedom through strong, risk-adjusted portfolios. Formerly, I was responsible for managing and co-managing over $600MM in cumulative assets for private households and institutions. I also undertook and completed my CFA® charter in 2015, a rigorous professional credential program promoting the highest standards of education, ethics, and professional excellence in the investment profession.

One of the many things I aim to accomplish with my newsletter is to help you personally navigate financial markets the way a professional would, by offering general market overviews over different time frames, leading and lagging sectors within the market, and (hopefully) captivating macroeconomic updates as necessary. Please feel free to reach out with any specific questions or updates you would like to see in future newsletters. I’m working for you and I look forward to helping you on your investment journey. Check out my full bio as well and – again – I encourage you to send me a message if you have any questions!

You will find today’s analysis below:

Markets rallied last Friday in a post-Thanksgiving shortened trading day.

The Dow Jones closed higher by 37.90 points, or 0.13% at 29,910.37. The S&P 500 notched another record closing high and gained 0.24%, while The Nasdaq also closed at a record high and advanced 0.92%. The small-cap Russell 2000 also rose another .56%.

Although the Dow did not end the week above 30,000 after piercing past that level for the first time ever on Tuesday (Nov 24), markets performed strongly last week and continued November’s surge. For the week, The Dow and S&P 500 rose 2.2% and 2.3%, respectively, while The Nasdaq gained nearly 3%. The small-cap Russell 2000 once again led the way and gained nearly 4%.

For the month, there has been euphoria and bullish mania consuming the markets due to political clarity after a bitter election, as well as positive vaccine data from three separate candidates. The Dow is up 12.9% in November to Friday's close, and on track for its biggest monthly gain since January 1987. The S&P 500 and Nasdaq are also up 11.3% and 11.9%, respectively. The small-cap Russell 2000, however, has led the way and is on track for its best month ever, up about 20%.

However, there are still very real concerns that could cap gains. Initial jobless claims this past week reached their highest level in 5 weeks, and increased to 778K in the week ended November 21st, compared to the previous week’s revised level of 748K. This was also significantly worse than market expectations of 730K. U.S. personal income also unexpectedly fell by 0.7% from a month earlier in October of 2020 compared to flat market expectations. Covid-19 also continues to ravage the country. More than 200,000 COVID-19 cases were reported in the U.S. on Friday alone – an all-time high. When you consider that in early November the U.S. was reporting 100,000 cases a day, this is alarming and as bad as it’s ever been. After Thanksgiving, things could very well take an even harsher turn for the worse.

Because of the short-term tug of war between optimism and reality, it is fairly difficult to proclaim BUY or SELL calls for the near-term future. Rather, in the short-term, I feel more comfortable staying neutral and calling HOLD for broader markets. There will be optimistic days when investors rotate into cyclicals and value stocks.

In the mid-term and long-term however, there is certainly a light at the end of the tunnel. Once this pandemic is finally brought under control and vaccines are mass deployed, volatility will surely stabilize and optimism and relief will permeate the markets. In fact, CNBC personality Jim Cramer said that beating COVID-19 would be like “the end of prohibition.” Stocks that are especially dependent on a rapid recovery and reopening, should thrive.

