In the premium editions of my newsletters, you know that I have been consistently touting the iShares Cohen & Steers REIT ETF (ICF) as a potential hedge against inflation.

In this REIT Special Edition, I will break down the WHY. But not, we aren’t going to just talk about the ICF ETF. We will dig into what specific real estate sectors you might want to consider when looking at REITs to invest in.

But first and foremost, what is a REIT, and why are they such strong bets right now?

Let’s just say, if you want to invest in real estate but do not necessarily have the capital, you will want to read on. If you don’t have the patience for illiquid assets like buildings, you will want to read on. And suppose you want the easiest, most convenient way to diversify your portfolio and add real estate exposure. You will want to read on.

A REIT, or real estate investment trust, is a company that owns, operates, or finances income-producing real estate assets. Think of REITs as mutual funds for real estate. REITs pool the capital of numerous investors.

For the most part, REITs trade on public exchanges like stocks, which makes them highly liquid, unlike physical real estate assets. But the thing I love most about REITs? They also almost mirror the consistent income streams you can get from real estate assets. REITs pay some of the best and most consistent dividends on the market. All while you as an investor don’t have to get your hands dirty and buy, manage, or finance the property.

REITs invest in almost every real estate sector. However, in this edition, we will focus specifically on multifamily, hospitality, industrial, and healthcare. Why? Multifamily and hospitality could see substantial recoveries after 2020. Industrial and healthcare had strong 2020s and could continue to succeed in 2021 and long after.

Hopefully, you find my insights enlightening. I welcome your thoughts and questions and wish you the best of luck.

Hospitality

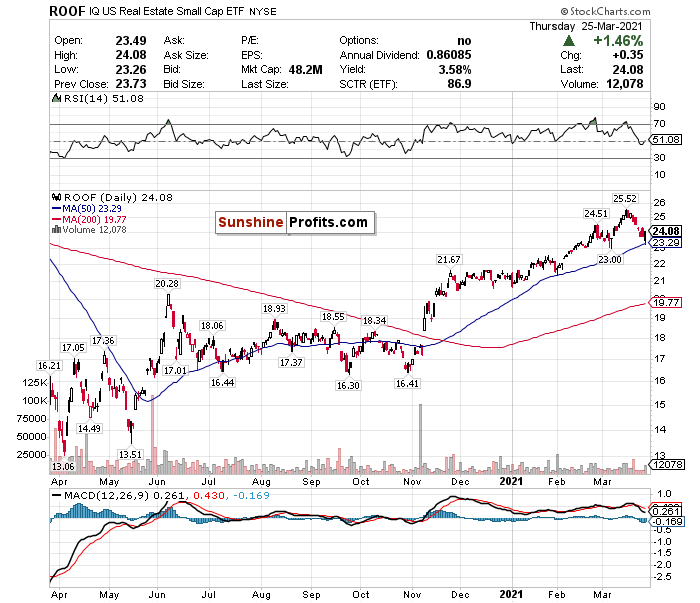

Figure 3- IQ U.S. Real Estate Small Cap ETF (ROOF)

There are a lot of questions for the hospitality industry. But when you hit bottom like this sector did, there’s nowhere to go but up.

Hospitality REITs focus on travel and hotel assets. Of course, thanks to travel restrictions and pandemic, this sector was destroyed in 2020. This sector, though, could make up a considerable amount of lost ground as pent-up travel demand is expected to surge. We’re already seeing the most amount of TSA check-ins since January 2020. Especially as more and more people become vaccinated, watch out.

Now, will it reach pre-pandemic levels? That’s questionable in 2021. The pandemic is still not over, and who knows what will happen with virus mutations and variants.

But according to Marcus & Millichap, Occupancy, ADR, and RevPAR numbers, critical metrics of hospitality success, lead in larger gateway metro areas. While still below pre-pandemic highs, the trends are encouraging.

Plus, we are seeing a good amount of new construction with interest-rates still extremely low.

