Trading position (short-term; our opinion): short positions (100% position size) with stop-loss level at 2750 and the initial downside target at 2200.

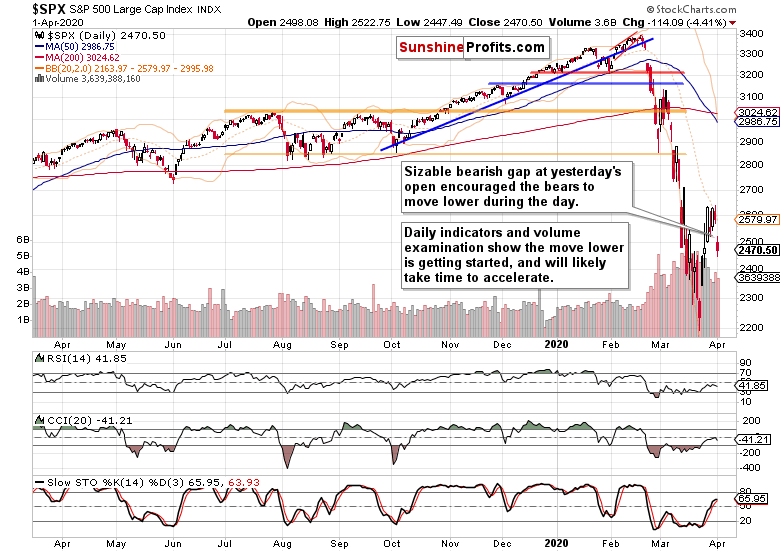

As expected, the S&P 500 had a down session yesterday. Opening with a sizable gap, the bears continued their push to move prices lower. Since the futures have been pointing higher before the unemployment claims came in, does it mark a tradable turnaround?

In short, that's unlikely. Let's start though with the daily chart examination (charts courtesy of http://stockcharts.com).

The days of inside candles are over as stocks indeed rolled over to the downside. These were our yesterday's observations:

(...) Stocks closed near the daily lows on Tuesday, and did so on higher volume than was the case on Monday. Another point speaking for the bears is that yesterday's upswing attempt was again soundly rejected. And still, the daily indicators are increasingly and tellingly curling lower.

The above holds true also today, and perhaps even more so as the daily indicators' examination reveals. Yesterday's bearish gap continues to support the bears, and we certainly expect the downside move to continue over the coming days.

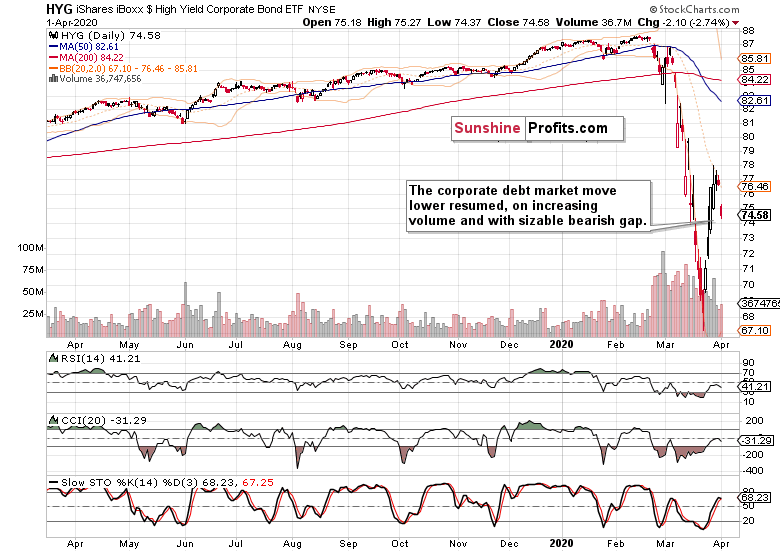

Let's check again the high-yield corporate debt chart (HYG ETF). It should confirm the move lower in stocks, shouldn't it?

It does confirm it. That's what we noted about HYG yesterday:

(...) The relentless yet decelerating climb higher has stopped, and there's a good chance that we'll see its way lower prices ahead, which would confirm the developing downswing in stocks.

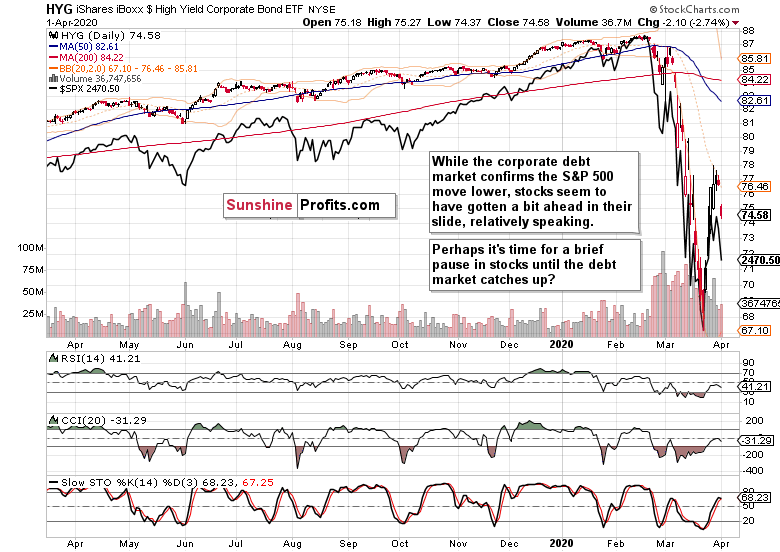

But does that mean stocks would move in a straight line lower now? Let's check the perspectives of both the stock and bond market, in order to check their relative dynamics.

The above charts overlays the corporate debt ETF's candles with the stock index line. Comparing the magnitude of yesterday's downswing shows that stocks are a bit ahead in the sliding game. Unless HYG declines more meaningfully today, stocks are likely to take a short-term pause as they have declined more profoundly yesterday. The emphasis here goes to short-term (which implies that any potential upswing certainly isn't going to be a tradable opportunity) - unless we see a turnaround in the debt market, any potential stock upswing doesn't really have legs.

Summing up, the bears enjoy the upper hand as can be seen on both the weekly and daily charts. The renewed downswing is underway, and lower S&P 500 (and SPY ETF) values are ahead. The daily indicators, high-yield corporate debt market and fundamental prospects of more coronavirus pain and its reflection in market prices mean that our open and increasingly profitable short position remains justified.

Trading position (short-term; our opinion): short positions (100% position size) with stop-loss level at 2750 and the initial downside target at 2200.

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits - Effective Investments through Diligence and Care