Short-Term

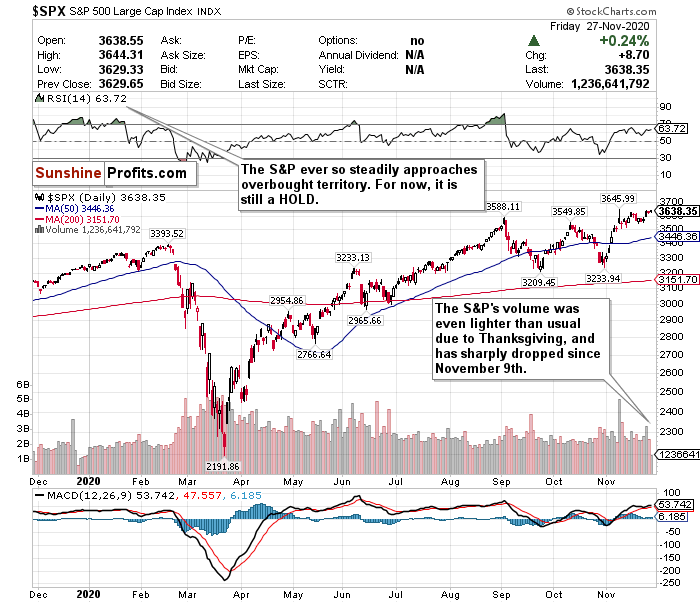

S&P 500

Although the S&P 500 reached another record close, markets continue to wrestle with the negative reality on the ground and optimism for an economic rebound in 2021. While recent developments with several vaccine candidates (most recently AstraZeneca and Oxford University) have been positive, unprecedented surges in COVID-19 cases combined with further economic damage is worrisome. Because of the rapid spread of COVID-19, lockdown measures have been reimposed around the world. Just this past week, many European countries extended lockdowns while in the U.S., Los Angeles reinstituted a 3-week “stay at home order.” This could be very concerning for the S&P. It’s important to remember that there is still no stimulus or concrete plan for economic aid. If the jobless claims from this week show us anything, it’s that this economic recovery has a long way to go before returning to pre-pandemic levels. Fear of a double-dip recession is certainly very legitimate.

In summary:

While there is long-term optimism, there is short-term pessimism. A short-term correction could certainly be on the horizon - especially without fiscal stimulus.

In the S&P chart above, there are several indicators that show that the S&P could face some near-term pain and volatility. While the RSI of 63.72 keeps the S&P in a HOLD category, it has steadily risen throughout this month towards an overbought 70 level.

Pay close attention to the sharp decline in volume as well.

Although volume generally is lighter than usual in the days before and after Thanksgiving, the consistent decline in volume for the S&P has been sharp and swift. This is a red flag.

Low volume, especially a sharp drop in volume, means that there are fewer shares trading. Lower volume also means less liquidity across the index, and an increase in stock price volatility. Therefore, this drop in volume puts some serious doubt on the sustainability of the recent rallies and the S&P’s short-term outlook.

We’re in the early recovery phase of the cycle following the COVID-19 recession, but this rapid rebound is under pressure. A pullback would not be a shock… but another surge based on good news would not be a shock either. Because of uncertainty, a HOLD for the S&P is an appropriate call. For an ETF that attempts to directly correlate with the performance of the S&P, the SPDR S&P ETF (SPY) is a good option.

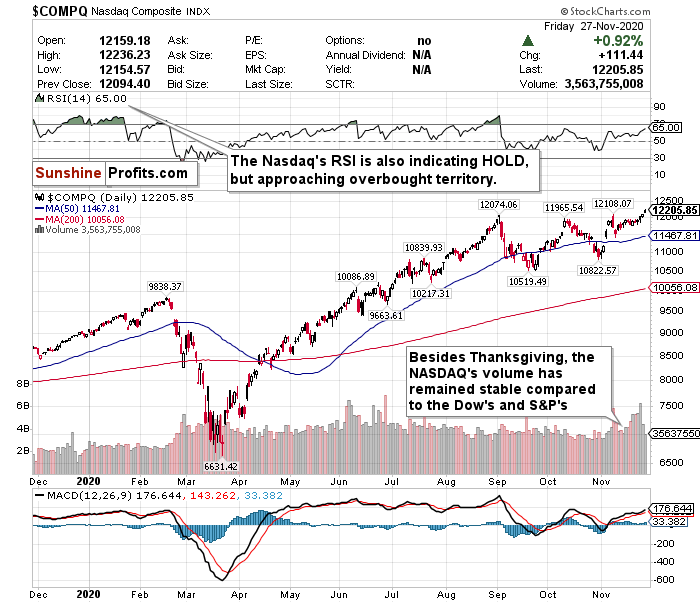

Investors May Be Returning to Tech

Although tech and stay-at-home stocks largely lagged behind cyclicals and value stocks during the initial vaccine rallies, this rotation appears to have stabilized. The NASDAQ outperformed both the Dow and S&P this week, and has now outperformed the S&P in November. COVID-19 winners such as Zoom (+6.29%) performed well on Friday as well. Most importantly, this index has shown more stable volume compared to the Dow and S&P.

On pessimistic days, having NASDAQ exposure is certainly a good thing because of all the “stay-at-home” stocks that trade on the index. However, positive vaccine news always induces the risk of downward pressure on tech names- both on and off the NASDAQ.

