Stocks gained for the third consecutive day on Thursday (Jan. 7) and hit record highs despite the unprecedented unrest in the U.S. Capitol in Washington.

News Recap

- The major indices hit a trifecta of record highs and historic milestones. The Dow Jones closed above 31,000 points for the first time and gained 211.73 points, or 0.7%, to 31,041.13. The S&P 500 also gained 1.5% to close above 3800 for the first time, and the Nasdaq climbed nearly 2.6% to close above 13,000 for the first time. The Russell 2000 also gained 1.89%.

- After Congress officially confirmed the election of Joe Biden as president, investors largely looked past the unrest in Washington and the unprecedented assault on the Capitol building by a mob of angry Trump supporters on Wednesday (Jan. 6). This was the first time since 1814 that the Capitol building was physically breached by hostile actors.

- Investors were likely relieved that President Trump finally “conceded” (in his own way) through a statement that “there will be an orderly transition on January 20th.”

- The Democrat sweep in the Georgia Senate elections continued to be cheered by investors. While there were some initial concerns that the markets could react negatively, the likelihood of further stimulus with a Democrat President, Senate, and House, outweighed any concerns. Stocks hit especially hardest during the pandemic could benefit the most from this.

- Jobless claims continue to stay somewhat level and beat expectations. Initial jobless claims came in at 787,000 for the week ending Dec. 31 and beat the estimated 815,000.

- Microsoft (MSFT) and Alphabet (GOOGL) both gained more than 2%, while Apple (AAPL) rose 3.4%.

- Walgreens Boots Alliance (WBA) led the Dow and rose 5.2% thanks to stronger-than-expected quarterly earnings. JPMorgan Chase (JPM) also advanced 3.3% after Bank of America upgraded it to buy from neutral.

- Tech and consumer discretionary were the best performing sectors on the S&P 500 and rose 2.7% and 1.8%, respectively.

It’s been two days after the U.S. Capitol was ransacked by an angry mob - and guess what? The markets keep going up! How can the markets keep going up when the centerpiece and symbol of American democracy was ransacked and breached by hostile actors for the first time since 1814?

It’s pretty simple when you look at the bigger picture. Despite the horror, disgust, and embarrassing display, at the end of the day it has no bearing on the economy. Although Wednesday's events were a black eye for American democracy, they have nothing to do with stocks and the economy.

CNBC personality Jim Cramer had very comprehensive and to the point statements on the matter Thursday (Jan. 7).

“We see the chaos in Washington, but many believe the storming of the Capitol will be the highwater mark of discord. The election is finally over, the results are certified, the challenges are finished. There’s a possibility of unity after years of polarization,” he said. “The stock market’s not a referendum on the state of the nation”

With encouraging ISM manufacturing data from earlier in the week, better than expected jobless claims, and political clarity, it makes some sense why the indices continue to hit all-time highs.

According to JJ Kinahan, chief market strategist at TD Ameritrade, Georgia’s election results give investors “more clarity” by “solidifying Democrat control in Washington and increasing expectations of more stimulus to come...With the political tensions easing, more stimulus expected to help boost the economy, and coronavirus vaccines helping bring a measure of calm to investors and traders, it seems that the market can now focus on earnings season.”

Goldman Sachs also expects another big stimulus package of around $600 billion. While this could be bad for the national debt and have long-term consequences, in the short-term, it could send the economy heating. Small-cap stocks surged as a result.

I still believe that there will be a short-term tug of war between good news and bad news. Many of these moves upwards or downwards are based on emotion and sentiment, and I believe there could be some serious volatility in the near-term. Although markets for now may be overly euphoric from the “Blue Wave”, consider this. Although it has no direct bearing on the economy, the Capitol was still invaded. January 7th was also the deadliest day of the pandemic yet in America, with over 4,000 deaths (Jan. 7).

There was no pullback to end 2020 as I anticipated, but I still believe that markets have overheated in the short-term. I believe that between now and the end of Q1 2020 a correction could happen.

