Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): No positions are currently justified from the risk/reward point of view.

The S&P 500 reached yet another new record high on Tuesday (4,445.21), but it gained just 0.1%. Is the market poised for a short-term correction?

The Consumer Price Index release this morning was as expected at +0.5% m/m, and stocks are about to open slightly higher following the data. The S&P 500 index may break above yesterday’s daily high. However, we will likely see some profit-taking action later in the day.

The index remains above its upward trend lines and moving averages, but we can see some negative technical divergences that may signal a coming weakness. However, there have been no confirmed negative signals to date.

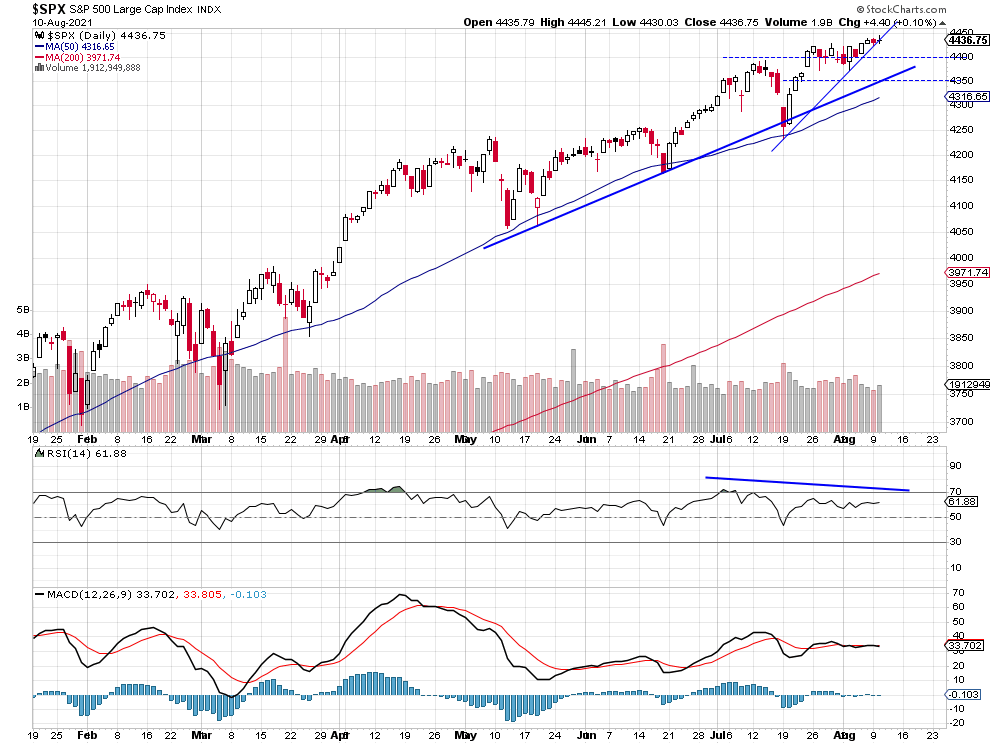

The broad stock market broke slightly above its two-week-long consolidation on Friday. The nearest important support level remains at 4,430, and the next support level is at 4,400. The S&P 500 index continues to trade above its three-month-long upward trend line, as we can see on the daily chart (chart by courtesy of http://stockcharts.com):

