We’re officially almost through with the first quarter of 2021. While a broad correction did not happen by now, as I thought, the Nasdaq dipped into correction territory twice.

There might also be as much uncertainty for tech stocks today as there was at March’s start.

However, let’s look at the big picture almost a week after we hit the 1-year anniversary of the market’s bottom. Three pillars remain in motion as a strong backdrop for stocks:

- Vaccines

- Dovish monetary policy full of stimulus

- Financial aid

While the major indices are still positive for 2021, every month this year has been marked by hot starts, marred by mid-month uncertainty and downturns. We’re dealing with rising bond yields, inflation scares, volatile Reddit trades, and an improving yet slowing labor market recovery.

Plus, although earnings came in strong this past quarter, stock valuations are still at an overly inflated point not seen in years. In fact, Ray Dalio, founder of the world’s largest hedge fund, Bridgewater Associates, says there’s a bubble that’s ‘halfway’ to the magnitude of 1929 or 2000.

We could see some more volatility on tap this week as the market continues to figure itself out.

- Suez Canal- There’s been a gigantic tanker blocking arguably one of the most crucial waterways for global trade for the last 6 days. There are indications that the tanker may be on the way to being freed. But the sooner this happens, the better. The Suez Cana controls about 10% of global trade, so you can only imagine the hundreds of billions of dollars bleeding per day the more this drags on.

- Economic Data- Consumer Confidence, the March job’s report, the unemployment rate, and the PMI Manufacturing index will be released this week.

- Earnings- Chewy (CHWY) will report Tuesday (Mar. 30) after market close, and Walgreens Boots Alliance (WBA), Dave & Busters (PLAY), Micron (MU) will all report after market close Wednesday (Mar. 31).

My goal for these updates is to educate you, give you ideas, and help you manage money like I did when I was pressing the buy and sell buttons for $600+ million in assets. I left that career to pursue one to help people who needed help instead of the ultra-high net worth.

With that said, to sum it up:

Over a year after we bottomed, there is optimism but signs of concern.

The market has to figure itself out. More volatility is likely, and we could experience more muted gains than what we’ve known over the last year. Inflation and interest-rate worries should be the primary tailwind. However, a decline above ~20%, leading to a bear market, appears unlikely to happen any time soon.

Hopefully, you find my insights enlightening. I welcome your thoughts and questions and wish you the best of luck.

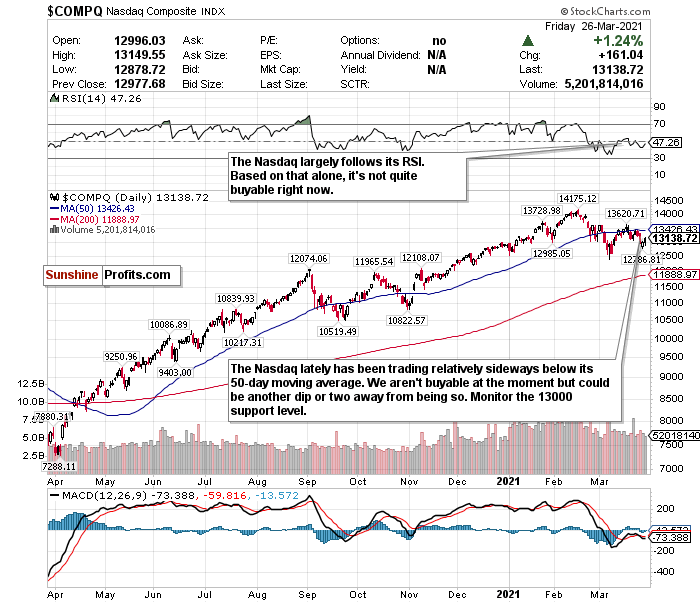

Nasdaq- Not Buyable but Stay Tuned

Figure 1- Nasdaq Composite Index $COMP

The last time I switched my Nasdaq call to a BUY on Feb 24, that worked out very well. I will use the same criteria again for the Nasdaq as the market figures out bond yields: The RSI and the 13000 support level. I need the Nasdaq’s RSI to dip below 40 while also falling below 13000 before buying.

We’re not quite there. The Nasdaq’s been relatively sideways over the last week and somewhat hovering around 13100-13200 levels with a 47.26 RSI.

We could be a dip or two away from possibly being buyable. Pay attention to what bond yields do and if Jay Powell so much as reads the ABCs. The market seemingly always makes extreme moves based on what the Fed Chair does.

