This market reminds me of the days leading up to Christmas Eve 2018. For those who don’t remember, it was a pretty dark day for those trading in financial markets.

I was in the office, alone, and felt particularly responsible for my clients that day. You see, since October of that year, markets had been in a tailspin lower.

“Fundamentals look good, add some exposure to equities here” I found myself saying, more than once. And just when I thought I would get a break, have a half day in the markets, and take a couple days off - boom. Markets fell two to three percent on the day.

I still remember the feeling, it was like a gut punch. We were unprepared and had added more equity exposure for most of our clients in the prior few weeks. My boss was furious, as I was responsible for allocating hundreds of millions of dollars and we were having our worst quarter ever. I vowed to never be caught unprepared and foolhardy about markets ever again after that quarter.

It was a great lesson, and one that allowed me to flourish in 2020. While I did not foresee a global pandemic, back in January of 2020, things were looking eerily similar to 2018. Markets were frothy, and it appeared that no downside was possible. And I cut exposure for my family assets significantly.

That allowed me to avoid the worst of the pullback, and in March, with an eye on the long run, I took my family assets and picked up several companies at mouth watering valuations, some we hadn’t seen in years.

So far, so good. My old boss would have been pleased - not that it matters…

And now? Well. We’re falling into the same song and dance lately, aren’t we. I have some tips below for those interested, and if you want to know how my personal portfolios have performed, slip into my DMs.

My goal for these updates is to educate you, give you ideas, and help you manage money like I did when I was pressing the buy and sell buttons for $600+ million in assets. I left that career to pursue one where I could help people who needed help, instead of the ultra high net worth. Hopefully, you’ll find the below enlightening from my perspective, and I welcome your thoughts and questions.

Although stocks closed mildly lower on Thursday (Jan. 14), stocks have overall had a strong start to 2021.

Be that as it may, I am still concerned about overheated valuations for stocks and the return of inflation. The S&P 500 is trading at its highest forward P/E ratio since 2000, and the 10-year treasury is at its highest level since March. The Russell 2000 is also up over 37% from its 200-day moving average for the first time in its history.

Overvalued stocks combined with inflation returning by mid-year is quite concerning for me. I feel that a correction between now and the end of Q1 2020 is likely.

I like how economist Mohammed El-Erian described the market as a “rational bubble.” But he did caution against four major risks that could cause a downturn.

The first two risks, and the least likely are the Fed pulling back on monetary stimulus and the potential for corporate bankruptcies. As Fed Chair Jay Powell said himself Thursday though, (Jan. 14) “be careful not to exit too early,”

The last two risks could be riskier.

The first is “some sort of market accident” akin to the dot-com bubble popping in 1999. THIS is what concerns me most right now. The IPO market is simply absurd right now. The DoorDash (DASH) and AirBnB (ABNB) IPOs were ridiculous, and other IPOs are looking more and more like a circus. Lender Affirm went public on Wednesday (Jan. 13) and nearly doubled. Shares of Poshmark also surged more than 130% in its debut Thursday (Jan. 14).

The other risk is the bond market and its effect on inflation. According to El-Erian, “If we were to see another 20 basis point move in yields, that would be bad news.”

Despite my concerns, it is clear to me that investors are loving the potential for a $1.9 trillion stimulus package under President-elect Biden.

Although a short-term tug of war between good news and bad news could continue, it seems to me that investors (for now) would just prefer to ride this out for what could be a strong second half of the year. According to CNBC’s Jim Cramer, there appears to be a lack of “people willing to sell”.

Be that as it may, jobless claims surged to their highest levels since August, and the pandemic is still out of control. According to Goldman Sachs’ Chief Economist Jan Hatzius, U.S. stocks and bond markets could possibly “take more of a breather” in the near term.

Generally, corrections are healthy, good for markets, and more common than most realize. Only twice in the last 38 years have we had years WITHOUT a correction (1995 and 2017). Because we haven’t seen a correction since March 2020, we could be well overdue.

