Indices, for the most part, closed fractionally higher to end the week.

But a new headwind for stocks could be more concerning- rising bond yields.

That correction I’ve been calling for weeks could have potentially started.

While I don’t foresee a crash like we saw last March and feel that the wheels are in motion for a healthy 2021, I still maintain that some correction before the end of Q1 could happen.

Bank of America also echoed this statement and said last week that “We expect a buyable 5-10% Q1 correction as the big ‘unknowns’ coincide with exuberant positioning, record equity supply, and as good as it gets’ earnings revisions.”

But rather than looking at the past, let’s take a look at what’s on tap this week to get you ready for what could potentially be a volatile week ahead.

This coming week, be on the lookout for the January leading indicator index, durable goods orders, and personal income and spending.

On Tuesday, we will also receive the February Consumer Confidence Index; on Wednesday, the Census Bureau will release upcoming home sales. On Friday, the University of Michigan will release its Consumer Sentiment Index.

Of course, as we’ve seen in weeks past, jobless claims from the previous week will be announced on Thursday too. After outperforming the last few weeks, the jobless claims announced last Thursday (Feb. 18) grossly underperformed and reached their worst levels in nearly a month.

Earnings season has been outstanding but is winding down now. Be on the lookout this week for earnings from Royal Caribbean (RCL) on Monday (Feb. 22), Square (SQ) on Tuesday (Feb. 23), Nvidia (NVDA) on Wednesday (Feb. 24), and Virgin Galactic (SPCE) and Moderna (MRNA) on Thursday (Feb. 25).

We have the makings of a volatile week, and as I mentioned before, a possible correction.

Look. Don’t panic. We have a very market-friendly monetary policy, and corrections are more common than most realize. Corrections are also healthy and normal market behavior, and we are long overdue for one. Only twice in the last 38 years have we had years WITHOUT a correction (1995 and 2017), and we haven’t seen one in a year.

While it won’t happen for sure, I feel like it’s inevitable because of how much we have surged over the last few months.

A correction could also be an excellent buying opportunity for what could be a great second half of the year.

My goal for these updates is to educate you, give you ideas, and help you manage money like I did when I was pressing the buy and sell buttons for $600+ million in assets. I left that career to pursue one to help people who needed help instead of the ultra-high net worth.

With that said, to sum it up:

While there is long-term optimism, there are short-term concerns. A short-term correction between now and the end of Q1 2021 is possible. I don’t think that a decline above ~20%, leading to a bear market, will happen.

Hopefully, you find my insights enlightening. I welcome your thoughts and questions and wish you the best of luck.

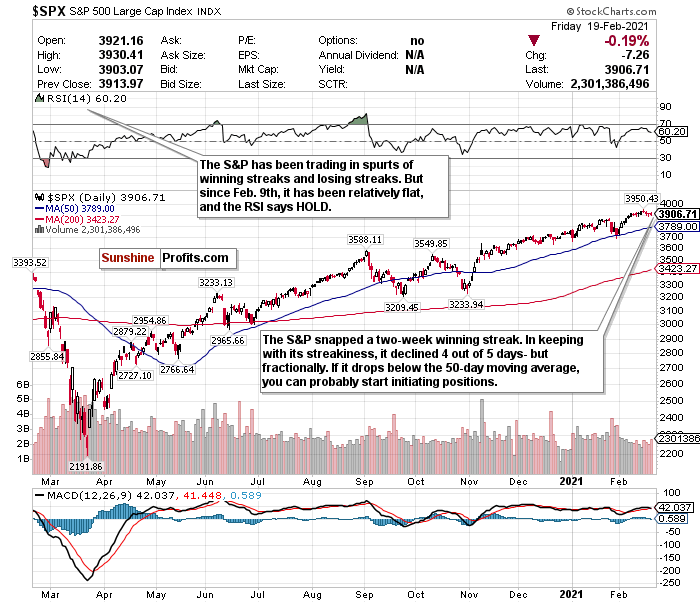

The S&P Remains Streaky and Flat

Figure 1- S&P 500 Large Cap Index $SPX

The S&P continues to trade as a streaky index. It seemingly rips off multiple-day winning streaks or losing streaks weekly.