If the tech sector takes another big dip, don’t get scared, don’t time the market, monitor the trends I mentioned and look for selective buying opportunities. If we hit my buying criteria, selectively look into high-quality companies and emerging disruptive sub-sectors such as cloud computing, e-commerce, and fintech.

HOLD, and let the RSI and 13000-support level guide your Nasdaq decisions. See what happens over subsequent sessions, research emerging tech sectors and high-quality companies, and consider buying that next big dip.

For an ETF that attempts to correlate with the performance of the NASDAQ directly, the Invesco QQQ ETF (QQQ) is a good option.

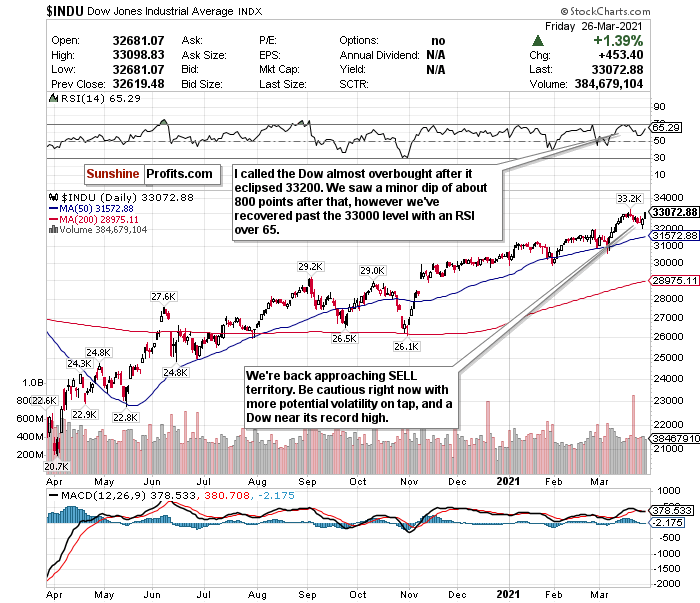

The Dow Jones- Almost Overbought

Figure 2- Dow Jones Industrial Average $INDU

The Dow Jones is red hot. There’s no denying that. I just don’t think it’s buyable. We’re about 200 points away from its record high with an RSI over 65.

Having Dow exposure can be valuable. The index has many strong recovery cyclical plays that should benefit from what appears to be a robust economic recovery and reopening. The Dow could also be quite beneficial as a hedge against volatile growth stocks. You won’t see bond yields spooking this index as much.

But at this level, it’s probably better to HOLD, let it ride, and maybe even consider trimming some profits on another up day.

Many analysts believe the index could end the year at 35,000 or higher, and the wheels are in motion for a furious rally. But you could do better for a buyable entry point.

From my end, I’d prefer to stay patient, vigilant and find better entry points.

My call on the Dow stays a HOLD.

For an ETF that aims to correlate with the Dow’s performance, the SPDR Dow Jones ETF (DIA) is a reliable option.

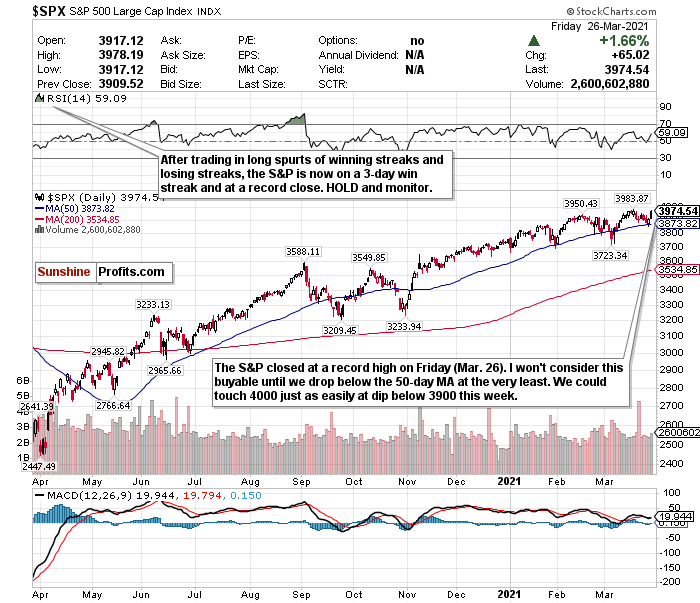

Next up for the S&P- 4000?

Figure 3- S&P 500 Large Cap Index $SPX

We’re so close to 4000 for the S&P 500 that I can taste it. I just don’t know it will happen this week. I don’t see this as a buyable index at the moment, and its streakiness scares me. I’d instead prefer a dip below the 50-day moving average, but even that is a questionable buy level.

