Quick Update

Dear readers, before we get into today’s news and stock analysis and because I’ve been receiving many questions from you, I’d like to first clarify what I mean by BUY, SELL, or HOLD. Here, I am largely referring to outperforming the S&P 500. When the conditions favor adding risk and buying the U.S. market overall, I will be issuing an "alert." I am not sure yet whether I will be moving to entry prices or target prices & stop losses, however, I have discussed this internally with the team at Sunshine Profits. In the current market environment, when fundamentals have essentially fallen to the wayside, I prefer to invest directionally rather than being married to certain levels in the market. In my view, trading with specific figures in mind can hurt long term returns if you do not let your winners run and cut your losers fast. I do update my calls daily, though, and any changes will be highlighted! Thank you again for being such great readers - I truly value your trust. Stay tuned for updates and let me know if you have any other questions!

Let’s begin Monday by reviewing what happened at the close of last week.

Volatile trading occurred on Friday (Dec. 18), with Congress struggling to close out a stimulus package, causing stocks to slip from record highs.

News Recap

- The Dow Jones fell 124.32 points, or 0.4%, to 30,179.05. At its session low, the index fell more than 270 points. The S&P 500 also dipped 0.4% and snapped a three-day winning streak. The Nasdaq fell only 0.1%, while the small-cap Russell 2000 fell 0.41%.

- While Congress claims to be on the brink of a $900 billion stimulus deal, it is working against time. In public, leaders are speaking optimistically that a deal will pass, however, there are last-minute partisan disputes on direct payments, small business loans, and a boost to unemployment insurance

- There was an unusually large amount of trading volume on Friday (Dec. 18) as Tesla (TSLA) was set to officially join the S&P 500 after the closing bell. Tesla is being added to the index in one fell swoop, marking the largest rebalancing of the S&P 500 in history. After surging 700% in 2020, from day 1, Tesla will be the seventh-largest company in the S&P in terms of market cap.

- The FDA officially approved Moderna’s vaccine for emergency use. Government officials plan to ship nearly 6 million doses of Moderna’s vaccine in addition to the 2.9 million Pfizer (PFE) doses already in distribution.

- Despite Friday’s (Dec. 18) losses, the indices closed out the week with mild gains. The Dow closed up 0.4%, the S&P 500 advanced 1.3%, and the NASDAQ closed up 3.1%. The small-cap Russell 2000 continued its strong run as well and gained 2.5% for the week.

- Meanwhile, the pandemic has reached its darkest days and is hitting unforeseen and unprecedented numbers. The U.S. shattered the previous record of daily deals on Wednesday (Dec. 16), recording over 3,600 deaths. As of Friday (Dec. 18), the country has also now surpassed 17 million confirmed cases, with death totals soaring past 300,000. California, Illinois, Pennsylvania, and Texas alone reported more than 1,000 deaths in the past week.

While the general focus between both investors and analysts appears to be on the long-term potential in 2021, there are certainly short-term concerns. Inevitably, there will be a short-term tug of war between good news and bad news. For now, though, the main catalyst is the stimulus package. If a stimulus package is passed before Christmas, the markets could benefit. If it doesn’t, markets will drop. Time is running short and we may be at a fork in the road.

According to Luke Tilley, chief economist at Wilmington Trust, another stimulus package was needed to keep the economic recovery from stalling before the mass distribution of a vaccine.

“With the continued rising cases and mass vaccinations still a ways out, we could see some further weakness in jobs and even a flattening where we’re not even adding jobs at all ... that’s absolutely a possibility for this next jobs report,” Tilley said. “And if we were to not get another stimulus package, you’re going to have 10 to 11 million people fall off the unemployment rolls right away, and that would hit spending as well.”

However, despite near-term risks, the overwhelming majority of market strategists are bullish on equities for 2021, especially for the second half of the year. While there may be some short-term worries, the consensus between market strategists is to look past the short-term pain and focus on the longer-term gains. Although the economic recovery could stutter in the early half of the year, the general focus is on the second half of the year when we could potentially return to normal. Many analysts expect double-digit gains to continue in 2021, with strategists in a CNBC survey expecting an average 9.5% rise in 2021 for the S&P 500.

Additionally, according to Robert Dye, Comerica Bank Chief Economist:

“I am pretty bullish on the second half of next year, but the trouble is we have to get there...As we all know, we’re facing a lot of near-term risks. But I think when we get into the second half of next year, we get the vaccine behind us, we’ve got a lot of consumer optimism, business optimism coming up and a huge amount of pent-up demand to spend out with very low interest rates.”

In the short-term, there will be some optimistic and pessimistic days. On some days, the broader “pandemic” market trend will happen, with cyclical and recovery stocks lagging, and tech and “stay-at-home” stocks leading. Sometimes a broad sell-off based on fear or overheating may occur as well. On other days, there will be a broad market rally due to optimism and 2021-related euphoria. Additionally, there will be days (and in my opinion this will be most trading days), when markets will trade largely mixed, sideways, and reflect uncertainty. But if we get an early Christmas present and a stimulus package passes, all bets are off. It could mean very good things for short-term market gains.

Despite the optimistic potential, the road towards normalcy will hit inevitable speed bumps. While it is truly hard to say with conviction that a short-term rally or bear market will come, I do believe that some consolidation and a correction could be possible in the short-term on the way towards another strong rally in the second half of 2021.

