Stocks closed mixed on Thursday (Dec. 10) after a new report showed that new jobless claims resurged to their worst level in months, while COVID-19 cases climbed to record numbers, and stimulus gridlock continues.

News Recap

- The Dow Jones fell 69.55 or .23%, the S&P 500 fell 0.13%, and the Nasdaq rose 0.54%.

- For the week ended Dec. 5th, 853,000 new jobless claims were reported. This is the worst level since September, the first increase in 4 weeks, and well above the market estimates of 725,000.

- A U.S. FDA advisory panel voted 17 to 4 to approve Pfizer’s vaccine for emergency use. The full FDA approval could grant emergency use authorization of Pfizer’s vaccine as early as Friday.

- Stimulus talks continued to slog forward. While lawmakers plan to pass a one-week government funding extension through to Dec. 18, to buy more time to craft a stimulus deal before year’s end, there are still significant hurdles to cross. Democrats and Republicans apparently have found consensus in some areas such as PPP loans, but issues including state and local aid, liability protections, unemployment assistance and stimulus checks are still dividing Congress.

- After DoorDash (DASH) IPO’d on Tuesday, and surged, AirBnB (ABNB) followed suit and closed nearly 113% higher on Thursday.

- This has been the most lethal week yet for COVID-19 in the U.S. Thursday saw a record 229,000+ cases and over 3,100 deaths. The worst may not be over yet either. According to the CDC Director Robert Redfield, US COVID-19 deaths are likely to exceed the 9/11 death toll for the next 60 days.

There is simply too much short-term uncertainty right now to predict what the next 1-3 months will be like. In the short-term, there will be optimistic days where investors rotate into cyclicals and value stocks, and pessimistic days where there will be a broad sell-off or rotation into “stay-at-home” names. Thursday’s session, for example, was a reflection of pessimistic sentiment, and a rotation back into tech. Other days, such as Wednesday (Dec. 9), tech may sharply sell-off and lead the declines.

In the mid-term and long-term, however, there is certainly a light at the end of the tunnel. Once this pandemic is finally brought under control and vaccines are mass deployed, volatility will likely stabilize, while optimism and relief will permeate the markets. The FDA advisory committee’s approval of Pfizer’s vaccine for emergency usage is certainly a step in the right direction. We could be just days away from vaccinations finally happening in America. Stocks especially dependent on a rapid recovery and reopening such as small-caps should thrive.

Markets will continue to wrestle with the negative reality on the ground and optimism for a 2021 economic reopening. This is simply the lay of the land nowadays. More positive vaccine news seemingly trickles in by the day despite increasingly horrifying COVID-19 numbers, economic news, and political news.

Because of how much the markets have heated the last 6-7 weeks, a correction could be a welcome sign. While short-term downside pressure could certainly persist based on days where bad news outweighs good news, due to this “tug of war” between sentiments, any subsequent move downwards would likely be modest in comparison to the gains since the bottom in March and since the U.S. election at the start of November. The vaccine is simply the “injection” that the markets need right now. It is truly hard to say with conviction that another crash or bear market will come. If anything, the mixed sentiment could keep markets trading relatively sideways.

Therefore, to sum it up:

While there is long-term optimism, there is short-term pessimism. A short-term correction is very possible. But it is hard to say with conviction that a big correction will happen.

This morning’s premium analysis will showcase the “Drivers and Divers” of the market. I will break down some market sectors that are in and out of favor. Dear readers, do me a favor and let me know what you think of this segment! Always happy to hear from you.

Driving

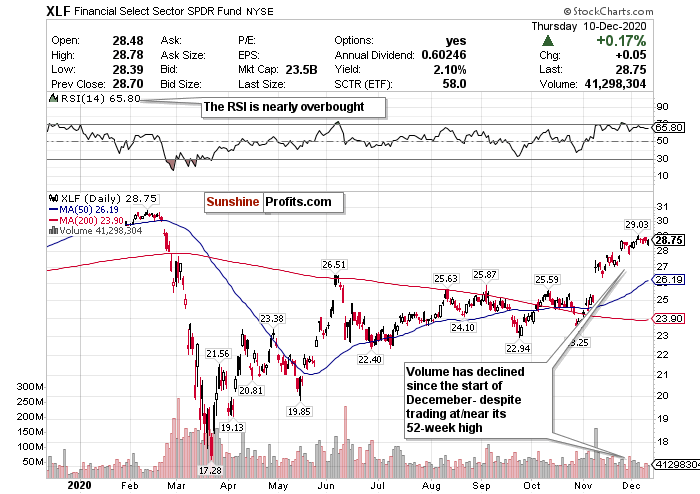

Financials (XLF)

Financial stocks continue to be strong in December, but I have some serious concerns about this sector. Although financials will lead markets on days where hopeful investors believe in businesses fully re-opening in 2021, be cautious. Interest rates, a huge driver of banking revenue, are still at unprecedented lows and will not change until possibly 2022-2023. Until these rates start rising again, profit margins will continue to narrow.