Look, I think exposure to the S&P 500 is excellent for long-term investing. In its history, S&P 500 bull markets since 1957 on average resulted in price gains of 179% and lasted an average of 5.8 years.

Because the S&P has risen just about 75% in a year, if history tells us anything, we’re just getting started. But, right now, the S&P 500 is a complex index to call. It’s probably better to monitor its swings for now until it hits a buyable level.

Consider this also. This index is about to get a heck of a lot more volatile. Tesla (TSLA) joined the index at the end of 2020, and Penn National Gaming (PENN) is about to follow suit. While this could make things a bit more exciting, it could also make things a bit more unpredictable.

Unless I see some sort of buy or sell signal for the S&P 500, I think we’ll keep playing this HOLD game.

HOLD for now, but be prepared to either BUY or SELL depending on its moves. For an ETF that attempts to directly correlate with the performance of the S&P 500, the S&P 500 SPDR ETF (SPY) is a great option.

Beware of Inflation

Bond yields and inflation fears have replaced the virus as the most significant market mover by far.

We need some clarity- is inflation really coming back, or is all this fear overblown?

On the one hand, all of this stimulus coupled with a dovish Fed make inflation a foregone conclusion. The Fed is clearly going to tolerate inflation, and we could see it hit 2.2% by the end of the year- about 20 basis points ahead of the Fed’s benchmark target. Plus, in the last year, the U.S. national debt has risen by more than $4 trillion. This will only get higher thanks to President Biden’s $1.9 trillion “Rescue Plan” and with an even bigger infrastructure spending bill on the horizon.

Plus, Moody’s Analytics chief economist Mark Zandi feels that investors have not fully grasped that inflation is “dead ahead” and are grossly underestimating its seriousness and effect on every sector in the market.

On the other hand, the 10-year yield, for now, has stabilized around 1.61%. BoA, in a March 10 note, described inflation as “well-contained.” The bank also said that inflation fears would subside by the end of the year and expects CPI inflation to be well shy of the Fed’s 2% target and hit 1.7% by the year’s end.

It’s great that the Fed is hopeful on a 6.5% GDP recovery, but if they keep rates at 0% through 2023, it won’t be sustainable with this growth rate. If they’re forced to hike rates before they want to, it could be very, very bad for stocks.

Five-year inflation expectations have also more than doubled from last year’s low and are now at around their highest levels since 2013.

“The rich world has come to take low inflation for granted. Perhaps it shouldn’t.” -The Economist.

As hedges against inflation, consider rereading my REIT special from last Friday (March 26).

Consider also BUYING the SPDR TIPS ETF (SPIP), the Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF (PDBC), and the iShares Cohen & Steers REIT ETF (ICF).