Outside of economic damages and an out-of-control virus, the market itself is flashing potential signs of over-optimism and euphoria. In its most recent survey, for example, the American Association of Individual Investors (AAII) found that 48.1% of investors identified as being bullish - well above the historical average of 38%. With an overabundance of cocky, euphoric, and optimistic investors, the market becomes more vulnerable to selling pressure. Corrections are very common though. Only twice in the last 38 years have we had years WITHOUT a correction (1995 and 2017). Because there has not been one since the lows of March, we could be due for one in the early part of 2021.

Therefore, to sum it up:

While there is long-term optimism, there are short-term concerns. A short-term correction in early 2021 is very possible, but I do not believe, with certainty, that a correction above ~20% leading to a bear market will happen.

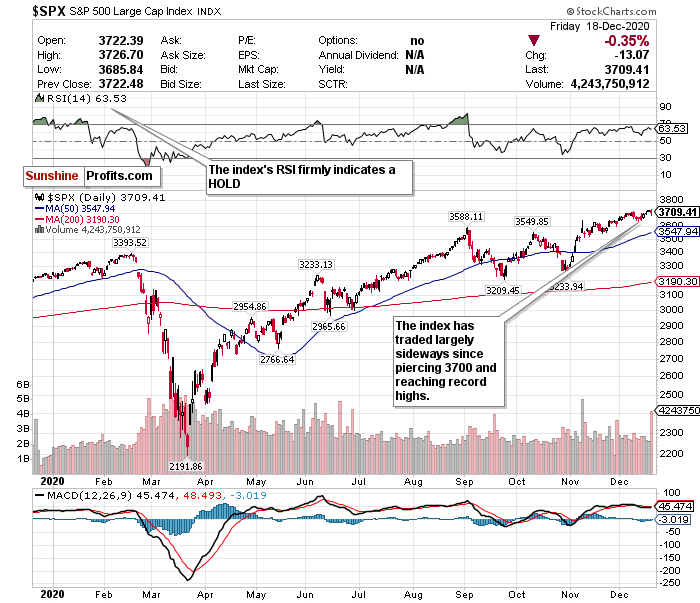

The S&P Has Long-term Upside Mixed with Uncertainty

The S&P is back over the 3700-level once again, however, it has largely traded sideways. I do like where the index is at, just not as a conviction buy. While a stimulus appears imminent, I simply believe that a short-term correction is inevitable in the early part of 2021.

While many analysts and strategists believe this short-term uncertainty is worth it for long-term potential, (and I tend to agree), I would prefer a sharper correction to initiate S&P exposure at a discount. There is definitely upside for the second half of 2021. I would just prefer to maximize the upside if I believe that it’s possible to buy the ETF at a lower level.

Some analysts believe the S&P could have up to a 20% upside in 2021, while others caution against an overheating index. According to another survey of market strategists conducted by CNBC, a narrow majority believe that U.S. stocks will continue to rally into 2021, with the S&P 500 rising between 8% and 22% next year from these current levels. This very well could be the case- but I believe most of this will happen in the next 6-12 months rather than 1-3 months.

I would prefer a drop closer to below 3600 before feeling more confident in initiating a BUY call. For now, I have the S&P 500 in a HOLD category.

For an ETF that attempts to directly correlate with the performance of the S&P, the SPDR S&P ETF (SPY) is a good option.

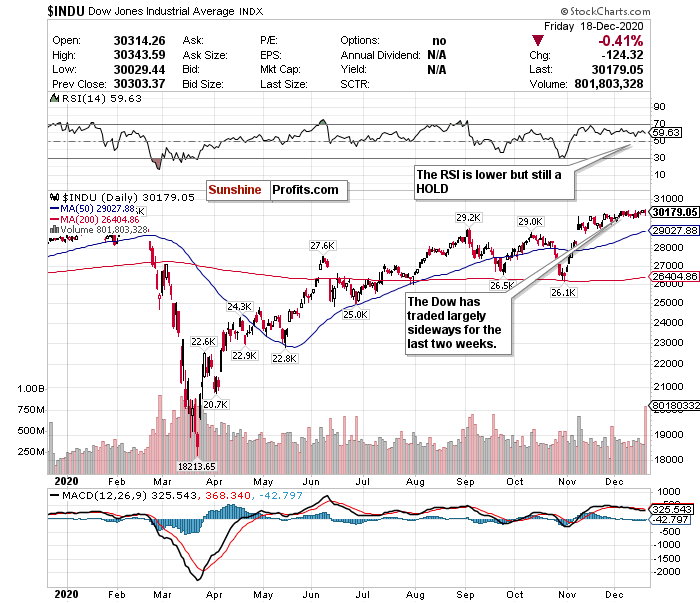

Does the Dow Approach 31,000 or 29,000 Before Mid-2021?

The Dow Jones has now pierced that critical 30,000 level for the third time. However, it has largely lagged behind the other indices as of late and traded sideways.

I do like that it appears to no longer be overheating in the short-term. The Dow Jones has largely traded sideways and hovered slightly above and below the 30,000 level. Volume has been relatively stable too except for Friday (Dec. 18), thanks to Tesla. But I have too many short-term questions as to whether or not the Dow can not only stay above 30,000 for more than a week at a time, but also let alone exceed 30,300 and hit more all-time highs.

In my opinion, it is just as likely for the Dow to approach 29,000 as it is to approach 31,000 in the early months of 2021. If a stimulus passes, though, it could potentially have a short-term pop.

