Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): long positions with entry at 4,340 price level, with 4,440 as the stop-loss (take profit) and 4,740 as the price target.

Stocks extended their short-term correction on Friday before closing slightly higher. So is this a topping pattern or just a consolidation following the advance?

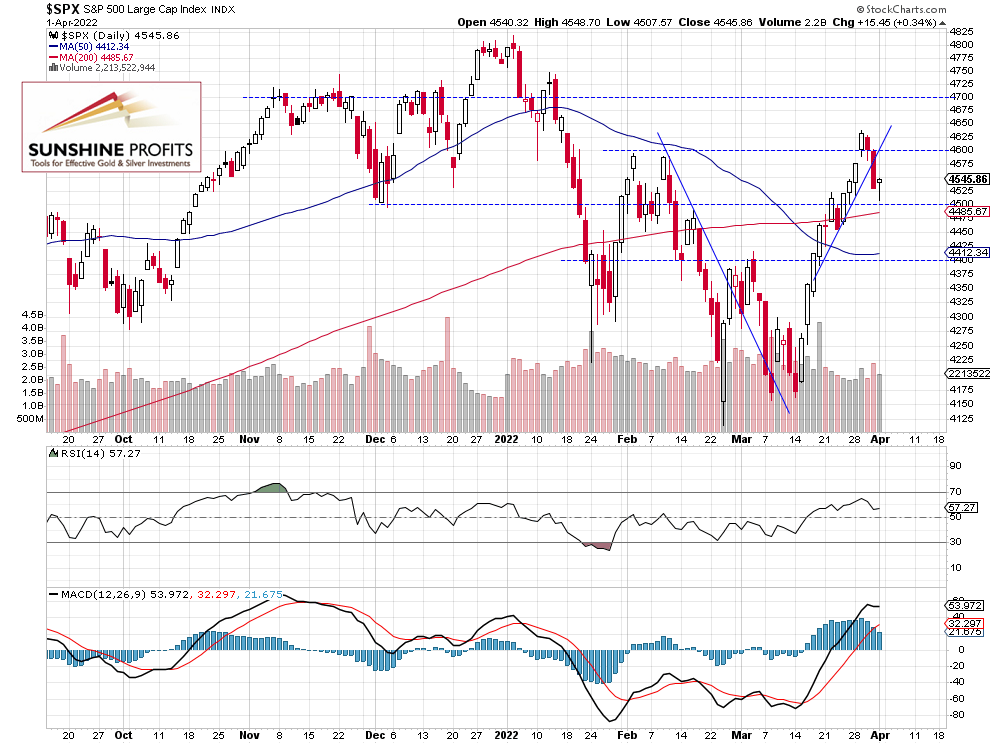

The S&P 500 index gained 0.34% on Friday following its Thursday’s decline of 1.3%, as investors took profits off the table after the recent rally and a breakout above the 4,600 level. For now, it looks like a downward correction. The market bounced from the 4,500 level, so there is a support level and some buying pressure. This morning the index is expected to open 0.2%. higher. We may see more short-term uncertainty, though.

The nearest important resistance level is at around 4,600-4,650, marked by the recent consolidation. On the other hand, the support level is at 4,450-4,500. On Thursday, the S&P 500 index broke below its short-term upward trend line, as we can see on the daily chart (chart by courtesy of http://stockcharts.com):

Futures Contract Remains Above the 4,500 Level

Let’s take a look at the hourly chart of the S&P 500 futures contract. It broke below the upward trend line last week and it got back below its local highs from February. So is this a reversal? For now, it looks like a correction and we are still maintaining our profitable long position from the 4,340 level. (chart by courtesy of http://tradingview.com):

Conclusion

The S&P 500 index will likely open slightly higher this morning. We may see some more uncertainty and profit-taking action. For now, it looks like a correction within an uptrend. However, it may also be a topping pattern before some more meaningful downward reversal. Therefore, we’ve recently moved our take-profit/ exit level upwards.

Here’s the breakdown:

- The S&P 500 index retraced some of the recent rally, as it got closer to the 4,500 level.

- We are maintaining our profitable long position (opened on Feb. 22 at 4,340).

- We are still expecting some upside from the current levels; however, it is time to get more cautious as there may be a bigger downward correction at some point.

As always, we’ll keep you, our subscribers, well-informed.

Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): long positions with entry at 4,340 price level, with 4,440 as the stop-loss (take profit) and 4,740 as the price target.

Thank you.

Paul Rejczak,

Stock Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care