This market continues trudging forward and weighing good news with bad. After stocks closed last week with their first weekly declines in nearly a month, stocks staged a mild recovery on Tuesday (Jan. 19th) led by tech, big banks, and small-caps.

Today's gains were primarily thanks to renewed stimulus hopes, faster vaccine distributions, and strong bank earnings. However, this is far from an “all clear.”

It still reminds me of the Q4 2018 pullback (read my story here). I remain steadfast that there is way too much complacency in today’s market- despite long-term tailwinds. In the short-term, we are truly walking on ice.

For one, valuations are absurd. Tech IPOs seem more like Barnum and Bailey than a capital market, the S&P 500 is trading near its highest forward P/E ratio since 2000, and the Russell 2000 has never traded this high above its 200-day moving average.

Signs are starting to point towards the return of inflation by mid-year as well. Despite declining Tuesday (Jan. 19), the 10-year yield remains around its highest level since March. Economist Mohammed El-Erian believes that “if we were to see another 20 basis point move in yields, that would be bad news.”

Edward Jones also claims that the 10-year breakeven rate, a market-based measure of inflation expectations, is at its highest level since 2018 thanks to rising commodity prices, a weaker dollar, and broad stimulus policy.

There are also some signs that the market is already pricing in Joe Biden's $1.9 trillion stimulus package.

On the one hand, according to Jim Cramer, “when an event occurs and the market gets exactly what it wants, but nothing more, it’s treated as a reason to sell, not to buy.” What happened in the market last week reflects this.

On the other hand, some of the economic benefits may not have been priced in yet. For example, JP Morgan believes that this stimulus plan could cut unemployment to less than 5% by year’s end.

But remember- the stock market is not the economy.

I remain firm that a correction between now and the end of Q1 2020 could happen thanks to this neverending pay-per-view bout between good news and bad news.

We may trade sideways this quarter- that would not shock me in the least. But I think we are long overdue for a correction since we haven’t seen one since last March.

Corrections are healthy for markets and more common than most realize. Only twice in the last 38 years have we had years WITHOUT a correction (1995 and 2017).

A correction could also be an excellent buying opportunity for what should be a great second half of the year.

Therefore, to sum it up:

While there is long-term optimism, there are short-term concerns. A short-term correction between now and Q1 2021 is possible. I don't think that a decline above ~20%, leading to a bear market will happen.

In a report released Tuesday (Jan. 19), Goldman Sachs shared the same sentiments.

My goal for these updates is to educate you, give you ideas, and help you manage money like I did when I was pressing the buy and sell buttons for $600+ million in assets. I left that career to pursue one where I could help people who needed help, instead of the ultra-high net worth. Hopefully, you find my insights enlightening, and I welcome your thoughts and questions.

Have a great shortened trading week! Best of luck.

Place Your Bets- Dow Over/Under 31,000 Before the End of January?

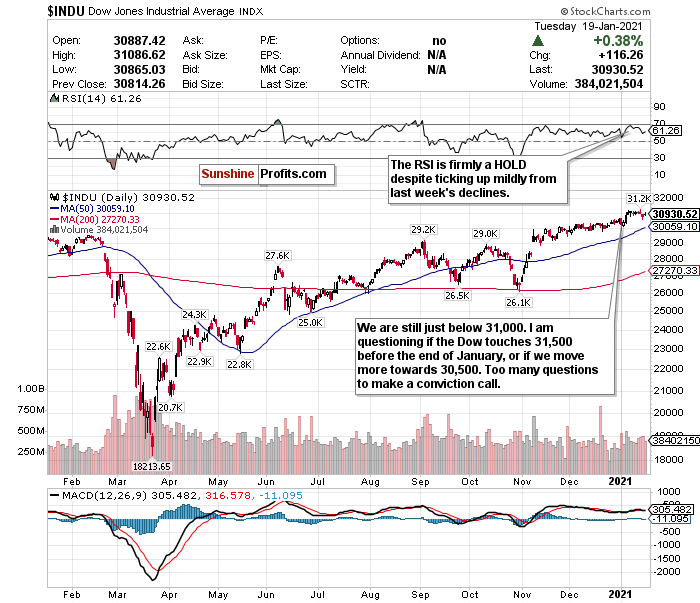

Figure 1- Dow Jones Industrial Average $INDU

It's NFL playoff season, and the Dow Jones reminds me of a tightly contested conference championship. It's at a point right now where if you were to place an over/under bet on 31,000, it might be best to choose "push."