Although higher quality loan applications, and an influx of new investors have helped certain banking stocks, I worry about overheating in this sector. Judging from its RSI, the decline in volume, pricing position relative to its moving averages, and proximity to its 2020 high, the signs are obvious. Without rising interest rates, it’s hard to truly justify these gains - despite the optimistic tailwinds.

The theme of mixed sentiment continues for this sector. However, because so much of the sector’s revenue depends on interest rates, and those will not go anywhere for at least the foreseeable future, I have this at a SELL. Take the profits while you can!

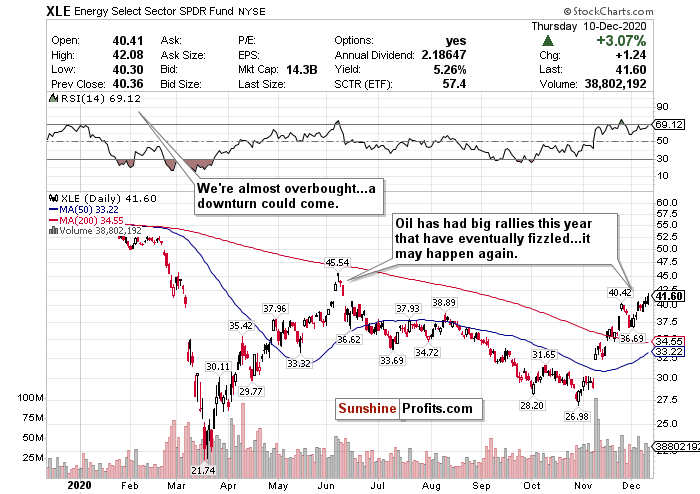

Energy (XLE)

Energy is a sector largely dependent on sentiment, with several question marks. On one hand, Christmas and New Years are coming up, oil exceeded $50 a barrel for the first time in months, and there could be imminent travel demand. On the other hand, unless you have been living under a rock, the pandemic’s numbers are through the roof and could get even worse. On optimistic days, energy will lead the S&P 500. On pessimistic days, it will be the laggard. These aren’t just small moves that we’re talking about either. These are major percentage swings on a day-to-day basis.

It is a very difficult sector to make a bullish call on. There are still simply too many headwinds to be overly euphoric. While energy is still largely undervalued, the RSI is trending towards overbought, the volume is not stable, and most importantly, nobody truly knows what oil’s long-term prospects are with the increased adoption of renewable energy and ESG investing.

This year, we have also seen that when energy rallies, it eventually pulls back. Judging from the chart, that inevitable pullback could possibly come again because of how much the sector has overheated. While there is vaccine optimism now that there wasn’t before, conditions are largely the same on the ground with regard to COVID-19 and travel demand. Therefore, my call is to take profits and SELL.

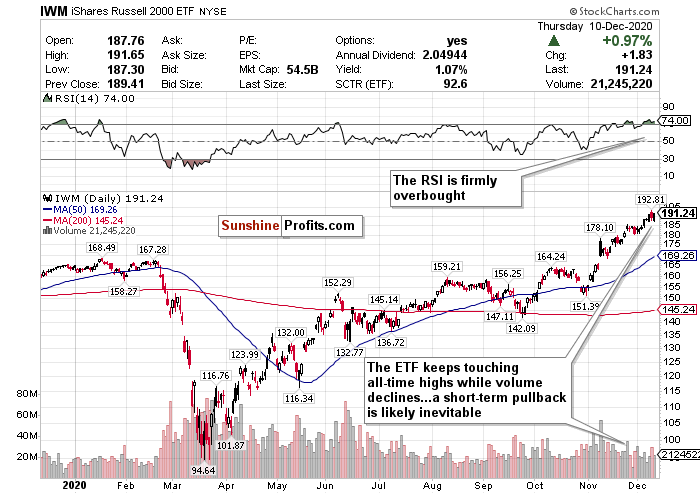

Small-Caps (IWM)

Small-caps keep winning and outperforming the other indices. On Thursday, the trend continued with the Russell 2000 rising in excess of another 1%. This run by small-caps is what makes the overall market rally since November different from the one in April/May. Instead of tech, which led the April/May rally, small-caps and cyclicals have led the way. This is a bullish sign for an economic recovery and shows that investors are optimistic that a vaccine will return life to relatively normalcy in 2021.

