In two weeks, Tom Brady vs. Patrick Mahomes will battle in the Super Bowl as the old guard vs. the new era. What's happening in the market right now is no different.

Think of Tom Brady as the hedge funds. As old Wall Street. As the suits. Think of Patrick Mahomes as the Reddit/Robinhood investor. The young renegade who could change the face of football or the stock market as we know it.

What's happened so far in 2021 is more significant than "stonks." What's happened is deeper than GameStop (GME) and AMC (AMC) surging by an astounding 1914.55% and 890.05%, respectively, year-to-date, thanks to these small-time investors.

We can make all the goofy stonk memes and laugh about how two has-been companies have suddenly become the new Bitcoin all we want.

But what happened is the potential changing of the guard of who the market-makers are.

I've been talking about a tug of war between good news and bad news and overvalued stocks (and "stonks") for weeks. But we have a new tug of war between the suits at Wall Street hedge funds and Reddit/Robinhood traders. The parallels between Brady vs. Mahomes are palpable.

The suits, aka the Tom Bradys, have been controlling the market for decades, manipulating it at their will.

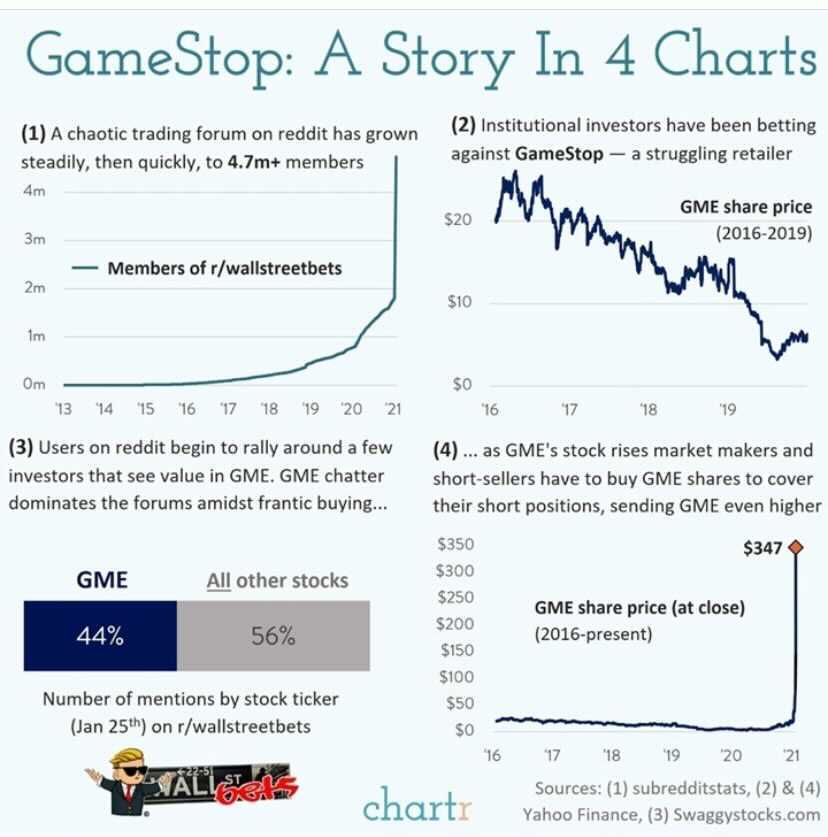

But recently, a Reddit group called "WallStreetBets," i.e., the Patrick Mahomes traders, caught on to their game. This group made a joke about how poor GameStop's prospects were and how hilarious it was that hedge funds were shorting it en masse. So they banded together, bought enough shares of the stock to send it soaring, then forced the hedge funds to cover their shorts by buying it up some more!

WallStreetBets succeeded so much that they ended up closing a hedge fund’s entire GameStop position!

Mahomes beat Brady in a blowout.

Granted, what happened on Thursday (Jan. 28) when Robinhood and other trading platforms halted all trading of GME, AMC, and other "stonks" of the like is disturbing. People are complaining about censorship on social media, and this is no different. It's a war against the little guy.

