Remember how every month in 2021 started off hot and then saw a pullback and volatility occur by the second half of the month? Welcome to the second half of April.

After switching my calls on the SPDR S&P ETF (SPY) and the SPDR Dow Jones ETF (DIA) a week ago (Apr. 16), both have declined over 1% and are on track for their first losing weeks in more than a month.

Despite the month’s promising start with blowout jobs reports, stronger-than-expected earnings, the lowest jobless claims in months, and more, remember how I said to stay vigilant on inflation and potential tax hikes?

Well, the market on Thursday (Apr. 22) tanked thanks to rumblings that President Biden could hike the capital gains tax rate for those earning over $1 million. This isn’t just some ordinary tax hike either. Biden would essentially double the current tax rate of 20% to 39.6% for those wealthy investors and hike it as high as 43.4% for the richest of the rich.

Not to mention President Biden has been talking for weeks about hiking corporate taxes to 28%.

Tax the rich? Guess Mr. President has to fund his spending sprees somehow, no?

Although April historically has been the strongest month for stocks over the past 20 years, with the S&P 500 witnessing gains in 14 of the past 15 years, not everything is smooth sailing right now. Especially if you’re a SPAC or a speculative sector.

In fact, for the broader market, I’d even caution that we may be at or around a peak, with most of the good news priced in already. Despite what’s been a rough week, the Dow and S&P are still at historically high levels. According to Binky Chadha, Deutsche Bank’s chief U.S. equity strategist, we could see a significant pullback between 6% and 10% over the next three months because of potentially full valuations and inflation fears.

My goal for these updates is to educate you, give you ideas, and help you manage money like I did when pressing the buy and sell buttons for $600+ million in assets. I left that career to pursue one to help people who needed help instead of the ultra-high net worth.

With that said, to sum it up:

We could see more volatility and more muted gains than what we’ve come to know over the last year.

April is historically strong, but please monitor overvaluation, inflation, bond yields, and potential tax hikes. Be optimistic but realistic. A decline above ~20%, leading to a bear market, appears unlikely. Yet, we could eventually see a minor pullback by the summer, as Deutsche Bank said.

Hopefully, you find my insights enlightening. I welcome your thoughts and questions and wish you the best of luck.

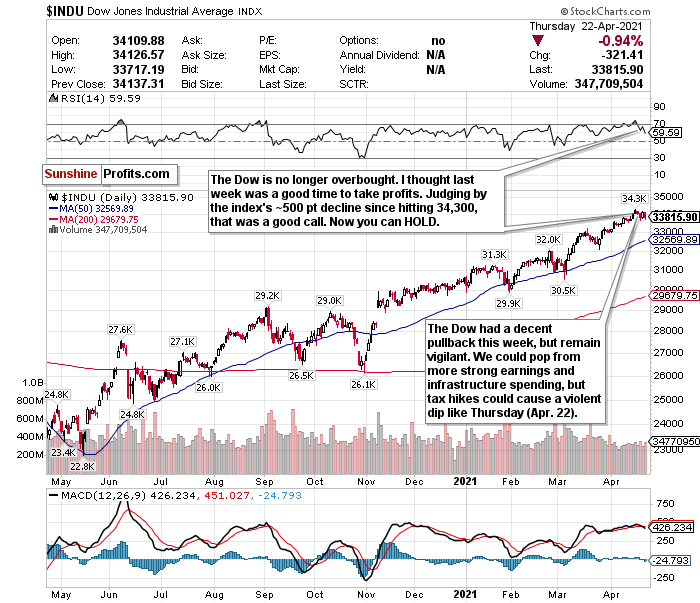

The Dow Jones- Have We Peaked?

Figure 1- Dow Jones Industrial Average $INDU

The Dow Jones has been red hot in 2021. Strong earnings, a recovering economy, and the potential for further infrastructure spending sent the index to numerous record highs in April alone. While we were overbought a week ago, this nearly 500 point decline from its peak of around 34,300 has been well needed.