Carl Icahn seemingly agrees with me, and said to CNBC on Monday (Jan. 4), “in my day I’ve seen a lot of wild rallies with a lot of mispriced stocks, but there is one thing they all have in common. Eventually they hit a wall and go into a major painful correction.”

National Securities’ chief market strategist Art Hogan also believes that we could see a 5%-8% pullback as early as this month.

I do believe though that corrections are healthy and could be a good thing. Corrections are more commonplace than people realize and is normal market behavior. Only twice in the last 38 years have we had years WITHOUT a correction (1995 and 2017). I believe we are long overdue for one since there has not been one since the lows of March 2020. A correction could be a very good buying opportunity for what I believe will be a great second half of the year.

While there will certainly be short-term bumps in the road, I love the outlook in the mid-term and long-term once vaccines become more widely available. The pandemic is awful right now, and these new infectious strains out of the U.K. and South Africa are quite concerning. But despite this, I believe the positive manufacturing data released on Tuesday (Jan. 5), and the better-than-expected jobless claims (Jan. 7) are positive steps in the right direction.

The consensus is that 2021 could be a strong year for stocks. According to a CNBC survey that polled more than 100 chief investment officers and portfolio managers, two-thirds of respondents said the Dow Jones will most likely finish 2021 at 35,000, while five percent also said that the index could climb to 40,000.

Therefore, to sum it up:

While there is long-term optimism, there are short-term concerns. A short-term correction between now and Q1 2021 is very possible. But I do not believe, with conviction, that a correction above ~20% leading to a bear market will happen.

This morning’s premium analysis will showcase the “Drivers and Divers” of the market. I will break down some market sectors that are in and out of favor. Dear readers, do me a favor and let me know what you think of this segment! Always happy to hear from you.

Driving

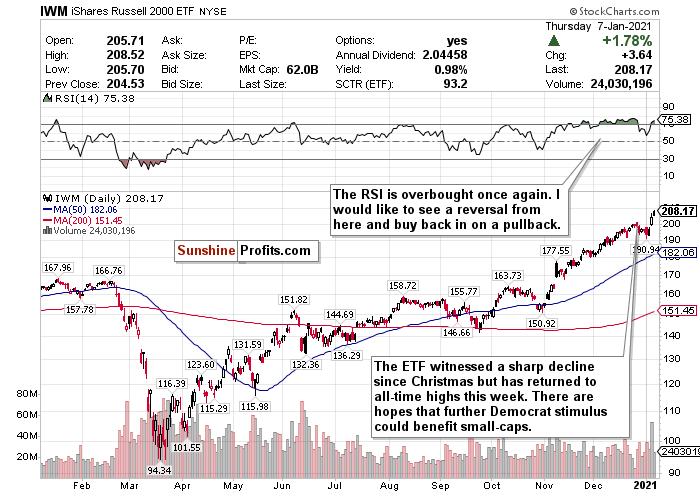

Small-Caps (IWM)

Figure 1 - iShares Russell 2000 ETF (IWM)

Small-caps are the comeback darlings of the week. Although I believed that the Russell 2000’s record-setting run since the start of November was coming to an end, it has rallied over 7.5% since January 4th. Thanks to a Democrat sweep in Georgia and hopes of further economic stimulus, small-cap stocks have climbed back towards record highs.

I love small-cap stocks in the long-term, especially as the world reopens. A Democrat-dominated Congress could help these stocks too. But I believe that in the short-term the index, by any measurement, has simply overheated. Before January 4th, the RSI for the IWM Russell 2000 ETF was at an astronomical 74.54. I called a pullback happening in the short-term due to this RSI, and it happened. Well now the RSI is above 75, and I believe that a more significant correction in the near-term could be imminent.

Stocks simply just don’t always go up in a straight line, and that’s what the Russell 2000 has essentially been between November and December. It’s looking the same this week.

What this also comes down to, is that small-caps are more sensitive to the news - good or bad. I believe that vaccine gains have possibly been baked in by now. There could be another near-term pop due to hopes of further stimulus, but I believe that it’s likely possible that small-caps in the near-term could trade sideways before an eventual larger pullback.