Before this week, here’s how the S&P has traded in February. It kicked off the month by ripping off a streak of gains in 6 of 7 days. It then promptly went on a 3-day losing streak, followed by a two-day winning streak and more record closes.

Now? We’ve declined 4 out of 5 days.

It’s hard to consider this much of a pullback though. It didn’t even decline a full percentage point last week.

The tailwinds seem to be healthy. More than 80% of S&P stocks have beaten earnings estimates, which is quite impressive. Yes, the forward P/E ratio is historically high. However, this P/E ratio has coincided with growing earnings.

The index started February off hot but has cooled off somewhat in the last two weeks. Even though there’s a healthy outlook for the second half of the year, if bond yields and consumer behavior shows us anything, it’s that we could be closer to inflation than we realize.

The S&P’s RSI is also still hovering at a HOLD level, mainly reflecting its recent muted moves.

A short-term correction could inevitably occur by the end of Q1 2021, but for now, I am sticking with the S&P as a HOLD.

For an ETF that attempts to directly correlate with the performance of the S&P, the SPDR S&P ETF (SPY) is a good option.

Is Tech’s Party Over?

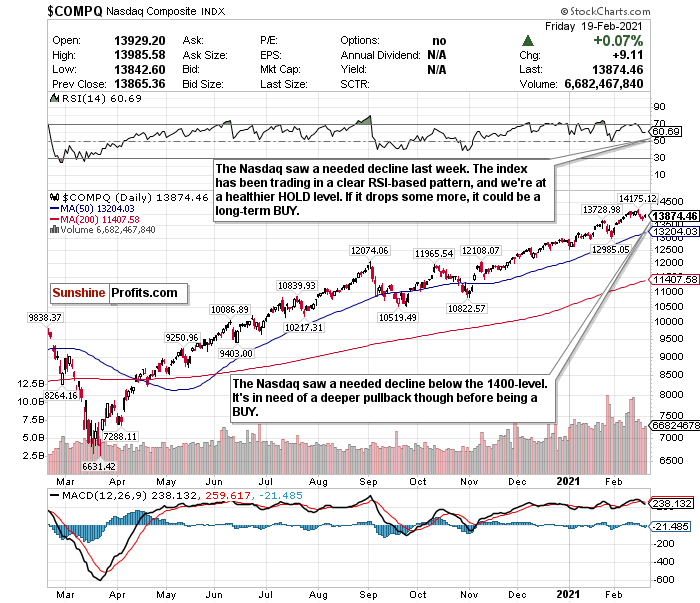

Figure 2- Nasdaq Composite Index $COMP

Is tech’s party over?

Outside of the Russell 2000, the Nasdaq has been the most overheated index. Tech remains frothy, and valuations are absurd. Rising bond yields coupled with this could be very problematic in the short-term.

The Nasdaq is off its record highs and below the 14000-level. The RSI is also at a much more manageable level, around 61.

But the pullback hasn’t been enough, and I feel that more pain could be on the horizon.

But the RSI says HOLD, and with the Nasdaq, the RSI is my bible.

Why?

Because the Nasdaq is trading in a precise pattern.

Despite my concerns in the short-run, I remain bullish on tech, especially for sub-sectors such as cloud computing, e-commerce, and fintech.

But please monitor the RSI.

Since December, let's break down the Nasdaq and how it has reacted whenever the RSI has exceeded 70.

December 9- exceeded an RSI of 70 and briefly pulled back.

January 4- exceeded a 70 RSI just before the new year and declined 1.47%.

January 11- declined by 1.45% after exceeding a 70 RSI.

Week of January 25- exceeded an RSI of over 73 before the week and declined 4.13% for the week.

It also declined about 0.25% after exceeding a 70 RSI earlier last week.

Every single time the RSI exceeded 70, I switched my Nasdaq call to a SELL.