Because there is a lot of uncertainty for tech names, the NASDAQ also gets a HOLD call. Its RSI value of 65.00 is even closer to an overbought level than the S&P and Dow, and could jump even further over the course of the next few sessions. For an ETF that attempts to directly correlate with the performance of the NASDAQ, the Invesco QQQ ETF (QQQ) is a good option.

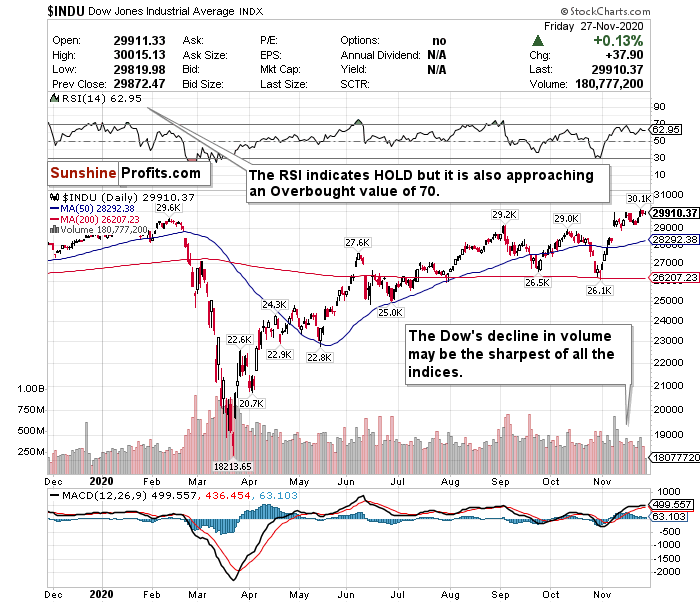

The Dow May Have Overheated

The Dow Jones may be the major index most vulnerable to news and sentiment at this time. Although the call on the Dow is also a HOLD, its RSI is also approaching an overbought level. The Dow’s sharp decline in volume in comparison to the NASDAQ’s also exposes it to more vulnerability and volatility.

Although the Dow did not close the week above 30,000 points, the fact that the Dow has gained nearly 3,700 points in the last month poses some overheating concerns. Especially as COVID-19 is peaking.

Despite the optimistic sentiment and strong vaccine data, the Dow may have short-term downside pressure since it is composed of so many cyclical stocks dependent on a strong economic recovery. For an ETF that attempts to directly correlate with the performance of the Dow, the SPDR Dow Jones ETF (DIA) is a strong option.