This is healthy market behavior and could be a very good buying opportunity for what should be a great second half of the year.

The consensus is that 2021 could be a strong year for stocks. According to a CNBC survey which polled more than 100 chief investment officers and portfolio managers, two-thirds of respondents said the Dow Jones will most likely finish 2021 at 35,000, while five percent also said that the index could climb to 40,000.

Therefore, to sum it up:

While there is long-term optimism, there are short-term concerns. A short-term correction between now and Q1 2021 is very possible. I don’t think that a correction above ~20% leading to a bear market will happen.

Hope everyone has a great day. Best of luck, and happy trading!

Can Small-caps Own 2021?

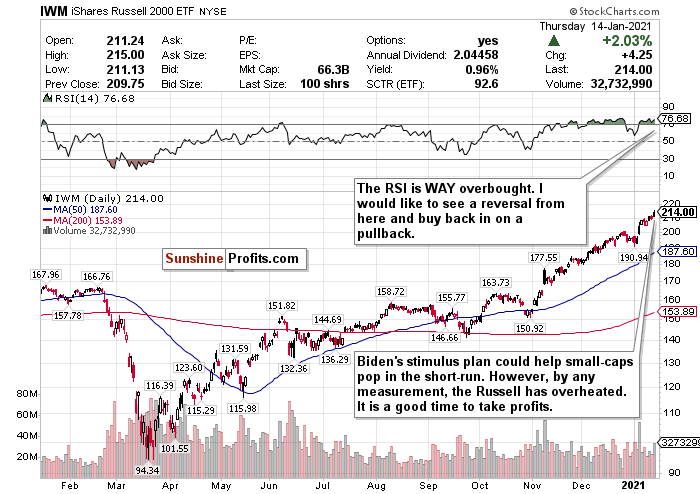

Figure 1- iShares Russell 2000 ETF (IWM)

Small-caps continue to surge.

Despite the markets experiencing a mild decline on Thursday (Jan. 14), the Russell 2000 continued its record-setting. The iShares Russell 2000 ETF (IWM) rallied over 2% on Thursday, and has rallied 10.56% since January 4th.

Small-cap stocks appear to be the most excited from the Democrat sweep in Georgia and the most optimistic about Biden’s stimulus plan.

While I love small-cap stocks in the long-term, especially as the world reopens, the index has overheated by any measurement. Before January 4th, the RSI for the IWM Russell 2000 ETF was at an astronomical 74.54. I called a pullback happening in the short-term due to this RSI, and it happened.

The RSI is scorching hot yet again at nearly 77. These stocks could imminently cool down in the near-term.

Stocks simply don’t always go up in a straight line, and that’s what the Russell 2000 did between November and Christmas. It has looked eerily similar since January 4.

Small-caps are more sensitive to the news- good or bad. Vaccine-related gains have probably been baked in by now. While there has been another pop for small-caps due to stimulus hopes, I think it’s likely that small-caps from here on out could trade sideways before an eventual pullback.

I hope small-caps decline a minimum of 10% before jumping back in for long-term buying opportunities.

SELL and take profits if you can- but do not fully exit positions. If there is a pullback, this is a STRONG BUY for the long-term recovery.

The Nasdaq’s RSI is Back Below 70...Where Does it Go From Here?

