Welcome to a Stock Trading Alerts special edition focusing on tech. We will do a brief run-through of what happened in 2020, followed by the emerging tech trends that we can expect in 2021.

Tech’s impact on our world was arguably the main economic story of 2020. Nobody truly knew what to expect after the pandemic reached U.S. shores in February because nobody has previously experienced a worldwide pandemic of this nature. A novel disease has never before shut down economies or turned our lives upside down.

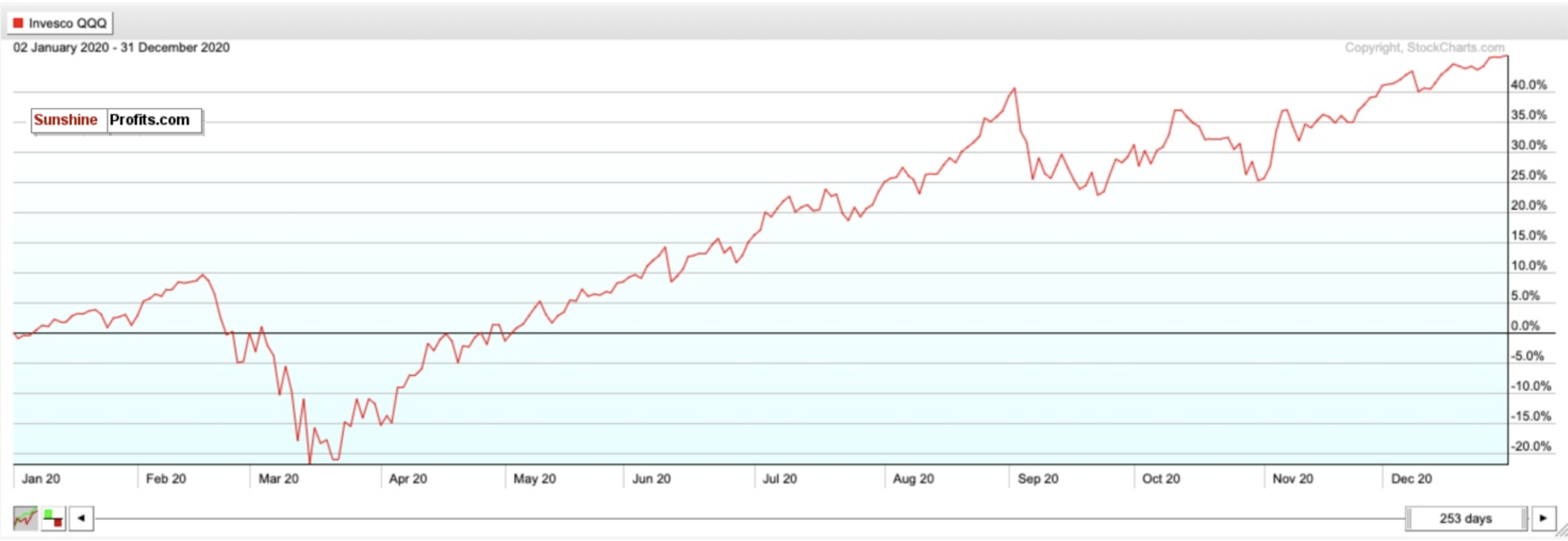

As we got used to this “new normal” though, it was obvious that tech would be the biggest beneficiary. It kept our world running, our businesses working, and students learning. With “stay-at-home” as the new norm, the Nasdaq hit record highs and saw its best year since 2009. Between January 2, 2020, and December 31, 2020, the Invesco QQQ ETF which tracks the Nasdaq, gained 46.20%.