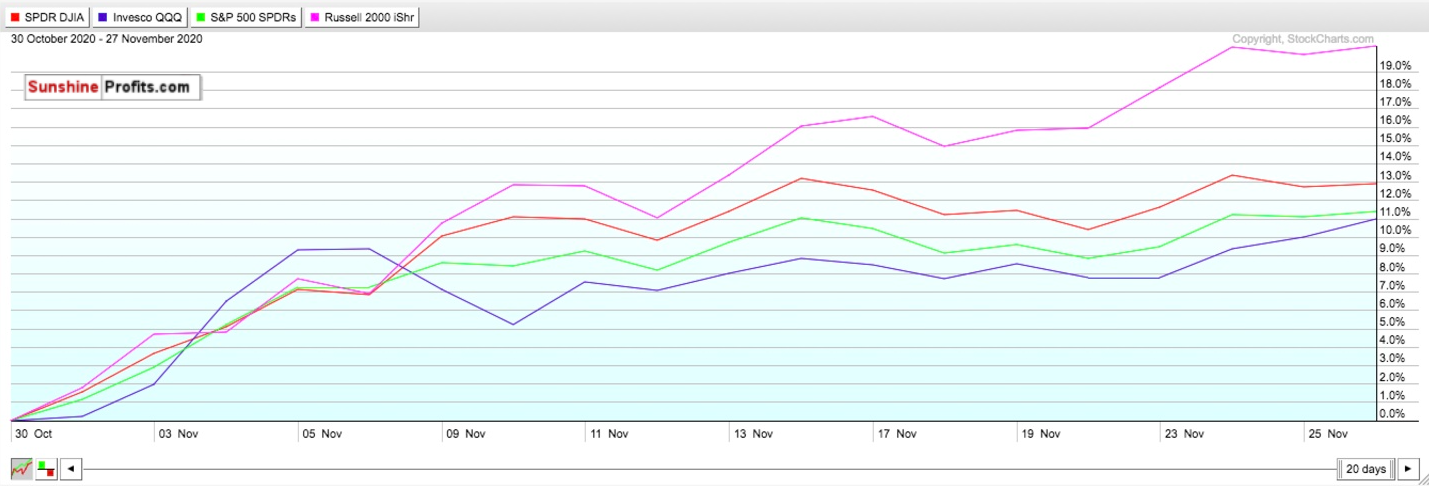

Small-Caps Continue to Outperform

In comparing the ETFs for the indices in the month of November, the iShares Russell 2000 ETF (IWM) has significantly outperformed ETFs tracking the other major indices - the Dow, S&P, and Nasdaq. As mentioned before, the Russell once again outperformed the other indices this week and is up around 20% this month - on pace for its best-ever monthly performance. Much of this can be attributed to the number of cyclical stocks in the index that are dependent on the recovery of the broader economy.

The Russell will surge on optimistic days, and drop more on pessimistic days. In the long-term, small-caps may be the best opportunity to bet on an economic recovery in 2021. However, in the short-term, small-cap stocks may be the most volatile of them all and are a HOLD.

Mid-Term

China Is the Best Bet in Emerging Markets Over the Mid-Term

Investors remain bullish on emerging markets overall, in both the short-term and medium-term. Regarding the short-term, it really depends on the region. China for example, is by far the largest presence in emerging markets indices, however, it has lagged significantly behind other global indices, with the iShares MSCI China ETF returning only 6% this month while the iShares MSCI Emerging Markets ex-China ETF (EMXC) is up nearly 16%.

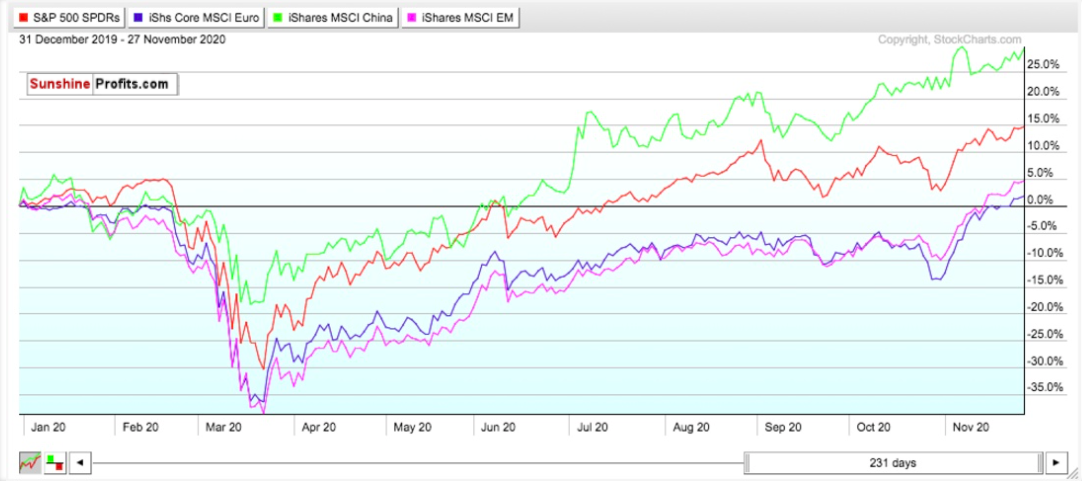

However, the comparison is staggering when looking at the returns from December 31, 2019, to today and comparing the performance of the iShares MSCI China ETF to the iShares MSCI Emerging Markets ex-China ETF, SPDR S&P ETF, and iShares Core Europe ETF. The closest ETF that compares to the China ETF is the SPDR S&P ETF, and the China ETF outperformed that by over 10%. Additionally, the Europe ETF and Emerging Markets ex-China ETF have barely traded above the flat line.

Simply put, China has handled the pandemic better. Because of the country’s size and strength, it’s hard to consider it an emerging market any longer. China and other countries in the region are clearly demonstrating that they were better prepared to handle COVID-19’s economic shocks, and are better prepared to handle this second surge. In fact, China’s GDP has managed to grow from where it was at this point last year - despite its record plunge at the start of the pandemic.

For broad exposure to emerging markets, you will want to BUY the iShares MSCI Emerging Index Fund (EEM), for exposure to China you will want to BUY the iShares MCHI ETF (MCHI), and for exposure to a regional economic power without the geopolitical risks of China, you will want to BUY the iShares MSCI Taiwan ETF (EWT). Consider the iShares MSCI Indonesia ETF (EIDO) as well for another growing regional economy.

