Briefly: In our opinion, no speculative positions are justified.

Our intraday outlook is neutral, and our short-term outlook is neutral. Our medium-term outlook remains bearish, as the S&P 500 index extends its lower highs, lower lows sequence. We decided to change our long-term outlook to neutral recently, following a move down below medium-term lows:

Intraday outlook (next 24 hours): neutral

Short-term outlook (next 1-2 weeks): neutral

Medium-term outlook (next 1-3 months): bearish

Long-term outlook (next year): neutral

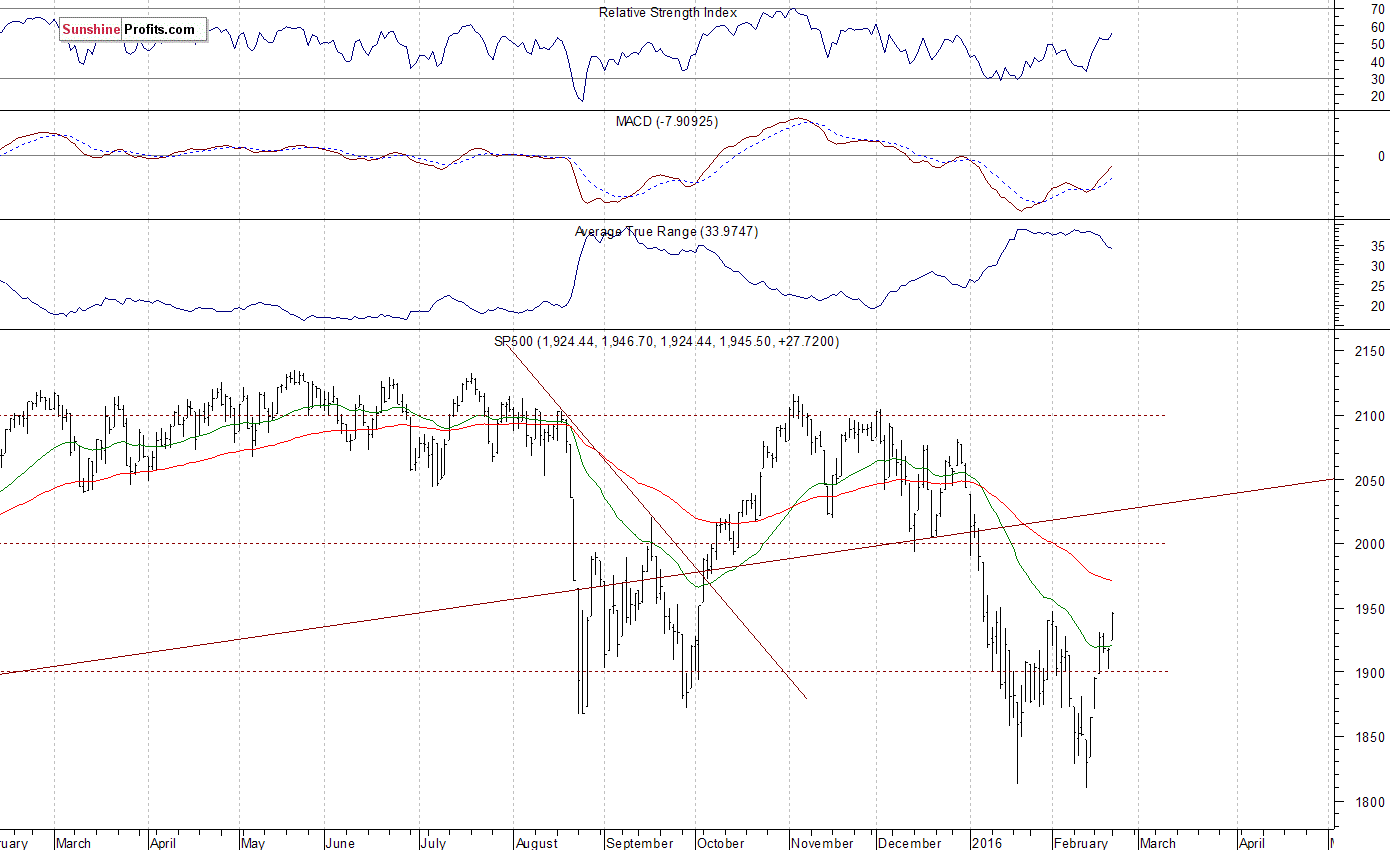

The main U.S. stock market indexes gained 1.4-1.6% on Monday, extending their short-term uptrend, as investors reacted to oil prices increase, among others. The S&P 500 index got close to its early February local low of 1,947.20. The nearest important level of resistance is at around 1,950. The next resistance level is at 1,980-2,000, marked by previous support level. On the other hand, the nearest important level of support is at 1,920-1,925, marked by yesterday's daily gap up of 1,918.78-1,924.44. The next support level is at around 1,900. For now, it looks like a consolidation following first half of January sell-off. Will it continue downwards? Or is the bullish downtrend's reversal scenario currently in play? Last year's August - September lows continue to act as medium-term support level, as we can see on the daily chart:

Expectations before the opening of today's trading session are slightly negative, with index futures currently down 0.1-0.3%. The European stock market indexes have lost 0.4-0.8% so far. The S&P 500 futures contract trades within an intraday consolidation, as it moves along the level of 1,930. The nearest important level of resistance is at around 1,940-1,945, marked by yesterday's daily high. On the other hand, support level is at 1,920, marked by local low. There have been no confirmed negative signals so far. For now, it looks like a downward correction within a short-term uptrend:

The technology Nasdaq 100 futures contract follows a similar path, as it currently trades along the level of 4,200. The nearest important level of resistance is at 4,220-4,230, marked by yesterday's daily high. On the other hand, support level is at 4,180, among others. For now, it looks like a correction following recent uptrend. There have been no confirmed negative signals so far:

Concluding, the broad stock market continued its short-term uptrend on Monday, as investors reacted to oil prices increase, among others. The S&P 500 index extends its consolidation along last year's August - September local lows, as they act as medium-term level of support. There have been no confirmed short-term negative signals so far. However, we can see some short-term overbought conditions. Our speculative long position has been closed at the opening of last week's Thursday's cash market trading session (1,925, Thursday's average opening price of the S&P 500 index). Overall, we gained 90 index points on that trade. Currently, we prefer to be out of the market, avoiding low risk/reward ratio trades. We will let you know when we think it is safe to get back in the market.

Thank you.

Paul Rejczak

Stock Trading Strategist

Stock Trading Alerts