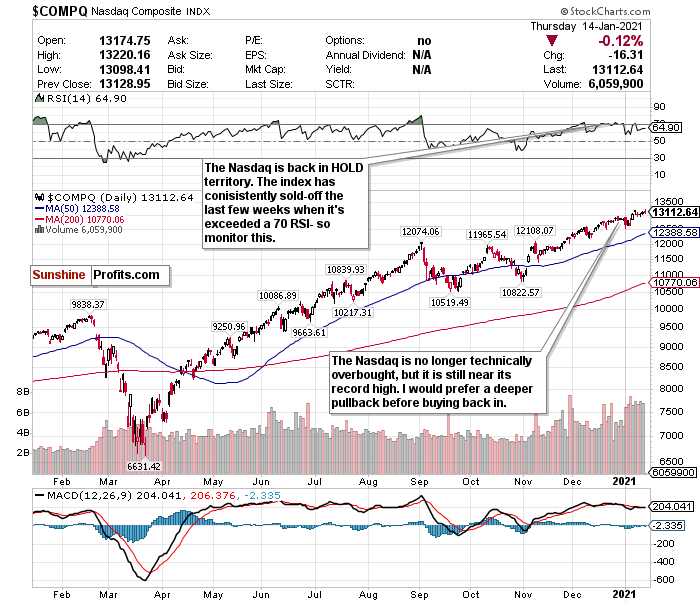

Figure 2- Nasdaq Composite Index $COMP

Tech stocks are sexy. There is no denying that. These are the stocks that have high growth potential, and these are the stocks that are changing our world.

Pay close attention especially to cloud computing, e-commerce, and fintech opportunities.

I am keeping the theme of using the RSI to judge how to call the Nasdaq. An overbought RSI does not automatically mean a trend reversal, but with the Nasdaq, I always keep a close eye on this.

I initially changed my short-term call on the Nasdaq from a SELL to a HOLD on January 5. I liked the Nasdaq’s declines to start 2021, especially after overheating. The RSI was no longer overbought as well.

After changing the call back to a SELL on January 11th, the Nasdaq declined 1.45%.

Over the last several weeks, this has been a consistent pattern for the Nasdaq. The Nasdaq pulled back on December 9th after it exceeded an RSI of 70, and briefly pulled back again after passing 70 again three weeks ago. We exceeded a 70 RSI again before the new year, and what happened on the first trading day of 2021? A decline of 1.47%.

The Nasdaq is no longer technically overbought and its RSI is now hovering around 65. I like this level more as a HOLD, but I still feel that it has overheated in the short-term. As I mentioned in the intro, the IPO market screams dot-com bubble to me.

I am generally optimistic and bullish for 2021, but I would like a pullback closer to the 50-day moving average before considering buying back in.

I also have some concerns with the Democrats winning Senate control, and its potential consequences for tech. The Democrat sweep is better for small-caps than tech.

It may not happen in 2021, but a Democrat-controlled Congress could raise taxes and further regulate tech companies showing high growth.

Because the RSI is still in HOLD territory, I’m keeping my call for now as a HOLD.

If the RSI ticks back up above 70, I’m switching back to SELL. The Nasdaq is trading in a clear pattern.

For an ETF that attempts to directly correlate with the performance of the NASDAQ, the Invesco QQQ ETF (QQQ) is a good option.

Does the Dow Approach 31,500 or 29,500 Before the End of January?