Now, was 34,3000 the peak? Good question. I did recommend taking profits last week after the Dow breached 34,000. I do think that most good news has been priced in the market too. Although I am very concerned about inflation and tax hikes for stocks, mainly because this does not seem to be an administration that’s all that focused on the stock market, I do, however, still think the Dow will eventually close the year at or above 35,000

But for now? April is almost over, and we could see some volatility heading into the summer. I happen to think you could do a heck of a lot better for a buyable entry point and would HOLD and assess the situation. We could have some swings ahead of us.

But despite my concerns, I see Dow exposure as valuable right now. The index has many strong recovery cyclical plays that should benefit from what appears to be an economic recovery and reopening going better than expected. The Dow could also be quite beneficial as a hedge against volatile growth stocks and SPACs. You won’t see bond yields spooking this index as much.

I have more questions about the Dow than answers. HOLD at this level and assess the situation.

For an ETF that aims to correlate with the Dow’s performance, the SPDR Dow Jones ETF (DIA) is a great option.

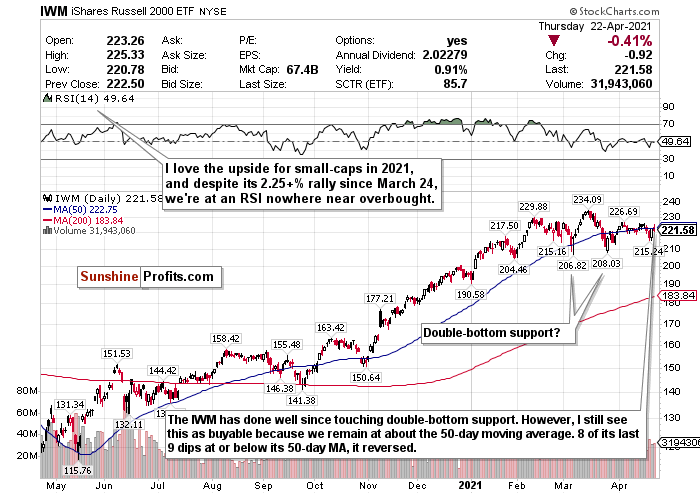

Russell 2000- Still Buyable?

Figure 2- iShares Russell 2000 ETF (IWM)

Although the iShares Russell 2000 ETF (IWM) has outperformed all the other index-tracking ETFs in 2021 to the tune of 14.73%, it has been a relative laggard in April. My thoughts? Good.

I proudly switched my call on the iShares Russell 2000 ETF (IWM) to a BUY on March 24, and since then, we’ve risen over 2.5%.

I still feel like we’re very buyable at this level. Aggressive government spending, friendly policies, and a reopening world bode well for small-caps in 2021. I think this is something you have to consider for the Russell 2000 and maybe overpay for.

The RSI is still hovering around 49. I also checked out the chart and noticed that almost every time the IWM touched or minorly declined below its 50-day moving average, it reversed.

Excluding the recovery last April from the great coronavirus crash, 8 out of the previous 9 times the Russell did this with its 50-day, it saw a sharp reversal. The only time it didn’t was in October 2020, when the distance between its 50-day and its 200-day moving average was a lot more narrow.

Fast forward to now. The Russell 2000, despite its gains since tanking on March 23, remains right at about its 50-day moving average. Until it moves significantly above this level, in my eyes, it’s buyable.

Based on the chart and macro-level tailwinds, I feel that you can still BUY this index. In fact, I think that it’s the most buyable of them all.

