Trading position (short-term; futures; our opinion): long positions (100% position size) with stop-loss at 3239 (moved lower to reflect the very short-term hesitancy in today's premarket) and initial upside target at 3300.

The bulls are showing real staying power above the early June highs as Friday's bearish candle marked not a upcoming downside reversal, but a bullish comeback. Following yesterday's slow but sure climb, the rally's internals understandably improved. But isn't too much greed present in the market place?

It rose a notch, but isn't roaring back. Far from it - even the data for the week ending July 29, show that 20% bulls faced 49% bears while 31% investors had a neutral outlook (AAII). This is not what all out greed looks like, and as such, it can power the upswing higher - regardless of the put/call ratio moving down these days.

You know what they say happens when too many people get to one side of the boat...

S&P 500 in the Short-Run

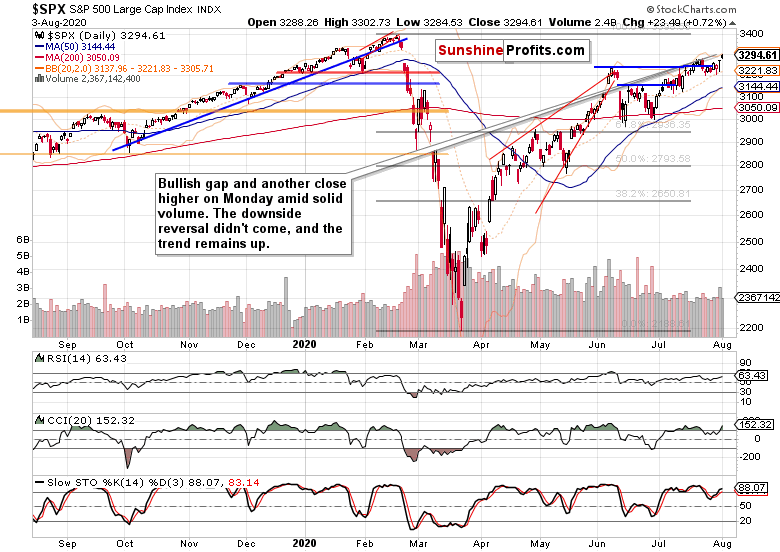

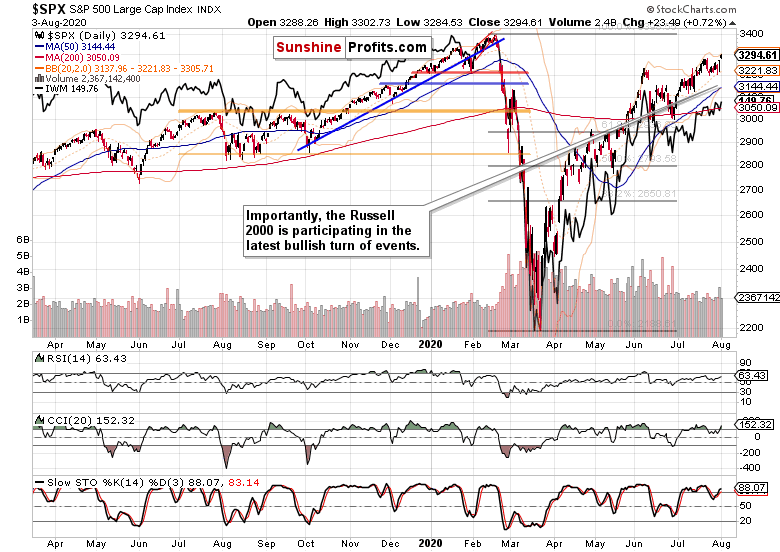

I'll start with the daily chart perspective (charts courtesy of http://stockcharts.com ):

This breakout attempt above the early June highs has legs, and yesterday's lower volume after Friday's high-powered reversal, is no obstacle. It's actually consistent with the path many uptrends in bull markets take. Prices haven risen as not enough sellers were willing to step in - that's how I read it.