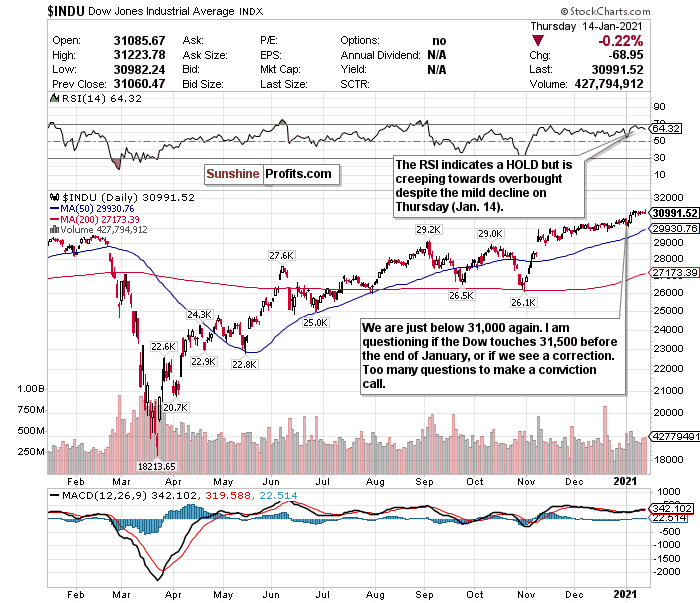

Figure 3- Dow Jones Industrial Average $INDU

I am not seeing the same type of overexuberance and euphoria in the Dow Jones as I am seeing with the Russell or Nasdaq. Although the Dow’s RSI is comparable to the Nasdaq’s, it has not exceeded overbought levels as much.

Whenever I question if the Dow has more room to run towards record highs, it hits them. It defies logic, frankly.

I still have some short-term concerns for the Dow Jones, and feel it could decline to 29,500, pop to 31,500, or hover around 31,000 by the end of month. It is very hard right now to make a conviction call on this index because of the short-term questions.

I don’t like how COVID-19 is trending (who does?), I am disappointed in the vaccine roll-out (although it’s improving), and I am concerned about short-term economic and political headwinds.

This is a challenging time to make a call on the Dow with conviction. But if and when there is a drop in the index, it should not be strong and sharply relative to the gains since March 2020. It is more likely than not that we will be in a sideways holding pattern until vaccines are available to the general public by mid-2021.

While a 35,000 call to close out 2021 is a bit aggressive, the second half of 2021 could potentially show robust gains for the index.

With so much uncertainty, the call on the Dow stays a HOLD. I am closely monitoring the RSI in the event that it exceeds 70.

For an ETF that attempts to directly correlate with the performance of the Dow, the SPDR Dow Jones ETF (DIA) is a strong option.