The RSI is right at about 61 now. I’d like to see this fall a bit more before buying back in. I'm bullish but concerned.

In case you forgot, consider this too. Goldman’s non-profitable tech index is at up about 250% year-over-year.

This is absurd.

Because of the Nasdaq’s precise trading pattern, I will follow the RSI literally and keep this a HOLD.

For an ETF that attempts to directly correlate with the performance of the NASDAQ, the Invesco QQQ ETF (QQQ) is a good option.

Boring Dow’s Time to Shine?

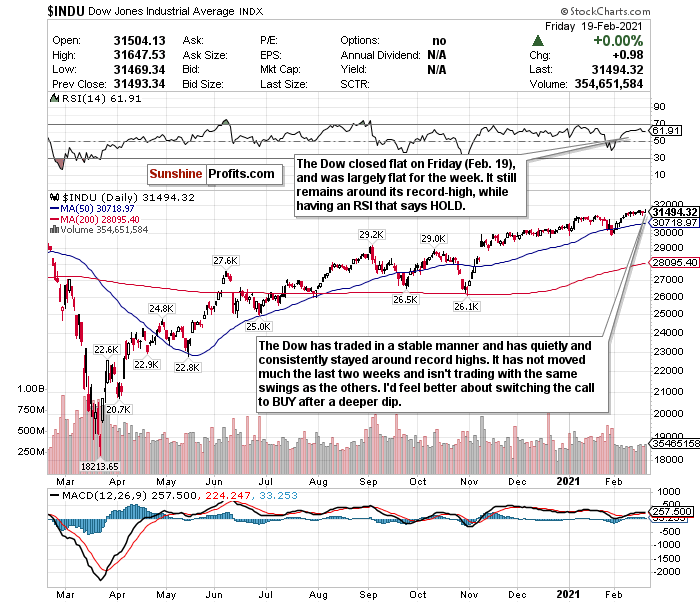

Figure 3- Dow Jones Industrial Average $INDU

After underperforming the S&P 500, Nasdaq, and Russell 2000 both year-to-date and month-to-date, the Dow outperformed last week with a fractional gain.

The Dow has traded marginally higher over the last two weeks and continues hovering around its record high. It’s trading with more stability than other indices, seems to be the only one not behaving as if it’s on MDMA, and may actually have the most room to run.

But it’s been quite dull as of late. That’s just the truth.

Yes, there are underlying concerns, and the market is more of a house of cards than anyone realizes. But the Dow is comparatively stable and undervalued to the others, and I can appreciate that.

If you want to start initiating positions, go ahead. It’s at a decent entry point, especially considering that many analysts call for it to end the year at 35,000.

From my end, though, the RSI is quietly ticking up, and I’d prefer to hold on and assess the situation.

The Dow could see another pullback.

My call on the Dow stays a HOLD, but this could change soon.

For an ETF that aims to correlate with the Dow’s performance, the SPDR Dow Jones ETF (DIA) is a reliable option.

Beware of Inflation

“The rich world has come to take low inflation for granted. Perhaps it shouldn’t.” -The Economist.

Complacency and an overvalued market are my biggest short-term concerns.

But rising bond yields and inflation are slowly but surely worrying investors more and, especially for the mid to long-term. Pay very close attention to how this trends over the next few weeks to months.

Pent-up consumer demand is great. Retail sales crushing expectations reflect this. However, rising bond yields coupled with a Fed showing no signs of hiking interest rates is as strong a sign of inflation as you can get.

Bond yields are rising because investors expect inflation to return and almost desire higher interest rates sooner rather than later.

Five-year inflation expectations have also more than doubled from last year’s low and are now at around their highest levels since 2013.

Chairman Powell will let the GDP overheat, despite inflationary indicators. It's pretty evident at this point.

We will see what happens to GDP growth by the end of Q1 2021, but I no longer think it will sputter as much as I previously thought.

