Briefly:

Intraday trade: The S&P 500 index gained 0.5% on Monday, after opening 0.2% higher. The stock market will likely open slightly higher today, but we may see short-term profit taking action at some point. We prefer to be out of the market, avoiding low risk/reward ratio trades.

Medium-term trade: In our opinion, no medium-term positions are justified.

Our intraday outlook is neutral. Our short-term outlook is neutral, and our medium-term outlook is neutral:

Intraday outlook (next 24 hours): neutral

Short-term outlook (next 1-2 weeks): neutral

Medium-term outlook (next 1-3 months): neutral

The U.S. stock market indexes gained 0.5-0.7% on Monday, as they slightly extended their Friday's move up. The S&P 500 index got closer to 2,750 mark, following breakout above its recent consolidation. It currently trades 4.3% below January's 26th record high of 2,872.87. Both Dow Jones Industrial Average and the technology Nasdaq Composite gained 0.7% yesterday.

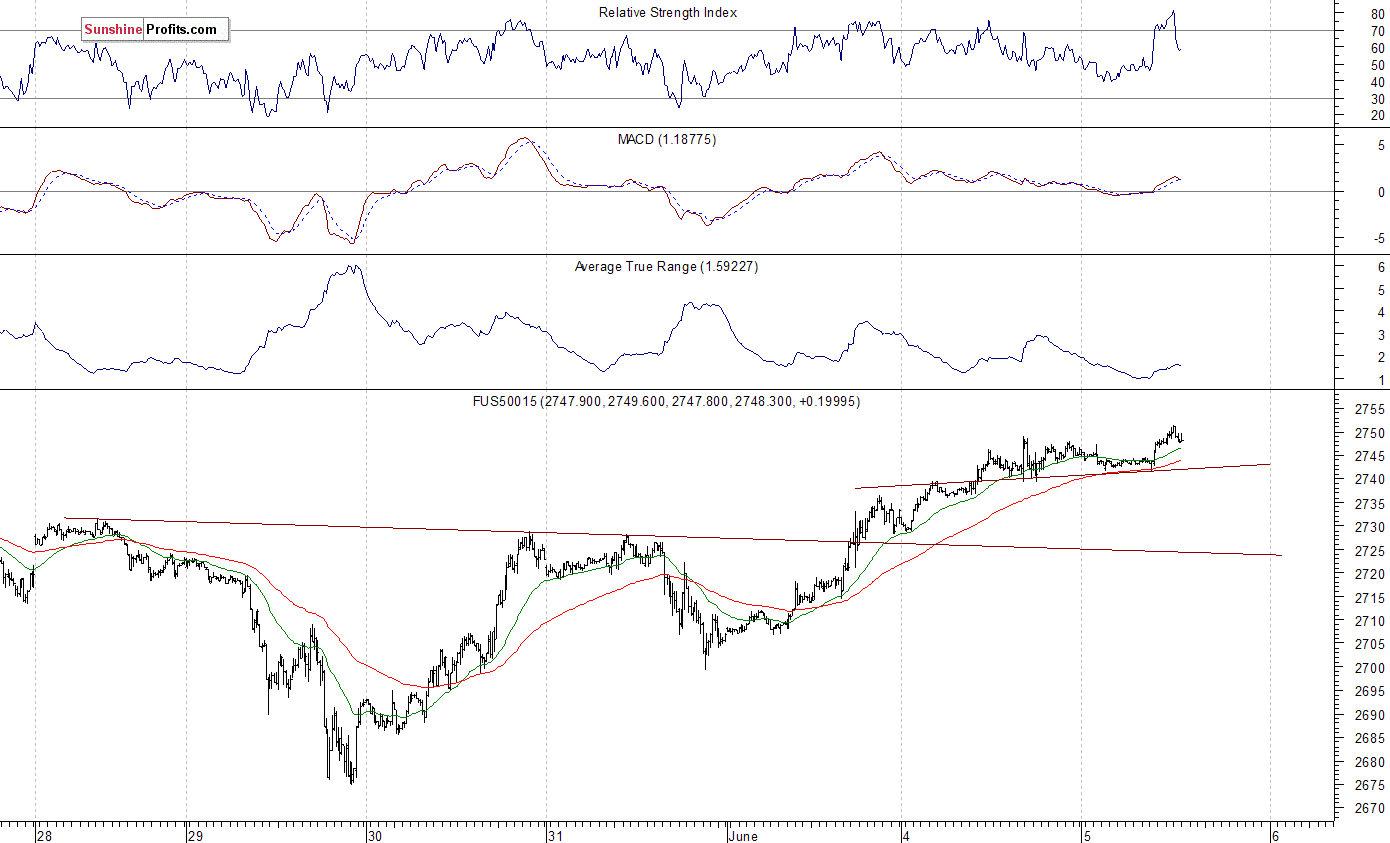

The nearest important level of resistance of the S&P 500 index is at around 2,750, marked by previous local highs along with mid-March local high. There was also the daily gap-down of 2,741.38-2,749.97 on March the 19th. Potential level of resistance is also at 2,780-2,800. On the other hand, support level is now at 2,735-2,740, marked by yesterday's daily gap-up of 2,736.93-2,740.54. The next level of support remains at 2,700-2,720, marked by recent price action.

The broad stock market extended its short-term uptrend in the beginning of May, as the S&P 500 index broke above the level of 2,700. Then the market traded within a consolidation. Stocks broke lower a week ago, as the index fell below 2,700 mark, but they quickly retraced their decline. Friday's rally brought us back to recent local highs. There are still two possible medium-term scenarios - bearish that will lead us below February low following trend line breakdown, and the bullish one in a form of medium-term double top pattern or breakout towards 3,000 mark. There is also a chance that the market will just go sideways for some time, and that would be positive for bulls in the long run (some kind of an extended flat correction):

Uptrend to Continue?

Expectations before the opening of today's trading session are slightly positive, because the index futures contracts trade 0.2-0.3% higher vs. their Monday's closing prices. The European stock market indexes have been mixed so far. Investors will wait for some economic data announcements today: ISM Non-Manufacturing PMI, JOLTS Jobs Openings number at 10:00 a.m. The broad stock market will likely extend its recent move up slightly today. The S&P 500 index is above its recent trading range, but it remains close to the resistance level of 2,750. There may be some more short-term uncertainty ahead.

The S&P 500 futures contract trades within an intraday uptrend, as it continues its yesterday's move up. The nearest important level of support is at around 2,740, marked by local lows. The support level is also at 2,725-2,730. On the other hand, resistance level is at 2,750, among others. The futures contract is close to short-term local highs, as the 15-minutes chart shows:

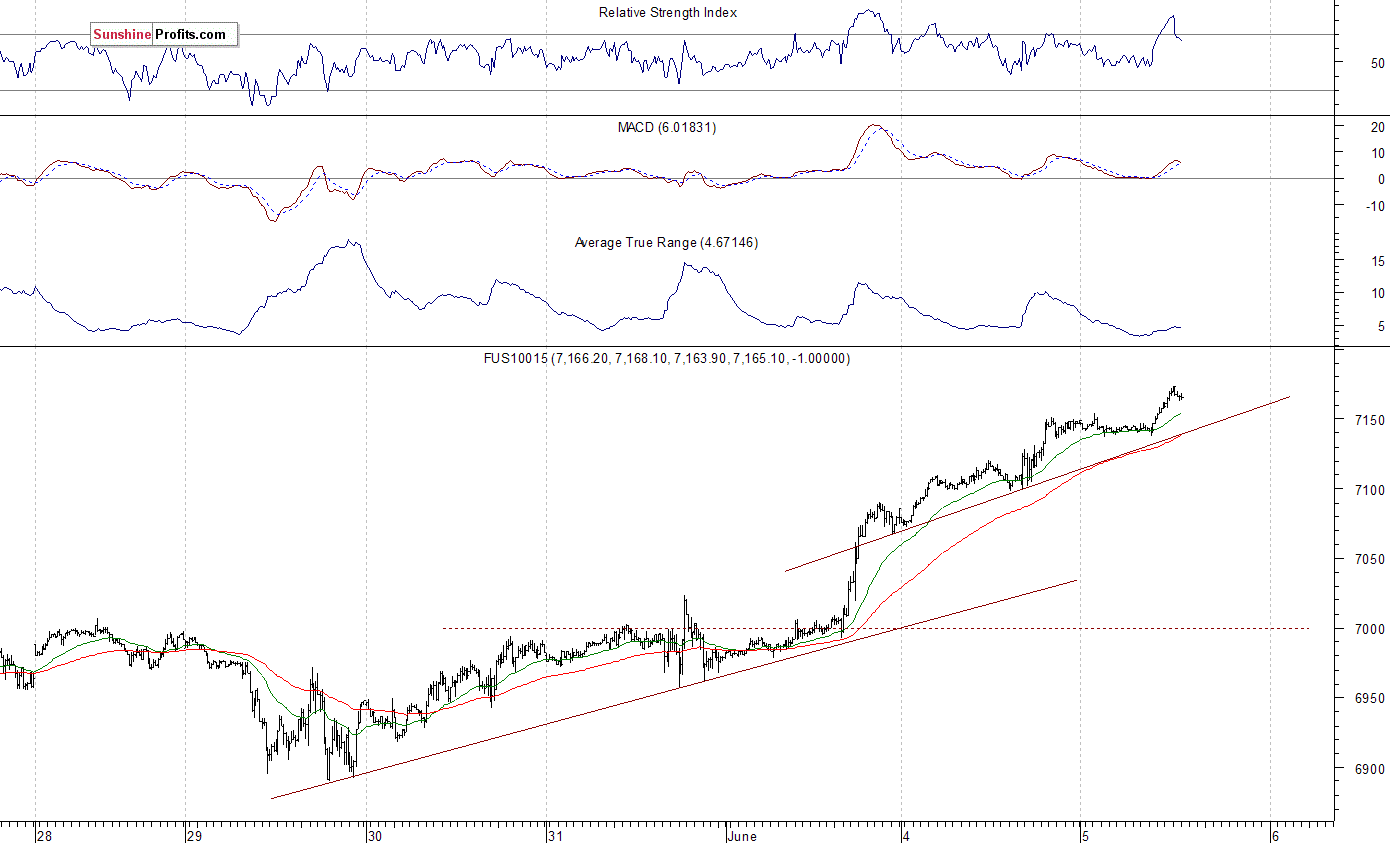

Nasdaq Much Closer to Record High

The technology Nasdaq 100 futures contract follows a similar path, as it continues its short-term uptrend. Tech stocks are relatively stronger than the broad stock market, as the index trades much closer to record high. It's gained almost 300 points from last Wednesday's local low. Potential level of resistance is at around 7,200, marked by mid-March all-time high. On the other hand, support level is now at 7,100-7,150, among others. The Nasdaq futures contract trades above its two-day-long upward trend line, as we can see on the 15-minute chart:

Apple, Amazon at New Record Highs

Let's take a look at Apple, Inc. stock (AAPL) daily chart (chart courtesy of http://stockcharts.com). It reached new record yesterday, as it continued its short-term uptrend following breakout above $190. There is still a potential resistance level of around $200. Investors' sentiment is bullish, but will uptrend continue? There have been no confirmed short-term negative signals so far:

Now let's take a look at Amazon.com, Inc. stock (AMZN) daily chart. It has also reached new record high yesterday. We were recently saying that its price action looked pretty bullish. And the stock did break higher! We can see some negative technical divergences, but there have been no confirmed negative signals so far:

Dow Jones Also Higher

The Dow Jones Industrial Average broke above its medium-term downward trend line in the first half of May. Then it continued higher above a few-week-long downward trend line. However, it kept bouncing off resistance level of 25,000. Two weeks ago we saw negative bearish engulfing candlestick pattern. The market broke below its recent consolidation a week ago, as it confirmed its short-term downward reversal. Potential level of support remains at around 24,000, and on the other hand, resistance level is at 24,800-25,000. The market is taking an attempt at breaking higher:

The broad stock market got closer to its recent local highs on Friday, as tech stocks sector rallied higher. The S&P 500 index has broken higher yesterday, but it's reached the resistance level of 2,750 so far. So, will uptrend continue? Expectations before the opening of today's trading session are slightly positive, but we may see profit taking action at some point. If the S&P 500 index breaks above its resistance level of around 2,750, we could see more buying pressure. However, just like we wrote in our several Stocks Trading Alerts, the early February sell-off sets a negative tone for weeks or months to come.

Concluding, the S&P 500 index will likely open slightly higher today and it may extend its recent advance. There have been no confirmed negative signals so far. But we may see short-term profit taking action at some point. Tech stocks will likely pause their rally after gaining almost 300 points since Wednesday (Nasdaq 100 index).

Currently, we prefer to be out of the market, avoiding low risk/reward ratio medium-term trades. We will let you know when we think it is safe to get back in the market.

To summarize: no medium-term positions are justified from the risk/reward perspective at this moment.

Intraday trade:

No intraday position is justified from the risk/reward perspective today.

No medium-term position is justified from the risk/reward perspective at this moment.

Thank you.

Paul Rejczak

Stock Trading Strategist

Stock Trading Alerts