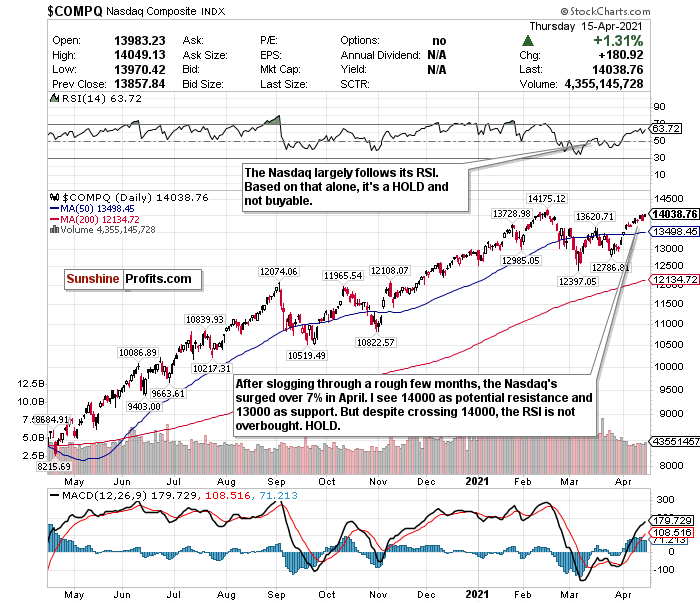

Nasdaq- Sideways For The Rest of April?

Figure 3- Nasdaq Composite Index $COMP

In the first half of April, the Nasdaq surged over 7%. Since then? We’re down over 2%. The Nasdaq has also been the biggest laggard this week.

I still have concerns about high-flying growth stocks, and it’s been an up-and-down 2 months for many Cathie Wood-like disruptors and tech-focused SPACs.

Tech is an excellent index to buy the dips in. I proudly bought the Nasdaq dip when I switched my call to a BUY on February 24, for example. While I don’t feel that we’re anywhere near a buy-level any longer for the Nasdaq, the Nasdaq-tracking Invesco QQQ ETF (QQQ) is up over 3.5% since February 24.

But, out of all the indices, the Nasdaq concerns me the most. I use the RSI as my primary Nasdaq guide, 13000 as my support level, and 14000 as a potential resistance level. Although I did not switch my call to a SELL last week when the Nasdaq crossed the 14000-level for the first time since February, in hindsight, maybe I should have. I used the RSI as my guide and kept it a HOLD.

Taking these technical factors into consideration, the Nasdaq is still a firm HOLD right now. It’s not at or above 14000, and the RSI is below 55. But I remain very concerned about inflation and bond yields and especially the prospects of corporate and capital gains tax hikes.

If any more tech stocks, namely SPACs, go public, I may lose my mind too. A different IPO or SPAC enters the market on what seems to be an almost weekly basis now. It’s comparable to the dot-com bust, and I don’t like it one bit. SPACs have been tanking for a reason. If this trend continues, we could see oversupply in the market and a shortage in demand. That is terrible for growth stocks.

I remain bullish on tech sectors like cloud computing, e-commerce, and fintech. While this rally has been fun, I’m actually more concerned now than I was several weeks ago. If anything, I feel like this index could move sideways for the rest of the month,

HOLD, and see what happens over the next few weeks. Monitor the infrastructure bill, tax hikes, and the IPO/SPAC market. Research emerging tech sectors and high-quality companies.

Beware of Inflation

Ugh. That’s all I have to say about this.

I’m not trying to scare anyone, but being realistic. We’re already experiencing inflation.

I filled up gas the other day and almost broke my side-view mirror out of anger. Gas prices have surged by nearly 25% from this point last year, and it will undoubtedly get worse.

Global food prices also rose for the 10th straight month and are at their highest levels since 2014. The cost of vegetable oil also reached its highest level in almost a decade.

Commodity prices are also surging, and the cost of toilet paper, diapers, and more are set to surge by June.

If and when President Biden’s infrastructure spending bill passes, watch out.

Bond yields and inflation fears have replaced the virus as the most significant market mover by far. In fact, according to MarketWatch, this could be the “biggest inflation scare in 40 years.”

While consumer price data came in tamer than expected, it still rose at its fastest pace in 9-years in March.