Mid-Term/Long-Term

Taiwan and Others for Emerging Market Exposure - Not China

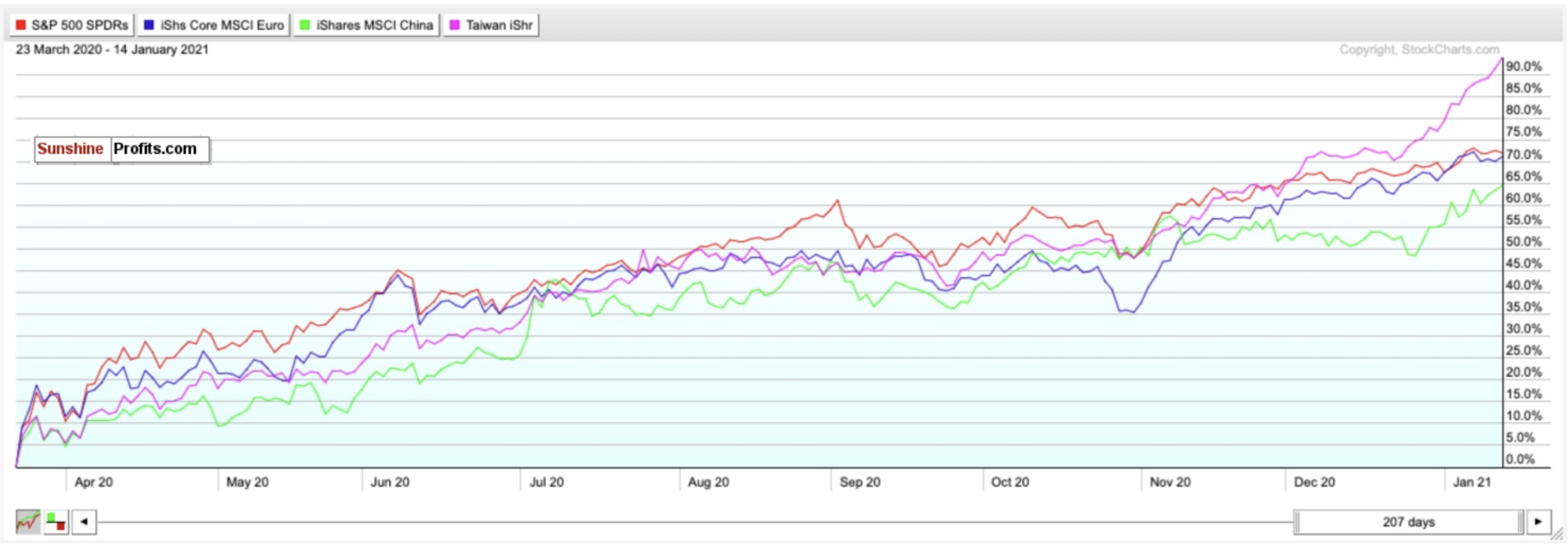

Figure 4- SPY, IEUR, MCHI, and EWT comparison chart-March 23, 2020-Present

I am quite excited about emerging markets in both the medium-term and long-term. This is an environment prime for emerging markets to shine. However, it is country-specific.

China garners most of the attention as a so-called “emerging market.” But it is truly hard to consider it an emerging market any longer. It’s the largest economy in the world and has over a billion people!

China has also underperformed other country-specific indices since markets bottomed on March 23rd.

China is not a top option for international exposure in 2021. While China’s regional upside is undeniable, it also has geopolitical risks and a baked-in economic recovery.

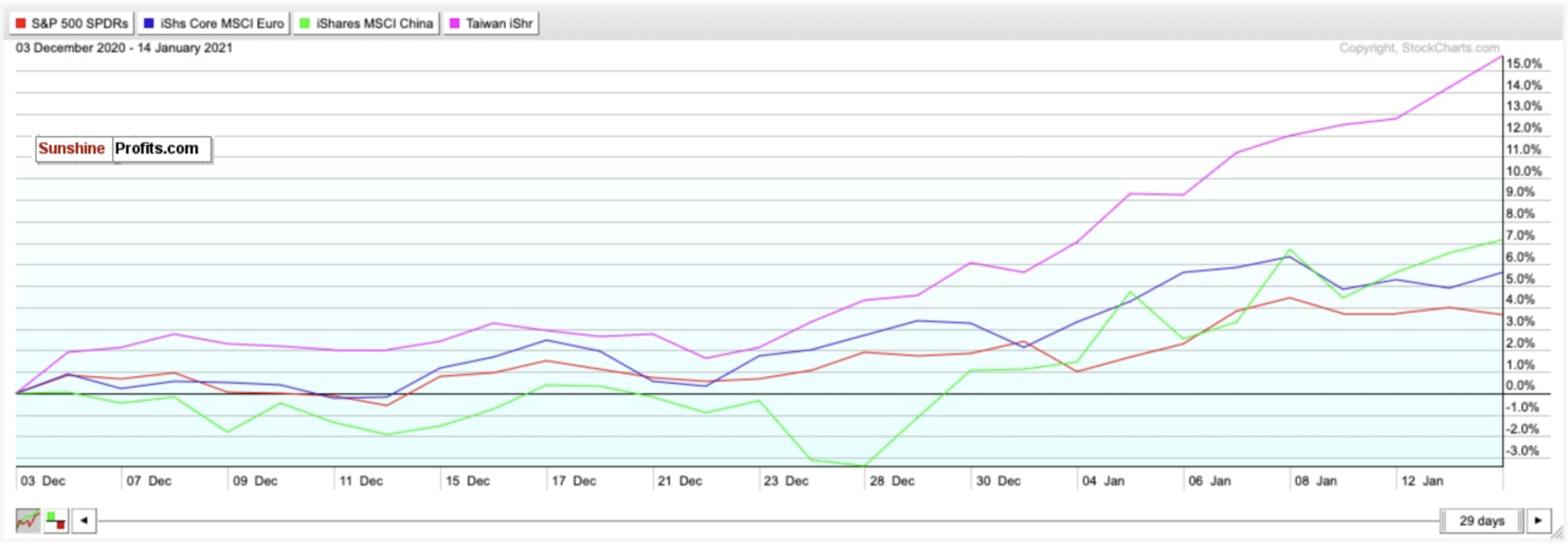

Continue to look at the Taiwan iShares ETF (EWT) as an alternative. Taiwan has outperformed China in the short-term, medium-term, and long-term.