Figure 1

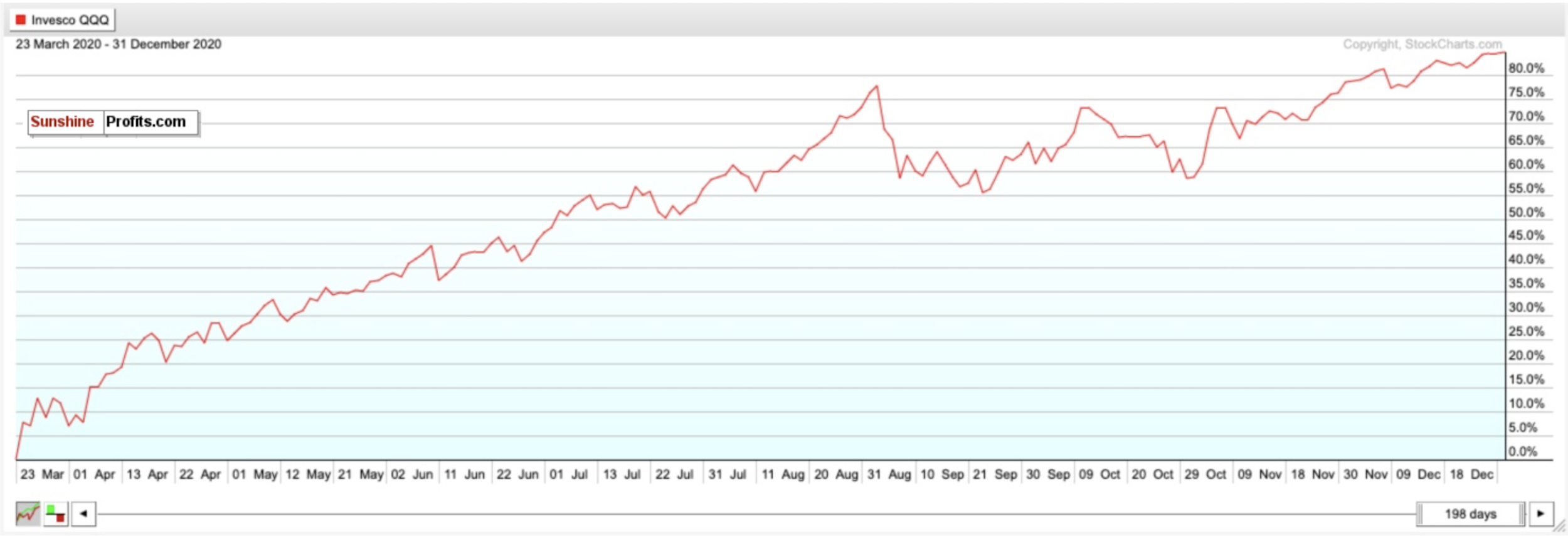

The QQQ also gained nearly 85% between the bottom of March 23, 2020, and December 31, 2020.

Figure 2

In its 2021 kickoff, the Nasdaq continued surging, having already gained 2.4% in the first week of the new year.

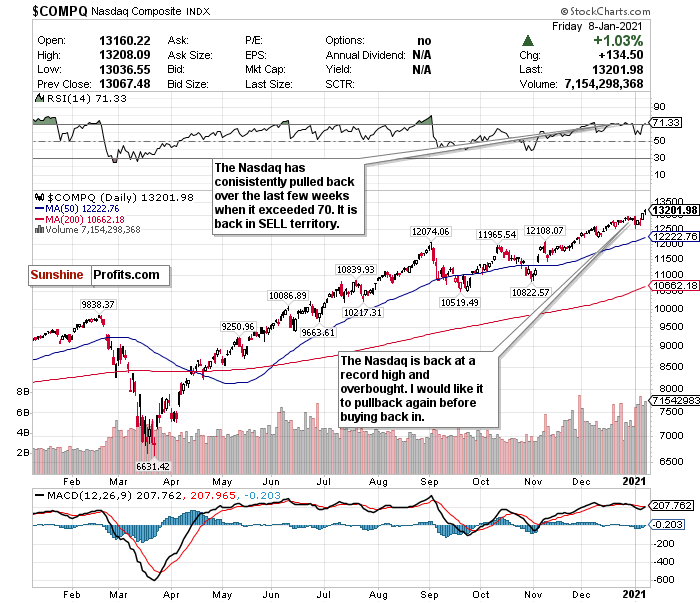

There are some concerns though about overstretched valuations. Three of the 10 biggest IPOs for U.S. tech companies took place in 2020, including the largest ever, with cloud-based data-warehousing company Snowflake (SNOW). Although old-school investors such as Warren Buffet, are finally seeing the benefits of tech stocks, if you look at the Nasdaq chart below, it screams “bubble”.

Figure 3 - Nasdaq Composite Index

Notice the Nasdaq’s RSI. While an overbought RSI does not automatically mean a trend reversal, with the Nasdaq, it tends to reverse in the short run anytime it exceeds a level of 70.

