Trading position (short-term; S&P 500 futures; my opinion): no positions are justified from the risk-reward perspective.

Wednesday’s daily upswing came, which I saw as probable. While Monday was a reversal, it was still a daily upswing, and its consolidation continues. So far continues, and the low daily volume yesterday spells an attempt to move down today.

It’s not only because of the Pfizer study effect wearing itself off – rightly so if you examine the mechanics I linked to. If I had to pick one of the many brave souls coming forward as regards the elections, it would be Richard Hopkins, the USPS Pennsylvania whistleblower – and I say power to those who take on wrongdoings wherever they happen – may justice be served! Back to Pennsylvania, it must be really serious when even a registered Democrat comes forward, or a Bernie Sanders supporter speaks.

I am standing by my call that we’re in for an elections upset. Republicans strengthen all around while Biden wins the presidency? Don’t forget about the Dominion or other software, about the analyses on how this flipped or lost votes by state. Take a look then at how the election results stand at the moment given the evidence. Keep an eye on the courts, on the Trump moves, watch the rule of law to win the day…

That’s what I see as the narratives gripping the marketplace ahead, and I don’t even bring up the post-election Pfizer announcement timing that didn’t benefit the President really.

Do the charts support the conclusions from my deep research? Do they exhibut signs of uncertainty coming back?

S&P 500 in the Short-Run

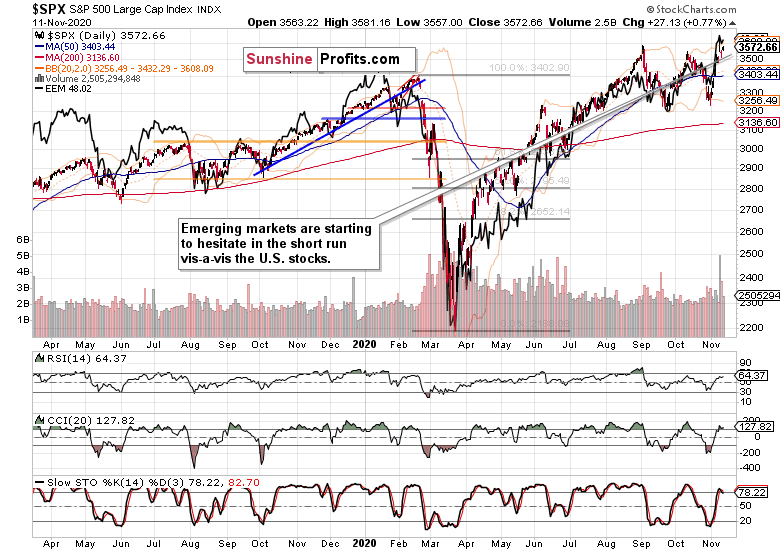

I’ll start with the daily chart perspective (charts courtesy of http://stockcharts.com ):

Yesterday’s upswing confirms that stocks aren’t looking for an upset. Volume declined, making the move higher a bit more vulnerable ahead, pointing out that the general outlook of a bullish bias may be about to be punctured.

Credit Markets and the Dollar

High yield corporate bonds (HYG ETF) had an uneventful session yesterday – one that could go both ways in the very short run, but the direction down still remains as more probable (I am still talking the very short run, only that).

No spectacular action in investment grade corporate bonds (LQD ETF) or the leading credit market ratios (HYG:SHY and LQD:IEI) either.

Long-term Treasuries (TLT ETF), this is where things get interesting. They’re not declining further, and moved higher timidly yesterday. I think they have good potential to rise some more when both the election and vaccine study results get more attention.

The dollar also gained ground yesterday, making it likely that stocks would take a breather today.

Let’s examine other stock markets and dig deeper into S&P 500 to whether that’s the case.

Smallcaps, Emerging Markets and S&P 500 Ratios

The Russell 2000 (IWM ETF) is leading the 500-strong index up, which is positive for U.S. indices, and a testament of rotation out of tech and into value plays that I’ve discussed lately.

Emerging markets (EEM ETF) are weakening a little here, which might be the precursor to the S&P 500 setback that I still see as hanging in the air, its timing being the great question. Couple that with IWM though, and there is no clear outcome from these two charts alone.

The consumer discretionaries to staples (XLY:XLP) ratio reflects the post-Pfizer reversal and persisting stimulus uncertainties. While it doesn’t flash danger to stocks, it shows they are under growing pressure.

The financials to utilities (XLF:XLU) ratio has been slowly moving lower in the last two days as well. While financials will rise in the latter stages of the stock bull run much more, the time for utilities to perform well now is far from over.

Both ratios are leaning towards the side of short-term caution.

Metals and Oil

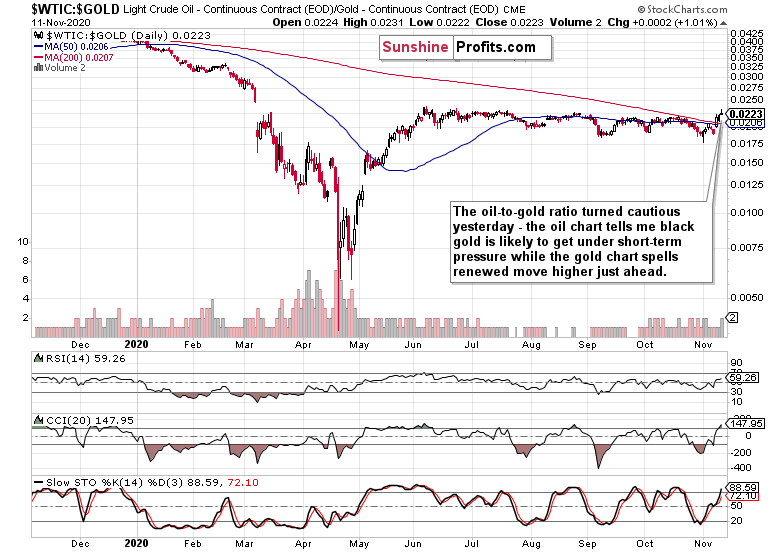

Copper didn’t trade in an eye catching mode yesterday, but it’s stability is telling me that its bull run is far from over. It’s the precious metals and oil that are sending engaging signals here.

The oil to gold ratio got under pressure yesterday, and that makes gold likely to outperform oil on the upside shortly, which would be consistent with the dollar and credit markets’ message, as that is of risk reprising and caution ahead. We had already seen much of the downside in the yellow metal, and the opportune entry point I talked about two days ago, is about to be seen even more in the rear view mirror soon.

The silver to gold ratio shows that the white metal might be a little too optimistic here, making gold the short-term favored precious metal in my eyes. The takeaway for the stock market traders and investors is that the ratio is trading well above the September and August lows, making the king of metals still the star. And that attests to the not absolutely clear skies for stocks ahead.

Summary

Summing up, the short-term seesaw trading continues until a catalyst comes. Vaccine news didn’t do the trick for the markets (I called the 3650 levels on Monday as quite rich), and the S&P 500 is meandering now, still in appreciation of the Biden media-declared win. That’s where I am looking for the upset to the current complacency to come from – first as uncertainty about the result, then as coming to terms with the Trump win that’s in the hands of the courts now.

The big picture though is of the S&P 500 bull market – it’s just about the suitable entry point now.

Trading position (short-term; S&P 500 futures; my opinion): no positions are justified from the risk-reward perspective.

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits: Analysis. Care. Profits.