But what does this show you? The power is in your hands now.

The suits are officially quaking in their fancy shoes and had to resort to drastic moves like this. These multi-billion dollar hedge funds probably called Robinhood in tears saying to stop the trades. Hedge-fund manager Leon Cooperman said as much when he appeared on CNBC Thursday with a sob story. It's quite similar to someone prominent who demanded to "stop the count" and "stop the steal" a few months ago.

Don't let this deter you from chasing your goals.

Now would I buy these stocks? No. It's not my style and not my philosophy. I think it's detached from reality and a dot-com bust all over again.

GameStop, AMC, Blackberry (BB), and Bed Bath and Beyond (BBBY) had predictable crashes on Thursday (Jan. 28) (partially thanks to the brokerages). Complacency is the most significant near-term risk to stocks by far, and I have been warning about this for weeks. But I tip my hat to all those who profited.

My goal for these updates is to educate you, give you ideas, and help you manage money like I did when I was pressing the buy and sell buttons for $600+ million in assets. I left that career to pursue one where I could help people who needed help, instead of the ultra-high net worth.

With that said, I still think we are long overdue for a correction since we haven't seen one since last March. The manic moves of the past week excite me but concern me greatly.

Corrections are healthy for markets and more common than most realize. Only twice in the last 38 years have we had years WITHOUT a correction (1995 and 2017).

A correction could also be an excellent buying opportunity for what should be a great second half of the year.

Therefore, to sum it up:

While there is long-term optimism, there are short-term concerns. A short-term correction between now and Q1 2021 is possible. I don't think that a decline above ~20%, leading to a bear market will happen.

Hopefully, you find my insights enlightening. I welcome your thoughts and questions, and wish you the best of luck.

We’re all in this together!

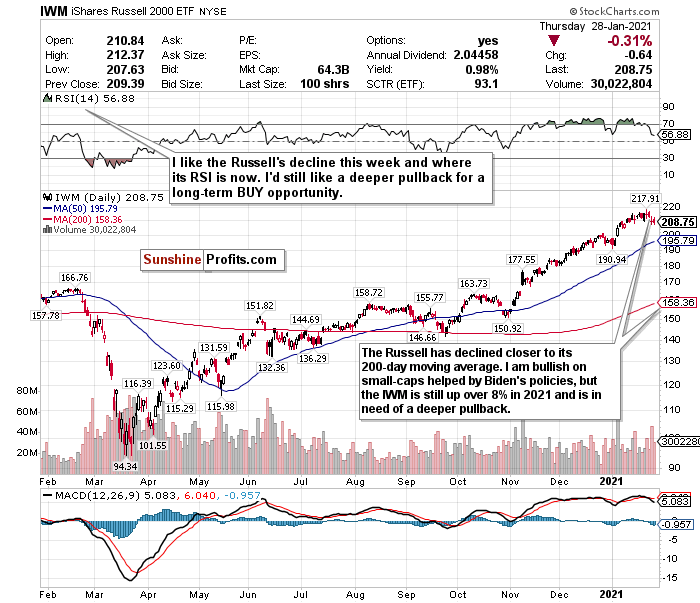

A Nice Pullback for Small-Caps

Figure 1- iShares Russell 2000 ETF (IWM)

The Russell 2000 was the only index to finish in negative territory Thursday.

As tracked by the iShares Russell 2000 ETF (IWM), small-cap stocks underperformed the larger indices on Thursday (Jan. 28) and have underperformed the larger indices week-to-date.

The RSI is no longer technically overbought, and the index is about flat year-to-date now. I called this decline coming, but I still think that it has more room to fall. Stocks don’t go up in a straight line without experiencing a sharp pullback, and the Russell 2000 may be overdue for something more profound.

The RSI is no longer technically overbought, and the index is about flat year-to-date now. I called this decline coming, but I still think that it has more room to fall. Stocks don’t go up in a straight line without experiencing a sharp pullback, and the Russell 2000 may be overdue for something more profound.

Barron’s also claims that the Russell 2000/S&P 500 ratio has entered a powerful 15-year resistance area.