There are also concerns for tech with Democrats winning Senate control. While a tax hike may not happen in 2021, a Democrat-controlled Congress wants to raise taxes on high growth companies. Further regulation for big tech companies could be imminent as well. Additionally, love him or hate him, the censorship of President Trump across social media platforms raises questions about what constitutes free speech and what is stepping over the line for censorship. Expect social media stocks to be hit hard in the near-term due to this controversy.

There are also tailwinds for tech, and they are specific to sub-sectors.

Because technology has been evolving at such a rapid pace, it is important to understand what the top trends were for 2020, and how these trends could have more room to run in 2021.

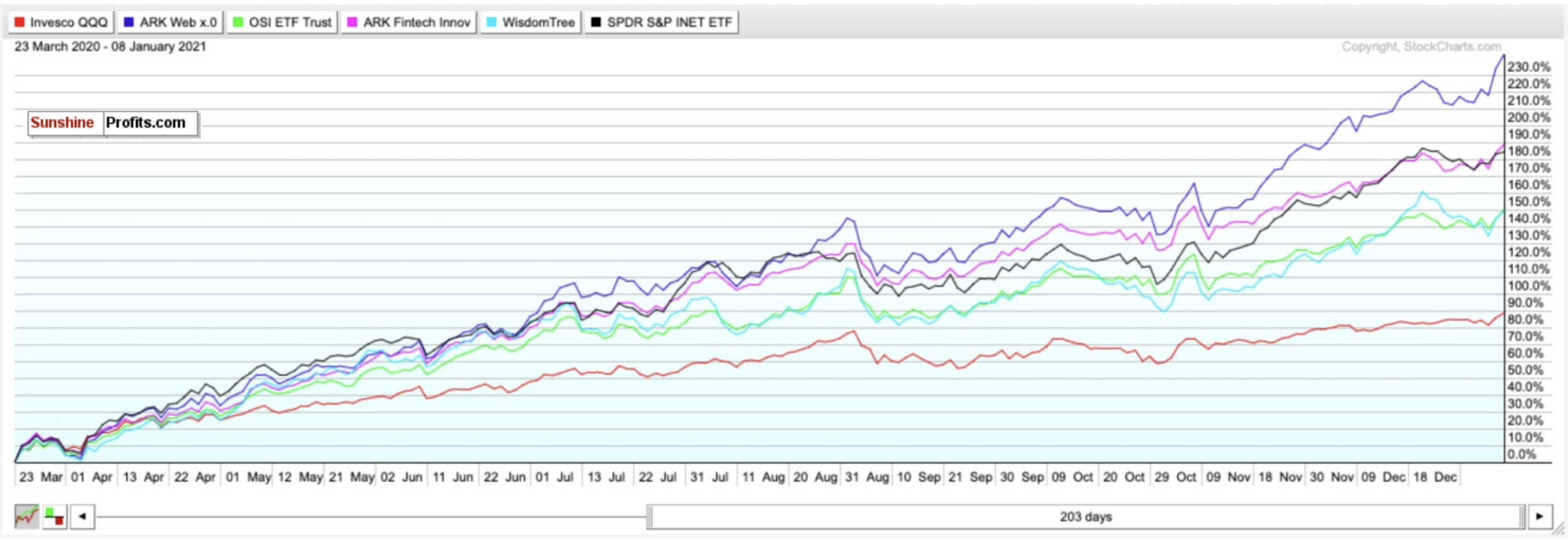

According to ETF.com, the Top 5 performing tech ETFs in 2020 were the following:

- ARK Next Generation Internet ETF (ARKW)

- O'Shares Global Internet Giants ETF (OGIG)

- ARK Fintech Innovation ETF (ARKF)

- WisdomTree Cloud Computing Fund (WCLD)

- SPDR S&P Internet ETF (XWEB)

Since March 23, the returns on these five ETFs compared to the QQQ are staggering:

Figure 4

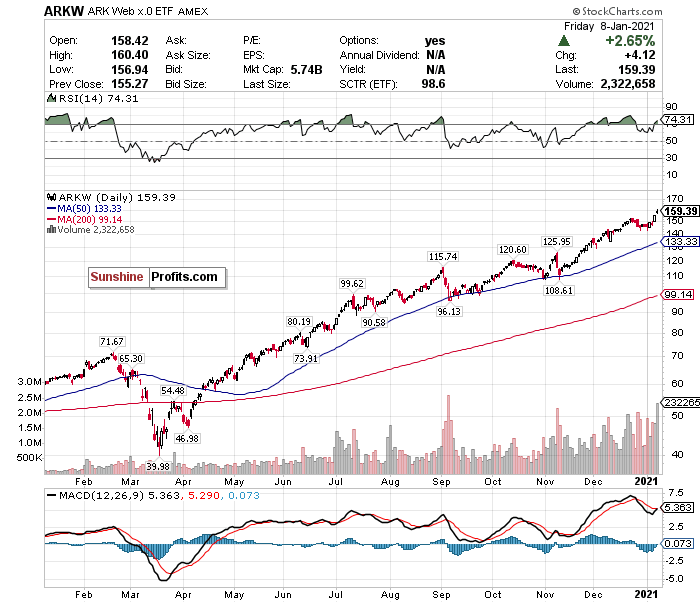

ARK Next Generation Internet ETF (ARKW)

Figure 5 - ARKW ETF

The ARK Next Generation ETF consists of companies involved in innovation and disruption such as Tesla (TSLA), Roku (ROKU), Grayscale Bitcoin Trust (GBTC), Square (SQ), and Teladoc (TDOC).

ARKW focuses on the world’s shift to the cloud and mobile and focuses on stocks that may benefit from the increased use of shared technology, infrastructure and services, internet-based products and services, new payment methods, big data, the internet of things, and social distribution and media.

Let’s do a quick dive into some of the sectors that sent ARKW higher in 2020, and what the outlook could be for 2021 and beyond.

1) Cloud Computing

Because the pandemic shut down our day to day lives in an instant back in March of last year, we have been forced to urgently adopt cloud computing solutions and services. In 2021, this will not change, even if we reach some sense of normality by mid-year.

Watch out for edge computing as well. A good way to look at edge computing is to see it as “Cloud Computing 2.0”.

Edge Computing is designed to solve latency issues associated with Cloud Computing, especially as more and more companies have increasing data demands.

Edge computing can also take on the form of mini data centers through processing time-sensitive data in remote locations with little to no connectivity to a centralized location. By 2022, the global edge computing market could reach $6.72 billion.

