Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): No positions are currently justified from the risk/reward point of view.

The S&P 500 index went sideways on Wednesday. There’s still a lot of uncertainty concerning Russia-Ukraine crisis. Where will stock prices go?

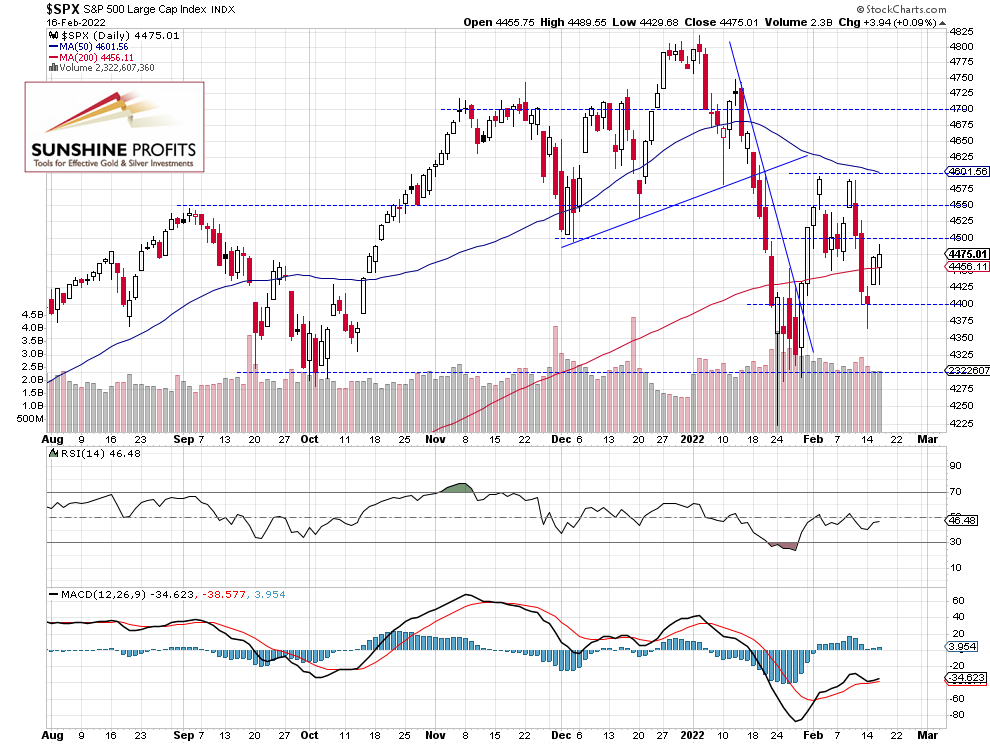

The broad stock market index gained 0.09% on Wednesday, Feb. 16, as it remained below the 4,500 level. On Tuesday it gained 1.6% and it retraced some more of its last week’s Thursday’s-Friday’s decline. Monday’s daily low was at 4,364.84 and the market retraced almost 125 points from that level.

This morning the S&P 500 index is expected to open 0.4% lower, as the markets react to the Russia-Ukraine crisis news. We may see some further short-term uncertainty.

The nearest important resistance level remains at 4,500, marked by the recent consolidation. The resistance level is also at around 4,550. On the other hand, the support level is at 4,350-4,400, among others. The S&P 500 index bounced from its late January consolidation, as we can see on the daily chart (chart by courtesy of http://stockcharts.com):

Futures Contract Is Going Sideways

Let’s take a look at the hourly chart of the S&P 500 futures contract. It reversed its short-term uptrend last week, and on Monday it traded as low as 4,360. On Tuesday the market retraced some of that decline. Since then, it has been fluctuating along the 4,450 level.

In our opinion, no positions are currently justified from the risk/reward point of view. We are waiting for a potential speculative long position entry, but at lower levels or after some more consolidation. (chart by courtesy of http://tradingview.com):

Conclusion

The S&P 500 index will likely open 0.4% lower this morning and we may see some further fluctuations. For now, it looks like a consolidation within a short-term uptrend. There’s still an uncertainty concerning Russia-Ukraine tensions.

Here’s the breakdown:

- The S&P 500 index will likely continue to fluctuate following Monday’s-Tuesday’s rebound. For now, it looks like a relatively flat correction.

- In our opinion, no positions are currently justified from the risk/reward point of view.

As always, we’ll keep you, our subscribers, well-informed.

Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): No positions are currently justified from the risk/reward point of view.

Thank you.

Paul Rejczak,

Stock Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care