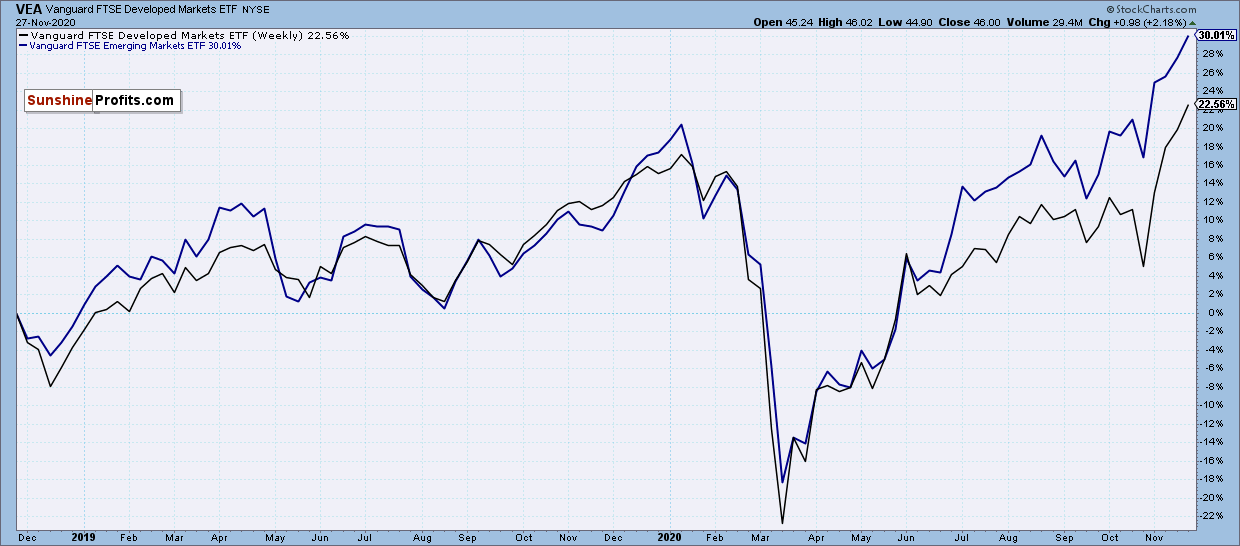

Additionally, since December 2019, the FTSE Emerging Markets Index has outperformed the Developed Markets index by around 8.5%.

….and the Dollar May Have More Room to Fall

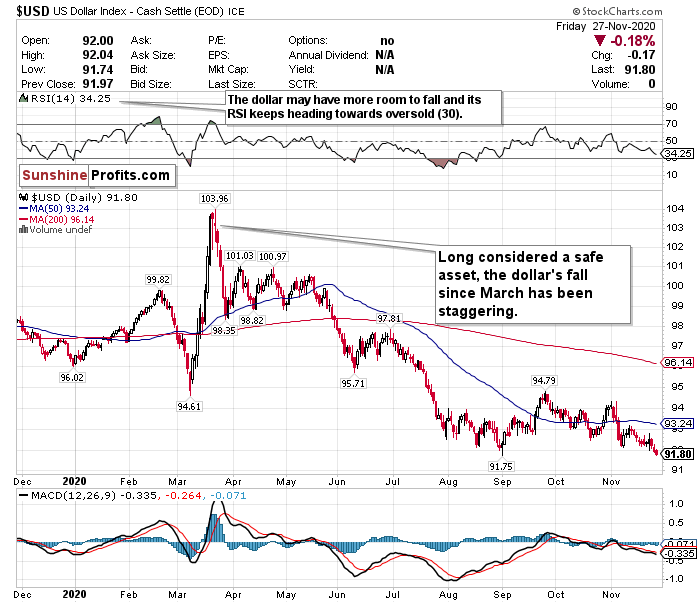

The U.S. Dollar has officially reached its lowest level in seven months, and the lowest level compared to a basket of currencies in over two years. The dollar’s plunge in excess of 10.5% since peaking in March has been staggering.

Many believe that the fall is not overdue to a multitude of headwinds.

First and foremost, as reflected by the performance of stocks, investors currently believe that COVID-19 will be conquered in the coming months. If the world returns to relative normalcy within the next year, investors may be more “risk-on” and less “risk-off” - which means bad things for the dollar’s value.