The battle between good and bad news is truly like Brady vs. Rogers.

I have too many short-term questions and concerns about the Dow Jones to make a conviction call unequivocally.

The Dow's RSI isn’t that far from the Nasdaq's, but I don’t feel that it’s overheated for the simple reason that it has not exceeded overbought levels as much as the Nasdaq.

But is it at a BUY level? I don’t think so. I liked the Dow's decline last week, but it wasn’t enough for me. This minor tick upwards doesn’t help the BUY case either, in my view.

I don't like how COVID-19 is trending (who does?), and while I am encouraged by improvements in the vaccine rollout, I am still concerned about short-term economic and political headwinds. I hope Wednesday's (Jan. 20) inauguration goes off without a hitch.

It's challenging to make a conviction call on this index, and if/when there is a drop in the index, it probably won't be anything like what we saw back in March 2020.

More likely than not, the Dow trades sideways for the rest of the month and hovers around 31,000. New president, new agenda, and lots of data for investors to weigh.

A 35,000 call to close out 2021 may be a bit aggressive, but the second half of 2021 could show robust gains once vaccines become available to the general public.

With so much uncertainty, the call on the Dow stays a HOLD. I am closely monitoring the RSI if it exceeds 70.

For an ETF that looks to directly correlate with the Dow's performance, the SPDR Dow Jones ETF (DIA) is a strong option.

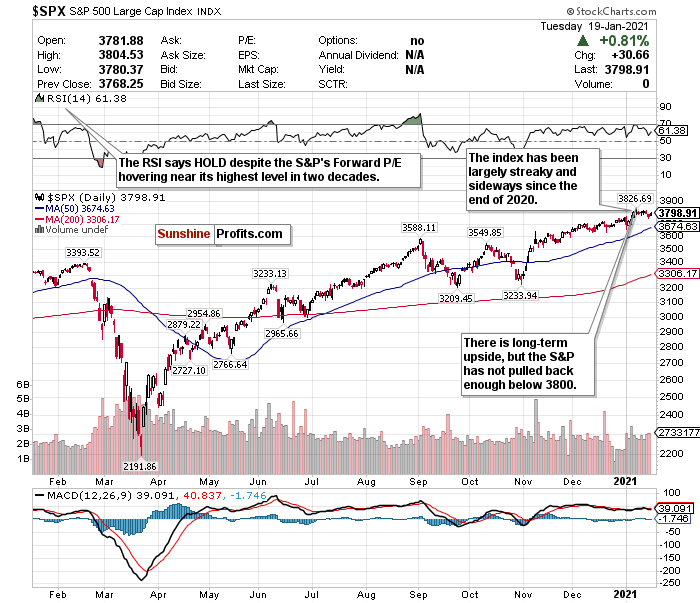

The S&P 500 Remains Streaky and Sideways

Figure 2- S&P 500 Large Cap Index $SPX

In keeping with the NFL theme, the S&P 500, since December 31st, is trading like a 9-7 fringe playoff team. Maybe they’ll squeak in a wild card game, and perhaps they’ll miss the playoffs. Or maybe they’ll go on a run.

Since December 31st, the S&P has gained just over 1%. What’s very interesting about how this index has been trading is that it seems to go on multiple day winning streaks and losing streaks. After seeing its worst sell-off since October two Mondays ago (Jan. 4), for example, it went on a four-day win streak and broke past 3800.

Then the S&P subsequently declined nearly 1% last week.

JP Morgan’s latest earnings report from last Friday (Jan. 15) tells me everything I need to know about the S&P 500 right now.

JP Morgan blew past top, and bottom-line estimates and saw a net income year over year growth of 42%.

On the other hand, CEO Jamie Dimon explained that JP Morgan’s abundance in reserves was due to pandemic-related “significant near term uncertainty.”

Dimon further added that the “ economic environment [is] far worse than the current base forecast by most economists.”

Although the RSI is a HOLD, mostly thanks to last week’s pullback, the valuations remain crazy. I'm quite concerned about the S&P’s overinflated forward P/E ratio.