I truthfully hope small-caps decline a minimum of 10% before jumping back in for long-term buying opportunities.

SELL and take this week’s profits if you can- but do not fully exit positions.

If there is a pullback, this is a STRONG BUY for the long-term recovery.

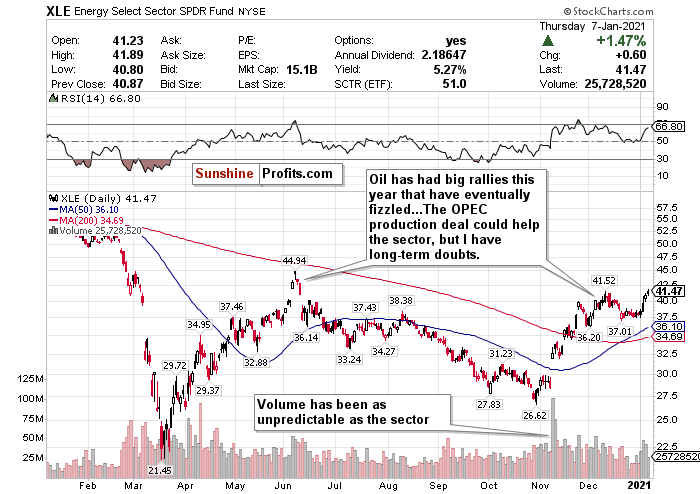

Energy (XLE)

Figure 2 - Energy Select Sector SPDR Fund (XLE)

Avoiding energy has been one of my biggest conviction calls for weeks. Energy is a sector largely dependent on sentiment. Although energy stocks have surged this week due to the OPEC production deal, I do not believe it will last. Throughout 2020, this is a sector that has had big rallies that have eventually fizzled. I believe this pattern will continue in 2021.

On one hand, if you are bullish, the vaccines bode well for a full economic reopening by the second half of 2021. That means travel, and therefore fuel demand could surge back to pre-pandemic levels. By many measurements, energy is still undervalued as well.

However, as the RSI in the Energy Select Sector SPDR Fund (XLE) is creeping back towards an overbought level, I believe that these tailwinds have been baked in already. Stricter shutdowns and travel restrictions are being imposed with fresh concerns over global fuel demand. In fact, according to Ned Davis Research, U.S. crude demand is still over 1.0 million barrels a day below pre-virus levels. I believe this will continue throughout Q1 2021.

In the long-term, 2021 could also witness further movements away from fossil fuels towards clean and sustainable energy. Pension funds worldwide have been divesting from oil in droves, for example. Because the Democrats now have full control of the government too, I do not believe that there will be any oil-friendly policies coming soon. In fact, I believe just the opposite.

I just have a hard time thinking bullish thoughts on this sector unless you want to day-trade or swing-trade.

My call is to take profits and SELL.

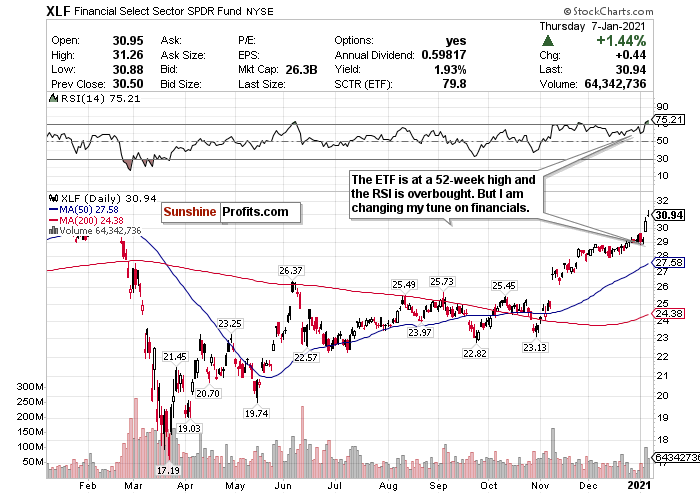

Financials (XLF)

Figure 3 - Financial Select Sector SPDR Fund (XLF)

The Financial Select Sector SPDR Fund (XLF) is at a 52-week high and has a scorching hot RSI. While I still do have some concerns of a dovish fed, and progressive government looking to take on big banks and Wall Street, I am changing my outlook on financials.