However, when looking at the chart for the Russell 2000 ETF (IWM), it becomes pretty evident that small-cap stocks have overheated in the short-term. These are stocks that will “sell the news” more so than other stocks, and experience more short-term volatility. The ETF keeps hitting record highs while the RSI keeps overinflating way past overbought levels and the volume declines. I would HOLD in the small-term, and maybe take some profits if you can - but do not fully exit these positions. BUY for the long-term recovery on a pullback.

Diving

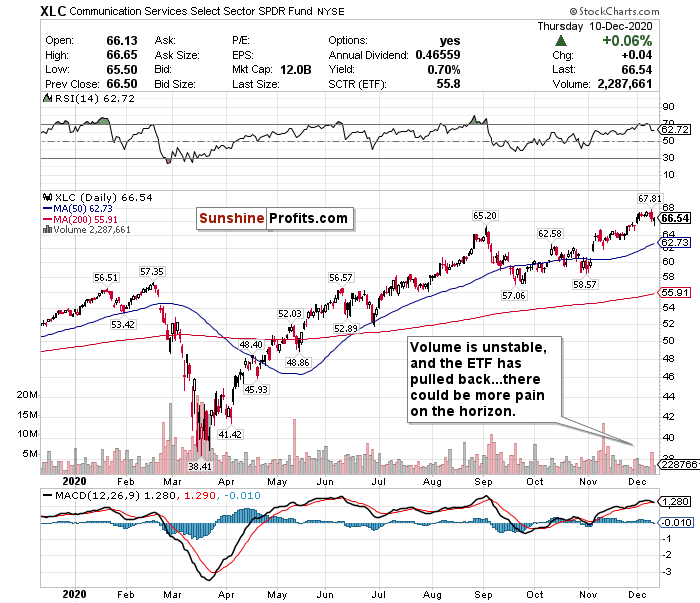

Communication Services (XLC)

Although the Communication Services ETF touched on a 52-week high last week, the gains have not been stable or as robust compared to other sectors. This is generally how communications stocks trade though; over both the short-term and long-term, communications stocks have generally underperformed other sectors. Furthermore, the decline in volume, combined with the minor pullback, screams volatility to me. I just can’t see how you would benefit from buying into this sector. It is hard to foresee how this sector will truly benefit from a vaccine and 2021 reopening relative to other sectors. Therefore, I give it a SELL call.

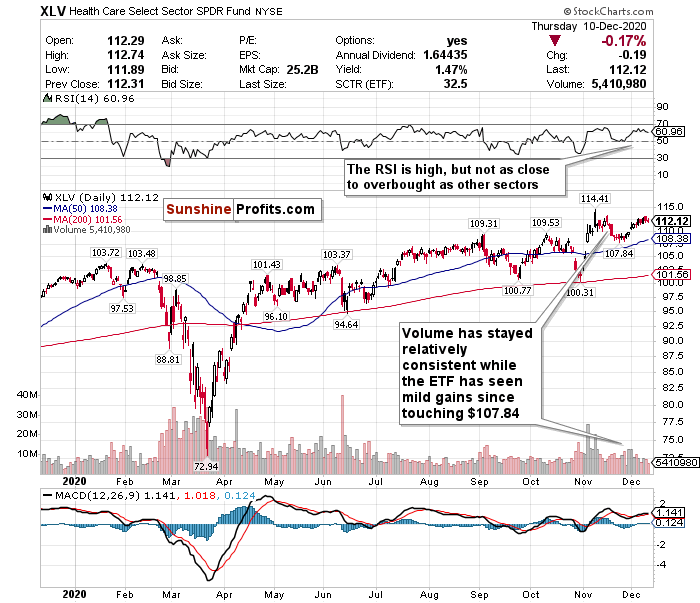

Health Care (XLV)

Healthcare somewhat declined on Thursday. In theory, this is a sector that should benefit from a vaccine. However, it continues to be one of the market’s biggest underperformers.

A vaccine will cause short-term surges in companies that are directly involved in vaccine production and distribution such as Pfizer (PFE). However, it will not be a long-term profit driver for these companies. Simply put, the vaccine will only benefit a few companies while the rest of the sector lags. The pandemic has caused hospitals and providers to lose a lot of money, and there could be more pain on the horizon.

Keep this in mind as well. Hospitals make a lot of their money from elective procedures. With the pandemic, hospitals’ resources are being stretched thin, and they are often prohibiting these types of procedures.