I would like to see a more profound drop to around 3600 or below before making a BUY call for the long-term. There is an upside for the second half of 2021, but I would prefer to maximize it from a lower level. Discount shopping can be fun for long-term opportunities.

A short-term correction could inevitably occur by the end of Q1 2021, but for now, I am sticking with the S&P as a HOLD.

For an ETF that attempts to directly correlate with the performance of the S&P, the SPDR S&P ETF (SPY) is a good option.

Have Small-caps Overheated?

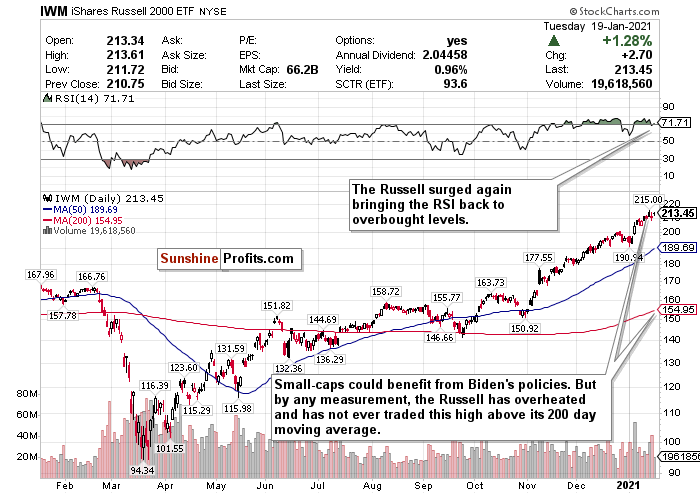

Figure 3- iShares Russell 2000 ETF (IWM)

After sharply declining Friday (Jan. 15), small-caps popped again. These stocks are the most likely beneficiaries from a Biden-led stimulus plan and Democrat-controlled Congress. They were cheering on incoming Treasury Secretary Janet Yellen’s pro-stimulus testimony Tuesday (Jan. 19) as well.

I love small-cap stocks in the long-term, especially as the world reopens. But the index has overheated by any measurement.

Before January 4, the RSI for the IWM Russell 2000 ETF was at a scorching hot 74.54. I called a sell-off happening in the short-term due to this RSI, and it happened.

After the RSI hit another overbought level of approximately 77 last Wednesday (January 13), the IWM Russell 2000 ETF declined by another 1.5%. I said that Russell stocks would imminently cool down because the RSI was too hot, and precisely that’s what happened.

Nobody knows what will happen the rest of this week, but we’re firmly above that 70-level again. Stocks don’t go up in a straight line without experiencing a sharp decline. The Russell 2000 did precisely this between November and Christmas before pulling back, and it happened again between January 4 and last Friday (Jan. 15).

So tread lightly.

Small-caps may have priced in vaccine-related gains by now, and some stimulus optimism may have been priced in too.

I hope small-caps decline a minimum of 10% before jumping back in for long-term buying opportunities. I love where these stocks could end up by the end of the year.

SELL and take profits if you can- but do not fully exit positions. If there is a deeper pullback, this is a STRONG BUY for the long-term recovery.