As seen in the chart below, ever since I first called the Taiwan ETF (IWT) a BUY on December 3rd it has outperformed the MSCI China ETF (MCHI), the SPDR S&P ETF (SPY), and iShares Core Europe ETF (IEUR).

The EWT has gained 15.73%- more than doubling the MSCI China ETF’s (MCHI) returns. The Taiwan ETF has also outperformed the SPY S&P 500 ETF by nearly 5x.

Figure 5- SPY, IEUR, MCHI, and EWT comparison chart- Dec. 3, 2020-Present

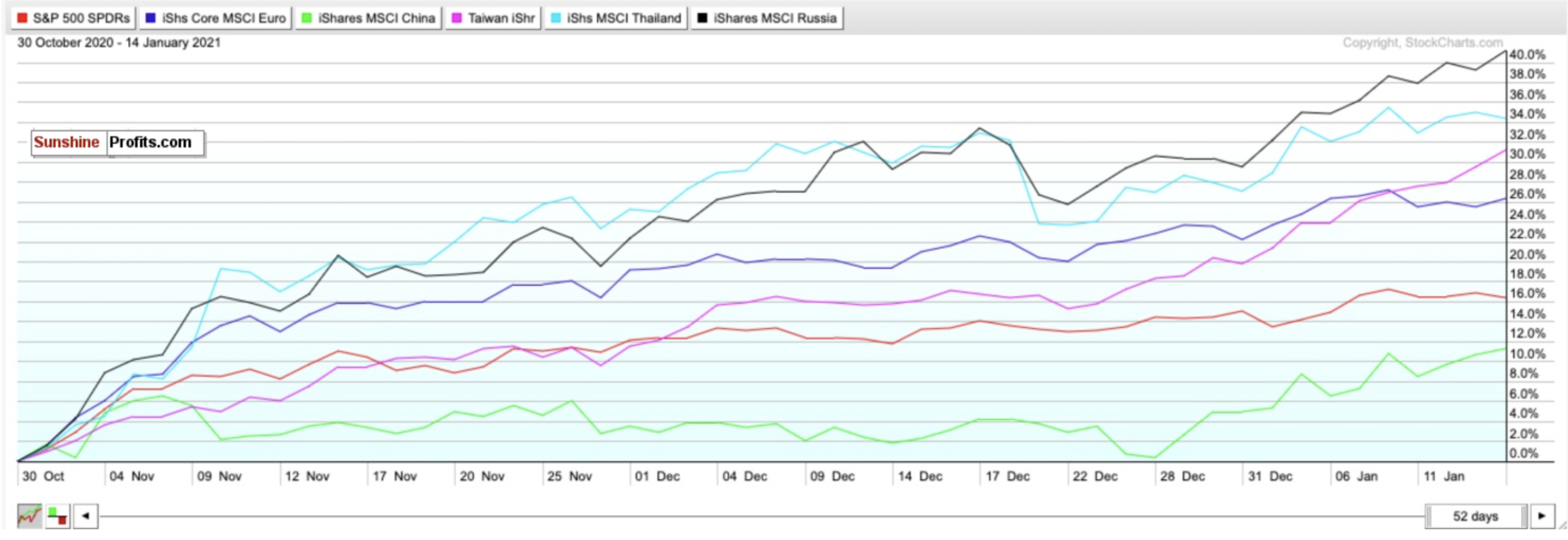

There are two other emerging markets I am very bullish on for 2021 as well- Thailand and Russia.