2) E-Commerce

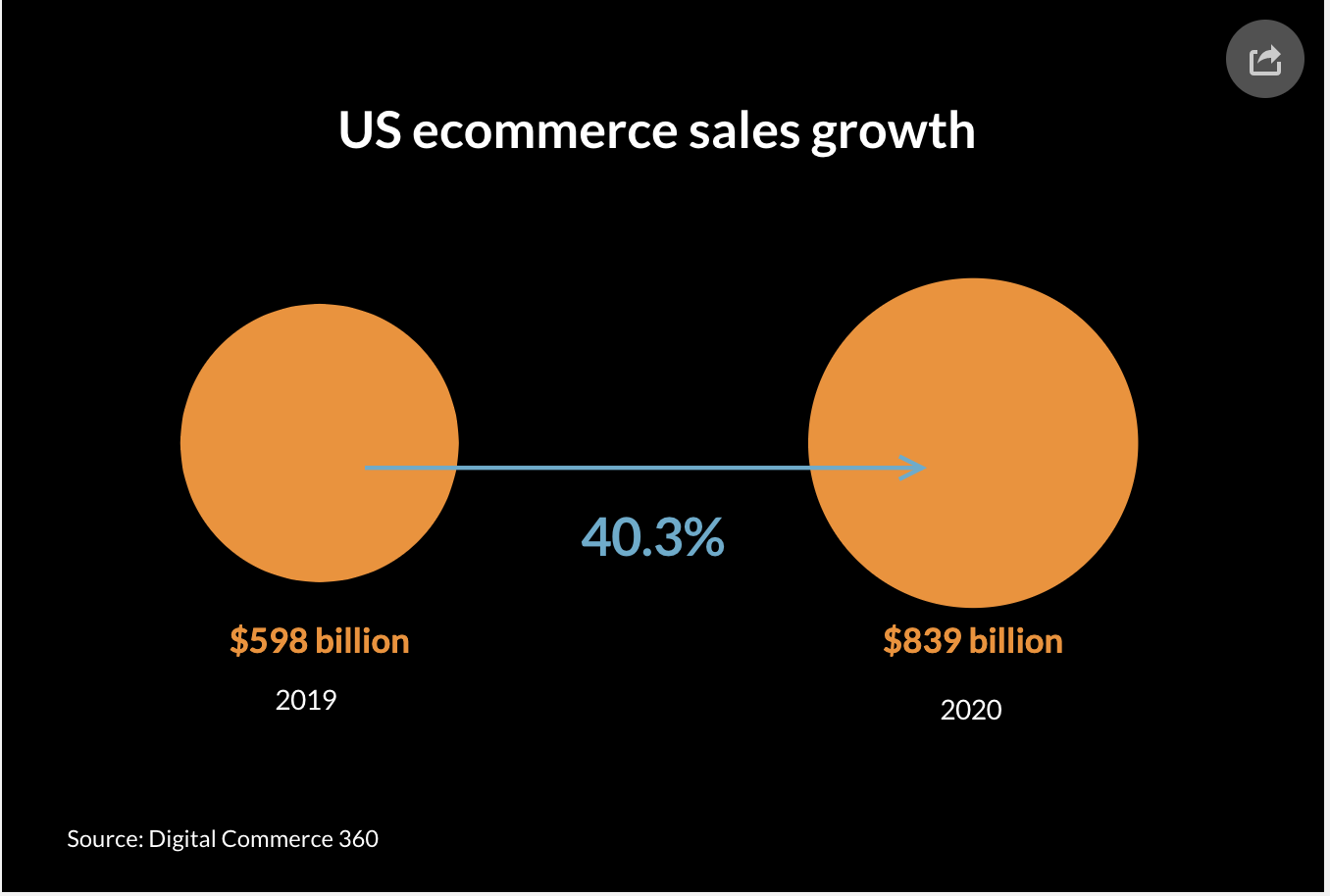

E-commerce has been an emerging trend long before COVID-19 was a real word. Thanks to people being forced to increasingly shop from home because of the pandemic, e-commerce has grown even faster.

According to Digitalcommerce360, e-commerce sales in the U.S. surged by 40.3% to reach $839.02 billion in 2020. This surge was the most e-commerce sales grew in at least two decades.

Even more staggering is that U.S. e-commerce sales reached their projected 2022 numbers more than two years ahead of time! Retail chains also ended 2020 with a 76.8% growth in e-commerce on average.

Figure 6

According to 3dcart, these are some of the biggest e-commerce trends to watch out for in 2021:

1. Use of Voice Commerce

2. Omnichannel Shopping

3. AI and AR Enhancing Shopping Experience

4. Dynamic Pricing Software

5. Growth of Mobile Commerce

6. Sustainability Practices Influencing Sales

7. Growth of Visual Commerce

3) FinTech

FinTech has taken center stage as society is becoming increasingly digitized and cashless. Major banks and financial firms, while late to the party, now know this and have dumped significant capital into technology-based solutions. Increased adoption and acceptance of infrastructure-based technology and APIs will also evolve financial services in the short and long-term. FinTech companies are also delivering low-cost personalized products.

Globally, FinTech is expected to grow at a CAGR of 20% between 2020-2025, and reach a market value of around $305 billion.

There are three trends to focus on specifically for FinTech in 2021 and beyond: Quantum computing, mobile payments, and blockchain/decentralized finance.

Quantum computing is a new way of computing looking to take advantage of quantum phenomena such as superposition and quantum entanglement. Quantum computing has recently come to the forefront as a crucial piece of technology in slowing the spread of COVID-19 and contributing to vaccine development. The technology is best known for its ability to easily query, monitor, analyze and act on data. Financial institutions have noticed this and can be expected to further adopt quantum computing in 2021 to manage credit risk, monitor trading, and detect fraud. The global quantum computing market is projected to surpass $2.5 billion in revenue by 2029.

2020 was likely only the beginning for the growth of mobile payments. Around 5.2 billion people use a mobile device in the world. This figure could grow to 7.3 billion by the end of 2023. 1.31 billion proximity mobile payment transaction users are also projected to exist worldwide by 2023 - a stunning increase from 950 million users in 2019. An Allied Market Research report also claims that the global mobile payment market could grow to $12.06 trillion by 2027 at a CAGR of 30.1%.