Mid-Term/Long-Term

Taiwan and Others for Emerging Market Exposure - Not China

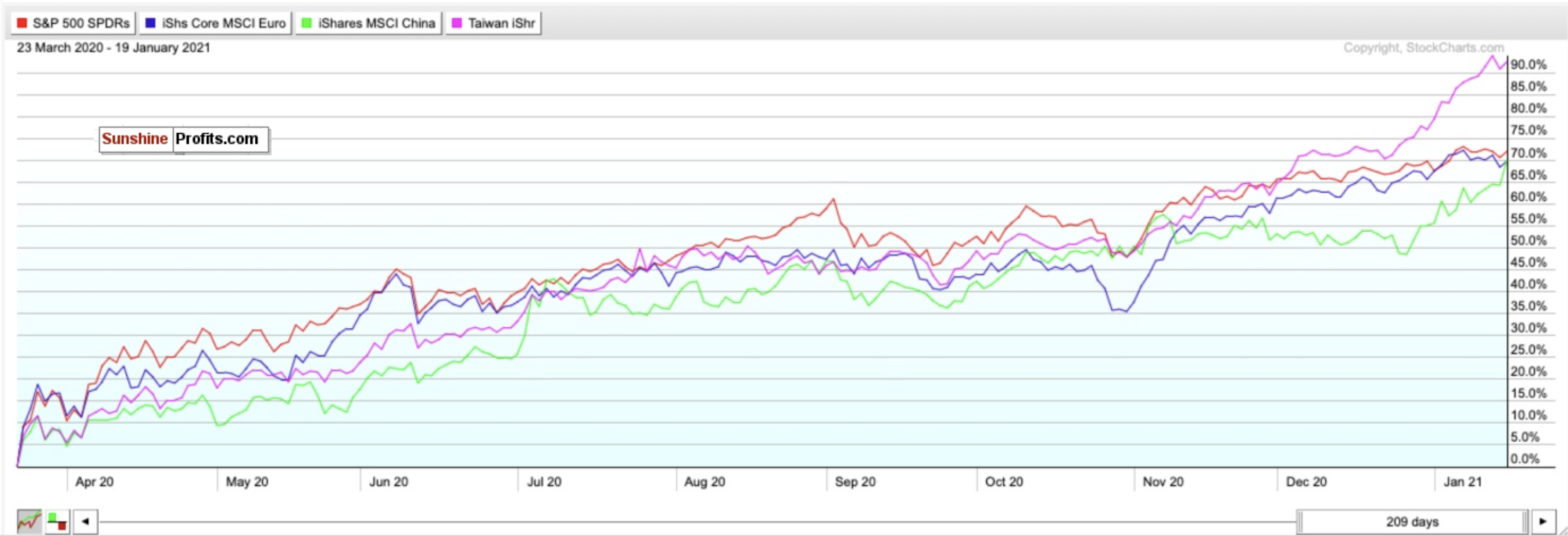

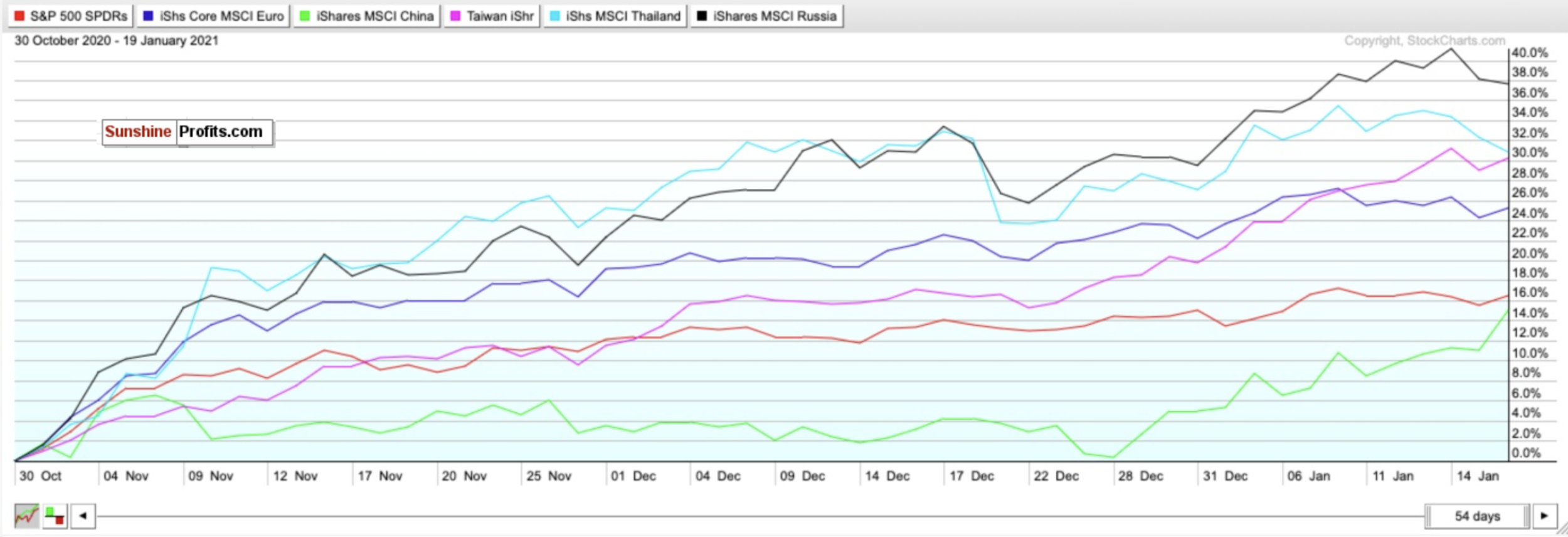

Figure 4- SPY, IEUR, MCHI, and EWT comparison chart-March 23, 2020-Present

China’s upside is undeniable. Official data released this week showed that its economy grew 2.3% in 2020, making the only major economy that expanded last year.