Outside of the Russell 2000, the Dow may be the index most vulnerable to news and sentiment. On pessimistic “sell the news” kind of days, the Dow may have more downside pressure than other indices, such as on Monday (Dec. 14). Many cyclical stocks that depend on a strong economic recovery trade on this index and any change in sentiment can adversely affect their performances.

With so much uncertainty and the RSI still firmly in hold territory, the call on the Dow stays a HOLD.

This is a very challenging time to make calls with conviction. But one thing I do believe is that IF there is a drop in the index, it will not be strong and sharply relative to the gains since March, let alone November. I believe that we could be in a sideways holding pattern as investors digest all the news being thrown at them daily. For an ETF that attempts to directly correlate with the performance of the Dow, the SPDR Dow Jones ETF (DIA) is a strong option.

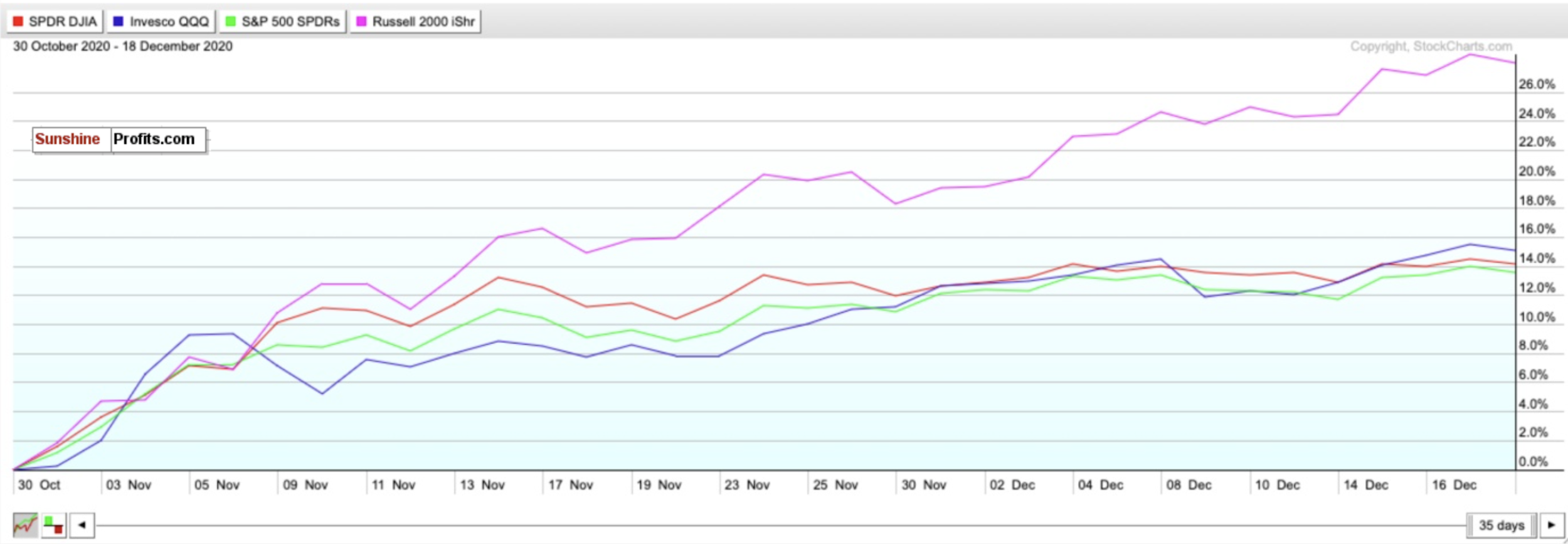

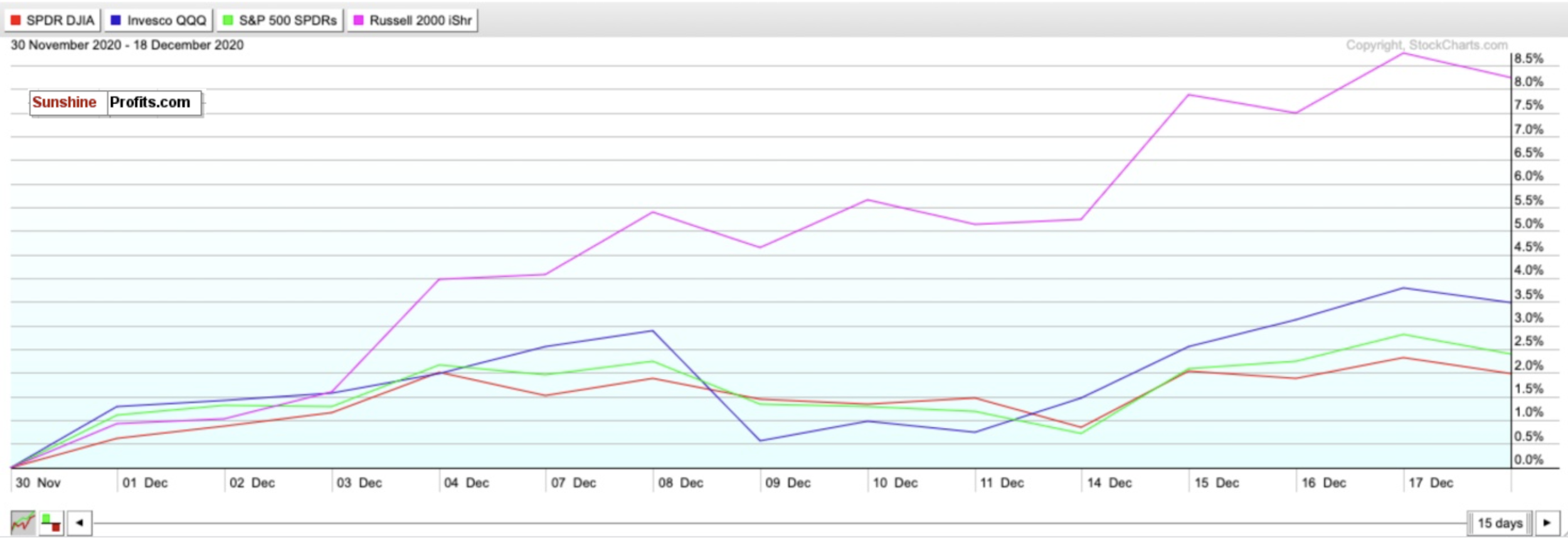

Can Small-caps Own December Too?

The small-cap Russell 2000 since November has been on a run that has amazed me. While it did not outperform the Nasdaq last week, since the start of November, the Russell 2000 has skyrocketed and considerably outperformed the other major indices. Just look how the iShares Russell 2000 ETF (IWM) compares to the ETFs tracking the Dow, S&P, and Nasdaq in that time frame. Since November, the IWM has risen 28%. This is at least 13% higher than all of the other major indices.

The run has not stopped in December either. The IWM Russell ETF has surged by 7.5% since the start of the month. This is nearly between 4%-6% higher than the ETFs tracking the other major indices.

This is an index especially dependent on news and sentiment and can experience greater volatility than larger-cap stock indices. Much of this can be attributed to the number of cyclical stocks in the index that are dependent on the recovery of the broader economy.

If the last nine months have shown us anything, it’s that Russell stocks will surge on optimistic days, and drop more on pessimistic days. Recent trading days have bucked this trend. I do have some concerns about overheating, and even more so than tech stocks. In the long-term, though, small-caps may be the best opportunity to bet on a 2021 economic recovery.

In the short-term, small-cap stocks may be the most volatile of all of them and may have overheated. SELL and take short-term profits if you can- but do not fully exit positions.

If there is a pullback and correction, consider small-caps a BUY and initiate positions.