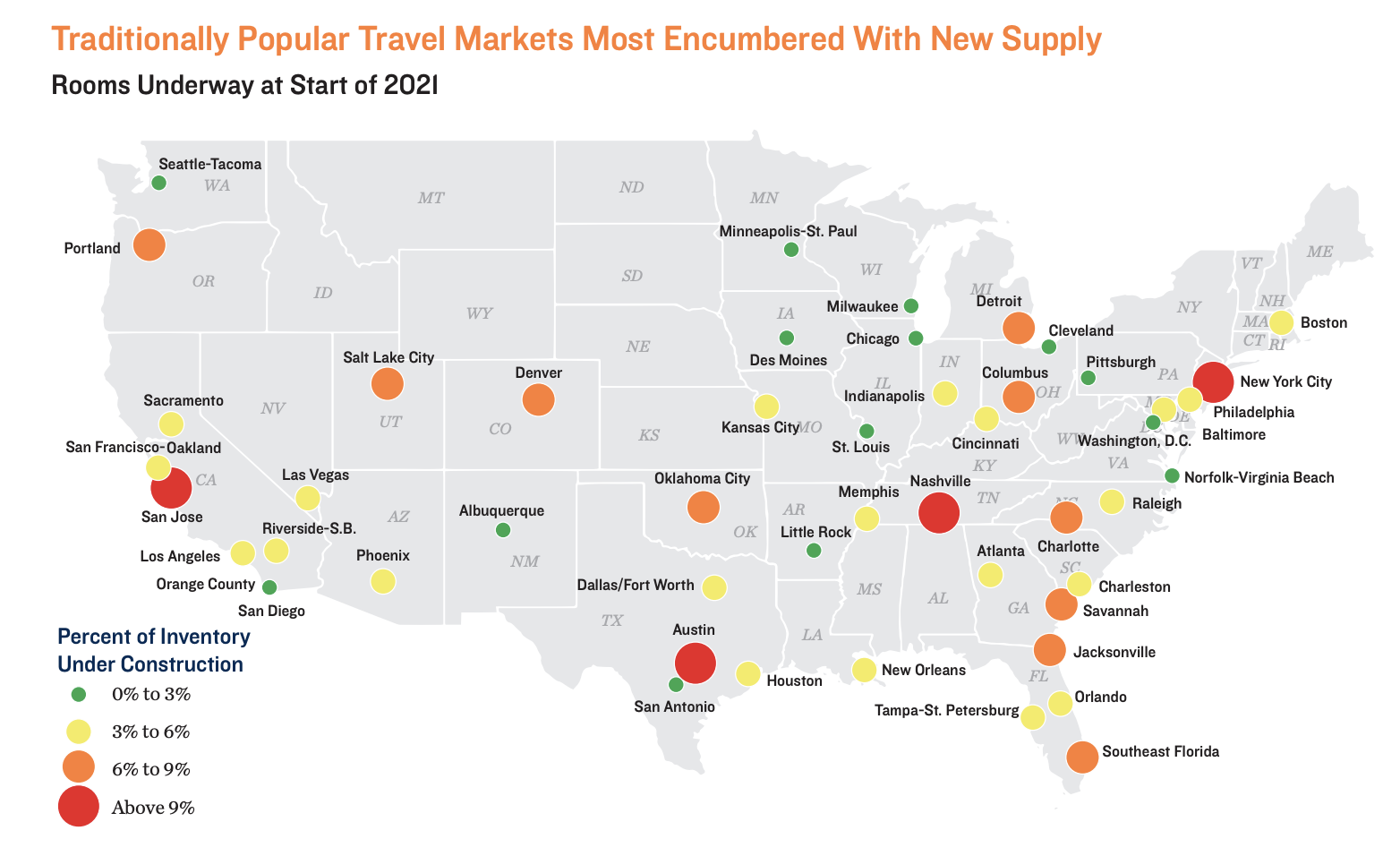

Figure 4: Marcus & Millichap Forecast

So to play this sector:

- Research individual REITs with strong dividend yields with a focus on hotels, restaurants, and hospitality.

- Add exposure to hospitality REITs through ETFs like the IQ U.S. Real Estate Small Cap ETF (ROOF) . While this ETF does not focus EXCLUSIVELY on hospitality REITs, it has strong exposure to numerous hospitality REITs such as Pebblebrook Hotel Trust (PEB), Sunstone Hotel Investors, Inc. (SHO), and Apple Hospitality REIT Inc. (APLE).