Outside of a few companies, it’s simply hard to see the upside in healthcare now. However, volume, while low, is stable, and the RSI is not as close to overbought as other sectors.

While there will not be as much upside in this sector as others, there will also not be as much volatility. Therefore, I give this a HOLD call (and if you own a vaccine stock, consider trimming some profits).

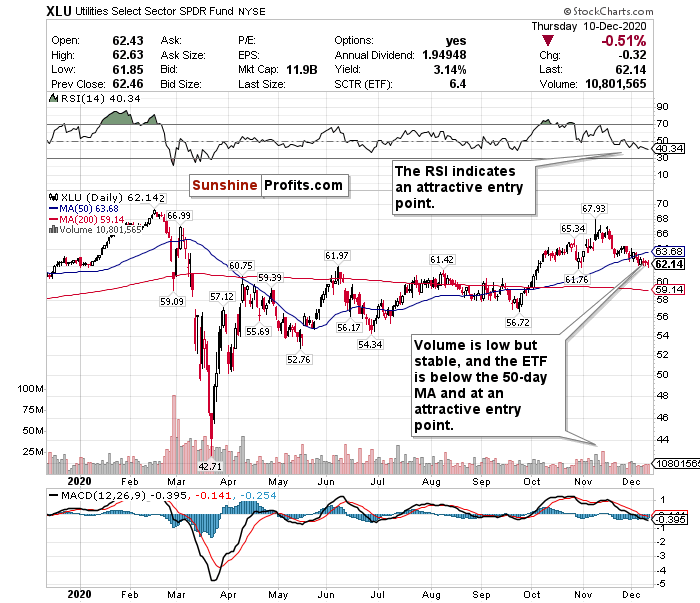

Utilities (XLU)

It is very hard to find value in a market this overinflated and manic. However, Utilities may be the only sector to offer just that. Utilities are considered to be defensive investments. As a result, this is a sector that has underperformed the market. This is frankly a boring sector not focused on growth or gains. On the other hand, for uncertain times, this is a solid sector to find value in because it is cheap, does not swing much upwards or downwards, and is generally a safe place to park your money. In the short-term and long-term, this sector may be a good hedge against volatility and bad news and may also be a good way to gain exposure in renewable energy and 5G.

Utilities do not pose the same type of overheating risks as other sectors, such as small-caps and energy. Most importantly, no matter what the economic condition is and no matter what the news of the day is, you can always count on utilities to stay relatively tame. The RSI is low and almost overbought, the ETF is trading below its 50-day moving average, and volume, while low, has been stable.

Therefore, at this valuation, I give utilities a BUY call - with the understanding that these stocks may not move much to the upside or downside but will provide a consistent yield.

Summary

While the surging spread of COVID-19 and resulting economic shutdowns may drive some short-term concerns, the progress made on the vaccine/treatment front poses significant optimism for 2021 and beyond. The start of global vaccinations, and the FDA advisory committee's approval, should be cheered by everyone. We may be just days away from beginning to get vaccinated in the U.S. Although sentiment seemingly changes day by day, the long-term outlook for equities, namely value stocks and cyclicals, could be very positive.

We are thankfully in the home stretch of 2020. This has been a year filled with turmoil and pain, but one that will hopefully end with happiness and optimism (and maybe a stimulus package?). But COVID-19 will not disappear before 2021 starts and may be here with us a little bit longer. We are currently at a point in the pandemic where every day is bringing us a daily death level not seen since 9-11 or Pearl Harbor. That is simply horrifying. Until COVID-19 is brought under control or is eradicated, there will be a continuous tug of war between vaccine optimism and health/economic pessimism.

Please keep in mind that markets are forward looking instruments and are investment vehicles that look 6-12 months down the road, however, it is very plausible that there could be some short-term uncertainty and volatility mixed in. But please remember how sharp and swift the rally was after the crashes in March. For the long-term, markets always end up climbing and are focused on the future rather than the present.

If everything goes well with the vaccines, and the virus can be somewhat contained, the short-term volatility may be worth monitoring for opportunities before the eventual mid-term and long-term reality turns positive and stable in 2021.

To sum up all our calls, I have a BUY call for:

- Small-Caps (VSMAX) - but ONLY on a pullback for the long-term

- Utilities (XLU)

HOLD calls for:

- S&P 500 (SPY)

- Materials (XLB)

- Small-Caps (VSMAX) - in the short-term

- Health Care (XLV)

And I have SELL calls for:

- Financials (XLF)

- Energy (XLE)

- US Dollar ($USD)

- Communication Services (XLC)

Thank you.

Matthew Levy, CFA

Stock Trading Strategist