There’s a reason why Former Treasury Secretary Larry Summers said Wednesday (Apr. 21) that inflation indicators were "flashing a red alarm."

“The rich world has come to take low inflation for granted. Perhaps it shouldn’t.” -The Economist.

As hedges against inflation, consider rereading my REIT special from March 26.

Consider also BUYING the SPDR TIPS ETF (SPIP), the Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF (PDBC), and the iShares Cohen & Steers REIT ETF (ICF).

Mid-Term/Long-Term

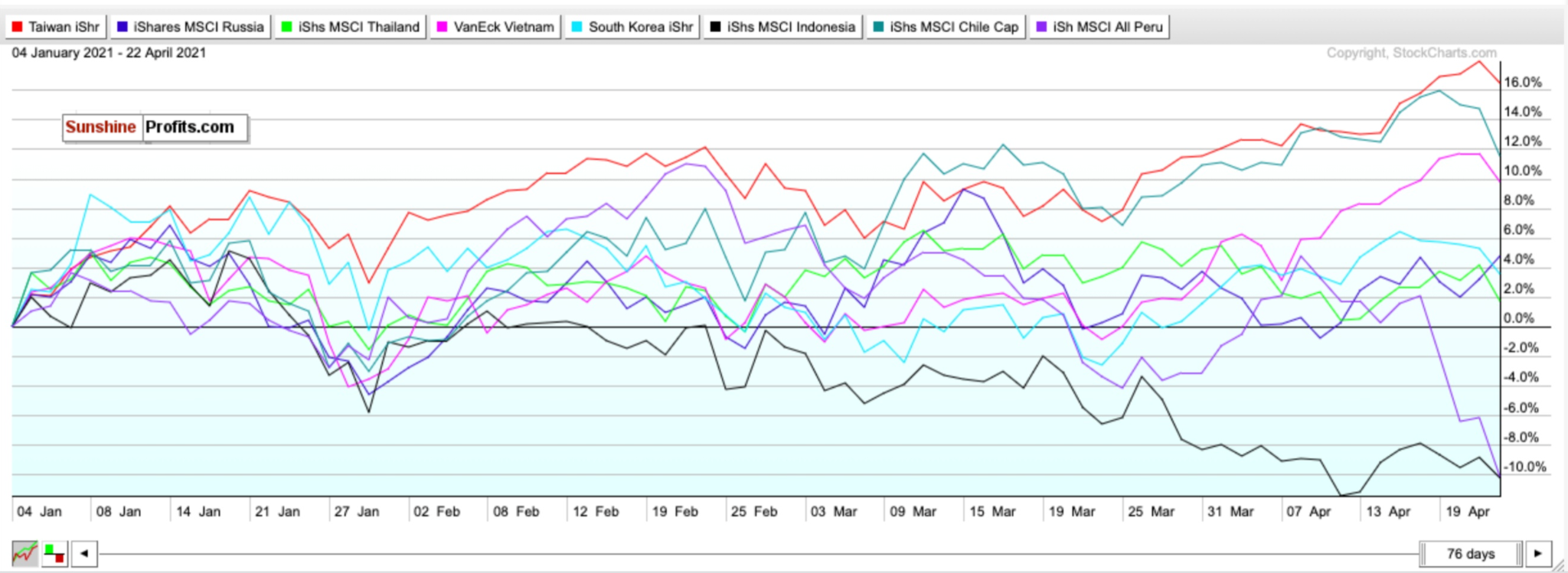

Add Emerging Market Exposure- Period

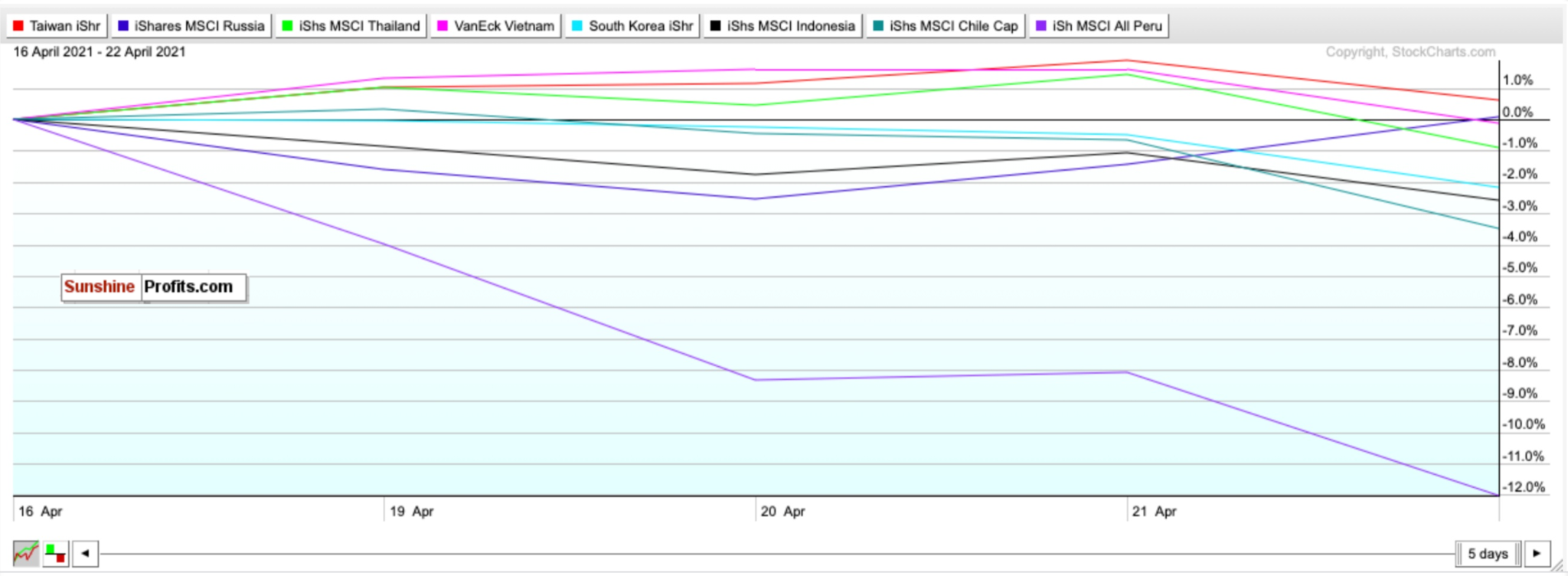

Figure 5- EWT, ERUS, THD, VNM, EWY, EIDO, ECH, EPU comparison chart- Year-to-Date

For my top emerging market picks of 2021, it’s been an up-and-down year so far. On the one hand, top performers of 2020, like South Korea (EWY), have declined over 10%. On the other hand, winners from 2020, like Taiwan (EWT), have continued winning, despite shortages in the chips industry and a historic drought.