China, after underperforming many regional and country-specific ETFs, has staged a nice rally in the last week too.

But not all is well. The country has geopolitical risks and an economic recovery that has been largely priced-in. Despite its strong economic response to COVID-19, retail sales still fell 3.9% over the full year, marking the first contraction since 1968.

Lockdowns have also returned to China thanks to a new wave in COVID-19 infections, with measures returning to the Hebei/Beijing region.

I flat out don’t see China as a top option for international exposure in 2021. You can do better with a regional alternative like Taiwan.

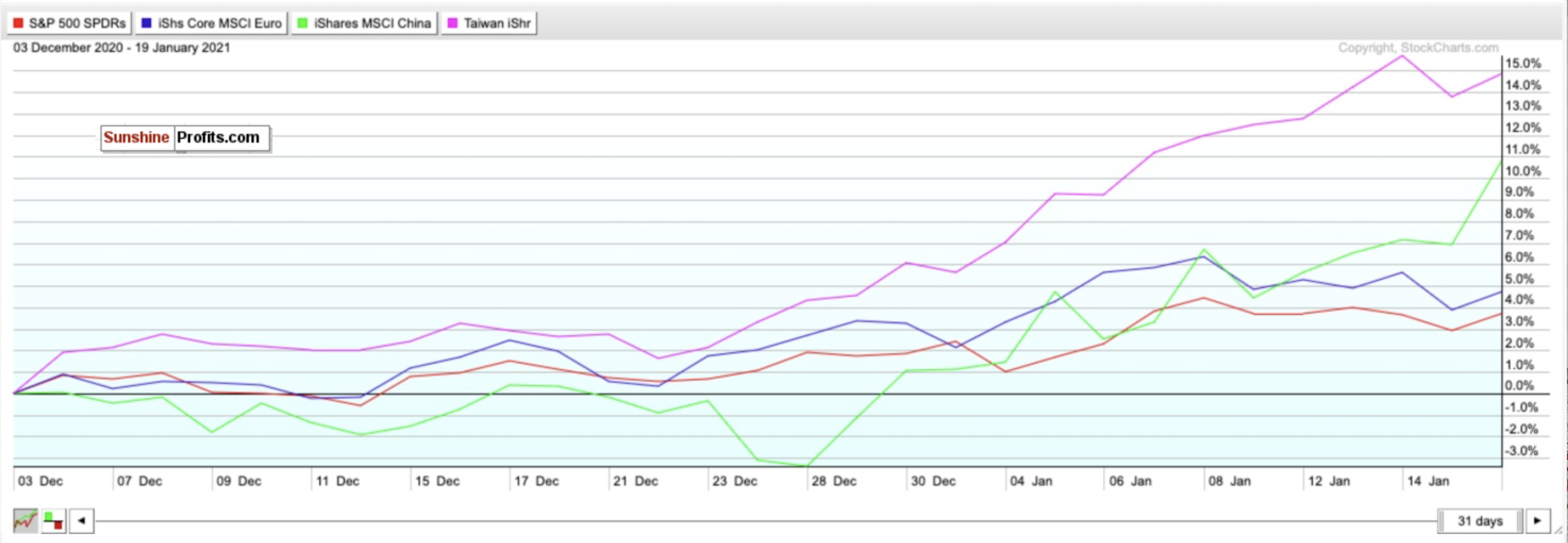

The Taiwan iShares ETF (EWT) has outperformed the MSCI China ETF (MCHI) in the short-term, medium-term, and long-term.

The chart above shows how the EWT has outperformed the MCHI, the SPDR S&P ETF (SPY), and iShares Core Europe ETF (IEUR) since the market bottomed on March 23.

