Briefly: In our opinion, speculative short positions are favored (with stop-loss at 1,975 and profit target at 1,875, S&P 500 index).

Our intraday outlook is now bearish, and our short-term outlook is bearish:

Intraday

(next 24 hours) outlook: bearish

Short-term (next 1-2 weeks) outlook: bearish

Medium-term (next 1-3 months) outlook: neutral

Long-term outlook (next year): bullish

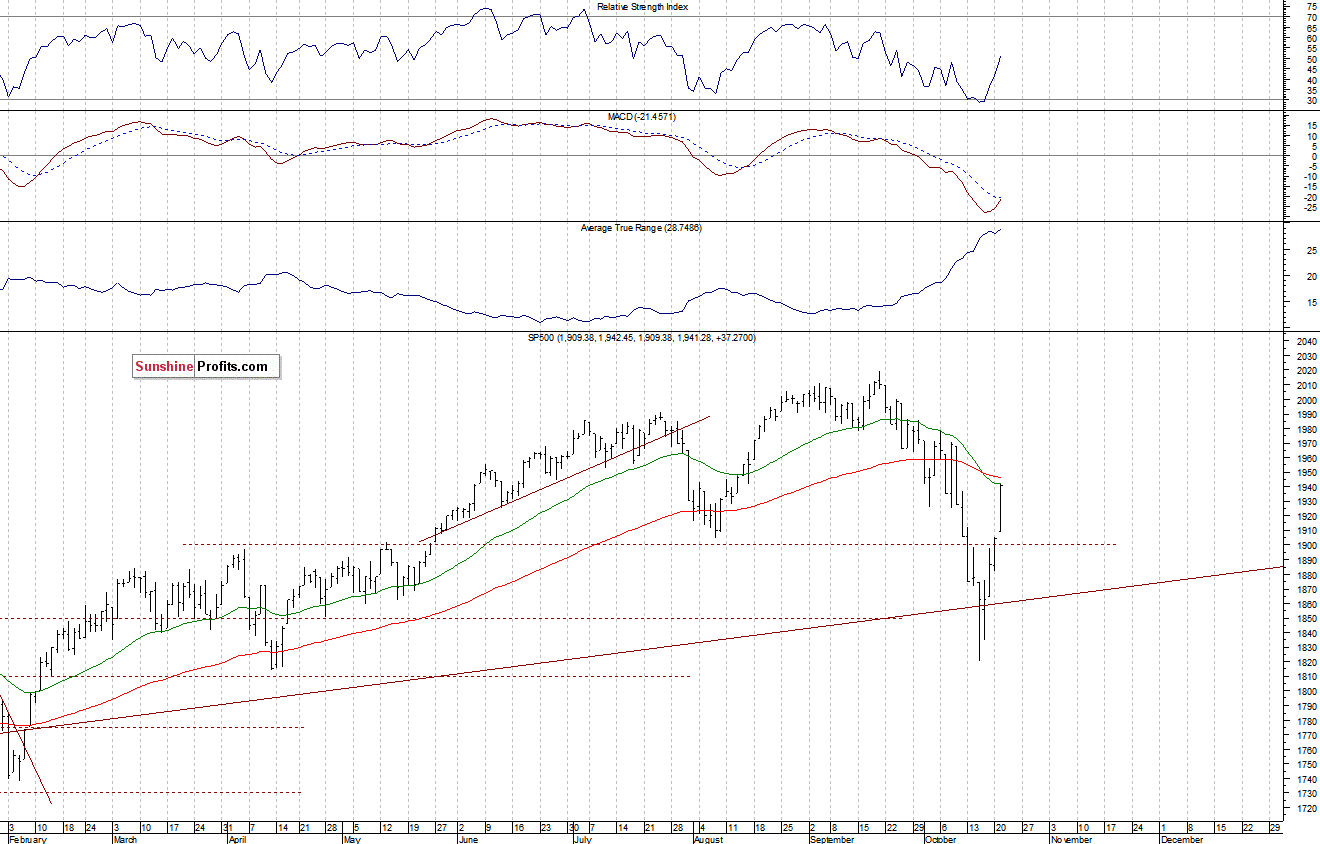

The main U.S. stock market indexes gained between 1.3% and 2.6% on Tuesday, extending their recent move up, as investors reacted very positively to some quarterly corporate earnings releases. The S&P 500 index retraced most of its October move down, breaking above short-term resistance level of 1,925, marked by some previous local lows. The nearest important resistance level is at around 1,970-1,980, marked by the early October local highs. On the other hand, the support level is at 1,905-1,910, marked by yesterday’s daily gap down, among others. It still looks like a sharp correction within a downtrend, as we can see on the daily chart:

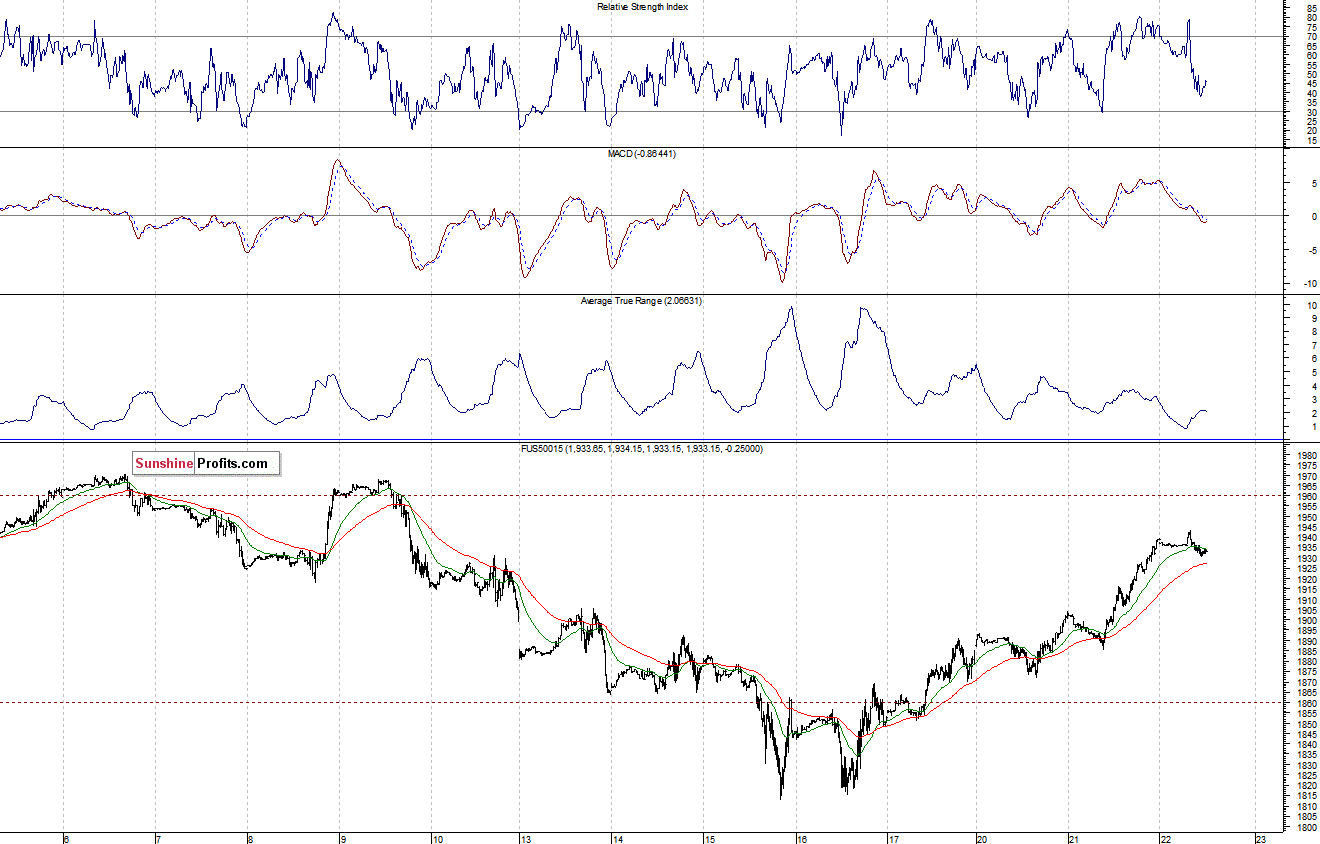

Expectations before the opening of today’s trading session are slightly negative, with index futures currently down 0.1-0.2%. The European stock market indexes have been mixed so far. Investors will now wait for some further quarterly corporate earnings releases and the Consumer Price Index number announcement at 8:30 a.m. The S&P 500 futures contract (CFD) is in an intraday consolidation, following sharp move up. The nearest important resistance level seems to be at around 1,940-1,945. On the other hand, the level of support is at 1,900-1,920, among others:

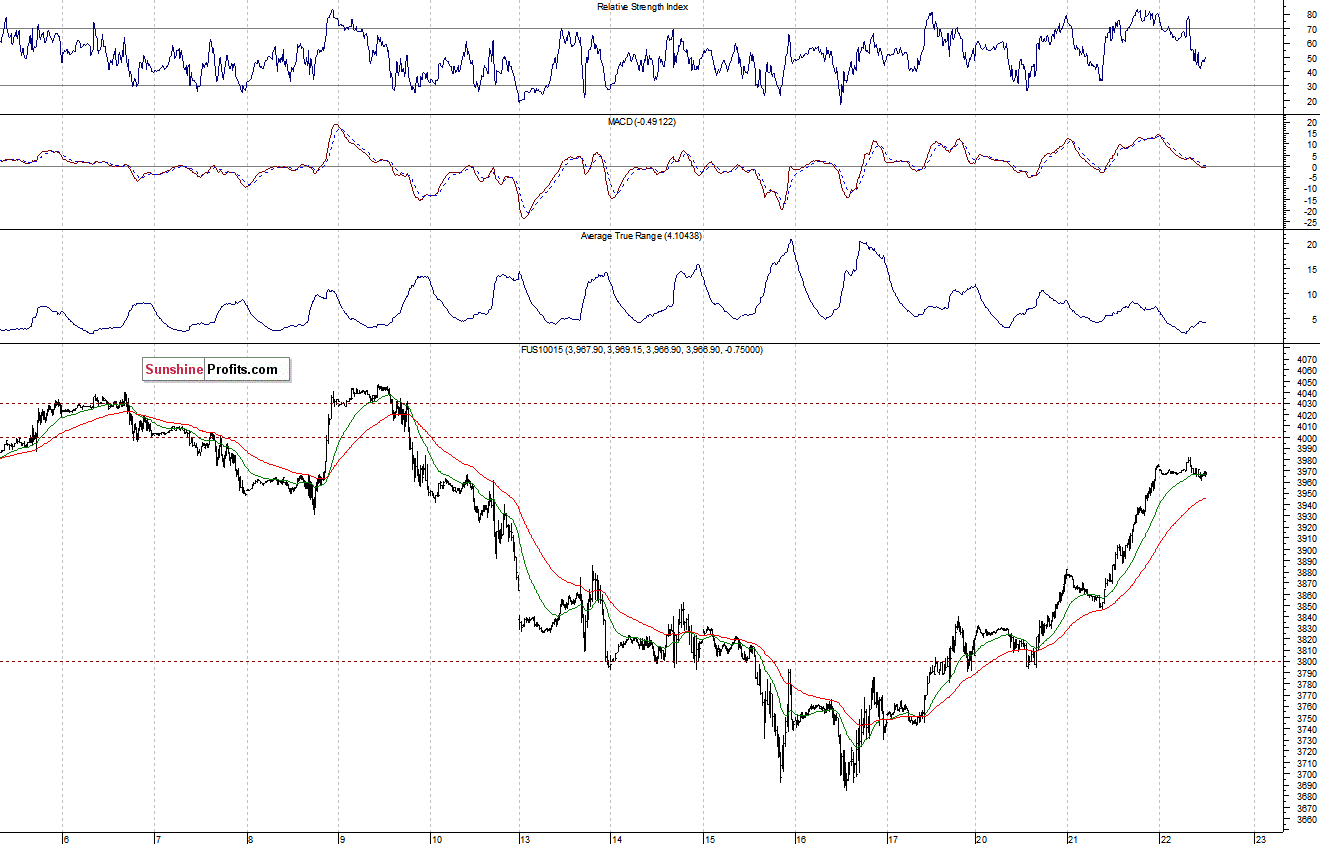

The technology Nasdaq 100 futures contract (CFD) follows a similar path, as it trades along the level of 3,970. The resistance level is at around 3,980-4,000, and the level of support is at 3,900, among others, as the 15-minute chart shows:

Concluding, the broad stock market accelerated its rebound, following last week’s move down. It still looks like an upward correction within a short-term downtrend, accompanied by high volatility. Therefore, we decided to re-open a speculative short position, at the open of today’s trading session (cash market). Our stop-loss is at 1,970, and potential profit target is at 1,870 (S&P 500 index).

Thank you.

Paul Rejczak

Stock Trading Strategist

Stock Trading Alerts