Let's check how did the credit markets.

The Credit Markets' Point of View

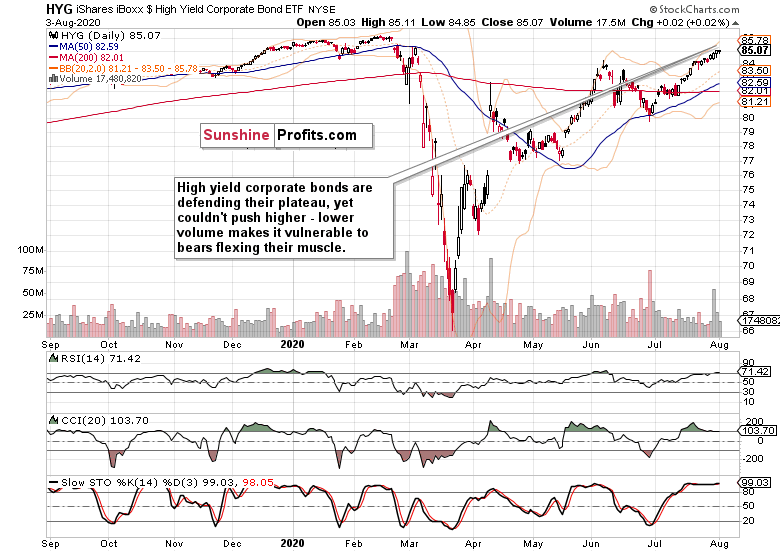

High yield corporate bonds (HYG ETF) didn't exactly keep all their Friday's gains intact, but didn't profoundly decline either. Monday's candle is one of consolidation, and its volume says that it would be very premature to look for signs of an impending reversal.

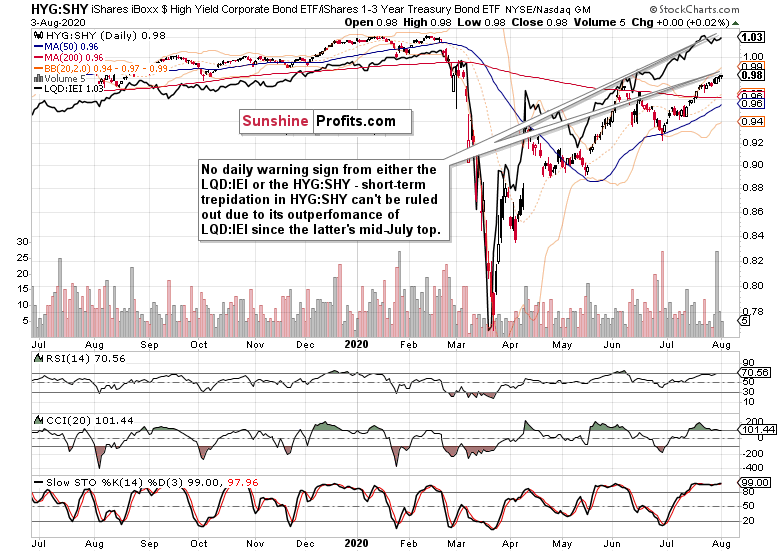

The caption says it all, and both leading credit market ratios - high yield corporate bonds to short-term Treasuries (HYG:SHY) and investment grade corporate bonds to longer-dated Treasuries (LQD:IEI) - are moving in lockstep higher, with the more risk-on one doing relatively better these days.

While that makes HYG:SHY vulnerable to short-term gyrations, unless LQD:IEI also rolls over, it would be a very temporary development. For the record, I don't look for either ratio to roll over, and see them as supporting the stock upswing.

The chart of stocks to all Treasuries ($SPX:$UST) highlights the progress stocks are making relative to the safety of instruments backed by the full faith and credit of the U.S. A breakout above the early June and mid-July highs is arguably a matter of time only.