Nobody knows what will happen during the rest of the quarter, but I called this week’s nearly 3% decline after the IWM began the week over a 70 RSI.

I’m debating switching my call because I love small-cap stocks for the long-term. As the world reopens and Biden passes aggressive stimulus, small-caps will benefit most.

But the index has not declined enough for my liking. Period.

Consider this too. Despite its pullback this week, the Russell has never traded this high above its 200-day moving average in its entire history.

Small-caps may have priced in vaccine-related gains by now, and some stimulus optimism may have been priced in too.

I hope small-caps decline before jumping back in for long-term buying opportunities. I love where these stocks could end up by the end of the year, and who knows. If they see a deeper decline on Friday (Jan. 30) to close out January, maybe I’ll switch my call by next week.

SELL and take profits if you can- but do not fully exit positions. If there is a deeper pullback, this is a STRONG BUY for the long-term recovery.

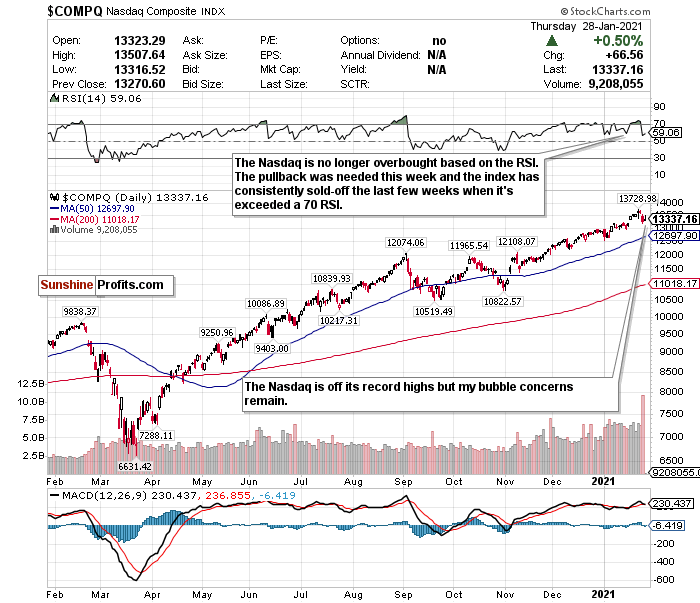

Are We in a Tech Bubble or What?

Figure 2- Nasdaq Composite Index $COMP

Earnings season for tech stocks hit record numbers this week. But once again, when investors get what they expect, it’s usually more of a reason to sell rather than buy.

Although I am bullish on these earnings and specific tech sectors such as cloud computing, e-commerce, and fintech for 2021, I’m concerned about the mania consuming tech stocks.

Tech valuations, and especially the tech IPO market, terrify me. The SPACs don’t help either.

All of this reminds me of the dot-com bubble 20-years ago. Remember, the dot-com bubble was a major crash in the Nasdaq after excessive speculation and IPOs sent any internet-related stock soaring. Between 1995-2000 the Nasdaq surged 400%. By October 2002, the Nasdaq declined by a whopping 78%.

Will the bubble pop now? That remains to be seen. But the similarities between now and 2000 are striking.

I am sticking with the theme of using the RSI to judge how to call the Nasdaq. An overbought RSI does not automatically mean a trend reversal, but with the Nasdaq, this appears to have been a consistent pattern over the last few weeks.

The Nasdaq pulled back on December 9 after exceeding an RSI of 70 and briefly pulled back again after passing 70 again around Christmas time. We also exceeded a 70 RSI just before the new year, and what happened on the first trading day of 2021? A decline of 1.47%.

The last time I changed my Nasdaq call from a HOLD to a SELL on January 11 after the RSI exceeded 70, the Nasdaq declined again by 1.45%.

The Nasdaq hit an RSI of over 73 earlier this week, and since I switched my call back to SELL, the Nasdaq declined 2.07%.

The Nasdaq is trading in a precise pattern.

I still love tech and am bullish for 2021. But I need to see the Nasdaq have a legitimate cooldown period and move closer to its 50-day moving average before considering it a BUY or a HOLD. Until that happens, I’m breaking my RSI rule with the Nasdaq, and keeping the SELL call for now.