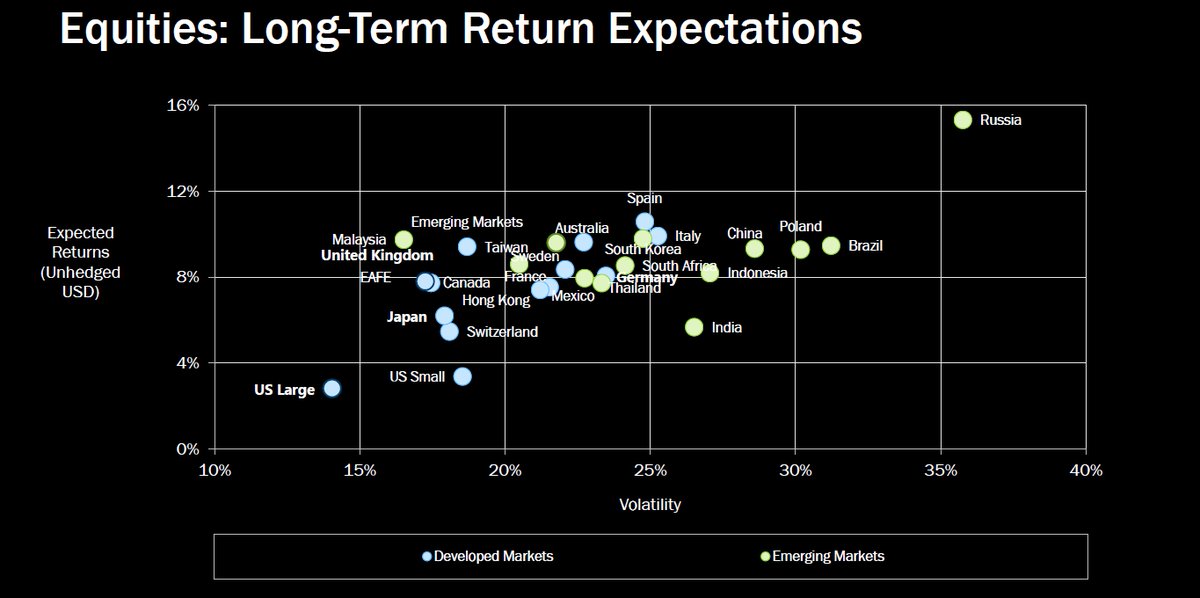

Either way, 2021 could be a generationally strong period to add exposure to emerging markets. It’s a big world we live in, and America is no longer the center of it like it was before. Plus, with inflation on the horizon, commodity prices should surge; this is enormous for countries with rich minerals and resources like Russia, Chile, and Peru.

Not to mention, we have evolving demographics which could send emerging markets upwards long-term. Consider the way birth rates have plummeted during the pandemic in developed markets, for example.

PWC echoes this sentiment and believes that emerging markets (E7) could grow around twice as fast as advanced economies (G7) on average in the coming decades.

For 2021, the following are my BUYs for emerging markets and why:

iShares MSCI Taiwan ETF (EWT)- Developing country, with stable fundamentals, diverse and modern hi-tech economy, regional upside without China’s same geopolitical risks.

iShares MSCI Thailand ETF (THD)- Bloomberg’s top emerging market pick for 2021 thanks to abundant reserves and a high potential for portfolio inflows. Undervalued compared to other ETFs.

iShares MSCI Russia Capped ETF (ERUS)- Bloomberg’s second choice for the top emerging market in 2021 thanks to robust external accounts, a robust fiscal profile, and an undervalued currency. Red-hot commodity market, growing hi-tech and software market, increasing personal incomes. Russian equities may also have potential upside north of 35%.

Figure 6- Equities: Long-Term Return Expectations Developed Markets/Emerging Markets

VanEck Vectors Vietnam ETF Vietnam (VNM)-Turned itself into an economy with a stable credit rating, strong exports, and modest public debt relative to growth rates. PWC believes Vietnam could also be the fastest-growing economy globally. It could be a Top 20 economy by 2050.

iShares MSCI South Korea ETF (EWY)- South Korea has a booming economy, robust exports, and stable yet high growth potential. The ETF has been the top-performing emerging market ETF since March 23.

iShares MSCI Indonesia ETF (EIDO)- Largest economy in Southeast Asia with young demographics. The fourth most populous country in the world. It could be less risky than other emerging markets while simultaneously growing fast. It could also be a Top 5 economy by 2050.

iShares MSCI Chile ETF (ECH)- One of South America’s largest and most prosperous economies. An abundance of natural resources and minerals. World’s largest exporter of copper. Could boom thanks to electric vehicles and batteries because of lithium demand. It is the world’s largest lithium exporter and could have 25% of the world’s reserves.

iShares MSCI Peru ETF (EPU)- A smaller developing economy but has robust gold and copper reserves and rich mineral resources.

Let’s see how my emerging market picks have performed in April thus far.