Mid-Term/Long-Term

Surging Commodities= Add Emerging Market Exposure

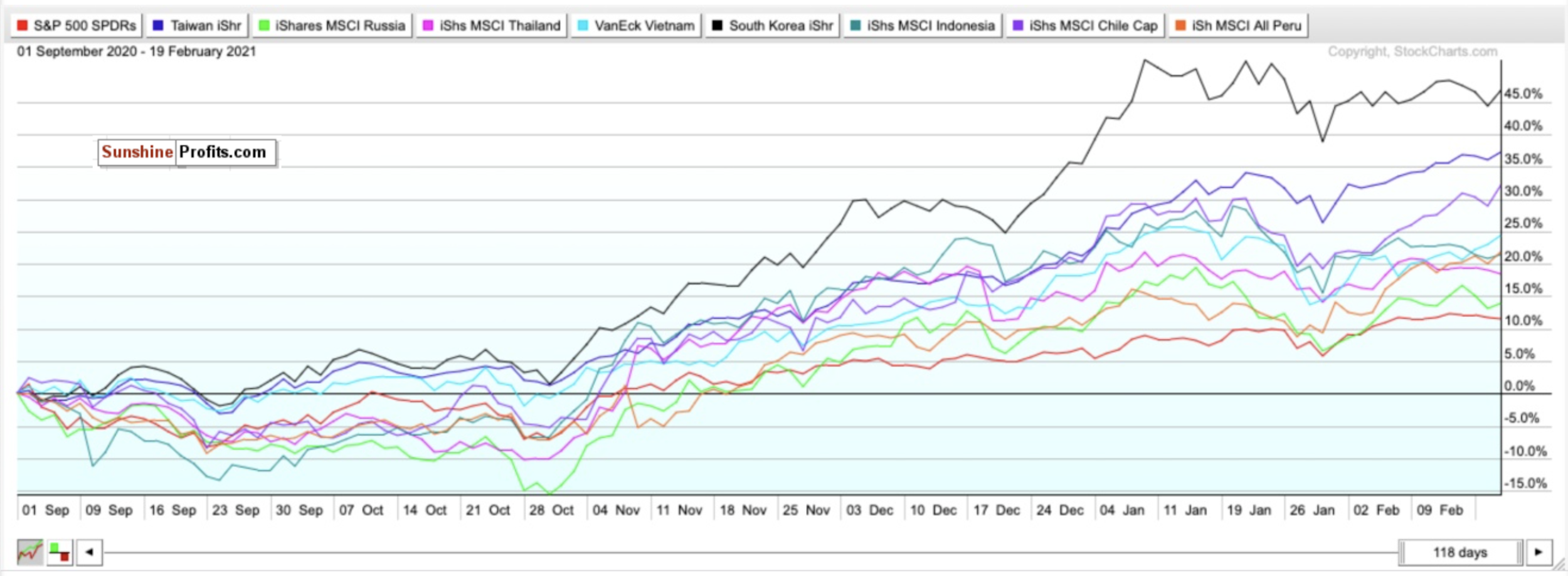

Figure 4- SPY, EWT, ERUS, THD, VNM, EWY, EIDO, ECH, EPU comparison chart- Sep. 1, 2020-Present

Since September, the SPDR S&P 500 ETF (SPY) has gained around 11.5%.

But if you compare that yield to that of my top emerging market picks for 2021, it has underperformed.

Consider this too.

A surge in commodity prices due to a weakening dollar combined with shifting demographics could send emerging markets upwards in the long-term too.

PWC also believes that emerging markets (E7) could grow around twice as fast as advanced economies (G7) on average in the coming decades.

For 2021, the following are my BUYs for emerging markets and why:

iShares MSCI Taiwan ETF (EWT)- Developing country, with stable fundamentals, diverse and modern hi-tech economy, regional upside without China’s same geopolitical risks.

iShares MSCI Thailand ETF (THD)- Bloomberg’s top emerging market pick for 2021 thanks to abundant reserves and a high potential for portfolio inflows. Undervalued compared to other ETFs.