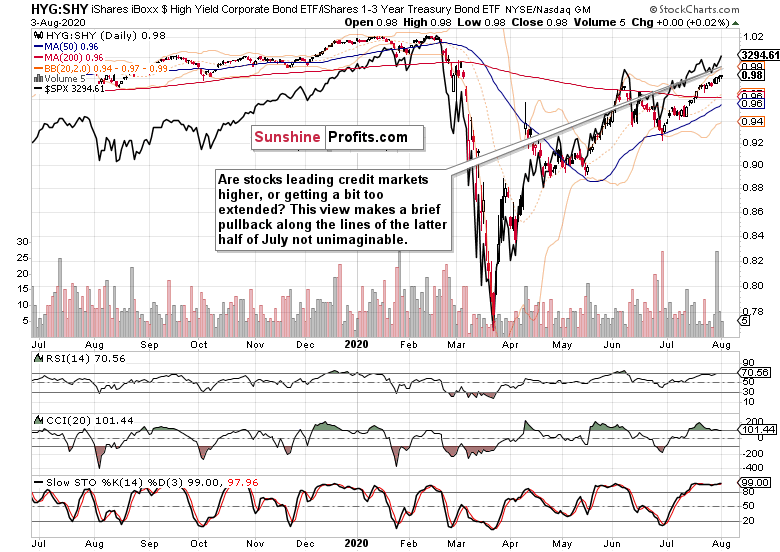

The overlaid S&P 500 closing prices (black line) against the HYG:SHY ratio don't scream danger for stocks. The rebound leaves stocks a little extended in the very short-term, but also reveals their readiness to lead.

As I am not looking for the HYG:SHY ratio to roll over, the stock upswing looks set to reach higher over the nearest sessions.

Smallcaps and Emerging Markets

The S&P 500 closing prices overlaid with the Russell 2000 (IWM ETF) paints a bullish picture of short-term smallcaps resilience. It needn't be an issue that yesterday's IWM upswing occurred at smaller volume - I look to the close near the daily highs as more important from the momentum point of view.

As long as the 200-day moving average in IWM doesn't see prices retreating to its proximity, the dynamics of the smallcaps move bodes well for the 500-strong index.

Emerging markets (EEM ETF) are taking a short-term breather, which is perfectly understandable now that the dollar is finally showing some signs of life. So, the light has turned from green to amber based on this chart alone.

But as higher highs and higher lows are the norm these weeks, the S&P 500 path of least resistance remains up.

S&P 500 Sectors in Focus

Technology (XLK ETF) has risen again, and it doesn't have to thank Apple (AAPL) for that. This highflyer suffered a daily setback, and gave up most of its intraday gains, by the way. The key thing though is the gradual return of momentum into the sector.

Healthcare (XLV) indeed delivered an upside surprise, and materials (XLB ETF) aren't too far from stabilizing and moving higher next too. Defensives (utilities and consumer staples - XLU ETF, and XLP ETF respectively) maintain their strong posture as the leading sectors in the currently unfolding rotation. Also, I look for financials (XLF ETF) to start catching up a bit more visibly.

Summary

Summing up, Monday's trading extended the S&P 500 gains amid improving rally internals such as the advance-decline line moving to positive territory with plenty of room to grow. Volatility's ($VIX) spike lower is also a welcome preview of things to come. The credit markets' posture in corporate bonds' ratios isn't merely on account of briefly pausing Treasuries (yes, I am looking at you, long-dated ones - TLT, TLH). While these indicate a possibility of the S&P 500 briefly declining, it's the smallcaps and emerging markets resilience that keeps painting a rather bullish picture for stocks.

Trading position (short-term; futures; our opinion): long positions (100% position size) with stop-loss at 3239 (moved lower to reflect the very short-term hesitancy in today's premarket) and initial upside target at 3300.

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits: Analysis. Care. Profits.