The chart below also shows how the Taiwan ETF (IWT) has outperformed these same ETFs ever since I called it a BUY on December 3rd. The EWT has gained 14.83% compared to the MCHI’s gain of 10.78%.

The Taiwan ETF has also outperformed the SPY S&P 500 ETF by nearly 11%.

Figure 5- SPY, IEUR, MCHI, and EWT comparison chart- Dec. 3, 2020-Present

There are two other emerging markets I am very bullish on for 2021 as well- Thailand and Russia.

A Bloomberg study from December 16th projected Thailand and Russia as the top emerging markets for 2021. Thailand topped the list due to solid reserves and a high potential for portfolio inflows, while Russia came in second thanks to robust external accounts, a strong fiscal profile, and an undervalued currency.

Guess who scored last on this list? China. High expectations were largely already baked in during its 2020 recovery, and there is no longer significant upside.

Do you also know who outperformed the MSCI China ETF (MCHI), the SPDR S&P ETF (SPY), and iShares Core Europe ETF (IEUR) along with the Taiwan ETF (IWT), since October 30th? The iShares MSCI Thailand ETF (THD) and the iShares MSCI Russia ETF (ERUS).

Figure 6- SPY, IEUR, MCHI, EWT, THD, ERUS comparison chart- Oct. 30, 2020-Present

For broad exposure to Emerging Markets, you will want to BUY the iShares MSCI Emerging Index Fund (EEM), for exposure to a regional economic power without the geopolitical risks of China, you will want to BUY the iShares MSCI Taiwan ETF (EWT). Consider the iShares MSCI Thailand ETF (THD) and the iShares MSCI Russia ETF (ERUS) as well for 2021 upside.

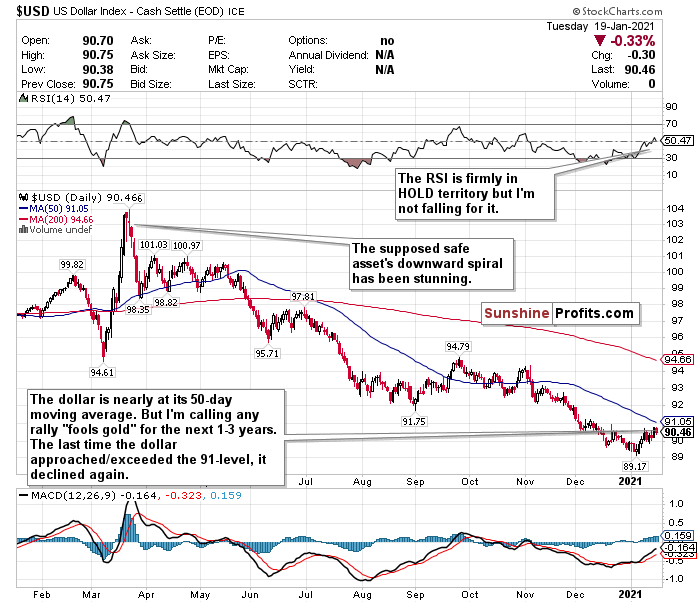

The Dollar Declined After Another Rally- More Dips Could Come

Figure 7- U.S. Dollar $USD

Although the U.S. Dollar has ticked up somewhat the last two weeks, I still do not see the benefit in running to the greenback as a safe asset.

I’m still calling out the dollar’s weakness after several weeks and expect the decline to pick up steam again thanks to a dovish Fed and multiple headwinds.

Any time the U.S. Dollar rallies, I am calling it “fools gold.”

Since I started doing these newsletters about a month ago, I have consistently said that any minor rally the dollar experienced would be a mirage. After it briefly pierced the 91-level on December 9th, it fell sharply.

Although the dollar is nearly back at the 91-level, I don’t think it will last. Tuesday’s (Jan. 19) minor decline could be the start of more.

Incoming Treasury Secretary Janet Yellen’s testimony Tuesday (Jan. 19) only strengthens my bearish outlook. With Democrats in full control of the government, Biden’s $1.9 trillion stimulus plan could further devalue the dollar.

You can’t keep printing money and expect the dollar to magically go up. This is real life, not a board game with pretend money.

With inflation possibly creeping back sooner than we realize, the dollar could be entering a typhoon of headwinds.