Interest rates - a huge driver of banking revenue - will not rise until 2023 at the earliest. While financial stocks have performed better than the U.S. dollar, rates this low for so long will not be good. Until rates start rising again, profit margins will continue to narrow.

With that being said, if the dollar continues to decline and the macro improves by 2H 2021 while commodities increase, it will likely begin to push inflation. With inflation heating up by 2H, it could potentially push rates higher sooner than we think.

Although I foresee a rise in COVID-19 related defaults coming in 2021, I am starting to change my outlook on financials.

I can’t say with conviction yet to BUY financials because so much of the sector’s revenue depends on interest rates. But I am changing my tune and switching the sector to a HOLD.

Diving

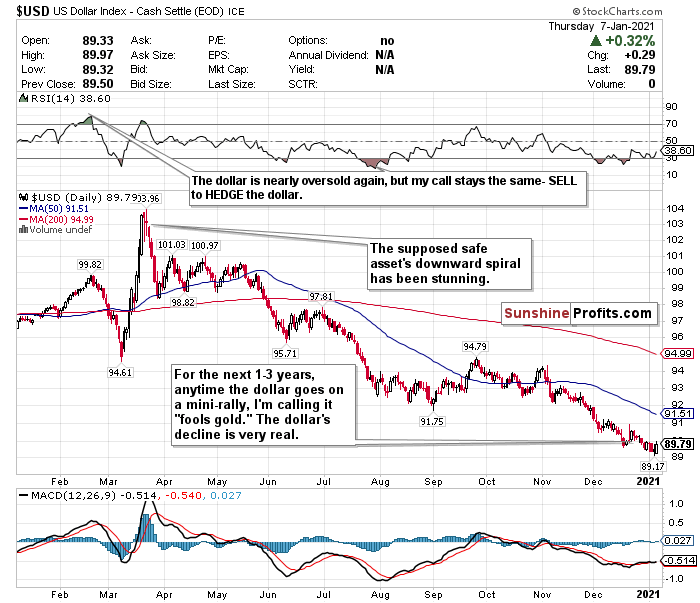

US Dollar ($USD)

Figure 4 - U.S. Dollar ($USD)

Although the U.S. Dollar has ticked up somewhat this week, I just don’t have faith in this commodity as a safe asset. I still am calling out the dollar’s weakness despite its low levels. I expect the decline to continue as well thanks to a dovish Fed.

Any time the U.S. Dollar rallies, I am calling it “fool’s gold.” Since I started doing these newsletters about a month ago, I have consistently said that any minor rally the dollar would experience would be a mirage. Since it briefly pierced the 91-level on December 9th, it has fallen nearly 1.75%. Despite the greenback experiencing another mini-rally and nearly piercing the 91-level again on December 22, I remained steadfast in my bearish outlook of the dollar. Since the open on December 23rd, the U.S. Dollar has declined nearly another 1%. I believed that it would drop back below 90 before the new year, and here we are to start off 2021 with the dollar at 89.50.

Since hitting a nearly 3-year high on March 20th, the dollar has plunged nearly 13.25% while emerging markets, foreign currencies, precious metals, and cryptocurrencies continue to strengthen. Gold for example reached an 8-week high on Tuesday (Jan. 5), and Bitcoin exceeded the $40,000 level on Thursday (Jan. 7) for the first time.

On days when COVID-19 fears outweigh any other positive sentiments, dollar exposure might be good to have since it is a safe haven. But in my view, you can do a whole lot better than the U.S. dollar for safety.

I have too many doubts on the effect of interest rates this low for this long, government stimulus, strengthening of emerging markets, and inflation to be remotely bullish on the dollar’s prospects over the next 1-3 years. Meanwhile, the U.S. has $27 trillion of debt, and it’s not going down anytime soon.