Additionally, because of all of the economic stimulus (with more inevitably on the way) and record low-interest rates, the dollar’s value has been hurt and could be further hurt. Strategists at Goldman Sachs predict a further 6% decline over the next 12 months, ING analysts forecast as much as a 10% drop, and most notably, Citigroup predicts a shocking 20% drop in 2021.

As the world’s reserve currency, the U.S. Dollar’s plunge in value is concerning both in the short-term and mid-term for the U.S. economy. A declining dollar means a strengthening of other foreign currencies such as the Yen or Yuan and could also mean a fall in the value of U.S. Treasuries.

In fact, the plunge of the dollar has been so severe, that it is currently trading below both its 50-day and 200-day moving averages. Furthermore, its 200-day moving average is considerably higher than its 50-day, further illustrating the sharp decline.

While the dollar may have more room to fall, according to its RSI, it is approaching oversold territory. Pay attention to the USD’s RSI - if it drops below that 30 level, there may be an opportunity to buy the currency at a bottom or near the bottom. However, for the time being, there may be more room for the world’s reserve currency to fall and...

For now, where possible, HEDGE OR SELL USD exposure.

Pay Very Close Attention to Inflation

Pay very close attention to the possible return of inflation within the next 6-12 months. The Fed has said it will allow the GDP to heat up, and it may overshoot in the medium-term as a result. Although JP Morgan and Goldman Sachs have cut their GDP growth estimates for Q1 2021, pay close attention to what happens in Q2 and Q3 once vaccines begin to be rolled out on a massive scale. It is only inevitable that inflation will return with the Fed’s policy and projected economic recovery by mid-2021.

If you are looking to the future to hedge against inflation, look into TIPS, commodities, gold, and potentially some REITS.

In the mid-term, I have BUY calls on the SPDR TIPS ETF (SPIP), the Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF (PDBC), the SPDR Gold Shares ETF (GLD), and the iShares Cohen & Steers REIT ETF (ICF).

Long-Term

While the surging spread of COVID-19 and resulting economic shutdowns may drive some short-term concerns, the progress made on the vaccine/treatment front poses significant optimism for 2021 and beyond. Although jobless claims underwhelmed last week for the second week in a row, and are at their lowest point in 5 weeks, the long-term outlook for equities, namely value stocks and cyclicals, could be very positive.

Summary

November has been filled with mania and euphoria consuming the markets. However, until COVID-19 is dealt with, there will be a continuous tug of war between vaccine optimism and health/economic pessimism.

Please keep in mind that markets are forward-looking instruments, and are investment vehicles that look 6-12 months down the road. However, it is very plausible that there could be some short-term uncertainty and volatility mixed in. But please remember how sharp and swift the rally was after the crashes in March. Since the markets bottomed on March 23rd, the Nasdaq is up 84%, the S&P is up 66%, and the Dow is up 64.2%. In the long-term markets always end by going up, and are focused on the future rather than the present.

For the very first time since the start of the pandemic, there may be a light at the end of the tunnel. We know that the vaccines work- but are they scalable? Can they be safely and effectively mass distributed? If everything goes well with the vaccines, and the virus can be somewhat contained, the short-term volatility may be worth monitoring for opportunities before the eventual mid-term and long-term reality turns positive and stable in 2021.

To sum up all our calls, in the short-term I have a HOLD call for:

- the SPDR S&P ETF (SPY),

- Invesco QQQ ETF (QQQ),

- SPDR Dow Jones ETF (DIA), and

- iShares Russell 2000 ETF (IWM).

However, I am more bullish for these ETFs in the long-term.

I suggest avoiding the US Dollar in the mid-term, and gaining exposure in the emerging markets.

I have BUY calls on:

- The iShares MSCI Emerging Index Fund (EEM),

- the iShares MSCI China ETF (MCHI),

- the iShares MSCI Taiwan ETF (EWT), and

- the iShares MSCI Indonesia ETF (EIDO)

Additionally, because I foresee inflation returning as early as mid to late 2021…

I also have BUY calls on:

- The SPDR TIPS ETF (SPIP),

- the Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF (PDBC)

- the SPDR Gold Shares ETF (GLD), and

- the iShares Cohen & Steers REIT ETF (ICF)

Thank you.

Matthew Levy, CFA

Stock Trading Strategist