For an ETF that attempts to directly correlate with the performance of the NASDAQ, the Invesco QQQ ETF (QQQ) is a good option.

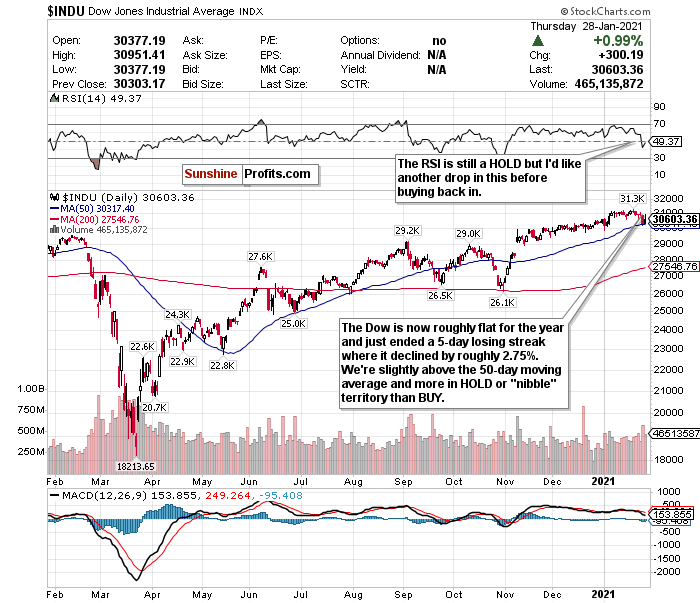

The Dow Could Be Approaching BUY Territory

Figure 3- Dow Jones Industrial Average $INDU

The Dow has been the least impressive index over the last two weeks and has lagged behind the other indices. While the Nasdaq and the S&P continued reaching highs before this week, the Dow quietly declined.

Year-to-date, the Dow is up roughly 1.25%. But over the last two weeks, it’s down about the same amount.

That’s not necessarily a bad thing. The Dow has been the only index that hasn’t traded like a maniac, nor has it overheated. While it saw a five-day losing streak before Thursday (Jan. 28) and is negative for the week, it has outperformed the S&P, Nasdaq, and Russell week-to-date.

Its sub-50 RSI also tells me that it may be nearing a BUY level again too.

However, I have many short-term questions and concerns about the Dow Jones to make a conviction call. If there’s an index that reflects the tug-of-war between good news and bad news, it’s the Dow.

But is the Dow at a BUY level? Not just yet.

COVID-19’s curve in the U.S. may be improving somewhat, and while I am encouraged by potential improvements in the vaccine rollout, I am still concerned about short-term economic and political headwinds.

It’s challenging to make a conviction call on this index, and if/when there is a drop in the index, it probably won’t be anything like what we saw back in March 2020.

We will see what happens in February as investors continue to evaluate this new president, his agenda, and incoming economic data.

A 35,000 call to close out 2021 may be a bit aggressive, but the second half of 2021 could show robust gains once vaccines become widely available to the general public.

With so much uncertainty, the call on the Dow stays a HOLD. But this could change soon.

For an ETF that looks to directly correlate with the Dow's performance, the SPDR Dow Jones ETF (DIA) is a strong option.

