Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): No positions are currently justified from the risk/reward point of view.

Dear Subscribers,

Due to a shift in some of our authors’ schedules, there are some present and coming changes.

Pawel Rejczak will currently update you on the world of stocks. Paul used to write the daily Stock Pick Updates and is currently at the helm of the Daily Gold News, which will soon feature a regular video release. He also writes the daily Oil Trading Alerts, whose reins will be taken over by a new author soon. You can find out more about Paul here, including links to his latest publications.

As always, we’ll keep you informed regarding upcoming changes. Keep the questions coming! Write to us about what you would like to have featured. Is there a particular stock or ETF that you would like our team to pick apart? Do you have a different opinion on an analysis we published? Either way, let us know!

Thank you.

Best regards,

Dominik Starosz

Managing Editor

Are you holding your breath as you watch the current state of the stock market? How high can it go?

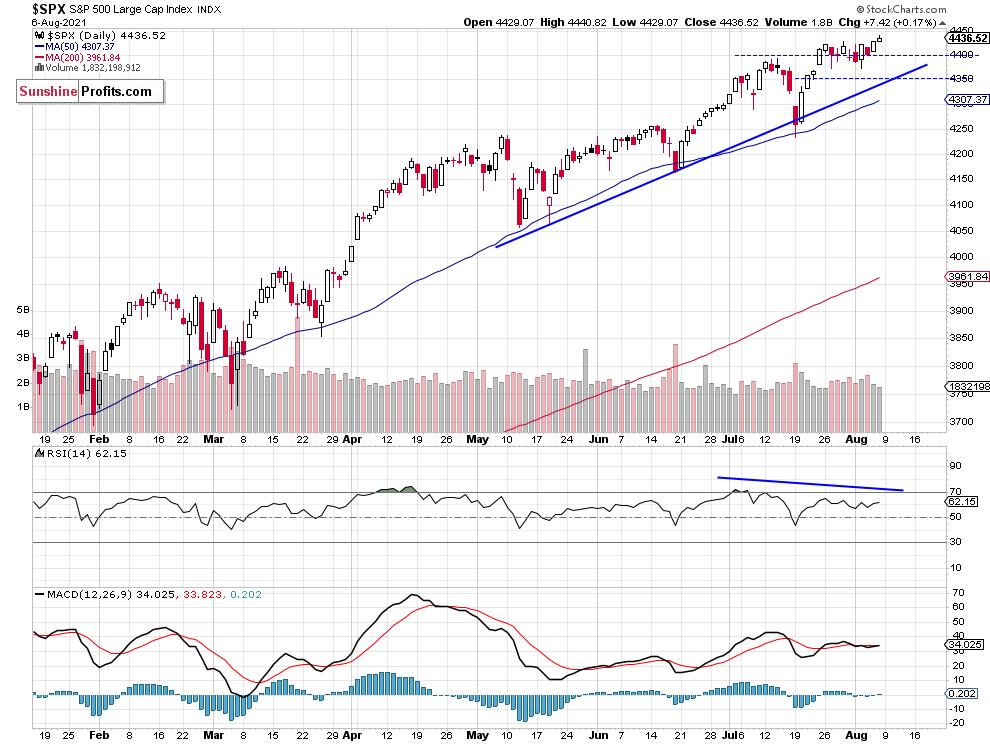

On Friday, the S&P 500 index reached yet another new record high at the level of 4,440.82. The market advanced by 0.2%, following a better-than-expected Nonfarm Payrolls release of +943,000. So, the market’s reaction was pretty mild given the recent bullish sentiment.

Does this mean that we are getting close to a downward reversal? The index remains above its upward trend lines and moving averages, but we can see some negative technical divergences that may signal a coming weakness. However, there have been no confirmed negative signals to date.

S&P 500 Soars the Sky

The broad stock market has broken above its two-week-long consolidation on Friday following the mentioned jobs data release. The nearest important support level is now at 4,430, and the next support level is at 4,400. The S&P 500 index continues to trade above its three-month-long upward trend line, as we can see on the daily chart (chart by courtesy of http://stockcharts.com):

Conclusion

The S&P 500 index has slightly extended its over-eleven-year-long bull market on Friday, as it reached a new record high of 4,440.82. Are we getting close to some medium-term high? The market seems overbought, but we haven’t seen any confirmed negative signals so far.

As always, we’ll keep you, our subscribers, well-informed.

Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): No positions are currently justified from the risk/reward point of view.

Thank you.

Paul Rejczak

Stock Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care