Industrial

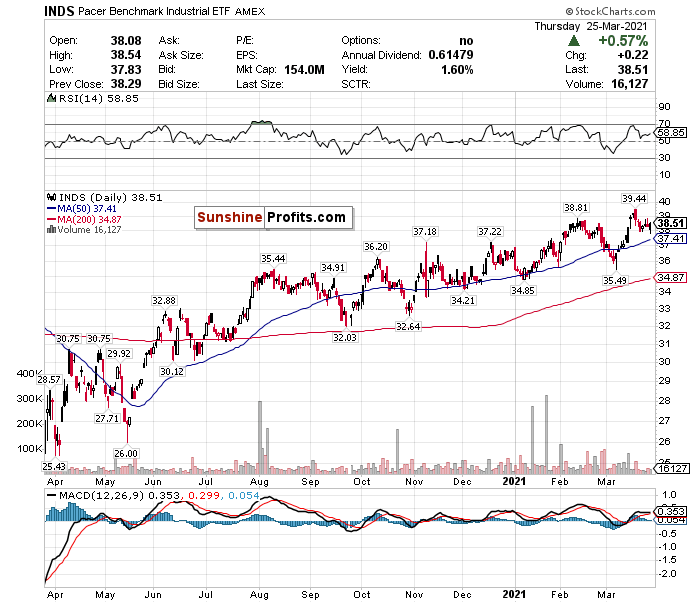

Figure 5- Pacer Benchmark Industrial Real Estate (INDS)

Industrial real estate is a personal favorite of mine. I loved how it was trending before the pandemic. I also loved how it was arguably one of the biggest winners of the pandemic.

Because our lives became so remote and “socially distant,” industrial real estate’s importance was and still is so important. It will likely become even more critical in the future too.

The rise in eCommerce is a primary driver of this. Demand for warehouses and logistics centers has skyrocketed. However, industrial real estate also includes data centers and cold-storage facilities.

I’ve also long loved industrial real estate as an investor because of its low overhead costs and stability. Not to mention, industrial spaces have some of the strongest occupancy rates out of all real estate sectors.

Lastly, this is not a sector so dependent on location like multifamily and hospitality. Wherever you are in this country, there will be needs for warehouse and distribution facilities and inventory expansion.

To add industrial real estate exposure, you can do the following:

- Research individual REITs with solid dividend yields filling a specific need for logistics, storage, or data.

- Add exposure to the Pacer Benchmark Industrial Real Estate (INDS), an ETF with a finite focus on industrial REITs part of the eCommerce distribution and logistics networks along with self-storage facilities.

Healthcare

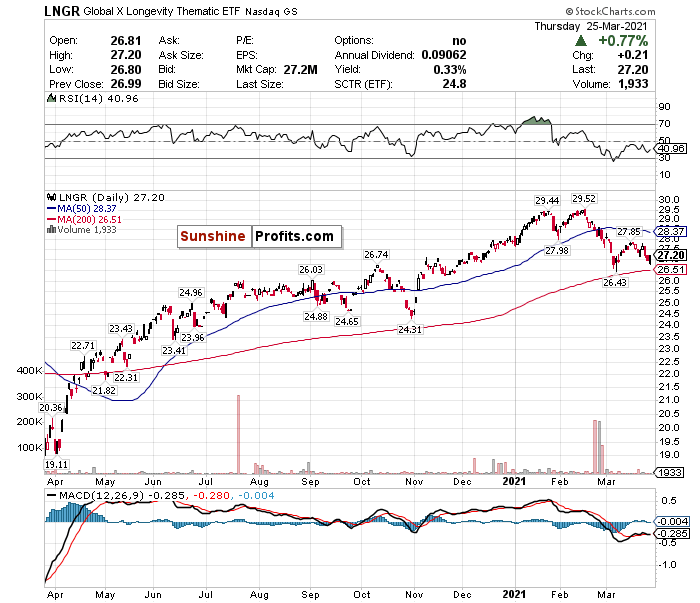

Figure 6- Global X Longevity Thematic ETF (LNGR)

Healthcare real estate is my favorite out of all.

Healthcare real estate has been remarkably stable, regardless of the economic climate. Its assets have also been known to have long-term leases, stable occupancy, consistent income streams, and high tenant quality.