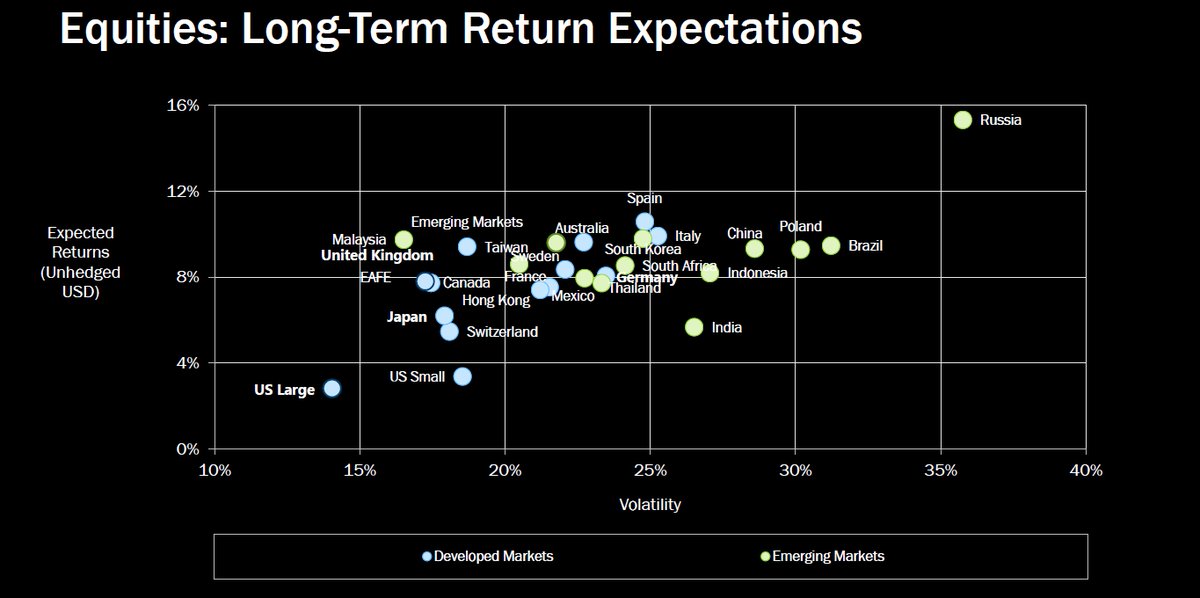

iShares MSCI Russia Capped ETF (ERUS)- Bloomberg’s second choice for the top emerging market in 2021 thanks to robust external accounts, a robust fiscal profile, and an undervalued currency. Red-hot commodity market, growing hi-tech and software market, increasing personal incomes. Compared to many other developed and emerging markets, Russia could have more than a 35% upside for its equities in the long-term as well.

Figure 5- Equities: Long-Term Return Expectations Developed Markets/Emerging Markets

VanEck Vectors Vietnam ETF Vietnam (VNM)-Turned itself into an economy with a stable credit rating, strong exports, and modest public debt relative to growth rates. PWC believes Vietnam could also be the fastest-growing economy globally. It could be a Top 20 economy by 2050.

iShares MSCI South Korea ETF (EWY)- South Korea has a booming economy, robust exports, and stable yet high growth potential. The ETF has been the top-performing emerging market ETF since March 23.

iShares MSCI Indonesia ETF (EIDO)- Largest economy in Southeast Asia with young demographics. The fourth most populous country in the world. It could be less risky than other emerging markets while simultaneously growing fast. It could also be a Top 5 economy by 2050.

iShares MSCI Chile ETF (ECH)- One of South America’s largest and most prosperous economies. An abundance of natural resources and minerals. World’s largest exporter of copper. Could boom thanks to electric vehicles and batteries because of lithium demand. It is the world’s largest lithium exporter and could have 25% of the world’s reserves.

iShares MSCI Peru ETF (EPU)- A smaller developing economy but has robust gold and copper reserves and rich mineral resources.

Let’s take a look at who the top emerging market performers were last week.