S&P 500 Remains at Year-Long Upward Trend Line

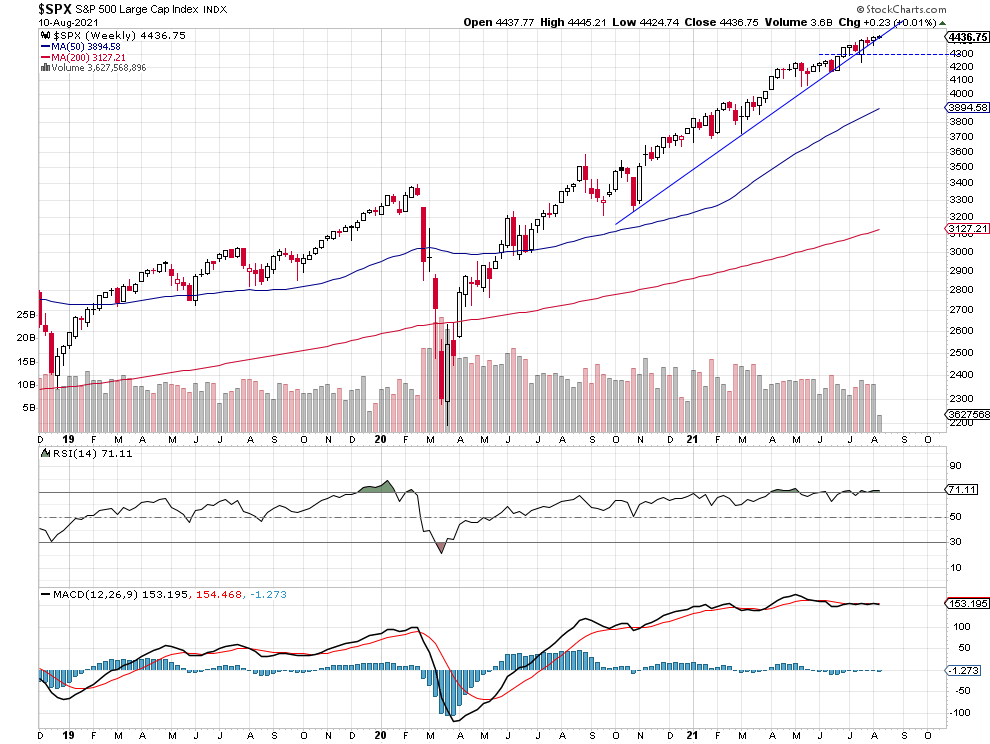

The S&P 500 index continues to trade along its medium-term upward trend line. The market will most likely break below that trend line and trade sideways for some time. For now, however, it just keeps moving along the line, as we can see on the weekly chart:

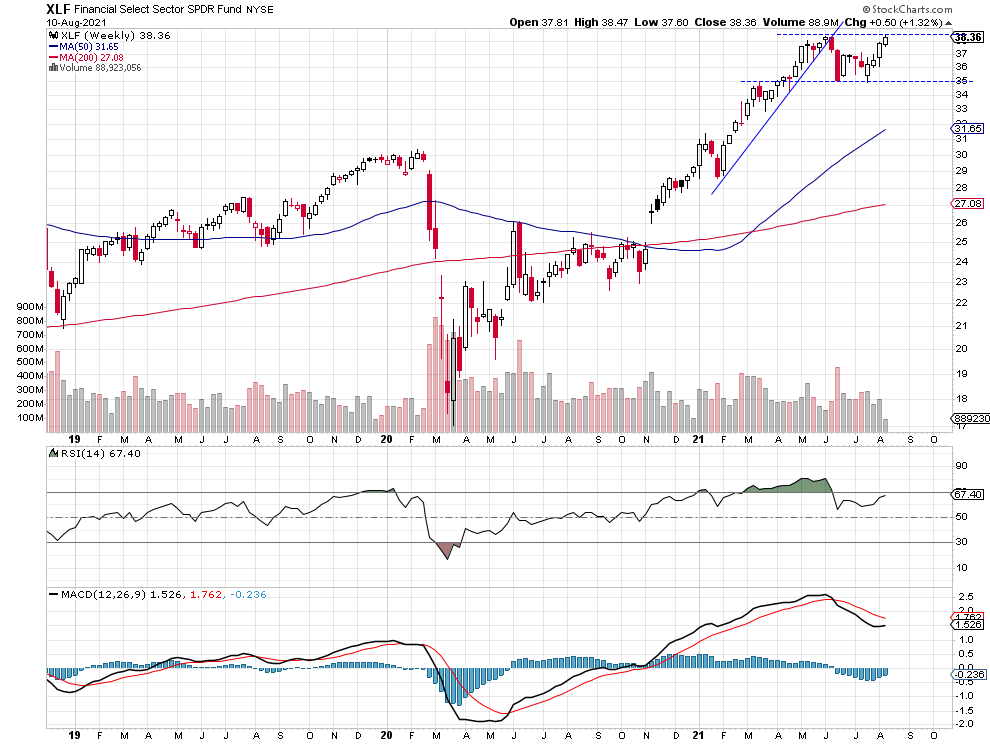

Now, let’s take a look at the XLF Financial Select Sector SPDR Fund chart. The XLF fund seeks to provide exposure to companies in banks, diversified financial services, insurance, capital markets, mortgage real estate investment trusts (“REITs”), consumer finance and thrifts and mortgage finance industries.

The XLF remains within a short-term uptrend and is close to breaking above the resistance level at 38.50. The support level is at 35.00. If the financials accelerate their uptrend, they may drive the whole market higher.

Conclusion

The S&P 500 index has been slightly extending its over-eleven-year-long bull market in recent days. Yesterday it reached a new record high of 4,445.21 and today it may get close to the 4,450 level. The market seems overbought, but we haven’t seen any confirmed negative signals so far.

As always, we’ll keep you, our subscribers, well-informed.

Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): No positions are currently justified from the risk/reward point of view.

Thank you.

Paul Rejczak,

Stock Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care