Another headwind to consider for the dollar is the imminent Democrat control of the government. With Democrats controlling both the House and the Senate, larger stimulus could be coming, further weakening the dollar.

Additionally, according to The Sevens Report, if the dollar falls below 89.13, this could potentially raise the prospect of a further 10.5% decline to the next support level of 79.78 reached in April 2014. With the dollar now at 89.79, we are coming dangerously close, despite this week’s rally.

For now, where possible, HEDGE OR SELL USD exposure.

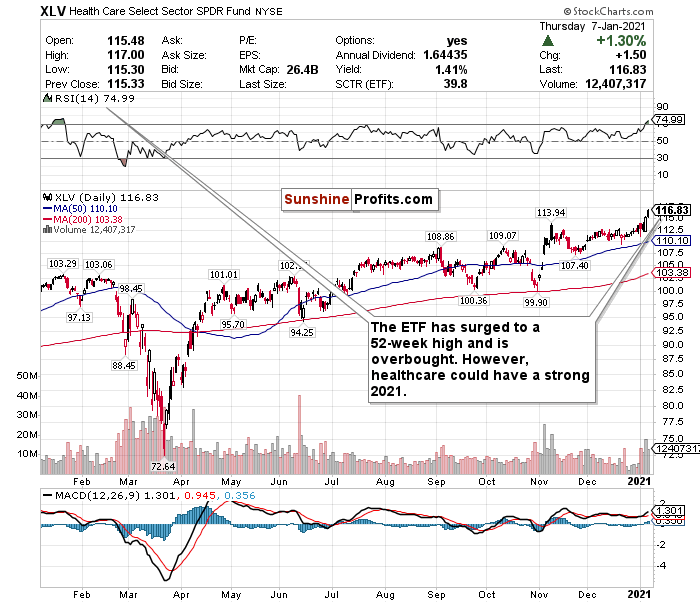

Health Care (XLV)

Figure 5 - Healthcare Select Sector SPDR Fund (XLV)

After reading Yana Barton’s, Eaton Vance’s growth equity co-director and portfolio manager, thoughts on why healthcare could be one of the biggest winners in 2021, I am starting to change my tune. According to Barton, healthcare is “trading at a 20-plus percent discount to the market, and there are some sub sectors like biopharma and biotechnology in particular that [are] trading at a 30% discount with really solid fundamentals.”

Although the Healthcare Select Sector SPDR Fund (XLV) is near its 52-week high, has an overbought RSI, and has likely had and good vaccine news baked in, this is a sector that offers value, long-term upside, and growth potential.

Many big pharma companies at the forefront of Operation Warp Speed have pulled back to more attractive valuations now as well. Since peaking December 10th, Pfizer’s (PFE) stock is down 10.16% while Moderna’s (MRNA) is down 27.85%.

Meanwhile, the pandemic has caused hospitals and providers to lose a lot of money, and there could be more pain in the short-term. Hospitals generate a lot of their revenue from elective procedures. With the pandemic, hospitals’ resources are being stretched thin, and they are often prohibiting these types of procedures. ICU capacity across the US is alarmingly declining by the second as well.

The XLV ETF though has shown fewer signs of volatility than other sector-specific ETFs and can outperform on any given day.

Although the ETF is trading at a high level with a high RSI, I like the healthcare’s valuation and long-term outlook. For now it is a HOLD, but I am switching to a BUY on a pullback once the RSI drops.

