The Biden administration is 125 days old, and things certainly feel different. What strategies are you employing to take advantage of the shift?

Things often change temporarily before reverting to a mean. Just like market instruments, changing political ideals can, do, and will change, before ultimately reverting back to a mean, or an average state.

Labor force configurations have changed drastically, partially due to the pandemic. What was once everyone’s dream “to work from home”, went from a wish to a potentially harsh reality and has stayed there for many people.

On top of the new remote workforce norm, there has been a shift for many wageworkers, as they are becoming increasingly reliant on government-funded subsidies such as unemployment benefits, food assistance, and others to survive. Many workers needed these benefits to survive during the peak of the pandemic. Many red states have already begun the process of limiting or restructuring unemployment benefits and requirements. However, many blue states have not done so, and perhaps do not intend on doing so.

These collective actions and inactions create a lack of desire for many wageworkers to return to work. And, why would they? If a worker can receive an equal-to, or in many cases, a higher amount of compensation without having to work, there is no financial incentive, albeit some may have a moral incentive. This dynamic creates challenges for small business owners in the US.

Let’s assume that you are a restaurateur. You require a labor force that has a certain skill set and commands a certain compensation. Since the labor market for this type of work does not command a very high rate of pay, the work pool shrinks, and labor is hard to find. So, raise the minimum wage, you say? Then, the small business restaurateur may not be able to survive and continue operations, doling out delicious delicacies to the neighborhood. Who wins in that situation?

Inflation does not help. Is it highly coincidental that inflation metrics have suddenly spiked while a large percentage of certain workforces are not working? What about housing? If you are in the US (depending on your local market), you may be all too familiar with sky-high single-family home prices, and rents are out of control in many markets. Housing seems to be a luxury in many markets and for many people at this time.

How do we try to profit from it? Automation.

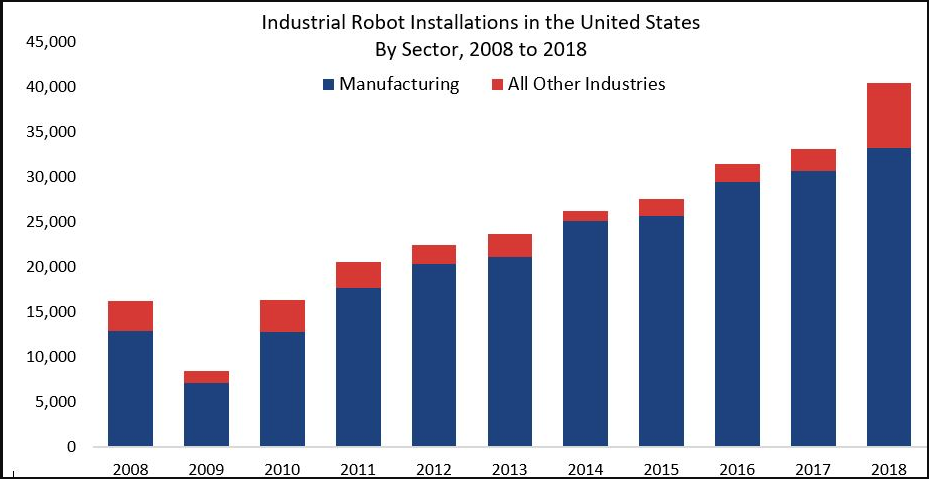

Figure 1 - Industrial Robot Installations in the United States 2008 - 2018. Source International Federation of Robots ifr.org

While the above graphic is a bit dated, it shows an exponential increase in industries other than manufacturing in 2018.

Robots don't need paychecks or lunch breaks. They never call in sick. Bringing a robot into service is a one-time cost and a maintenance cost. If there is no human work pool to fill a demand, robots and automation will likely continue to be the answer, and potentially at a higher rate of increase.

There is no shortage of ETFs for an investor to gain exposure to this trend in automation. After sifting through many of them, I wanted to discuss one that really stood out to me today.

Today’s ETF is QTUM - Defiance Quantum ETF. You can read all about the ETF here. Per Defiance: “QTUM provides exposure to companies on the forefront of cloud computing, quantum computing, machine learning, and other transformative computing technologies.”

So, while this product provides more exposure on the computer side of robotics and automation versus the physical automation side, the chart is so pretty right now, that I could not pass up the opportunity to mention it.

Figure 2 - QTUM Defiance Quantum ETF Daily Candles November 1, 2020 - May 24, 2021. Source stockcharts.com

I mention the MACD(12,26,9) crossover and the RSI(14) 50 line frequently. It just happens to be something that I look for in my analysis. As we can see here, we have those two technical indicators showing a bullish clue. In addition, QTUM has been consolidating nicely since January 2021, which leads me to speculate that this is a bullish continuation pattern.