Mid-Term/Long-Term

Taiwan, South Korea, and More for Best Emerging Market Exposure

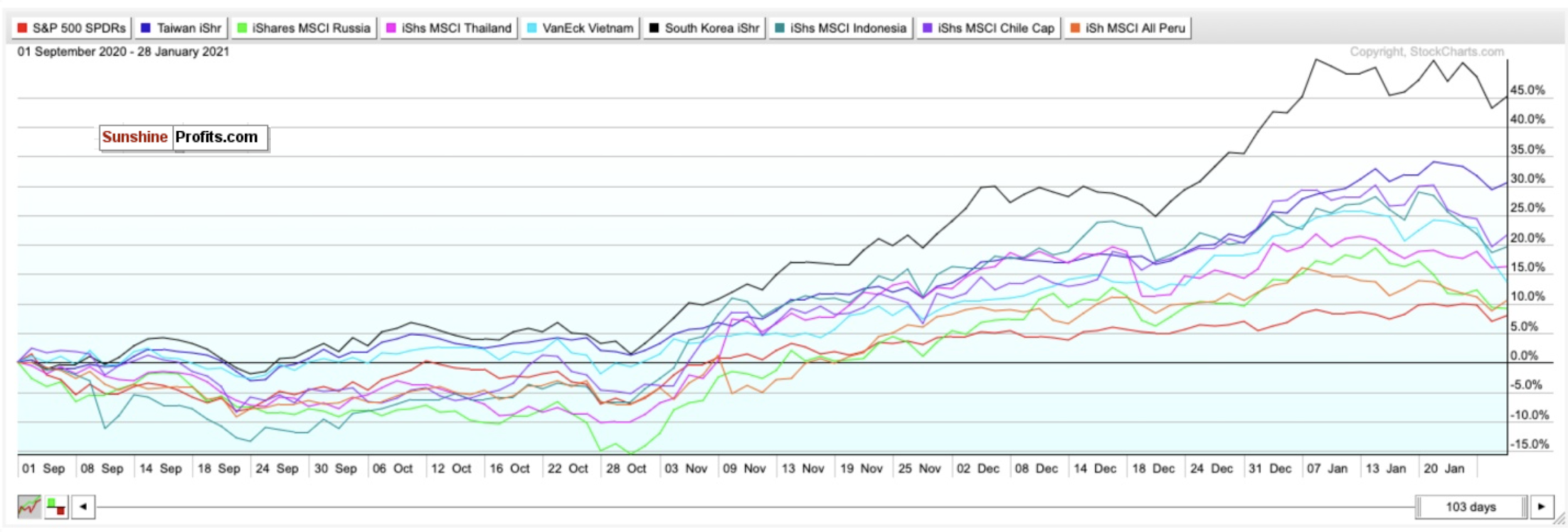

Figure 4- SPY, EWT, ERUS, THD, VNM, EWY, EIDO, ECH, EPU comparison chart- Sep. 1, 2020-Present

I’m bullish on emerging markets for 2021 because of a declining dollar, what could be a surge in demand for commodities and minerals, and shifting demographics. Developed markets are old. Emerging markets are young.

Many predicted a COVID baby boom to happen, but we might be in a baby bust. Initial stats show significant drops in December 2020 births, compared to a year earlier.

PWC also believes that emerging markets (E7) could grow around twice as fast as advanced economies (G7) on average in the coming decades.

China gets most of the glory as an emerging market, and its upside is obvious. But I still maintain that this is not the best bet for international exposure in 2021, and I have no clue how China is considered an emerging market anymore.

For 2021, the following are my BUYs for emerging markets and why:

iShares MSCI Taiwan ETF (EWT)- Developing country, with stable fundamentals, diverse and modern hi-tech economy, regional upside without China’s same geopolitical risks.

iShares MSCI Thailand ETF (THD)- Bloomberg’s top emerging market pick for 2021 thanks to abundant reserves and a high potential for portfolio inflows. Undervalued compared to other ETFs.

iShares MSCI Russia Capped ETF (ERUS)- Bloomberg’s second choice for the top emerging market in 2021 thanks to robust external accounts, a robust fiscal profile, and an undervalued currency. Red-hot commodity market (a big deal for a declining dollar), growing hi-tech and software market, increasing personal incomes.

VanEck Vectors Vietnam ETF Vietnam (VNM)-Turned itself into an economy with a stable credit rating, strong exports, and modest public debt relative to growth rates. PWC believes Vietnam could also be the fastest-growing economy globally. It could be a Top 20 economy by 2050.

iShares MSCI South Korea ETF (EWY)- South Korea has a booming economy, robust exports, and stable yet high growth potential. ETF has been the top-performing emerging market ETF and surged by 138.23% since the market bottomed on March 23rd.

iShares MSCI Indonesia ETF (EIDO)- Largest economy in Southeast Asia with young demographics. The fourth most populous country in the world. It could be less risky than other emerging markets while simultaneously growing fast. It could also be a Top 5 economy by 2050.

iShares MSCI Chile ETF (ECH)- One of South America’s largest and most prosperous economies. An abundance of natural resources and minerals. World’s largest exporter of copper. Could boom thanks to electric vehicles and batteries because of lithium demand. It is the world’s largest lithium exporter and could have 25% of the world’s reserves.

iShares MSCI Peru ETF (EPU)- A smaller developing economy but has robust gold and copper reserves and rich mineral resources.

