Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): long positions with entry at 4,340 price level, with 4,120 as a stop-loss and 4,640 as an initial price target.

Stocks sold off last week following Russia-Ukraine crisis news. Will the market reverse its downward course or break below the late Jan. low?

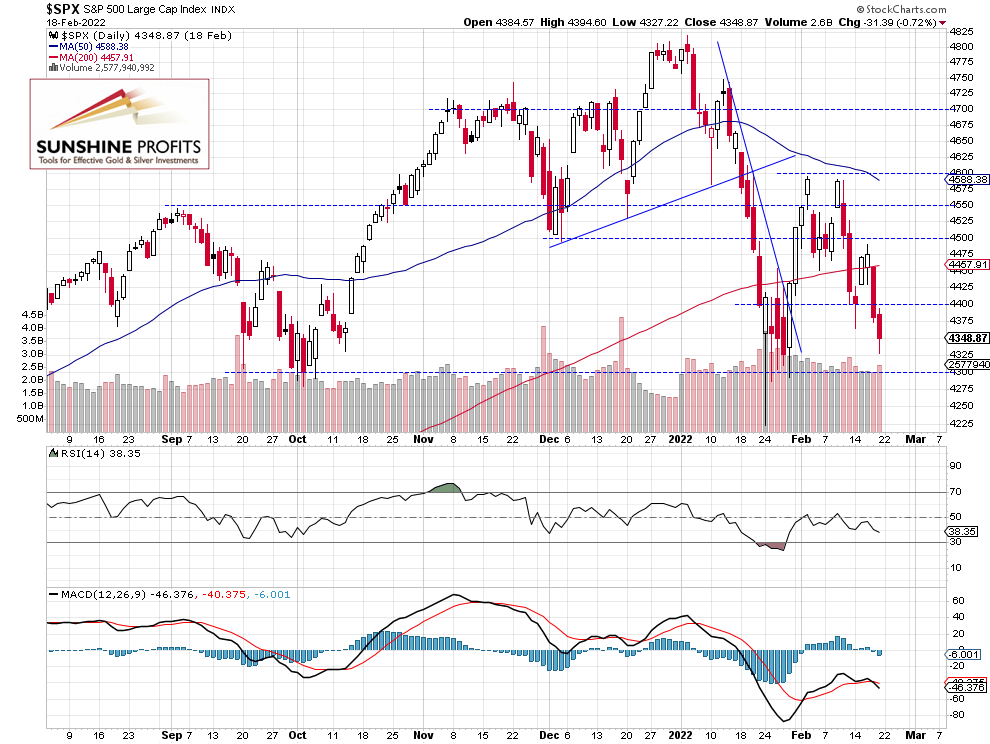

The S&P 500 index lost 0.72% on Friday, Feb. 18 following its Thursday’s decline of 2.1%, as it reacted to the worrying news concerning Russia-Ukraine tensions and rising inflation fears. Last week the broad stock market bounced from the resistance level of 4,500 and it came back below the 4,400 level. Yesterday the futures contract extended its decline, but this morning it’s trading higher after getting to the Friday’s closing price again.

Today the S&P 500 index is expected to open virtually flat despite yesterday’s futures contract’s news-driven sell-off. We may see a rebound or some short-term consolidation here. Investors seem to be shrugging off some of the latest political news.

The nearest important resistance level is at 4,400-4,425, marked by the recent support level. On the other hand, the support level is at 4,300, among others. The S&P 500 index is now within its late January consolidation, as we can see on the daily chart (chart by courtesy of http://stockcharts.com):

Futures Contract at Previous Lows

Let’s take a look at the hourly chart of the S&P 500 futures contract. It extended the downtrend yesterday, but it managed to stay slightly above its late January local lows. We may see an upward reversal.

Therefore, we decided to open a speculative long position this morning, before the opening of the cash market (4,340 price level). Stop loss and profit target levels are wider than usual because of an increased volatility. We are expecting an upward correction from the current levels (chart by courtesy of http://tradingview.com):

Conclusion

The S&P 500 index sold off last week on Russia-Ukraine crisis, but this morning it will likely bounce or fluctuate along the Friday’s closing price which is a bullish scenario. It may be a bottoming pattern before some more meaningful upward correction. Investors seem to be shrugging off some of the latest political news.

Here’s the breakdown:

- The S&P 500 index will likely bounce or fluctuate following its late last week’s sell-off

- Opening a speculative long position (4,340 price level) is justified from the risk/reward perspective.

- We are expecting an upward correction from the current levels.

As always, we’ll keep you, our subscribers, well-informed.

Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): long positions with entry at 4,340 price level, with 4,120 as a stop-loss and 4,640 as an initial price target.

Thank you.

Paul Rejczak,

Stock Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care