Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): No positions are currently justified from the risk/reward point of view.

The S&P 500 index broke below its short-term consolidation and it fell closer to the 4,400 level. But will the downtrend continue?

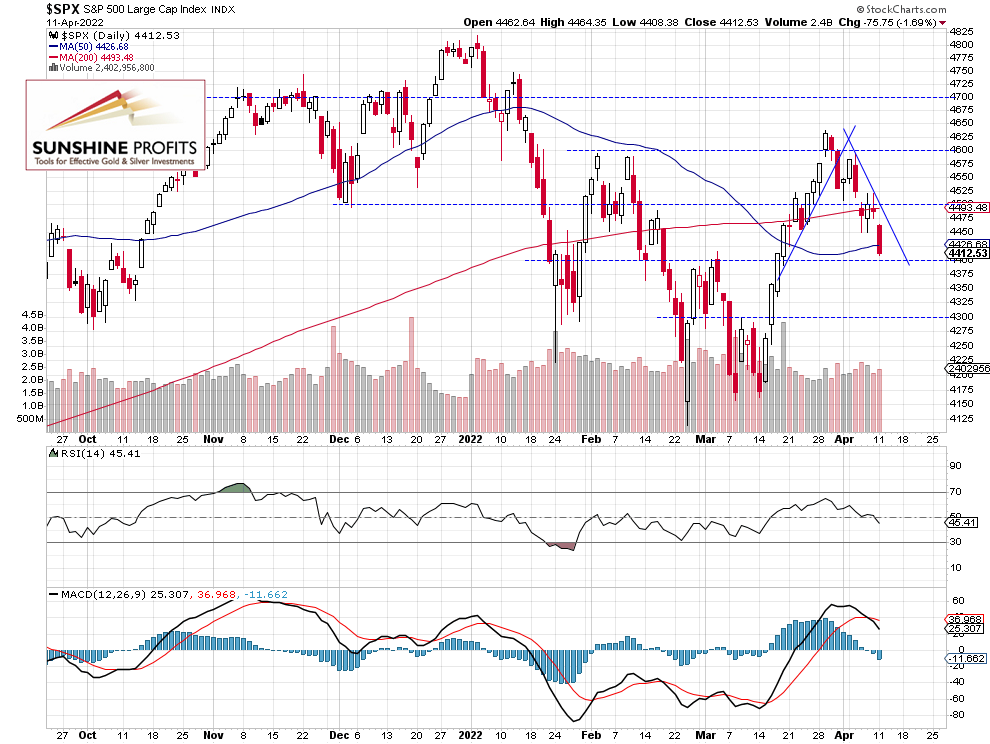

The broad stock market index lost 1.69% on Monday, after breaking below the 4,500 level. There is still a lot of uncertainty concerning the Ukraine conflict and Fed’s monetary policy tightening plans. Yesterday it all led to a more pronounced profit-taking action. However, the coming quarterly earnings releases season may be a positive factor in the near term.

The S&P 500 index has been fluctuating within a consolidation after rallying from the March 14 local low of around 4,162 recently, but on Wednesday it broke below its short-term lows. And yesterday it extended the downtrend. This morning the broad stock market is expected to open 1.2% higher following the Consumer Price Index release.

The nearest important resistance level is now at around 4,475-4,500, marked by the recent support level and yesterday’s daily gap down. On the other hand, the support level is at 4,400. The S&P 500 index retraced more of its March rally, as we can see on the daily chart (chart by courtesy of http://stockcharts.com):

Futures Contract Retraces Its Decline

Let’s take a look at the hourly chart of the S&P 500 futures contract. Yesterday it broke below the 4,400 level and our profitable long position was closed at the stop-loss (take-profit) level of 4,440. Overall, we gained 100 points on that trade in a little less than two months’ time (it was opened on Feb. 22 at 4,340 level). So now we will wait for another profit opportunity. (chart by courtesy of http://tradingview.com):

Conclusion

The S&P 500 index is expected to open 1.2% higher following consumer inflation number release. Stocks will likely retrace some of their yesterday’s sell-off. For now it looks like an upward correction within a short-term downtrend.

Here’s the breakdown:

- The S&P 500 index moved closer to the 4,400 level yesterday, as investors continued to take profits off the table after the March rally.

- Our profitable long position was closed at the 4,440 level (a gain of 100 points from the Feb. 22 opening).

As always, we’ll keep you, our subscribers, well-informed.

Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): No positions are currently justified from the risk/reward point of view.

Thank you.

Paul Rejczak,

Stock Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care