Mid-Term/Long-Term

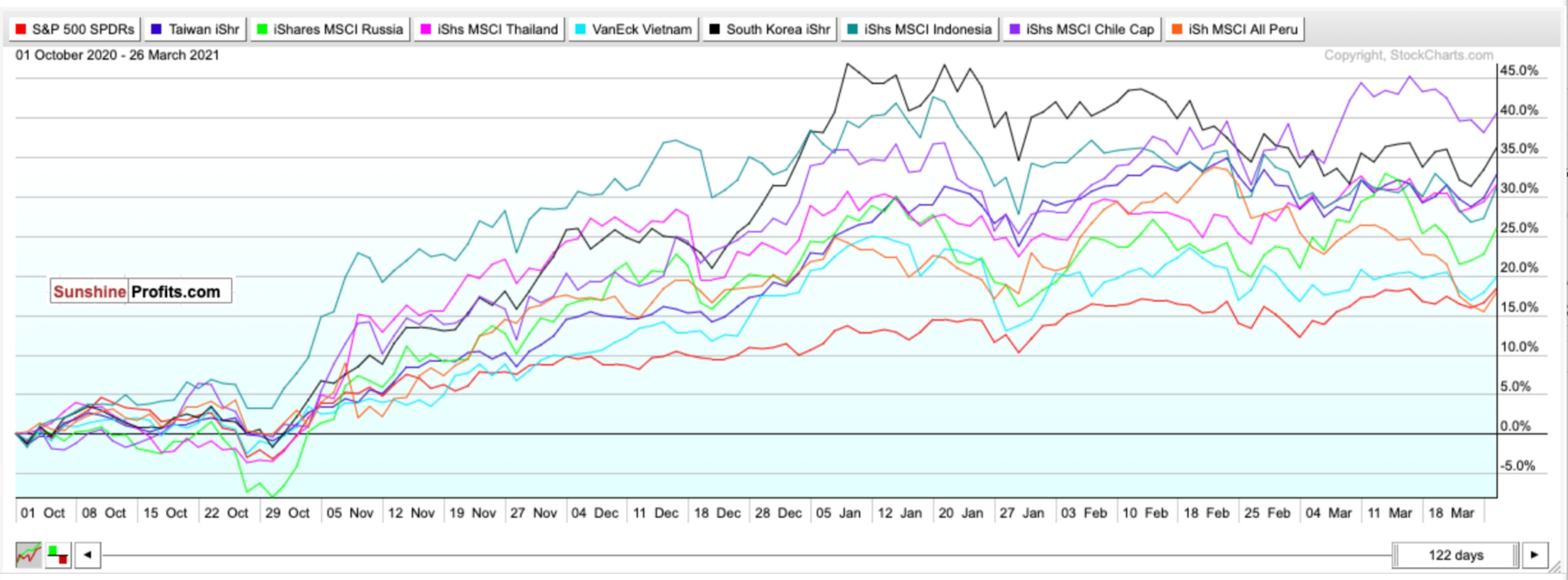

Add Emerging Market Exposure- Period

Figure 5- SPY, EWT, ERUS, THD, VNM, EWY, EIDO, ECH, EPU comparison chart- Oct. 1, 2020-Present

Since October 1, 2020, the SPDR S&P 500 ETF (SPY) has gained around 18.37%.

Outside of a recent plummet for my ETF pick for Peru exposure (EPU), the SPY has underperformed my emerging market picks in that timeframe by quite a bit.

Consider this too.

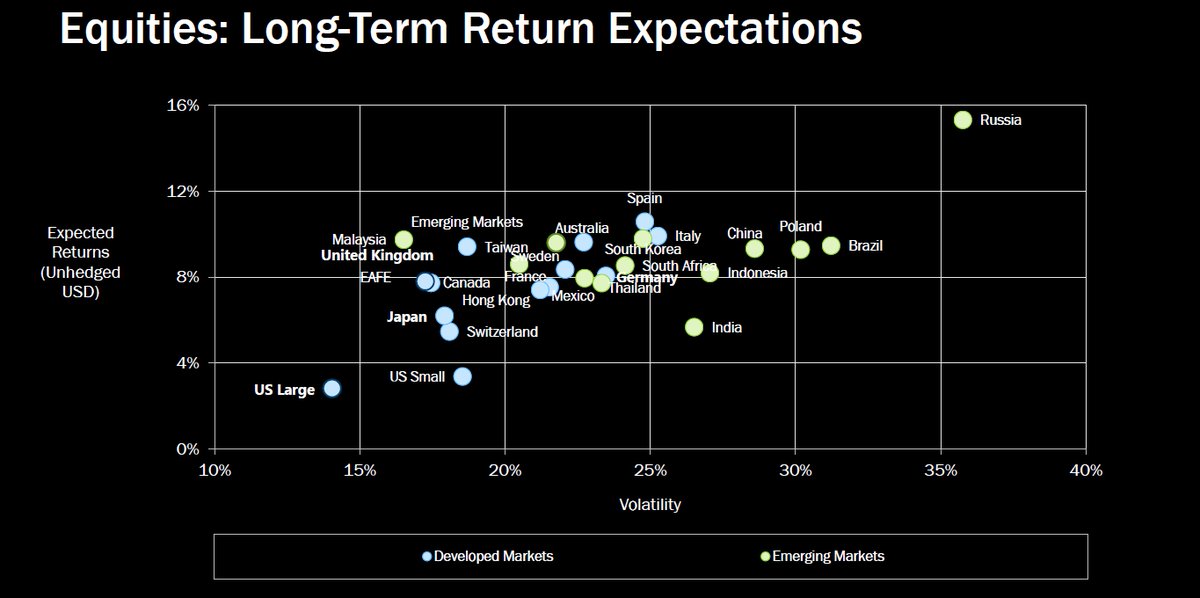

With inflation on the horizon, a surge in commodity prices combined with shifting demographics could send other emerging markets upwards long-term. Plus, with birth rates plummeting during the pandemic in developed markets, it could mean long-term upside for emerging markets.

PWC echoes this sentiment and believes that emerging markets (E7) could grow around twice as fast as advanced economies (G7) on average in the coming decades.