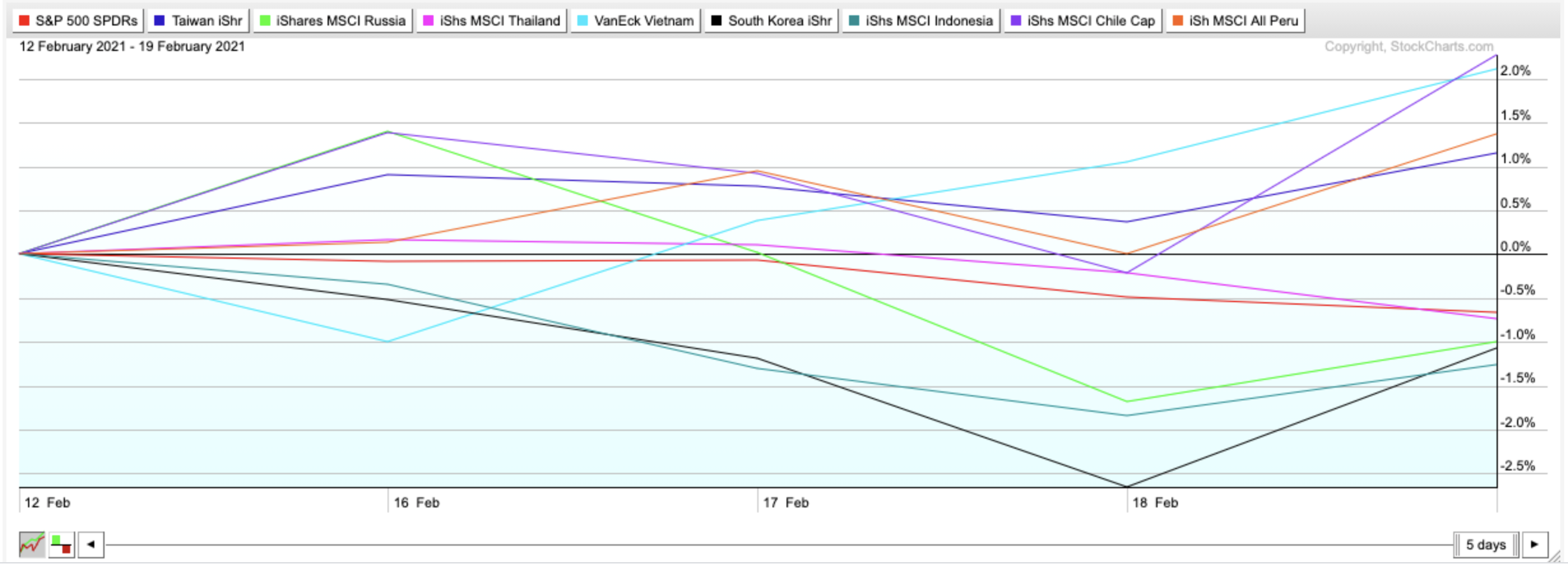

Figure 6- SPY, EWT, ERUS, THD, VNM, EWY, EIDO, ECH, EPU comparison chart- Feb. 12, 2021-Feb. 19, 2021

The top performers last week were Chile (2.28%), Vietnam (2.11%), Peru (1.38%), and Taiwan (1.16%).

Peru and Chile’s outperformance wasn’t exactly shocking. Both have significant gold and copper reserves, and Chile especially is the world’s largest copper and lithium exporter. Month-to-date, copper is up about 14.89%, and the Global X Lithium ETF (LIT) is up about 2.5%. But before its decline between Wednesday (Feb. 17) to Friday (Feb. 19), LIT was up 11.5% for the month.

Vietnam’s rise this week isn’t entirely surprising either. Vietnam is a growing economy that has handled the pandemic as well as anyone. UBS Global Wealth Management’s Kelvin Tay said that Vietnam’s economic outlook is positive, and the economy has “huge potential.” Tay also said that the Vietnamese stock market is seeing strong growth and could become more prominent than the Philippines in terms of the market cap “sometime in the middle of this year.” Vietnam was also one of Asia’s top-performing economies in 2020, and outside of China, it was one of the very few countries that managed to record GDP growth despite the pandemic.