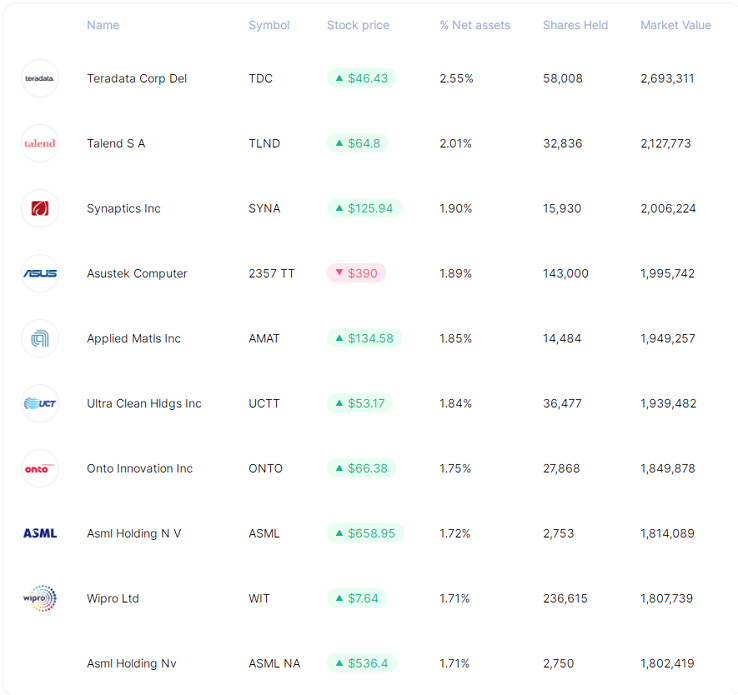

Figure 3 - QTUM Defiance Quantum ETF Top 10 holdings as of May 25, 2021 Source defianceetfs.com/qtum/

Taking a look at the top 10 holdings, you may see some familiar names and some that you may not be too familiar with at this time. Time to do some research! QTUM is up 13.59% YTD as of the time of this writing.

QTUM could be an interesting play in the AI & automation space, especially if the consolidation pattern breaks to the upside shortly.

To sum up the current viewpoint and opinion:

I have BUY opinions for:

- Defiance Quantum ETF (QTUM) between $44.00 - $47.25. Look for pullbacks for entries, and always use a stop loss level that caters to your individual risk tolerance.

- Amplify Transformational Data Sharing ETF (BLOK) between $37.68 - $37.91. BLOK has a history of high volatility, so proceed with caution. Always use a stop loss level that caters to your individual risk tolerance. Update 05/25: We haven’t yet reached the buy idea target area and will remain patient due to the volatility in this name.

- Invesco MSCI Sustainable Future ETF (ERTH) between $67.76 - $70.82. Always use a stop loss level that caters to your individual risk tolerance. Update 05/25: ERTH closed at $72.66 yesterday and is looking good.

I have a SELL opinion for:

- June 10-Year Notes (ZNM2021) between 132’06 - 132’17. Always use a stop loss level that caters to your individual risk tolerance. Update 05/25: June 10-year notes have traded through our sell idea range and currently sit at 132’19 as of the time of this writing (2 points above the sell idea range). Use a stop order that you are comfortable with and see what transpires.

- Invesco DB Commodity Index Tracking Fund (DBC) $18.50 - $18.75. Target 17.50 (old highs) to $17.75. Always use a stop loss level that caters to your individual risk tolerance. Update 05/25: The DXY may want to put in its key Fibonacci retracement level of $88.40 before finding support. Nobody knows for sure. But, use caution if you are trying this trade, knowing that the DXY could capitulate to this level. See the May 19th publication for more details.

I have a HOLD opinion for:

- First Trust NASDAQ Clean Edge Smart Grid Infrastructure Index Fund (GRID). GRID has traded through our idea range of between $86.91 and $88.17. It is not suggested to chase it, if not already long, in my opinion. Update 05/25: GRID closed at $89.34 yesterday and is chugging along. I now have it listed as a Hold because there were better entry prices a week ago. Don’t chase.

- Short-term traders can look at the 52-week high of $90.96 and high $90.00’s to the psychological $100.00 level as take profit level ideas. Always use a stop loss level that caters to your individual risk tolerance.

Remember to be patient with your entries and to use stop orders. Have a great day!

Thank you,

Rafael Zorabedian

Stock Trading Strategist