Mid-Term/Long-Term

Taiwan Continues to Outperform

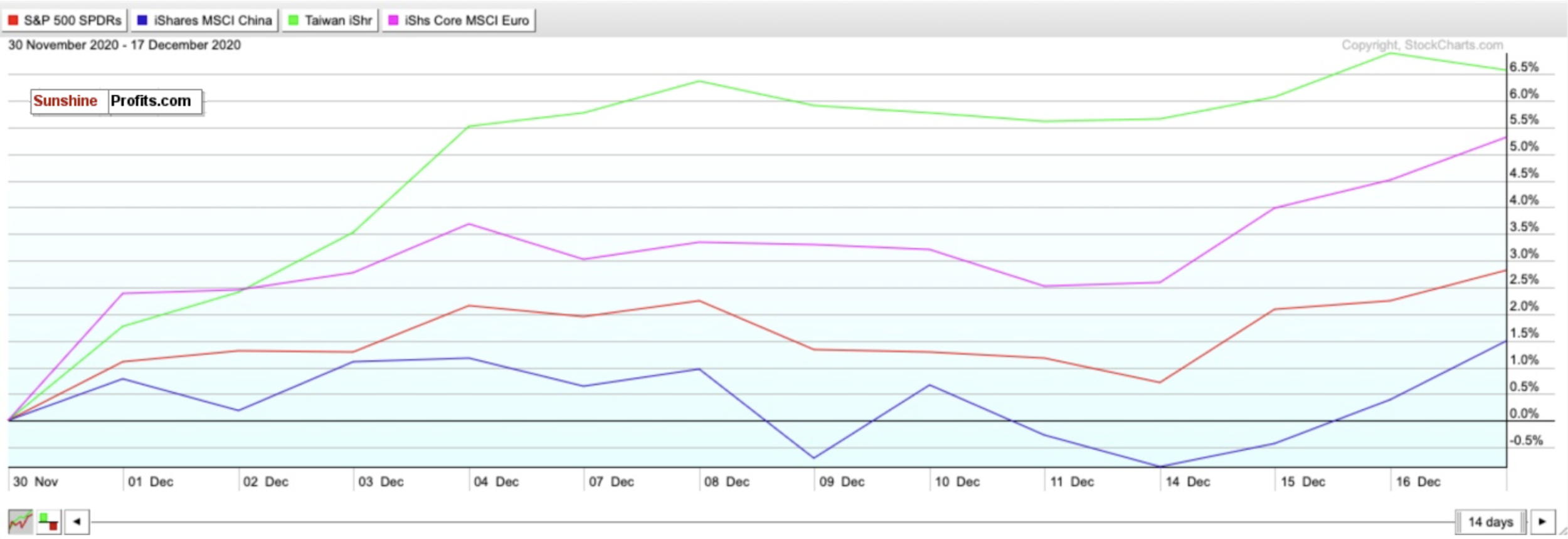

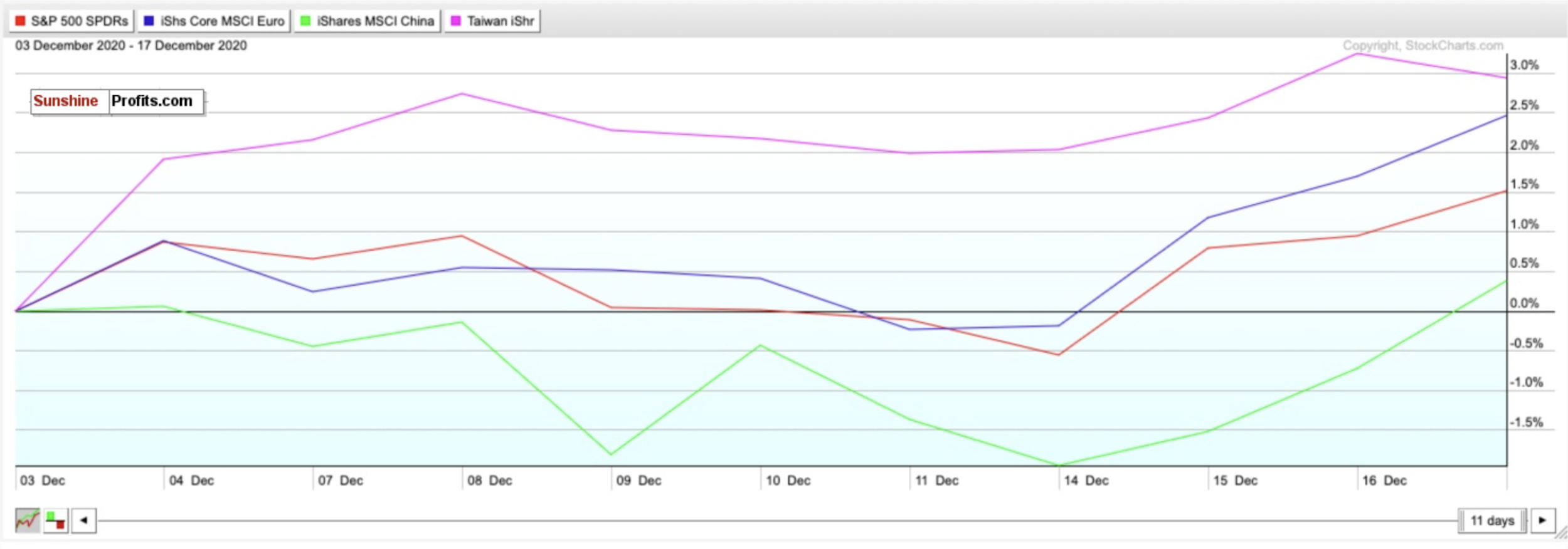

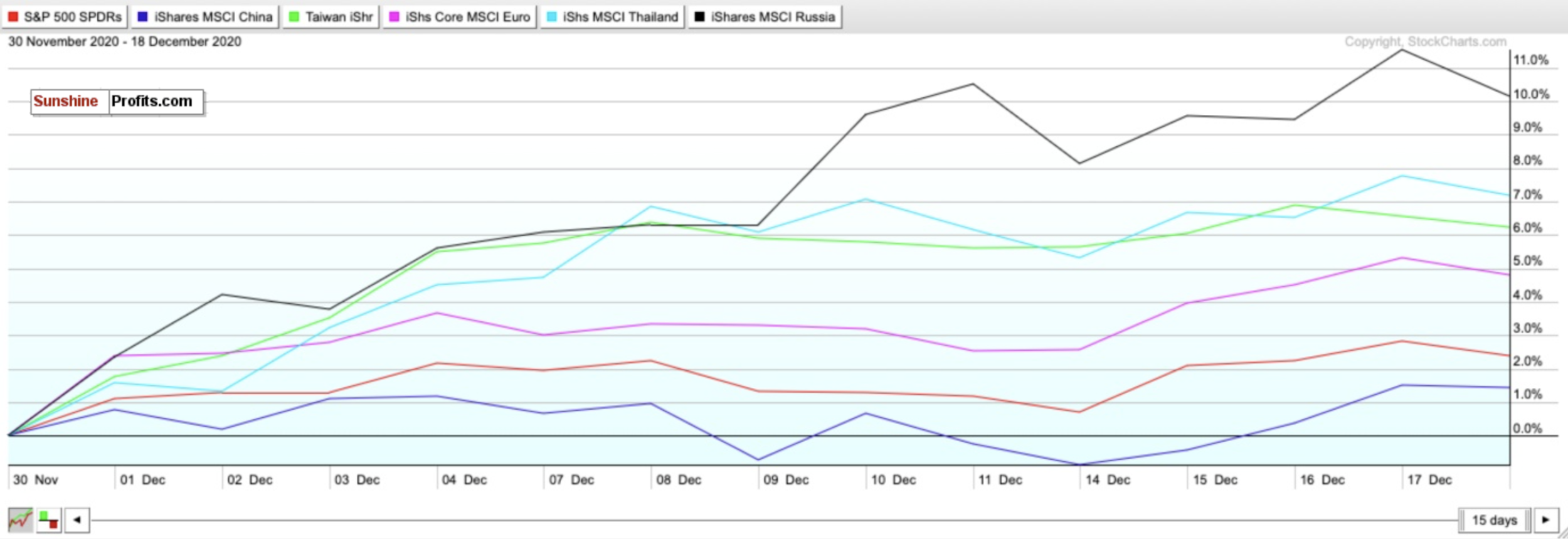

Investors are bullish on emerging markets in both the medium-term and long-term. However, outperformance or underperformance depends on the region. For example, although China garners most of the attention and is by far the largest presence in emerging market indices, Taiwan continues to distance itself as a top-performing emerging market in 2020. As seen in the chart below, ever since I first called the Taiwan ETF (IWT) a BUY on December 3rd it has outperformed the MSCI China ETF (MCHI), the SPDR S&P ETF (SPY), and iShares Core Europe ETF (IEUR).

