Trading position (short-term; S&P 500 futures; my opinion): no positions are justified from the risk-reward perspective.

The text below is what Monica Kingsley wrote for today (in addition to declining my request to keep her political opinions out of the analyses) that I edited (I removed parts of the text; changing nothing within the text that was left).

=====

S&P 500 in the Short-Run

I’ll start with the daily perspective (charts courtesy of http://stockcharts.com ):

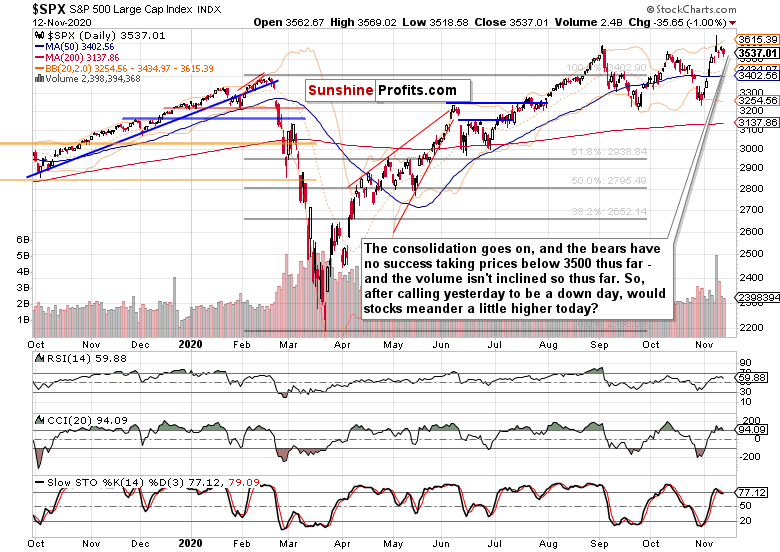

Stocks had a weaker day yesterday – the S&P 500 is working off its Monday reversal. The index is consolidating, volume is little by little declining, which is increasing the odds of today ending slightly higher – the general outlook of a bullish bias doesn’t look to be about to be punctured today.

Credit Markets’ Point of View

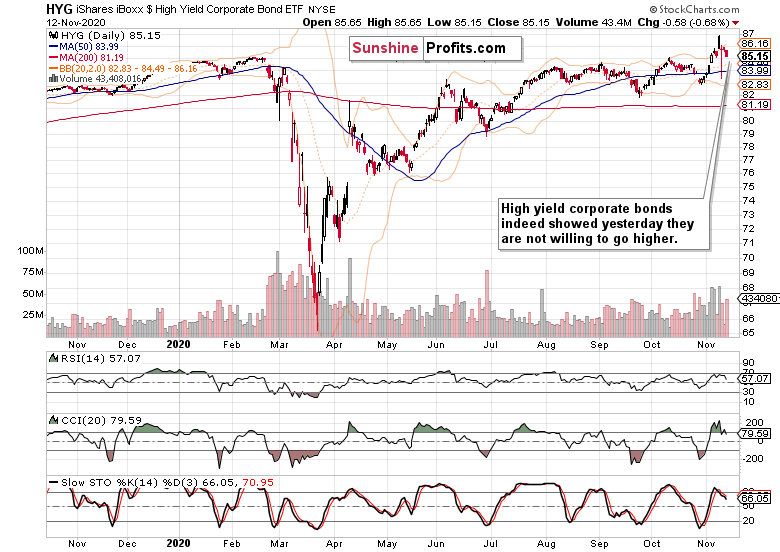

High yield corporate bonds (HYG ETF) aimed lower in what is the instruments’ consolidation of gains reached since late October. The general bias is higher here as well, but the prominent lower knot highlights the risks to the downside, which may or may not materialize (that’s similar to the political risks to the stock bull’s short-term health).

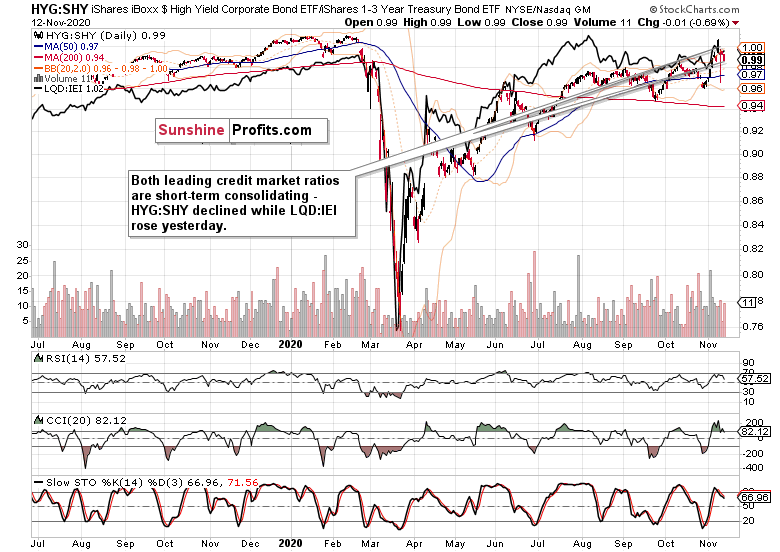

No spectacular action in the leading credit market ratios (HYG:SHY and LQD:IEI) either. Yesterday was a down day in its overall implications.

Long-term Treasuries (TLT ETF) are again catching my eye – they’re rising as I called them to do yesterday. We’re seeing a shift to the risk off that is not negated by the dollar going nowhere on Thursday.

