Briefly: In our opinion, no speculative positions are justified.

Our intraday outlook is neutral, and our short-term outlook is neutral:

Intraday

(next 24 hours) outlook: neutral

Short-term (next 1-2 weeks) outlook: neutral

Medium-term (next 1-3 months) outlook: neutral

Long-term outlook (next year): bullish

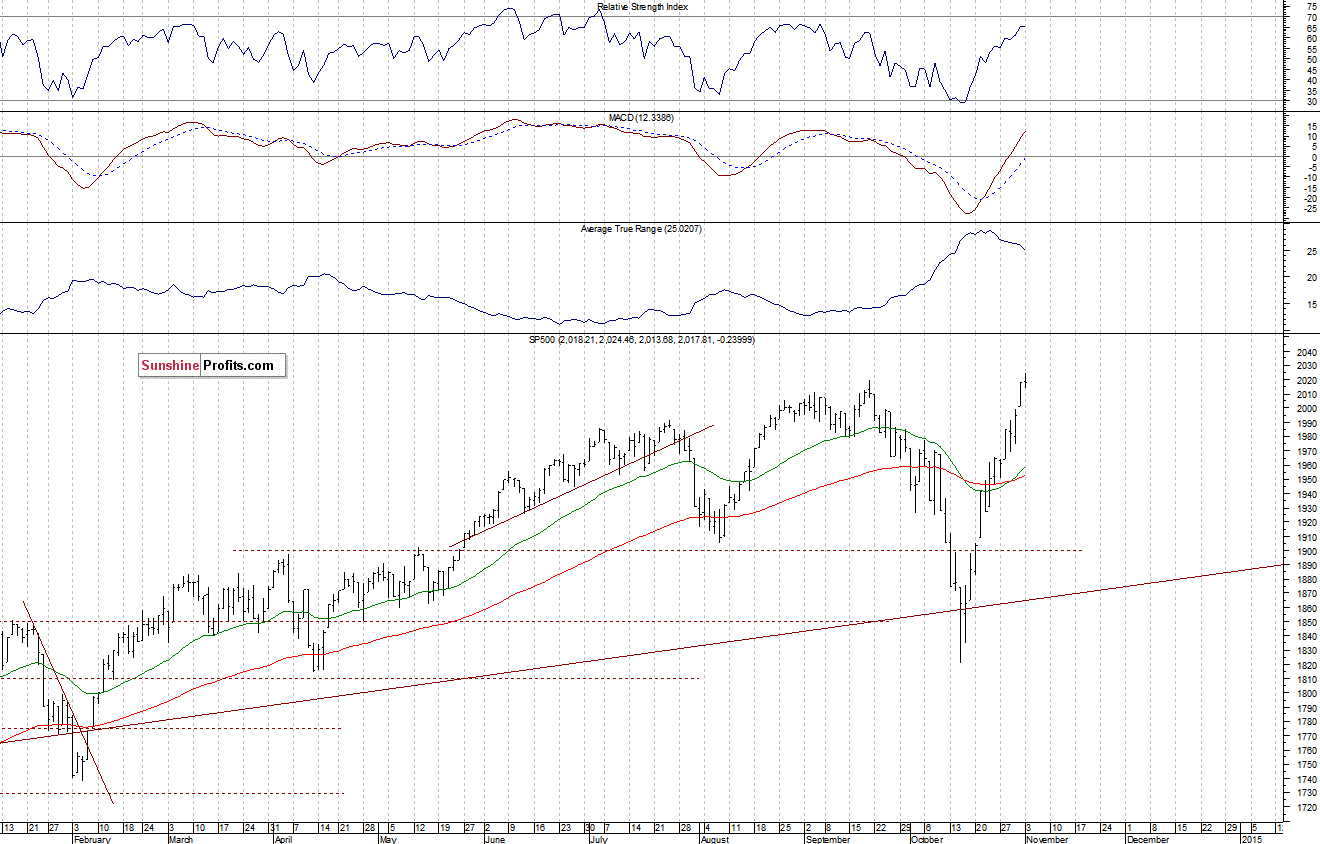

The U.S. stock market indexes were virtually flat on Monday, as investors hesitated following recent rally. Our yesterday’s neutral intraday outlook has proved accurate. The S&P 500 index has managed to reach new all-time high at the level of 2,024.26, slightly breaching its September top of 2,019.26. The nearest important level of resistance is at around 2,020-2,025, and support level is at around 2,000. There have been no confirmed negative signals so far, however, we can see some overbought conditions:

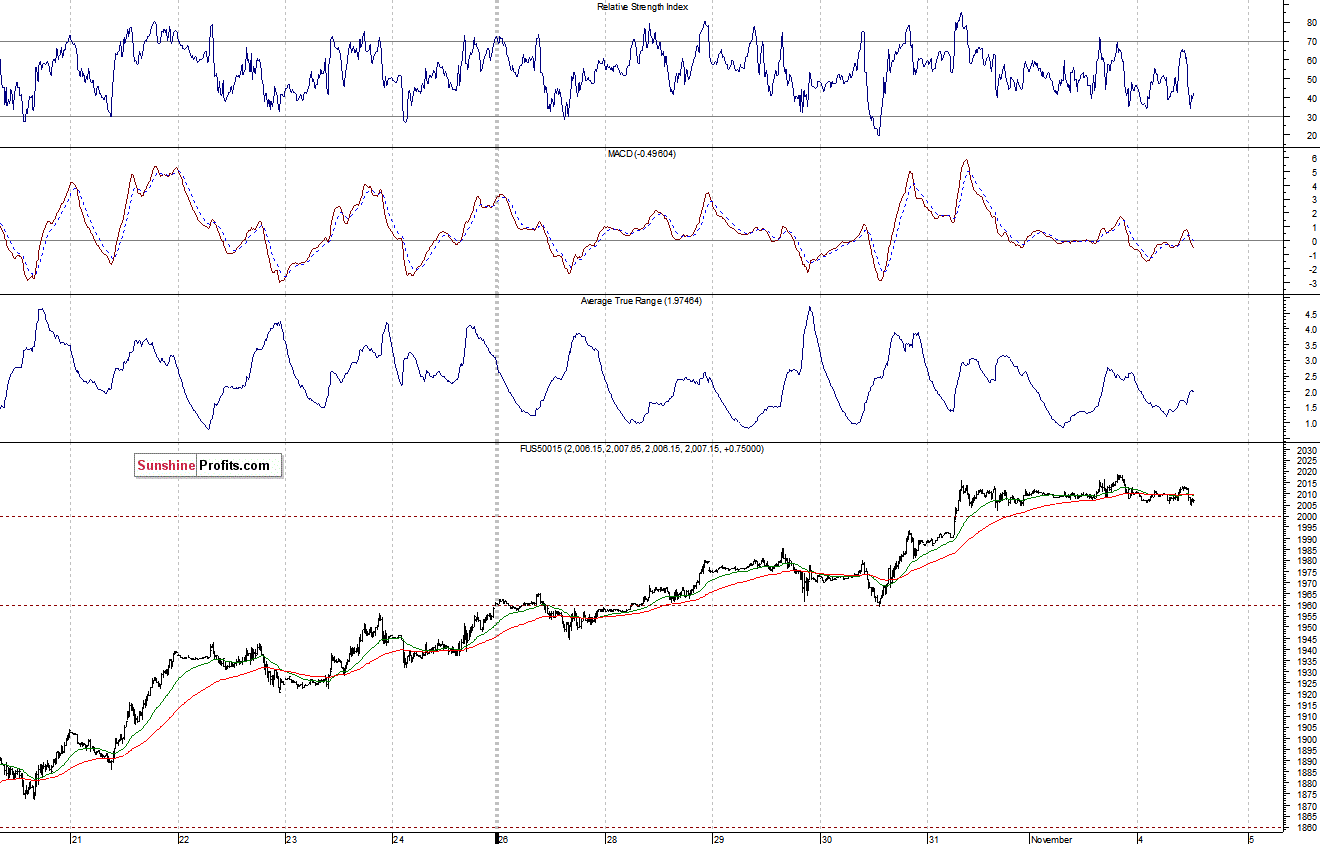

Expectations before the opening of today’s trading session are slightly negative, with index futures currently down 0.1-02%. The main European stock market indexes have been mixed so far. Investors will now wait for some economic data announcements: Trade Balance at 8:30 a.m., Factory Orders at 10:00 a.m. The S&P 500 futures contract (CFD) continues to trade above the level of 2,000, which is positive. For now, it looks like a flat correction within a short-term uptrend. The nearest important resistance level is at 2,015-2,020, as we can see on the 15-minute chart:

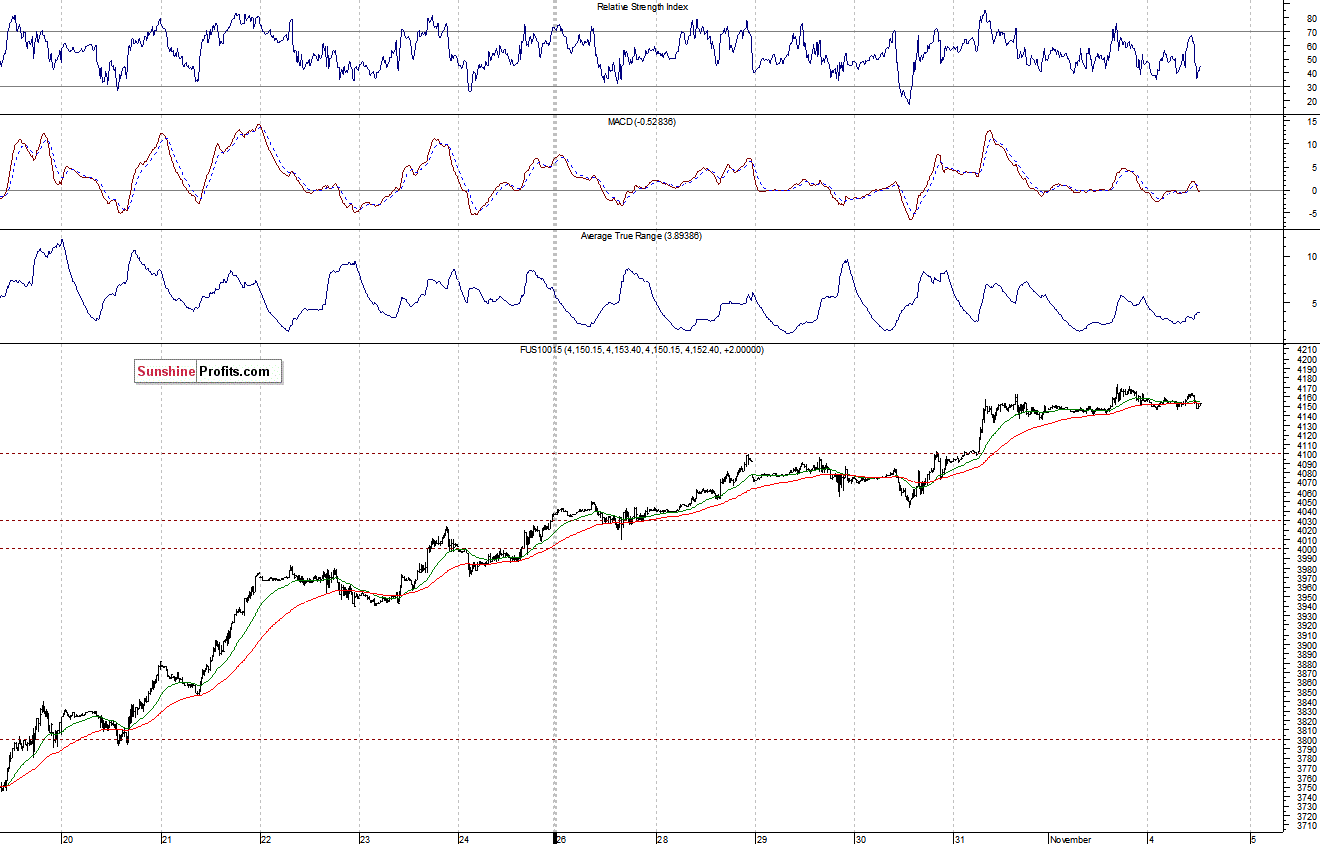

The technology Nasdaq 100 futures contract (CFD) is close to long-term highs, as it trades along the level of 4,150. Resistance level is at around 4,170-4,180, and the nearest important level of support remains at 4,130-4,150, as the 15-minute chart shows:

Concluding, the broad stock market extended its uptrend, following better-than-expected economic data releases. There have been no confirmed negative signals so far. However, we can see some short-term overbought conditions which may lead to a downward correction at some point in time. We prefer to be out of the market, avoiding low risk/reward ratio trades. We will let you know when we think it is safe to get back in the market.

Thank you.

Paul Rejczak

Stock Trading Strategist

Stock Trading Alerts