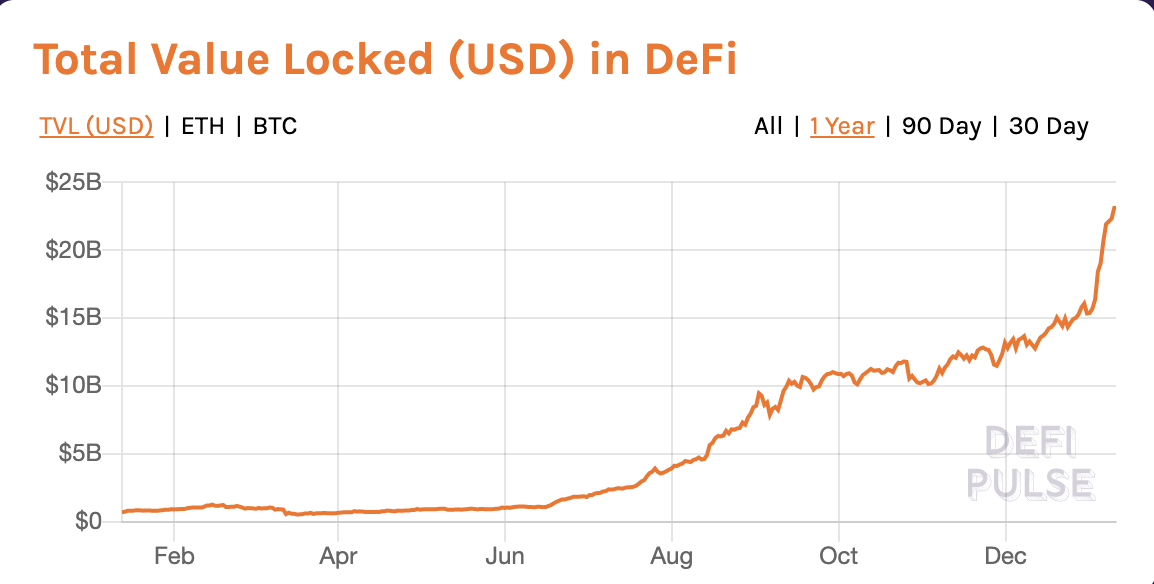

What has the potential to be the most important emerging trend in FinTech is Decentralized Finance, or DeFi. DeFi is an ecosystem of financial applications based on blockchain technology. DeFi aims to make financial transactions more secure, easily accessible, open, and borderless. With nearly 1.7 billion people in the world underbanked, DeFi acts as a worldwide, easily accessible, and open alternative to mainstream financial services. Although Bitcoin garnered most of the attention for its rocketship-like returns in 2020, the DeFi market experienced an even stronger year without the fanfare or glamor. In the beginning of 2020, the total value locked into the DeFi market was around $680 million. This value surged to $15.362 billion by the end of the year. This is an astounding gain of 2159%.

Since the start of 2021, the DeFi market has added another billion dollars worth of value per day and is now sitting at around $22.35 billion of total value locked in.

Figure 7

This could only be the beginning, too.

While the surging spread of COVID-19 and resulting economic shutdowns may drive some short-term concerns, the progress made on the stimulus deal, as well as with the vaccine(s) poses significant optimism for 2021 and beyond.

The start of global vaccinations, and the FDA’s approval of Moderna’s vaccine should be cheered by everyone. Although sentiment can seemingly change at the snap of a finger, the long-term outlook for equities could be very positive.

While we can officially enter 2021 with some glimmer of hope, COVID-19 is still here and has not been eradicated. Until that happens, there will inevitably be a tug of war between vaccine optimism and health/economic pessimism. Furthermore, the mania that has consumed the markets could potentially lead to a short-term correction to start off 2021.

Please keep in mind though that markets are forward looking instruments and are investment vehicles that look 6-12 months down the road. Although it is very plausible that there could be some short-term uncertainty and volatility, remember how sharp and swift the rally was after the crashes in March.

I doubt that a crash like that is on the horizon, but if there is a short-term correction or downturn, keep your eyes on buying opportunities. Why? Since markets bottomed on March 23rd, here is how the ETFs tracking the indices have performed: Russell 2000 (IWM) up 98.32%. Nasdaq (QQQ) up 82.48%. S&P 500 (SPY) up 67.70%. Dow Jones (DIA) up 64.34%.

In the long-term, markets always end up moving higher and are focused on the future rather than the present.

If the stimulus deal officially passes before Christmas, and everything goes well with the vaccines, the short-term volatility may be worth monitoring for opportunities.

Thank you.

Matthew Levy, CFA

Stock Trading Strategist