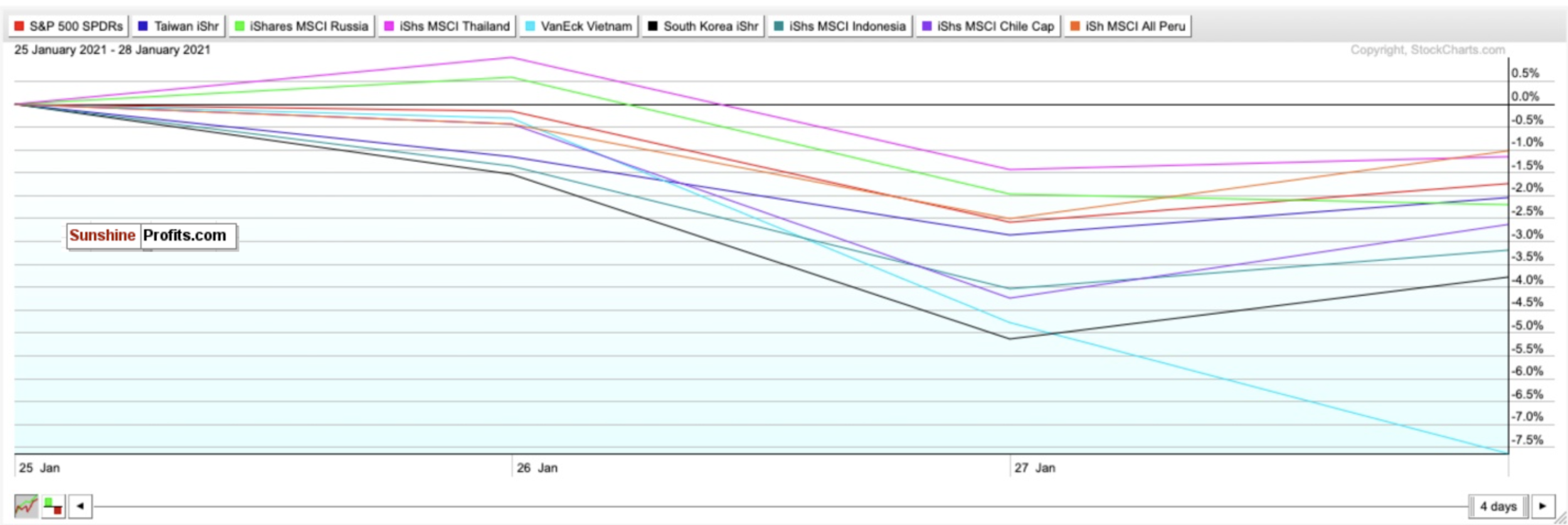

While all of these emerging market ETFs have had a down week, Taiwan and South Korea have performed the best thus far in 2021, with gains of 6.19% and 4.31, respectively.

Thus far, Vietnam has been 2021’s laggard, mostly thanks to its decline week-to-date of over 7%. New COVID-19 variants have appeared in the country, and it imposed strict lockdown measures in certain regions, which likely sent the ETF downwards.

However, don’t let this deter you. VNM is as good a BUY opportunity as there is for emerging markets. A recent CNBC report showed that Vietnam was likely the top-performing Asian economy in 2020- including China.

Vietnam shockingly did not see a single quarter of economic contraction, and government estimates showed that the Vietnamese economy grew 2.9% last year from a year ago, topping China’s forecast-beating 2.3% growth during the same period.

Outside of the aforementioned country-specific ETFs, you can also BUY the iShares MSCI Emerging Index Fund (EEM) for broad exposure to Emerging Markets.