While the MSCI China ETF has barely managed to trade over the flatline in that same period, Taiwan adds stronger returns and a stronger opportunity for emerging market exposure, without the same type of geopolitical risks as China.

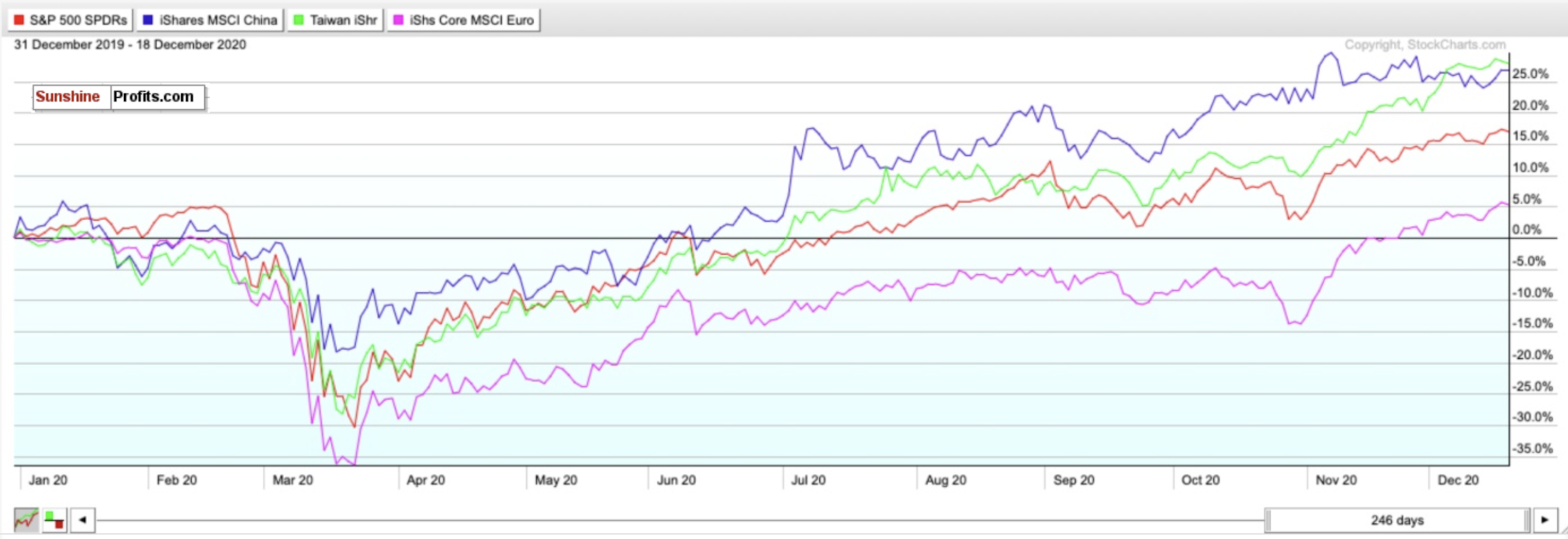

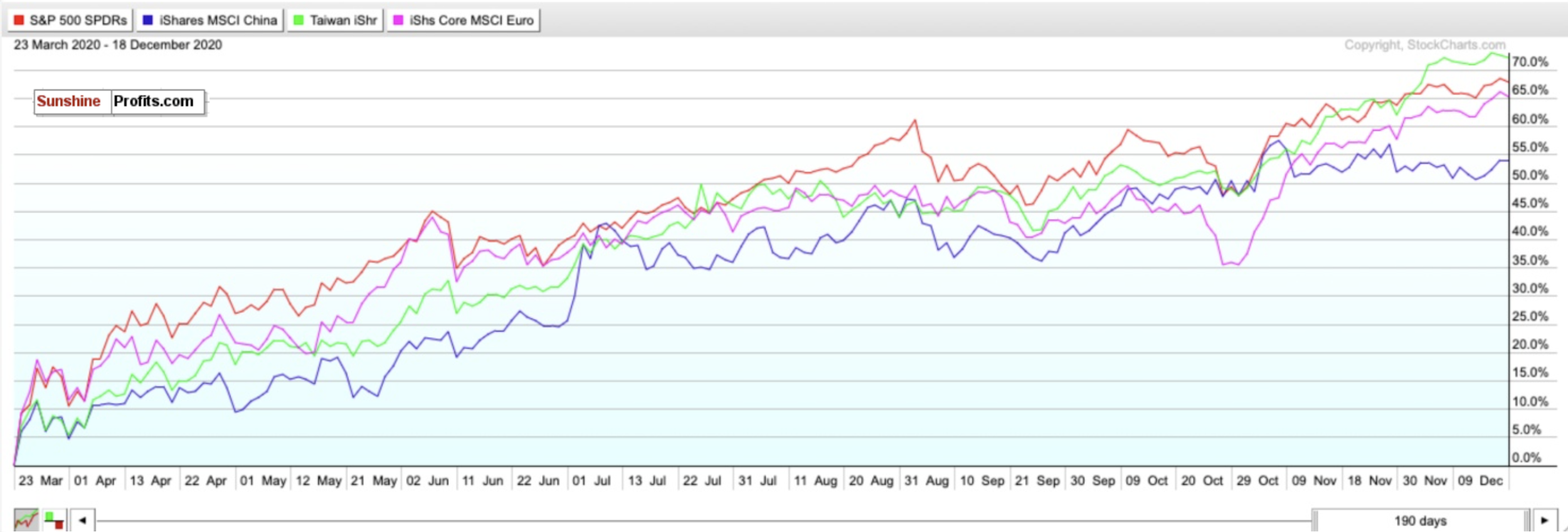

If you also look at returns since December 31, 2019, as well as returns since the market bottoms of March 23rd, 2020, the Taiwan ETF outperforms every single time.

After the China ETF outperformed the other ETFs for most of 2020, the iShares Taiwan ETF has now overtaken the China ETF’s 2020 returns. The Taiwan ETF has also outperformed the SPDR S&P ETF by over 12% while the Europe ETF has barely gained 5%.

Additionally, since March 23rd, the China ETF has been the biggest laggard and underperformed the Taiwan ETF by nearly 20%. It has also underperformed the S&P ETF and Europe ETF by nearly 15% and 10%, respectively.

China may have handled the pandemic better than other countries and continues to demonstrate its ability to handle COVID-19’s economic shocks. But keep in mind that this is a regional victory, not just China. I feel that Taiwan may arguably pose an even stronger opportunity.

For 2021, I am also bullish on Thailand and Russia for emerging market exposure. According to a Bloomberg study based on 11 indicators of economic and financial performance, Thailand topped the list due to solid reserves and a high potential for portfolio inflows, while Russia scored second due to robust external accounts, a strong fiscal profile, and an undervalued currency.

Do you know who scored poorly on this list? China. High expectations were largely already baked in during its 2020 recovery, and there is little upside.