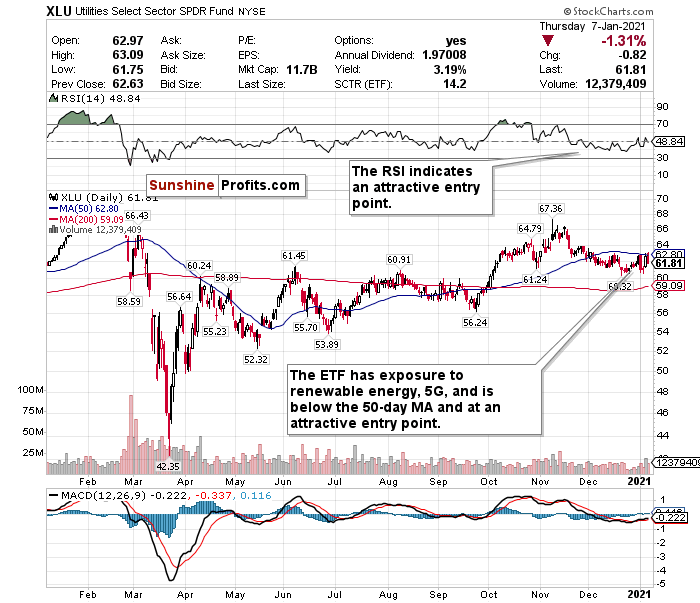

Utilities (XLU)

Figure 6 - Utilities Select Sector SPDR Fund (XLU)

A lot of investors avoid utilities or don’t like them. I get it. Utilities are not exciting to invest in if you’re focused on returns and growth. Especially during bull runs. The market surged yesterday and the Utilities Select Sector SPDR Fund (XLU) dropped by 1.31% - who wants that?

After outperforming in September and October when the market saw a brief downturn, this sector has been a laggard since November. Utilities, though, are dependable stocks and may offer the best opportunity to find value in a market that appears to be overinflated, manic, and unpredictable.

Utilities are considered to be defensive investments, and as a result, can underperform on good days. However, on days when there is volatility and investors are either taking profits or running for the hills, this is a good sector to own.

This is a boring sector not focused on growth or gains. But during uncertain times, this is a safe place to find value. Utilities are cheap, they do not swing much upwards or downwards, and pay solid dividends.

In the short-term and long-term, this sector may also be a good hedge against volatility and bad news. It may also be a good way to gain exposure to renewable energy and 5G. Renewable energy especially, could thrive under a Biden administration and Democrat controlled House and Senate.

Utilities do not pose the same type of overheating risks as other sectors such as small-caps. Most importantly, no matter what the economic condition is and no matter what the news of the day is, you can always count on utilities to stay relatively tame. The RSI is lower than other sectors and the ETF is trading just below its 50-day moving average.

Therefore, at this valuation, I give utilities a BUY call - with the understanding that these stocks may not move much to the upside or downside but will provide a consistent yield.

Summary

The current headwinds are very concerning. Nobody likes living through a pandemic, and nobody likes seeing their Capitol Building ransacked by thugs. With that being said, I am optimistic for the second half of 2021. The path there could be bumpy though. Until COVID-19 is eradicated, there will inevitably be a tug of war between optimism and pessimism.

I believe that a short-term correction to start 2021 is inevitable. But do not let this scare you. Remember - corrections are NORMAL and markets tend to look 6-12 months down the road. Although it is very plausible that there could be some short-term uncertainty and volatility, use this as a time to find buying opportunities for the second half of 2021. Do not get caught up in fear if there is a correction.

I do not believe a crash like the one we saw in March is on the horizon, but a pullback of some sort is coming. Do not be fearful though. Since markets bottomed on March 23rd, here are how the ETFs tracking the indices have performed: Russell 2000 (IWM) up 111.35%. Nasdaq (QQQ) up 85.71%. S&P 500 (SPY) up 72.20%. Dow Jones (DIA) up 69.02%.

In the long-term, markets always end up moving higher and are focused on the future rather than the present.

To sum up all our calls, I have a BUY call for:

- Small-Caps (IWM) - but ONLY on a pullback for the long-term

- Materials (XLB)- but ONLY on a pullback for the long-term

- Utilities (XLU)

HOLD calls for:

- Materials (XLB)

- Financials (XLF)

- Health Care (XLV)

BUT BUY ALL ON A PULLBACK

And I have SELL calls for:

- Small-Caps (IWM) - in the short-term. But do not fully exit positions.

- Energy (XLE)

- US Dollar ($USD)

- Communication Services (XLC)

Thank you.

Matthew Levy, CFA

Stock Trading Strategist