For 2021, the following are my BUYs for emerging markets and why:

iShares MSCI Taiwan ETF (EWT)- Developing country, with stable fundamentals, diverse and modern hi-tech economy, regional upside without China’s same geopolitical risks.

iShares MSCI Thailand ETF (THD)- Bloomberg’s top emerging market pick for 2021 thanks to abundant reserves and a high potential for portfolio inflows. Undervalued compared to other ETFs.

iShares MSCI Russia Capped ETF (ERUS)- Bloomberg’s second choice for the top emerging market in 2021 thanks to robust external accounts, a robust fiscal profile, and an undervalued currency. Red-hot commodity market, growing hi-tech and software market, increasing personal incomes. Russian equities may also have potential upside north of 35%.

Figure 6- Equities: Long-Term Return Expectations Developed Markets/Emerging Markets

VanEck Vectors Vietnam ETF Vietnam (VNM)-Turned itself into an economy with a stable credit rating, strong exports, and modest public debt relative to growth rates. PWC believes Vietnam could also be the fastest-growing economy globally. It could be a Top 20 economy by 2050.

iShares MSCI South Korea ETF (EWY)- South Korea has a booming economy, robust exports, and stable yet high growth potential. The ETF has been the top-performing emerging market ETF since March 23.

iShares MSCI Indonesia ETF (EIDO)- Largest economy in Southeast Asia with young demographics. The fourth most populous country in the world. It could be less risky than other emerging markets while simultaneously growing fast. It could also be a Top 5 economy by 2050.

iShares MSCI Chile ETF (ECH)- One of South America’s largest and most prosperous economies. An abundance of natural resources and minerals. World’s largest exporter of copper. Could boom thanks to electric vehicles and batteries because of lithium demand. It is the world’s largest lithium exporter and could have 25% of the world’s reserves.

iShares MSCI Peru ETF (EPU)- A smaller developing economy but has robust gold and copper reserves and rich mineral resources.

The last 7 days have been relatively rough for my emerging market picks. However, there could be some attractive buying opportunities. Let’s take a closer look.