I also have too many doubts on the effect of interest rates this low for this long, the strengthening of emerging markets, commodity prices, and yes, even cryptocurrencies, to be remotely bullish on the dollar’s prospects over the next 1-3 years.

Meanwhile, the US has $27 trillion of debt, and it’s not going down anytime soon.

According to The Sevens Report, if the dollar falls below 89.13, this could raise the prospect of a further 10.5% decline to the next support level of 79.78 reached in April 2014. We are closer to this point than most realize.

When COVID-19 fears outweigh any other positive sentiments, dollar exposure might be useful since it is a safe harbor. But you can do a whole lot better than the U.S. dollar for safety. Since hitting a nearly 3-year high on March 20th, the dollar has plunged almost 12.3%

Where possible, HEDGE OR SELL USD exposure.

Pay Very Close Attention to Inflation

Pay very close attention to the possible return of inflation within the next 6-12 months. The Fed has said it will allow the GDP to heat up, and it may overshoot in the medium-term as a result. GDP growth may stutter in Q1 2021 but pay close attention to what happens in Q2 and Q3 once vaccines begin to be rolled out on a massive scale. It is only inevitable that inflation will return with the Fed’s policy and projected economic recovery by mid-2021.

The 10-year yield’s recent rally, as well as the 10-year breakeven rate, reflects this as well.

If you are looking to the future to hedge against inflation, look into TIPS, commodities, gold, and potentially some REITs.

In the mid-term, I have BUY calls on the SPDR TIPS ETF (SPIP), the Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF (PDBC), the SPDR Gold Shares ETF (GLD), and the iShares Cohen & Steers REIT ETF (ICF).

Long-Term

There is so much to worry about in the short-term. But I’m convinced that economic stimulus and the progress made with administering the vaccines bodes well for the second half of 2021. We may be at the beginning of the end of the pandemic-but over the next 1-3 months, this could be a very bumpy ride back.

There does seem to be one consensus though: 2021 could be a big year for stocks.

Small-caps, value stocks, and cyclicals, could especially surge. I just have a much better feeling for them in the second half of the year. I almost hope we see a correction within the first 3 months of 2021. This could be a very strong buying opportunity.

Summary

The current headwinds are very concerning. But I remain optimistic for the second half of 2021 despite the bumpy road there. Until COVID-19 is eradicated, a battle between optimism and pessimism is inevitable.

A short-term correction is likely. But do not let this scare you.

Corrections are NORMAL, and what happened last March likely won’t happen again this year. If there is a short-term downturn, take a breath, and use it as a time to find buying opportunities. Do not get caught up in fear and most of all:

NEVER TRADE WITH EMOTIONS.

Consider this. Since markets bottomed on March 23rd, ETFs tracking the indices have seen returns like this: Russell 2000 (IWM) up 116.71%. Nasdaq (QQQ) up 86.55%. S&P 500 (SPY) up 72.00%. Dow Jones (DIA) up 68.44%.

In the long-term, markets always end up moving higher and are focused on the future rather than the present.

To sum up all our calls, in the short-term I have a SELL call for:

- The iShares Russell 2000 ETF (IWM) (but do not fully exit positions- trim profits),

I have a HOLD call for:

- The Invesco QQQ ETF (QQQ),

- the SPDR S&P ETF (SPY), and

- the SPDR Dow Jones ETF (DIA)

I also have a long-term STRONG BUY call for:

- the iShares Russell 2000 ETF (IWM) BUT IF AND WHEN IT PULLS BACK

For all these ETFs, I am more bullish in the long-term for the second half of 2021.

For the mid-term and long-term, I recommend selling or hedging the US Dollar, and gaining exposure into emerging markets.

I have BUY calls on:

- The iShares MSCI Emerging Index Fund (EEM),

- the iShares MSCI Taiwan ETF (EWT),

- the iShares MSCI Thailand ETF (THD), and

- the iShares MSCI Russia ETF (ERUS).

Additionally, because I foresee inflation returning as early as mid to late 2021…

I also have BUY calls on:

- The SPDR TIPS ETF (SPIP),

- the Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF (PDBC)

- the SPDR Gold Shares ETF (GLD), and

- the iShares Cohen & Steers REIT ETF (ICF)

Thank you.

Matthew Levy, CFA

Stock Trading Strategist