Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): long positions with entry at 4,340 price level, with 4,440 as the stop-loss (take profit) and 4,740 as the price target.

Stock prices went closer to their local lows yesterday, and this morning they are poised to break lower. Is this still just a correction?

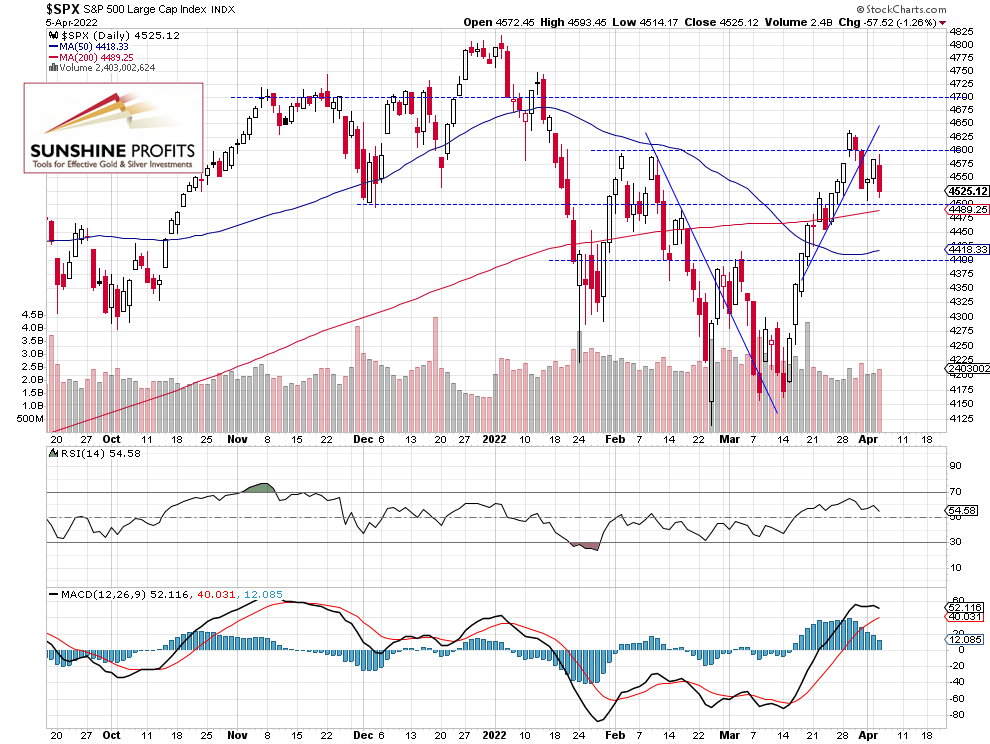

The S&P 500 index lost 1.26% on Tuesday, as it came back to the last week’s low and it got closer to the 4,500 level again. There is still a lot of uncertainty concerning the Ukraine conflict and Fed’s monetary policy tightening plans. The broad stock market’s gauge has been fluctuating within a consolidation after rallying from the March 14 local low of around 4,162. The market broke below the 4,600 level and on Friday it traded closer to the 4,500 level. Yesterday it was close to the 4,500 level yet again and this morning it will likely break below that short-term support level.

The nearest important resistance level remains at around 4,600, marked by the recent consolidation. On the other hand, the support level is at 4,450-4,500. On Thursday, the S&P 500 index broke below its short-term upward trend line, as we can see on the daily chart (chart by courtesy of http://stockcharts.com):

Futures Contract Extends the Decline

Let’s take a look at the hourly chart of the S&P 500 futures contract. It broke below the upward trend line last week and it got back below its local highs from February. So is this a reversal? For now it still looks like a correction and we are maintaining our profitable long position from the 4,340 level. (chart by courtesy of http://tradingview.com):

Conclusion

The S&P 500 index is expected to open 0.9% lower. It will likely break below the 4,500 level following yesterday’s FOMC Member Brainard comments about reducing the Fed’s Balance Sheet. It still looks like a correction within an uptrend, however, it may also be a topping pattern before some more meaningful downward reversal. Therefore, we’ve recently moved our take-profit/ exit level upwards.

Here’s the breakdown:

- The S&P 500 index will likely break below the 4,500 level this morning.

- We are maintaining our profitable long position (opened on Feb. 22 at 4,340).

- We are still expecting some upside from the current levels; however, it is time to get more cautious as there may be a bigger downward correction at some point.

As always, we’ll keep you, our subscribers, well-informed.

Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): long positions with entry at 4,340 price level, with 4,440 as the stop-loss (take profit) and 4,740 as the price target.

Thank you.

Paul Rejczak,

Stock Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care