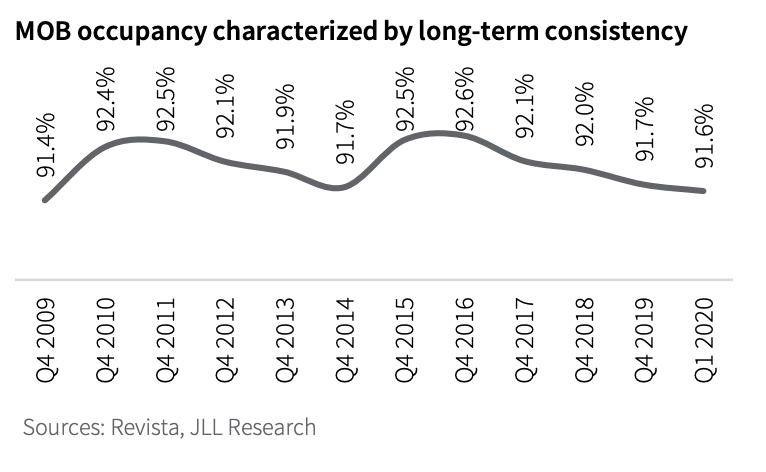

Between the financial crisis of 2008 and Q1 2020, the average occupancy rate for healthcare assets remained remarkably stable, between 91.4% and 92.6%. That’s significantly higher than the average occupancy rate of 82.1% to 85.8% for U.S. offices in that same period, for example.

Figure 7: JLL Healthcare Real Estate Outlook

Consider this too. Healthcare real estate development usually does not have speculative gambles. Healthcare properties, on average, demand a minimum pre-leasing of 50 percent before launching new constructions.

Not to mention, our demographics are significantly aging. By 2040, about one in five Americans could be age 65 or older compared to approximately one in eight in 2000. Age correlates with healthcare demand, period. The older you are, the more healthcare services you will require.

Plus, telehealth is creating additional real estate demand rather than supplanting in-person care. The rise of MedTail, or medical properties in retail spaces, is also skyrocketing and creating a whole new category of real estate.

In fact, all of these tailwinds have led to an average of roughly 20 million square feet of new Medical Office Building construction per year.

To add health real estate exposure, you can do the following:

- Research individual REITs with diversified healthcare exposure. According to Investopedia , there are approximately 17 healthcare REITs in the U.S. that specialize in senior housing, skilled nursing, medical office buildings, hospitals, and life science labs.

- Consider the Global X Longevity Thematic ETF (LNGR) as a creative way to add not only healthcare REIT exposure but a way to invest in our aging demographics. It is not a real estate-focused ETF. However, it allocates over 8% of its weight to healthcare REITs. The underlying goal of the ETF is to “invest in companies positioned to serve the world’s growing senior population through exposure to health care, pharmaceuticals, senior living facilities and other sectors that contribute to increasing lifespans and extending quality of life in advanced age.”

Summing it Up

I love REITs in this current climate. Complacency, overvaluation, rising bond yields, and especially inflation are giving the market for jitters right now more than necessary. I frankly don’t like it very much. Who does?

That’s why I see REITs as a perfect hedge. REITs add consistent dividends to your portfolio and give you a sense of sanity in these crazy markets.

In other words? I’m sick and tired of hanging on to Jay Powell’s every footstep and seeing how it will impact my holdings.

Are REITs immune to volatility? No, of course not. However, in these times, it’s essential to add diversification and play a little defense. REITs are one of the best ways to do that. You might be especially happy if you zero in on certain real estate sectors that could benefit from the current monetary policy, pent-up demand, societal and demographic shifts, and the economic recovery.

To sum up my calls:

I recommend focusing on real estate sub-sectors such as

- Multifamily

- Hospitality

- Industrial

- Healthcare

While I also recommended researching specific REITs in each of these sectors for easy, convenient, and broad-based exposure, consider the following ETFs as potential BUYs.

- The iShares Residential Real Estate ETF (REZ),

- the IQ U.S. Real Estate Small Cap ETF (ROOF),

- the Pacer Benchmark Industrial Real Estate (INDS), and

- the Global X Longevity Thematic ETF (LNGR).

Thank you.

Matthew Levy, CFA

Stock Trading Strategist