Figure 7- SPY, EWT, ERUS, THD, VNM, EWY, EIDO, ECH, EPU comparison chart- April 16-Present

Over the last week, my emerging market picks have seen minor losses for the most part. Only Taiwan and Russia are positive for the week, but they’re practically flat.

The biggest mover this week has been Peru which has been absolutely crushed with a 12% decline. Peru is a country with enormous upside, with significant risks as well. While its economy is based on minerals and resources like its neighbor Chile, it’s not nearly as developed of an economy.

That is precisely what’s sending Peru down this week. Political risk is one of the most significant risks you have to consider when investing in emerging markets. Peru is going through a bit of a political situation right now.

The Peru ETF has plummeted in the last week because the country's presidential election is headed for a run-off, with far-left candidate Pedro Castillo expected to win the first round.

Why’s this a big deal?

According to Alejandro Arevalo, emerging market debt manager at Jupiter Asset Management,

"Castillo's three pillars are pretty scary. He's talking about nationalisation, about the government taking control of the economy. He's in favour of governments or revolutions like in Cuba, Ecuador, Venezuela, so it's something that could bring significant volatility to the market, just to the bonds overall,"

Yeah so...with that being said, maybe consider selling Peru?

Outside of the aforementioned country-specific ETFs, you can also BUY the iShares MSCI Emerging Index Fund (EEM) for broad exposure to Emerging Markets.

Summary

While I don’t foresee the same gains that we saw since March 23, 2020, 2021 should still be a solid year for stocks despite some choppy waters. Although April is historically strong for stocks, and the overall backdrop right now remains favorable, I, unfortunately, think we may be at or around peak levels.

In my view, outside of the Russell 2000, I don’t think we’re buyable right now.

If we see more volatility, and we very likely will if Deutsche Bank’s calls come true, watch out. If tax hikes pass, watch out some more.

However, take this piece of wisdom from JP Morgan CEO Jamie Dimon:

“Guessing at market tops, market bottoms, that is a complete loser's game.”

It's a mistake to fearfully sit out or run for the hills, even if you see storm clouds coming. If anything, just increase your cash position, and dollar cost average on the dips. Scared money doesn’t make money.

Over a year out from the market’s bottom, let’s see the returns you’d see if you bought ANY of these index-tracking ETFs on March 23, 2020, when it appeared the world was ending: Russell 2000 (IWM) up 125.39%. Nasdaq (QQQ) up 97.88%. S&P 500 (SPY) up 87.88%. Dow Jones (DIA) up 84.92%.

Nobody knows “where” the actual bottom is for stocks. However, in the long-term, markets always move higher and focus on the future rather than the present.

To sum up my calls:

I have BUY call for:

- The iShares Russell 2000 ETF (IWM)

I have a HOLD call for:

- The SPDR S&P ETF (SPY),

- the SPDR Dow Jones ETF (DIA), and

- the Invesco QQQ ETF (QQQ)

I also recommend selling or hedging the US Dollar and gaining exposure into emerging markets for the mid-term and long-term.

I have BUY calls on:

- The iShares MSCI Emerging Index Fund (EEM),

- the iShares MSCI Taiwan ETF (EWT),

- the iShares MSCI Thailand ETF (THD),

- the iShares MSCI Russia ETF (ERUS),

- the VanEck Vectors Vietnam ETF (VNM),

- the iShares MSCI South Korea ETF (EWY),

- the iShares MSCI Indonesia ETF (EIDO),

- the iShares MSCI Chile ETF (ECH),

- and the iShares MSCI Peru ETF (EPU) (But be cautious of the political situation)

Additionally, because inflation shows signs of returning, and I foresee it potentially worsening as early as Q3 or Q4 2021...

I have BUY calls on:

- The SPDR TIPS ETF (SPIP),

- the Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF (PDBC), and

- the iShares Cohen & Steers REIT ETF (ICF)

Thank you.

Matthew Levy, CFA

Stock Trading Strategist