Do you also know who outperformed the Taiwan ETF (IWT), the MSCI China ETF (MCHI), the SPDR S&P ETF (SPY), and iShares Core Europe ETF (IEUR) since November 30th? The iShares MSCI Thailand ETF (THD) and the iShares MSCI Russia ETF (ERUS).

For broad exposure to Emerging Markets, you will want to BUY the iShares MSCI Emerging Index Fund (EEM), for exposure to a regional economic power without the geopolitical risks of China, you will want to BUY the iShares MSCI Taiwan ETF (EWT). Consider the iShares MSCI Thailand ETF (THD) and the iShares MSCI Russia ETF (ERUS) as well for 2021 upside.

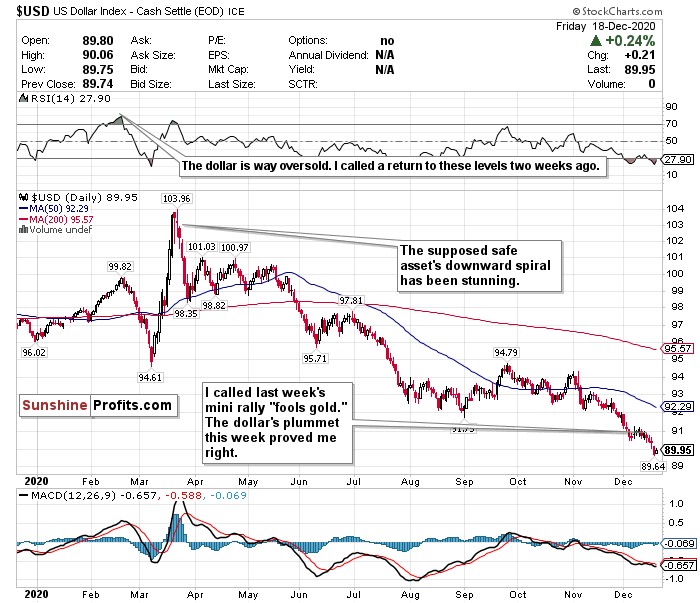

The Dollar’s Plunge Will Continue

The U.S. Dollar’s plunge continues to its lowest levels in years. I called the return to oversold levels this week despite the currency piercing the 91-level last Wednesday (Dec. 9). It looked like it was “fool's gold” and I figured that it was not the sign of any sort of breakout.

Since I called this rally a mirage on December 9th, the dollar has declined by 1.24%.

I am still calling out the dollar’s weakness after several weeks, despite its low levels, and expect the decline to continue as well.

The world’s reserve currency is still trading below 90 and has not traded this low since April 2018. I am calling this right now too – the dollar will fall more thanks to a dovish Fed.

I am not fooled by the dollar’s mini rally on Friday (Dec. 18). After the Federal Reserve’s announcement had a predictably dovish tone on Wednesday (Dec. 16), I took this as a sign to keep selling the dollar.

Joe Manimbo, a senior analyst at Western Union Business Solutions, seemingly agrees with me as well and said that “the latest blow to the dollar came from the Fed, which vowed not to touch policy even if the outlook for the U.S. economy brightens as it now expects.”

Since hitting a nearly 3-year high on March 20th, the dollar has plunged 12.5% while other currencies continue to strengthen.