Pay Very Close Attention to Inflation

Pay very close attention to the possible return of inflation by mid-Q2 or Q3. An aggressive stimulus could be imminent, and the Fed has not been shy in its plans to allow the GDP to heat up. It may overshoot in the medium-term as a result. GDP growth could stutter in Q1 2021 but pay close attention to what happens in Q2 and Q3 once vaccines begin to roll out on a massive scale. Inflation will inevitably return with the Fed’s policy and projected economic recovery by mid-2021.

The 10-year yield’s recent rally, as well as the 10-year breakeven rate, reflects this as well.

If you are looking to the future to hedge against inflation, look into TIPS, commodities, gold, and potentially some REITs.

In the mid-term, I have BUY calls on the SPDR TIPS ETF (SPIP), the Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF (PDBC), the SPDR Gold Shares ETF (GLD), and the iShares Cohen & Steers REIT ETF (ICF).

Long-Term

There is so much to worry about in the short-term. But I’m convinced that economic stimulus and the progress made with administering the vaccines bodes well for stocks in the second half of 2021. We may be at the beginning of the end of the pandemic-but over the next 1-3 months, this could be a very bumpy ride back.

There does seem to be one consensus though: 2021 could be a big year for stocks.

Small-caps, value stocks, and cyclicals, could especially surge. I just have a much better feeling for them in the second half of the year. I almost hope we see a correction within the first 3 months of 2021. This could be a very strong buying opportunity.

Summary

The current headwinds are very concerning. But I remain optimistic for the second half of 2021 despite the bumpy road there. Until COVID-19 is eradicated, a battle between optimism and pessimism is inevitable.

Despite the strong earnings we are seeing so far, a short-term correction is likely. But do not let this scare you.

Corrections are NORMAL. What happened last March is ABNORMAL.

The crash and subsequent record-setting recovery we saw in 2020 is a generational occurrence. I can’t see it happening again in 2021. If there is a short-term downturn, take a breath, stay cool, and use it as a time to find buying opportunities. Do not get caught up in fear and most of all:

NEVER TRADE WITH EMOTIONS.

Consider this. Since markets bottomed on March 23rd, ETFs tracking the indices have seen returns like this: Russell 2000 (IWM) up 111.91%. Nasdaq (QQQ) up 89.45%. S&P 500 (SPY) up 71.53%. Dow Jones (DIA) up 66.67%.

In the long-term, markets always end up moving higher and are focused on the future rather than the present.

To sum up all our calls, in the short-term I have a SELL call for:

- The iShares Russell 2000 ETF (IWM) (but do not fully exit positions- trim profits), and

- the Invesco QQQ ETF (QQQ) (but do not fully exit positions- trim profits),

I have a HOLD call for:

- the SPDR S&P ETF (SPY), and

- the SPDR Dow Jones ETF (DIA)

I also have a long-term STRONG BUY call for:

- the iShares Russell 2000 ETF (IWM) BUT IF AND WHEN IT PULLS BACK

For all these ETFs, I am more bullish in the long-term for the second half of 2021.

For the mid-term and long-term, I recommend selling or hedging the US Dollar, and gaining exposure into emerging markets.

I have BUY calls on:

- The iShares MSCI Emerging Index Fund (EEM),

- the iShares MSCI Taiwan ETF (EWT),

- the iShares MSCI Thailand ETF (THD),

- the iShares MSCI Russia ETF (ERUS),

- the VanEck Vectors Vietnam ETF Vietnam (VNM),

- the iShares MSCI South Korea ETF (EWY),

- the iShares MSCI Indonesia ETF (EIDO),

- the iShares MSCI Chile ETF (ECH),

- and the iShares MSCI Peru ETF (EPU)

Additionally, because I foresee inflation returning as early as mid to late 2021…

I also have BUY calls on:

- The SPDR TIPS ETF (SPIP),

- the Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF (PDBC)

- the SPDR Gold Shares ETF (GLD), and

- the iShares Cohen & Steers REIT ETF (ICF)

Thank you.

Matthew Levy, CFA

Stock Trading Strategist