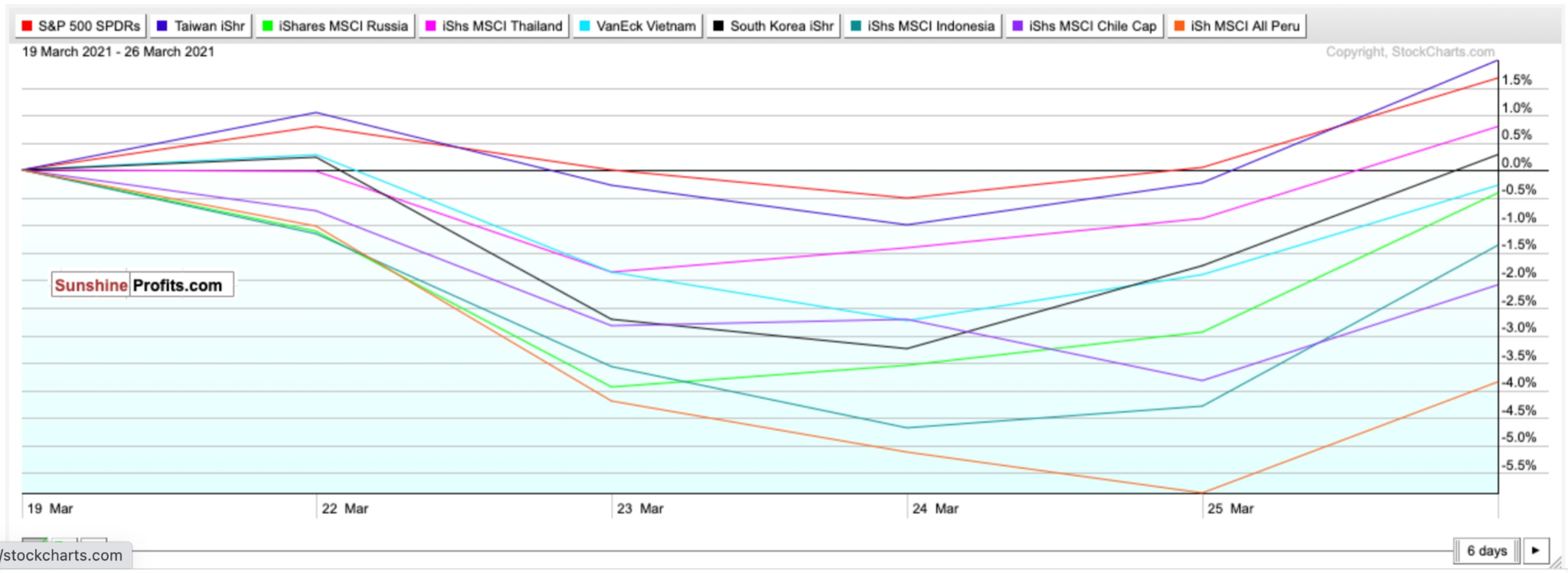

Figure 7- SPY, EWT, ERUS, THD, VNM, EWY, EIDO, ECH, EPU comparison chart- March 19-Present

Since March 19, Peru and Chile have been the biggest laggards. This can be primarily due to volatile commodity prices, namely precious metals and battery metals. Since March 19, while gold has been relatively flat, copper has declined about 1%, silver about 4.7%, and lithium, as tracked by the LIT ETF, about 1.95%. While Peru and Chile aren’t necessarily directly correlated to these metals' performance, their ETFs are undoubtedly impacted since their economies depend on mining so much.

Taiwan has been the leader since March 19, rising about 2.65%.

Outside of the aforementioned country-specific ETFs, you can also BUY the iShares MSCI Emerging Index Fund (EEM) for broad exposure to Emerging Markets.

Long-Term

Over a year out from the bottom and I remain more convinced than ever that the economic recovery is going better than expected. Vaccines for any adult who wants them in America is right around the corner. But it’s a blessing and a curse if this recovery goes “too well.”

Continue to pay attention to complacency, overvaluation, bond yields, and especially inflation.

Once again- if he so much has shops at 7-11, Jay Powell will move the markets.

Time will tell what happens. There could be more short-term swings. But the economic climate is reopening, and things look a bit sunnier than they did at this time a year ago.

I think we could see some more swings as the market figures out bond yields and inflation. We may be at the beginning of the end of the pandemic, and 2021 should be a big year for stocks despite some choppy waters. While I don’t foresee the same gains that we saw since March 23, 2020, we should still do well.

Summary

I’m going to list once again the top lessons learned from a year ago, as eloquently written by Ethan Wolff-Mann of Yahoo! Finance. He’s absolutely on the money with them.

- ‘Every crisis is the same’

- Panic can hurt a portfolio

- You genuinely don’t know what’s going to happen

- Rebalancing comes out as a huge winner

Learn these lessons from a year ago—play volatility to your advantage. Be cautious but not scared, and do not try to time the market. There are some concerns, but the overall backdrop right now is favorable for stocks.

Most importantly, though:

NEVER TRADE WITH EMOTIONS.

Consider this too. You can sit out and be scared and wait for the perfect buying opportunity all you want. But as we now sit over a year out from the market’s bottom, let’s see the returns you’d see if you bought ANY of these index-tracking ETFs on March 23, 2020, when it appeared the world was ending: Russell 2000 (IWM) up 124.4%. Nasdaq (QQQ) up 86.55%. Dow Jones (DIA) up 80.75%. S&P 500 (SPY) up 80.46%.

Nobody knows “where” the actual bottom is for stocks. However, in the long-term, markets always move higher and focus on the future rather than the present.

To sum up my calls:

I have BUY call for:

- The iShares Russell 2000 ETF (IWM)

I have HOLD calls for:

- The Invesco QQQ ETF (QQQ),

- the SPDR S&P ETF (SPY), and

- the SPDR Dow Jones ETF (DIA)

I also recommend selling or hedging the US Dollar and gaining exposure into emerging markets for the mid-term and long-term.

I have BUY calls on:

- The iShares MSCI Emerging Index Fund (EEM),

- the iShares MSCI Taiwan ETF (EWT),

- the iShares MSCI Thailand ETF (THD),

- the iShares MSCI Russia ETF (ERUS),

- the VanEck Vectors Vietnam ETF (VNM),

- the iShares MSCI South Korea ETF (EWY),

- the iShares MSCI Indonesia ETF (EIDO),

- the iShares MSCI Chile ETF (ECH),

- and the iShares MSCI Peru ETF (EPU)

Additionally, because inflation shows signs of returning, and I foresee it potentially worsening as early as Q3 or Q4 2021...

I have BUY calls on:

- The SPDR TIPS ETF (SPIP),

- the Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF (PDBC), and

- the iShares Cohen & Steers REIT ETF (ICF)

Thank you.

Matthew Levy, CFA

Stock Trading Strategist