According to a Bloomberg study from December 16th projecting the top emerging markets for 2021, Thailand topped the list due to solid reserves and a high potential for portfolio inflows, Russia came in second due to robust external accounts, a strong fiscal profile, and an undervalued currency.

Guess who scored last on this list? China. High expectations were largely already baked in during its 2020 recovery, and there is no longer upside.

Do you also know who significantly outperformed the Taiwan ETF (IWT), the MSCI China ETF (MCHI), the SPDR S&P ETF (SPY), and iShares Core Europe ETF (IEUR) since October 30th? The iShares MSCI Thailand ETF (THD) and the iShares MSCI Russia ETF (ERUS).

Figure 6- SPY, IEUR, MCHI, EWT, THD, ERUS comparison chart- Oct. 30, 2020-Present

For broad exposure to Emerging Markets, you will want to BUY the iShares MSCI Emerging Index Fund (EEM), for exposure to a regional economic power without the geopolitical risks of China, you will want to BUY the iShares MSCI Taiwan ETF (EWT). Consider the iShares MSCI Thailand ETF (THD) and the iShares MSCI Russia ETF (ERUS) as well for 2021 upside.

The Dollar Saw Another Rally- Predictably, it Stalled

Figure 7- U.S. Dollar $USD

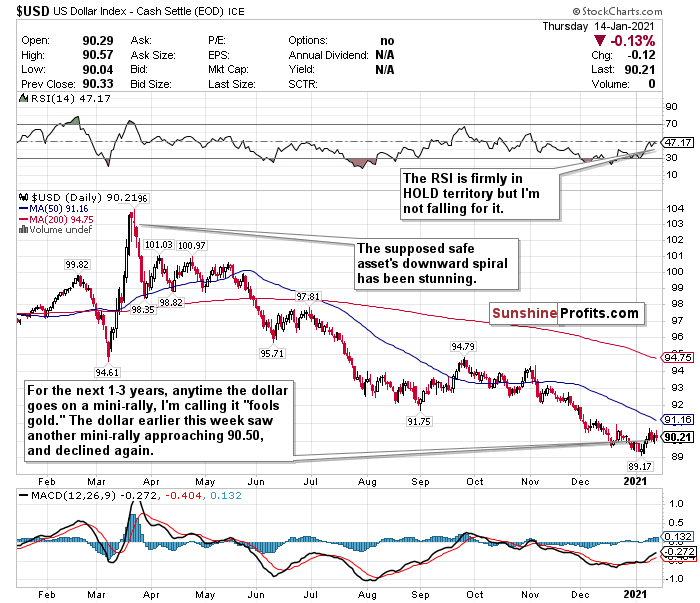

Although the U.S. Dollar ticked up somewhat last week (and the start of this week), I did not and still do not have faith in the greenback as a safe asset.

I’m still calling out the dollar’s weakness after several weeks and expect the decline to restart thanks to a dovish Fed and multiple headwinds.

Any time the US Dollar rallies, I am calling it “fools gold.”

Since I started doing these newsletters about a month ago, I have consistently said that any minor rally the dollar experienced would be a mirage. Since it briefly pierced the 91-level on December 9th, it has fallen nearly 0.95%.

It has also declined another 0.25% since the start of the week.

Although the dollar is back above the 90-level, I don’t think it will last.

Since hitting a nearly 3-year high on March 20th, the dollar has plunged nearly 12.85% while emerging markets, foreign currencies, precious metals, and cryptocurrencies continue to strengthen.

On days when COVID-19 fears outweigh any other positive sentiments, dollar exposure might be good to have since it is a safe haven. But in my view, you can do a whole lot better than the US dollar for safety.

I have too many doubts on the effect of interest rates this low for this long, government stimulus, strengthening of emerging markets, and inflation to be remotely bullish on the dollar’s prospects over the next 1-3 years. Meanwhile, the US has $27 trillion of debt, and it’s not going down anytime soon.

