Briefly: In our opinion, speculative short positions are favored (entry point at 2,000.5 with stop-loss at 2,030 and a profit target at 1,900, S&P 500 index)

Our intraday outlook is bearish, and our short-term outlook is bearish:

Intraday

(next 24 hours) outlook: bearish

Short-term (next 1-2 weeks) outlook: bearish

Medium-term (next 1-3 months) outlook: neutral

Long-term outlook (next year): bullish

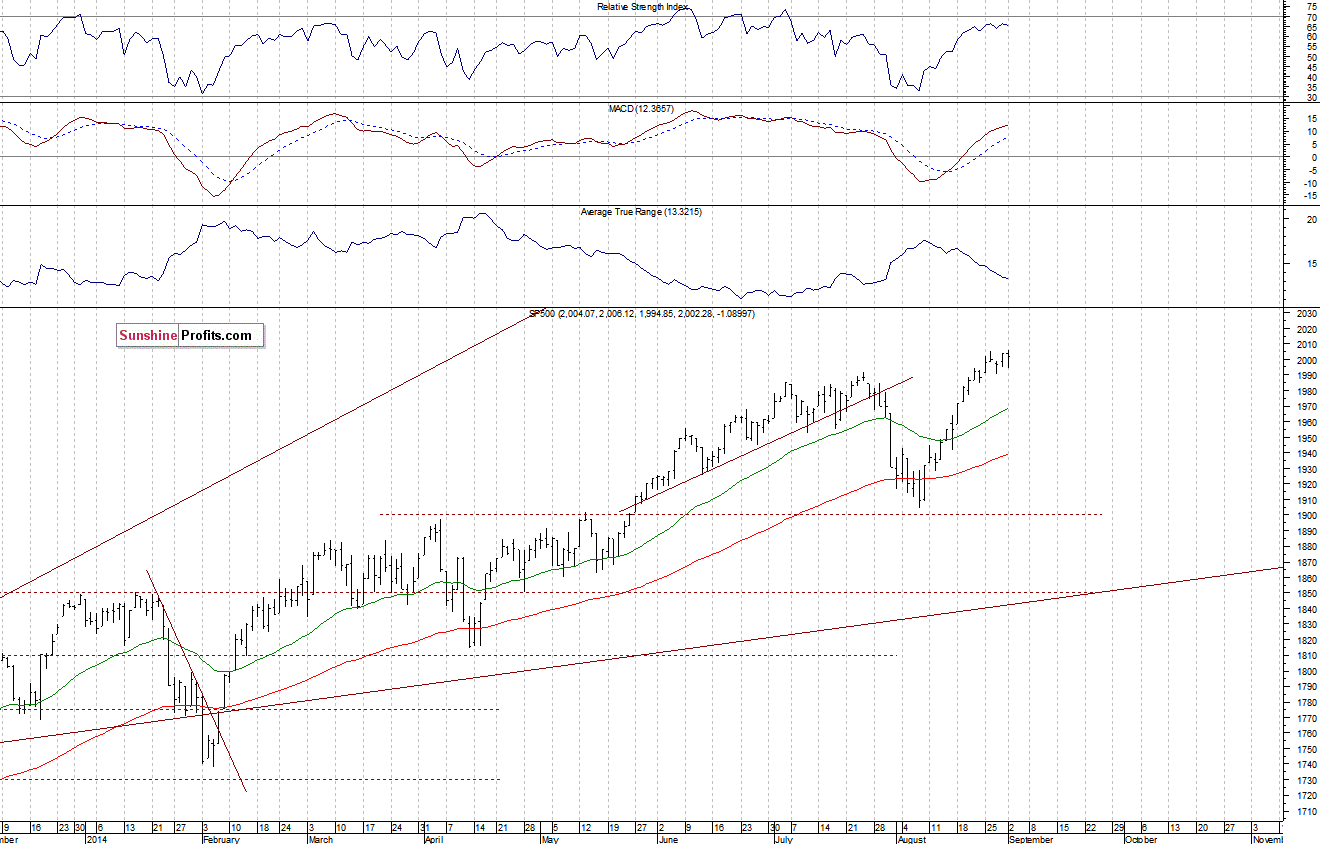

The U.S. stock market indexes were mixed between -0.2% and +0.3% on Tuesday, extending their short-term consolidation, as investors continued to hesitate following recent rally. However, the S&P 500 index has reached a new all-time high of 2,006.12. The nearest important level of resistance remains at 2,000-2,005. On the other hand, the support level is at 1,985-1,990, among others. There have been no confirmed negative signals so far, however we still can see negative technical divergences, accompanied by some overbought conditions which may lead to a downward correction:

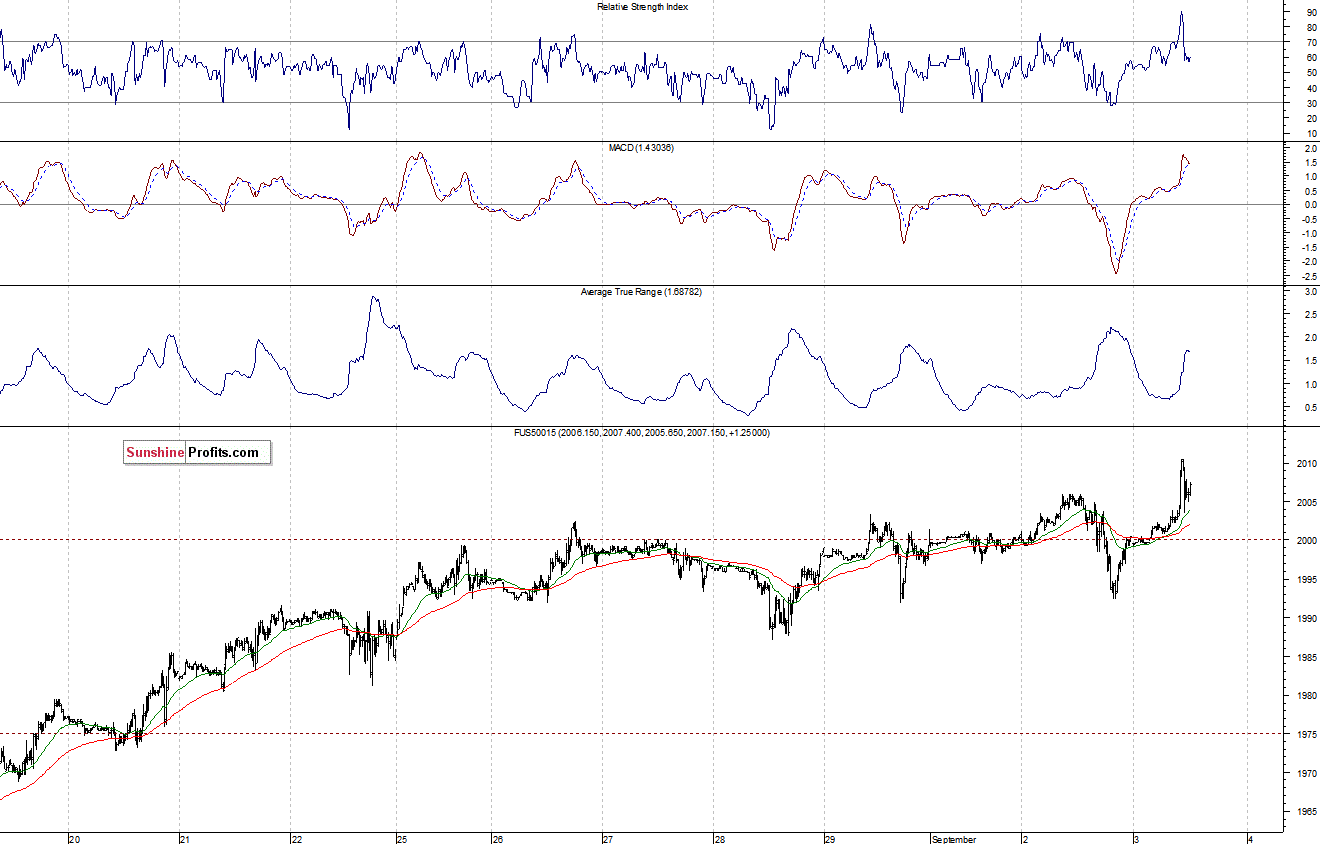

Expectations before the opening of today’s session are positive, with index futures currently up 0.3% on positive geopolitical news concerning Russia-Ukraine conflict. The European stock market indexes have gained 0.7-1.1% so far. Investors will now wait for some economic data announcements: Factory Orders at 10:00 a.m., Fed’s Beige Book at 2:00 p.m. The Beige Book is a report on the U.S. current economic conditions that is published eight times a year by the Federal Reserve. It is watched closely by investors and traders. The S&P 500 futures contract (CFD) is in an intraday uptrend, as it trades above the level of 2,000, close to new all-time high. The nearest level of support is at around 1,990-2,000, marked by recent local lows. On the other hand, the resistance level is at 2,010, as the 15-minute chart shows:

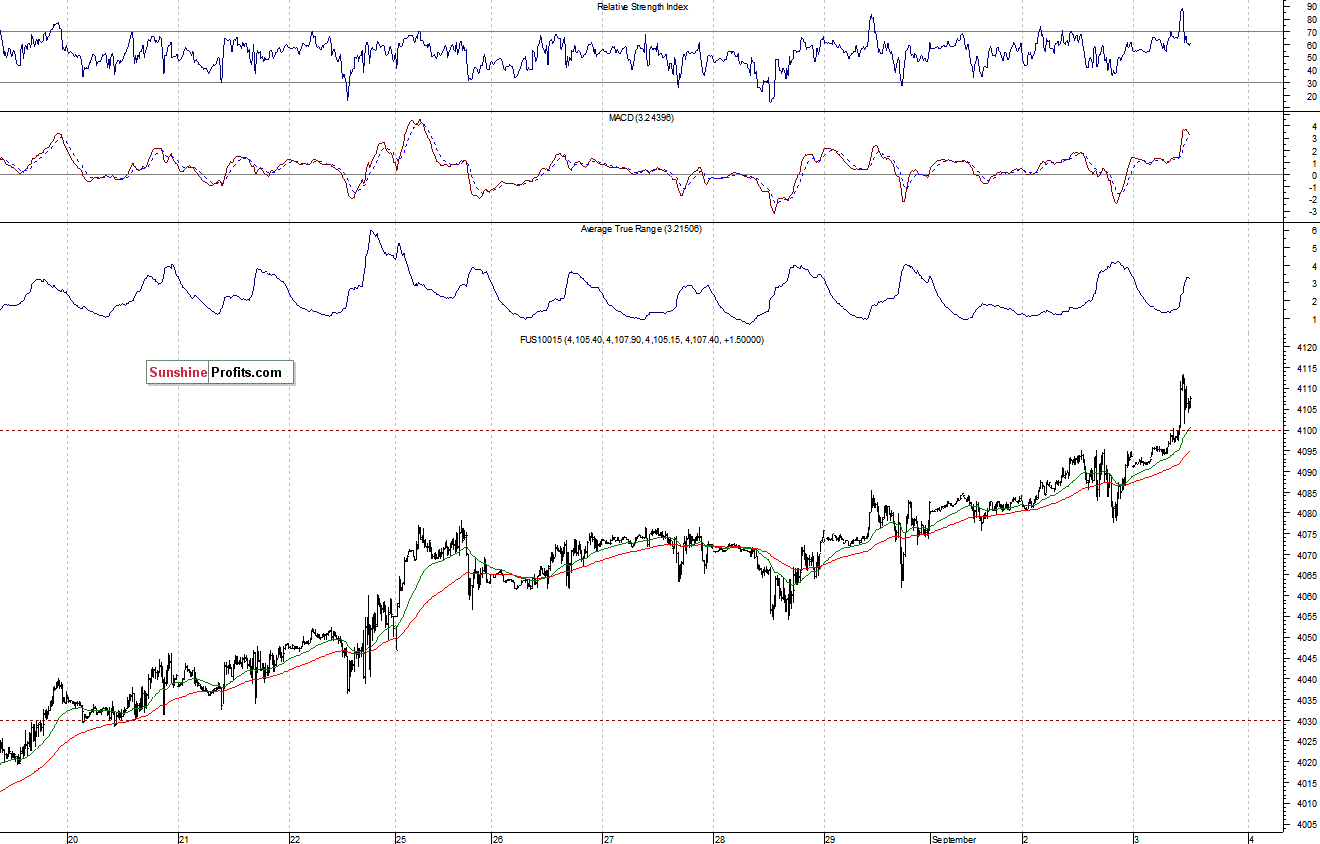

The technology Nasdaq 100 futures contract (CFD) is follows a similar path as it trades close to new long-term high. The nearest important level of support is at 4,080-4,100, marked by previous resistance level. There have been no confirmed negative signals so far, as we can see on the 15-minute chart:

Concluding, the broad stock market trades close to all-time high as the S&P 500 index is slightly above the level of 2,000. There have been no confirmed negative signals. However, we remain bearish, expecting a downward correction or uptrend reversal. We continue to maintain our speculative short position with entry point at 2,000.5 (S&P 500 index). The stop-loss is at the level of 2,030 and potential profit target is at 1,900 (S&P 500 index).

Thank you.

Paul Rejczak

Stock Trading Strategist

Stock Trading Alerts