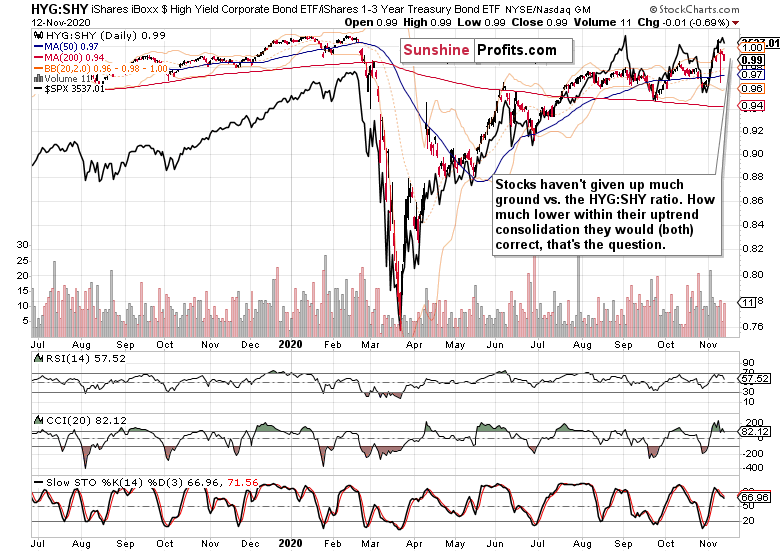

Overlaying the S&P 500 against the HYG:SHY ratio shows that stocks haven’t really conceded much ground just – both metrics are consolidating within their prevailing uptrends, regardless of short-term turbulences.

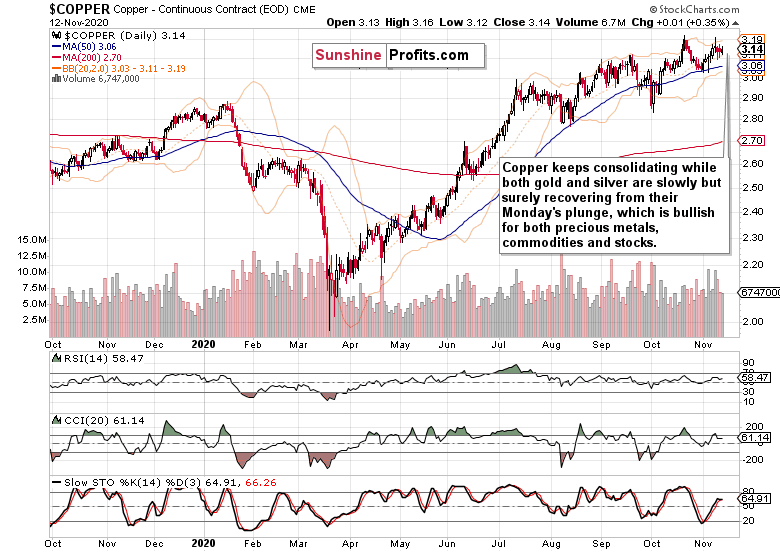

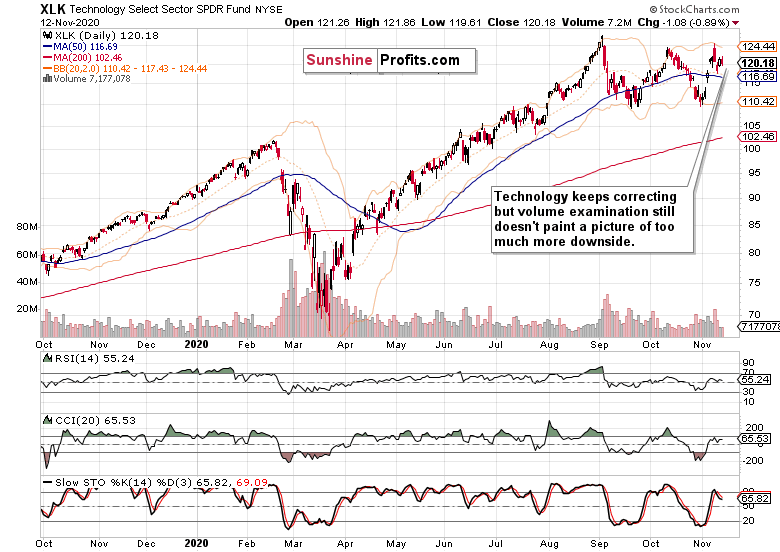

Copper and Technology

Let’s pick copper among the commodities – in spite of it going nowhere in the short run. See the robust uptrend instead of the daily fluctuations. Then, look elsewhere among the metals and also at oil. I view the daily strength in both gold and silver as outweighing crude oil weakness – that’s precisely what I called for yesterday when analyzing the $WTIC:$GOLD ratio. The implications remain bullish for stocks.

Technology (XLK ETF) keeps consolidating, yet the volume reveals that there isn’t much downside left in the very short run. The chart shows sideways consolidation with the September and October price points being the floor, which I however don’t look for to be reached, not by a long shot – as things stand today.

Summary

Summing up, the short-term seesaw trading continues until a catalyst comes. Wednesday up, Thursday down, and today in all likelihood up again. Monday’s vaccine news predictably didn’t stick, and the S&P 500 is meandering now. Stocks are closer to a short-term upset (regardless of the catalyst, presidency or corona, or something else – or even nothing when too many traders tilt to the same side of the boat) as the quite complacent put/call ratio shows.

The big picture though is of the S&P 500 bull market – it’s just about the suitable entry point now.

Trading position (short-term; S&P 500 futures; my opinion): no positions are justified from the risk-reward perspective.

Thank you.

=====

I apologize for the inconvenience the change regarding authorship of Stock Trading Alerts might have caused.

Thank you for your patience.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-Chief