Additionally, according to Barron’s, the COVID-19 vaccine(s) could benefit currencies such as the euro more than the dollar. Eurozone GDP is expected to have fallen harder in 2020 than that of the U.S., while the dollar has weakened. If vaccines jolt economies back to pre-pandemic levels, Europe will rebound more spectacularly than the U.S.

Meanwhile, the gap between the yields of U.S. Treasuries and European government bonds is narrowing. This gives investors less of a reason to hold dollar-denominated debt.

After briefly rising above an oversold RSI of 30 last week, the dollar’s RSI is now at an alarmingly low 27.90. The dollar is also significantly trading below both its 50-day and 200-day moving averages.

While the dollar may have more room to fall, this MAY be a good opportunity to buy the world’s reserve currency at a discount, as the RSI is oversold. But I have too many doubts on the effect of interest rates this low for this long, government stimulus, strengthening of emerging markets, and inflation to be remotely bullish on the dollar’s prospects over the next 1-3 years. Additionally, according to The Sevens Report, if the dollar falls below 89.13, this could potentially raise the prospect of a further 10.5% decline to the next support level of 79.78 reached in April 2014

I’m not a crypto guy either myself, but Bitcoin’s run compared to the dollar’s disastrous 2020 has to really make you think sometimes….

For now, where possible, HEDGE OR SELL USD exposure.

Pay Very Close Attention to Inflation

Pay very close attention to the possible return of inflation within the next 6-12 months. The Fed has said it will allow the GDP to heat up, and it may overshoot in the medium-term as a result. Although JP Morgan and Goldman Sachs have cut their GDP growth estimates for Q1 2021, pay close attention to what happens in Q2 and Q3 once vaccines begin to be rolled out on a massive scale. It is only inevitable that inflation will return with the Fed’s policy and projected economic recovery by mid-2021.

If you are looking to the future to hedge against inflation, look into TIPS, commodities, gold, and potentially some REITs.

In the mid-term, I have BUY calls on the SPDR TIPS ETF (SPIP), the Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF (PDBC), the SPDR Gold Shares ETF (GLD), and the iShares Cohen & Steers REIT ETF (ICF).

Long-Term

While all of these headwinds may drive some short-term concerns, the progress made on the vaccine/treatment front cannot be ignored. With the vaccine rollout beginning, this may be the beginning of the end of the pandemic. There is certainly significant optimism for 2021 and beyond, but over the next 1-3 months, it could be a bumpy ride back to normalcy. Projections for the economy, the markets, and the pandemic are so all over the place right now, that the only real certainty is that nobody knows a thing, and nobody can predict the future. I do have a very good feeling about stocks, especially value stocks and cyclicals, in the second half of 2021. I almost hope we see a correction within the first three months of 2021. This could be a very strong buying opportunity.

Summary

While the surging spread of COVID-19 and resulting economic shutdowns may drive some short-term concerns, the progress made on the stimulus deal, as well as with the vaccine(s) poses significant optimism for 2021 and beyond.

The start of global vaccinations and the FDA’s approval of Moderna’s vaccine should be cheered by everyone. Although sentiment seemingly can change at the snap of a finger, the long-term outlook for equities could be very positive.

While we can officially enter 2021 with some glimmer of hope, COVID-19 is still here and has not been eradicated. Until that happens, there will inevitably be a tug of war between vaccine optimism and health/economic pessimism. Furthermore, the mania that has consumed the markets could potentially lead to a short-term correction to start 2021.

Please keep in mind that markets are forward-looking instruments and are investment vehicles that look 6-12 months down the road. Although it is very plausible that there could be some short-term uncertainty and volatility, remember how sharp and swift the rally was after the crashes in March.

I do not believe a crash like that is on the horizon, but if there is a short-term correction or downturn, keep your eyes on buying opportunities. Why? Since markets bottomed on March 23rd, here is how the ETFs tracking the indices have performed: Russell 2000 (IWM) up 98.32%. Nasdaq (QQQ) up 82.48%. S&P 500 (SPY) up 67.70%. Dow Jones (DIA) up 64.34%.

In the long-term, markets always end up moving higher and are focused on the future rather than the present.

If the stimulus deal officially passes before Christmas, and everything goes well with the vaccines, the short-term volatility may be worth monitoring for opportunities.

To sum up all our calls, in the short-term I have a SELL call for:

- Invesco QQQ ETF (QQQ) (but do not fully exit positions - trim profits)

- iShares Russell 2000 ETF (IWM) (but do not fully exit positions)

I have a HOLD call for:

- the SPDR S&P ETF (SPY),

- SPDR Dow Jones ETF (DIA)

I have a BUY call for:

- iShares Russell 2000 ETF (IWM) if it pulls back

For all these ETFs though, I am more bullish in the long-term for the second half of 2021.

For the mid-term and long-term, I recommend selling or hedging the US Dollar, and gaining exposure into emerging markets.

I have BUY calls on:

- The iShares MSCI Emerging Index Fund (EEM),

- the iShares MSCI Taiwan ETF (EWT),

- the iShares MSCI Thailand ETF (THD), and

- the iShares MSCI Russia ETF (ERUS).

Additionally, because I foresee inflation returning as early as mid to late 2021…

I also have BUY calls on:

- The SPDR TIPS ETF (SPIP),

- the Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF (PDBC)

- the SPDR Gold Shares ETF (GLD), and

- the iShares Cohen & Steers REIT ETF (ICF)

Thank you.

Matthew Levy, CFA

Stock Trading Strategist