Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): short positions with entry at 4,678 price level, with 4,720 as a stop-loss and 4,350 as a price target.

The S&P 500 index went below the 4,700 level again. Was it a downward reversal or just a quick correction before another leg up?

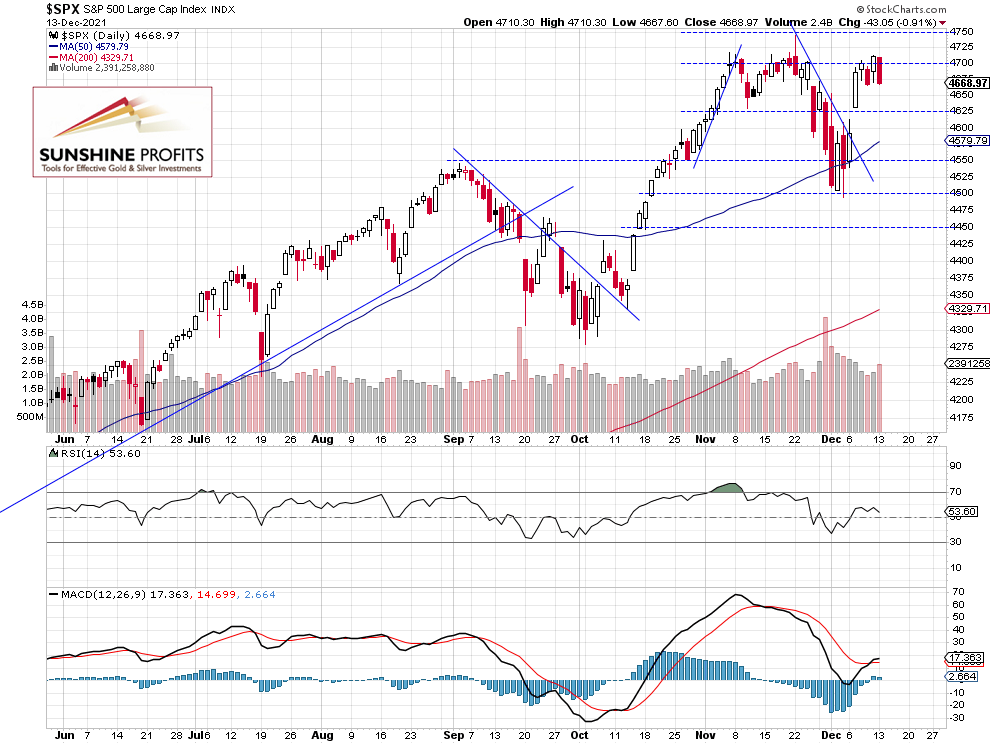

The broad stock market index lost 0.91% on Monday, as investors took short-term profits off the table following the recent advances. Recently the market retraced most of its late November declines and on Friday it closed the highest in history. On the previous Friday the index fell to the local low of 4,495.12 and it was 5.24% below the Nov. 22 record high of 4,743.83. So, bulls were back in full force and we saw another attempt at getting back to the all-time high. But today the market is expected to open 0.7% lower. It is poised to break below the short-term consolidation and to retrace some more of the recent rally. For now, it looks like a downward correction.

The nearest important resistance level is at 4,700 and the next resistance level is at 4,740-4,750, marked by the record high. On the other hand, the support level is at around 4,665-4,670, marked by the recent local lows. The next support level is at 4,610-4,630, marked by the previous Tuesday’s daily gap up of 4,612.60-4,631.97. The S&P 500 is still at its previous consolidation, as we can see on the daily chart (chart by courtesy of http://stockcharts.com):

Our Short Position Is Profitable Again

Let’s take a look at the hourly chart of the S&P 500 futures contract. It broke above the downward trend line last week and it rallied up to its previous local highs. Yesterday the market was very close to our stop-loss level of 4,720 and it traded slightly above it in the early morning. But it got back well below that level, so we are still maintaining our short position (opened on Nov. 23 at the 4,678 price level). (chart by courtesy of http://tradingview.com):

Conclusion

The S&P 500 index will likely extend its yesterday’s decline this morning following higher than expected Producer Price Index release, among other factors. For now, it looks like a downward correction. But we may see more profit-taking action in the near term.

Here’s the breakdown:

- The S&P 500 is expected to open lower this morning and it will break below the recent trading range.

- We are maintaining our short position from the 4,678 level.

As always, we’ll keep you, our subscribers, well-informed.

Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): short positions with entry at 4,678 price level, with 4,720 as a stop-loss and 4,350 as a price target.

Thank you.

Paul Rejczak,

Stock Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care