With Democrats in full control of the government, Biden’s $1.9 trillion stimulus plan could further devalue the dollar.

According to The Sevens Report, if the dollar falls below 89.13, this could potentially raise the prospect of a further 10.5% decline to the next support level of 79.78 reached in April 2014. We are closer to this point than most realize with more stimulus on the horizon.

Where possible, HEDGE OR SELL USD exposure.

Pay Very Close Attention to Inflation

Pay very close attention to the possible return of inflation within the next 6-12 months. The Fed has said it will allow the GDP to heat up, and it may overshoot in the medium-term as a result. GDP growth may stutter in Q1 2021 but pay close attention to what happens in Q2 and Q3 once vaccines begin to be rolled out on a massive scale. It is only inevitable that inflation will return with the Fed’s policy and projected economic recovery by mid-2021.

The 10-year’s recent rally reflects this as well.

If you are looking to the future to hedge against inflation, look into TIPS, commodities, gold, and potentially some REITs.

In the mid-term, I have BUY calls on the SPDR TIPS ETF (SPIP), the Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF (PDBC), the SPDR Gold Shares ETF (GLD), and the iShares Cohen & Steers REIT ETF (ICF).

Long-Term

There is so much to worry about in the short-term. But I’m convinced that economic stimulus and the progress made with administering the vaccines bodes well for the second half of 2021. We may be at the beginning of the end of the pandemic-but over the next 1-3 months, this could be a very bumpy ride back.

There does seem to be one consensus though: 2021 could be a big year for stocks.

I have a very good feeling about stocks, especially small-caps, value stocks, and cyclicals. I just have a much better feeling for them in the second half of 2021. I almost hope we see a correction within the first 3 months of 2021. This could be a very strong buying opportunity.

Summary

The current headwinds are very concerning. But I remain optimistic for the second half of 2021 despite the bumpy road there. Until COVID-19 is eradicated, there will inevitably be a tug of war between optimism and pessimism.

A short-term correction could be inevitable-but do not let this scare you.

Remember- corrections are NORMAL and markets tend to look 6-12 months down the road. If there is a short-term downturn, take a breath, and use it as a time to find buying opportunities for the second half of 2021. Do not get caught up in fear if there is a correction.

NEVER TRADE WITH EMOTIONS.

Consider this. Since markets bottomed on March 23rd, ETFs tracking the indices have seen returns like this: Russell 2000 (IWM) up 117.21%. Nasdaq (QQQ) up 85.34%. S&P 500 (SPY) up 71.91%. Dow Jones (DIA) up 68.77%.

In the long-term, markets always end up moving higher and are focused on the future rather than the present.

To sum up all our calls, in the short-term I have a SELL call for:

- The iShares Russell 2000 ETF (IWM) (but do not fully exit positions- trim profits),

I have a HOLD call for:

- The Invesco QQQ ETF (QQQ),

- the SPDR S&P ETF (SPY), and

- the SPDR Dow Jones ETF (DIA)

I also have a long-term STRONG BUY call for:

- the iShares Russell 2000 ETF (IWM) BUT IF AND WHEN IT PULLS BACK

For all these ETFs, I am more bullish in the long-term for the second half of 2021.

For the mid-term and long-term, I recommend selling or hedging the US Dollar, and gaining exposure into emerging markets.

I have BUY calls on:

- The iShares MSCI Emerging Index Fund (EEM),

- the iShares MSCI Taiwan ETF (EWT),

- the iShares MSCI Thailand ETF (THD), and

- the iShares MSCI Russia ETF (ERUS).

Additionally, because I foresee inflation returning as early as mid to late 2021…

I also have BUY calls on:

- The SPDR TIPS ETF (SPIP),

- the Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF (PDBC)

- the SPDR Gold Shares ETF (GLD), and

- the iShares Cohen & Steers REIT ETF (ICF)

Thank you.

Matthew Levy, CFA

Stock Trading Strategist