Taiwan is an interesting case too. It has been one of my best BUY calls (up 17.25% since Dec. 3). Taiwan also more than doubled its forecast for export growth this year. However, it warned investors that global demand for its flourishing computer chips sector could add further upward pressure on its local currency.

Inflation risks are everywhere you look in the world.

Outside of the aforementioned country-specific ETFs, you can also BUY the iShares MSCI Emerging Index Fund (EEM) for broad exposure to Emerging Markets.

Long-Term

I remain convinced that the economic recovery is going better than expected as the progress in administering the vaccines improves. Winter weather could be a potential short-term hiccup in this, though.

We may be at the beginning of the end of the pandemic, and despite what could be a bumpy ride, 2021 should be a big year for stocks.

But as I keep saying, pay attention to complacency, overvaluation, bond yields, and especially inflation.

The way things are going is a blessing and a curse.

Small-caps, value stocks, and cyclical stocks could significantly surge. I just will have a much better feeling for them in the second half of the year- especially if they cool off as I hope.

I think we are overdue for another down week or two before entering a powerful buying opportunity for the second half of the year.

Summary

Is it possible to become increasingly optimistic while at the same type becoming increasingly cautious?

That’s how I feel right now.

I was hoping that as the vaccines became more widespread and COVID numbers improved, the tug-of-war between optimism and pessimism would subside.

But I was wrong. It’s just a new tug of war now—stocks vs. bonds.

The crash and subsequent record-setting recovery we saw in 2020 is a generational occurrence. I can’t see it happening again in 2021. But as I said in the intro, I think a correction is inevitable.

We’re too complacent right now, and there are signs that the “rational bubble” could pop.

If there is a short-term downturn, though, take a breath, stay cool, and use it as a time to find buying opportunities. Do not get caught up in fear and most of all:

NEVER TRADE WITH EMOTIONS.

If you cautiously bought a little bit at the end of January, you’re probably pleased right now. Even though the downturn to close out January wasn’t a full-blown correction, it was indeed an excellent opportunity to rebalance and add exposure.

That’s why I love down weeks—especially overdue ones.

Consider this too. Since markets bottomed on March 23rd, ETFs tracking the indices have seen returns like this: Russell 2000 (IWM) up 128.63%. Nasdaq (QQQ) up 95.17%. S&P 500 (SPY) up 77.17%. Dow Jones (DIA) up 71.82%.

In the long-term, markets always move higher and focus on the future rather than the present.

To sum up all our calls, I have HOLD calls for:

- The iShares Russell 2000 ETF (IWM)

- the SPDR S&P ETF (SPY),

- the Invesco QQQ ETF (QQQ), and

- the SPDR Dow Jones ETF (DIA)

I am more bullish for all of these ETFs for the second half of 2021 and the long-term.

I also recommend selling or hedging the US Dollar and gaining exposure into emerging markets for the mid-term and long-term.

I have BUY calls on:

- The iShares MSCI Emerging Index Fund (EEM),

- the iShares MSCI Taiwan ETF (EWT),

- the iShares MSCI Thailand ETF (THD),

- the iShares MSCI Russia ETF (ERUS),

- the VanEck Vectors Vietnam ETF Vietnam (VNM),

- the iShares MSCI South Korea ETF (EWY),

- the iShares MSCI Indonesia ETF (EIDO),

- the iShares MSCI Chile ETF (ECH),

- and the iShares MSCI Peru ETF (EPU)

Additionally, because I foresee inflation returning as early as mid to late 2021…

I also have BUY calls on:

- The SPDR TIPS ETF (SPIP),

- the Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF (PDBC), and

- the iShares Cohen & Steers REIT ETF (ICF)

Thank you.

Matthew Levy, CFA

Stock Trading Strategist