Briefly:: In our opinion, speculative short positions are favored (with stop-loss at 2,140, and profit target at 2,000, S&P 500 index).

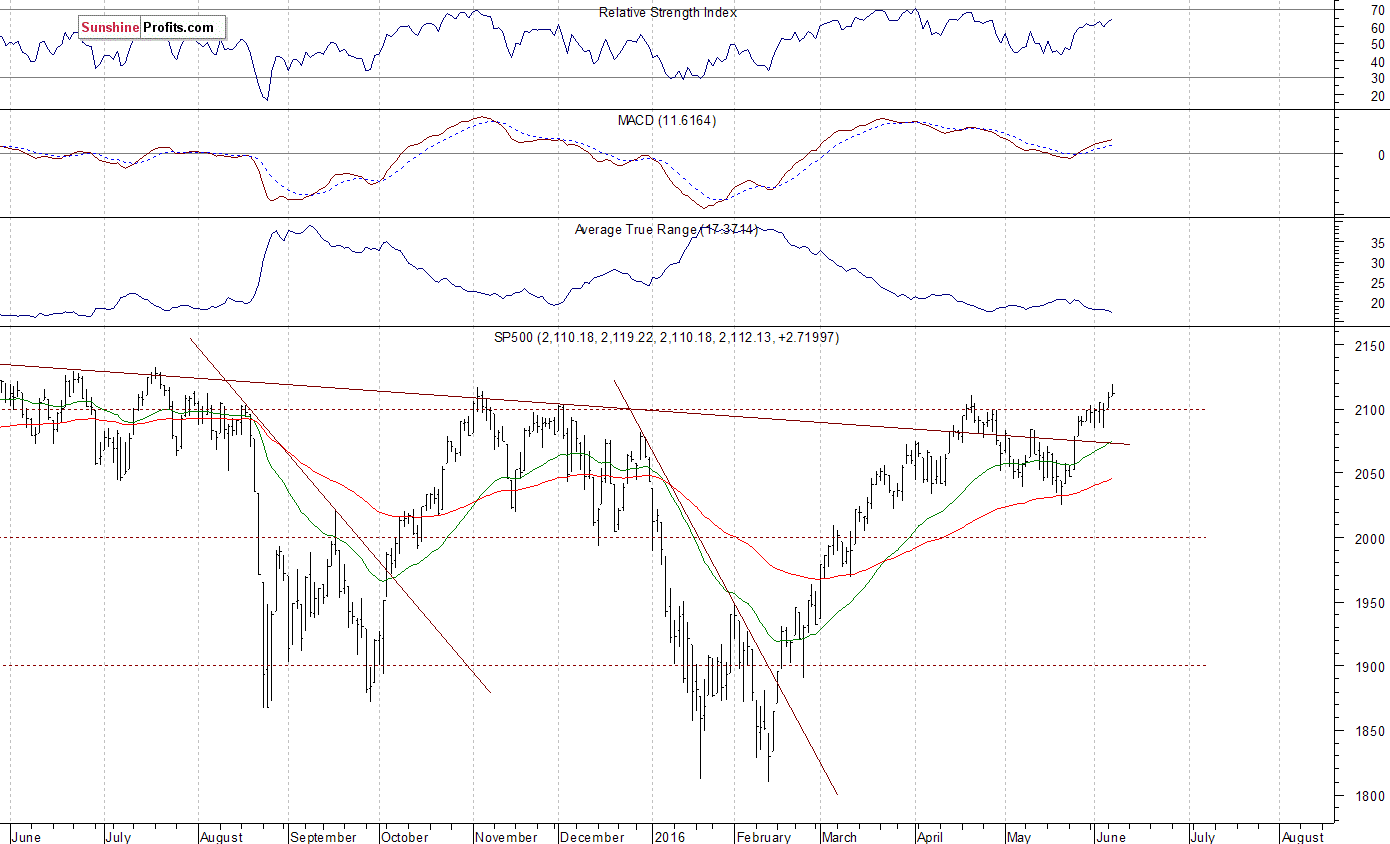

Our intraday outlook is bearish, and our short-term outlook is bearish. Our medium-term outlook remains bearish, as the S&P 500 index extends its lower highs, lower lows sequence:

Intraday outlook (next 24 hours): bearish

Short-term outlook (next 1-2 weeks): bearish

Medium-term outlook (next 1-3 months): bearish

Long-term outlook (next year): neutral

The U.S. stock market indexes were mixed between -0.2% and +0.1% on Tuesday, as investors hesitated following recent move up. The S&P 500 index continues to trade close to 2,100 mark. The nearest important resistance level is at 2,110-2,120, marked by April's local high. The next resistance level is at around 2,130, marked by last year's all-time high of 2,134.72. On the other hand, support level is at 2,100, marked by previous level of resistance. The next important support level is at around 2,070-2,085. Last year's highs along the level of 2,100 continue to act as medium-term resistance level. Will the market break above these medium-term highs and continue its seven-year long bull market?

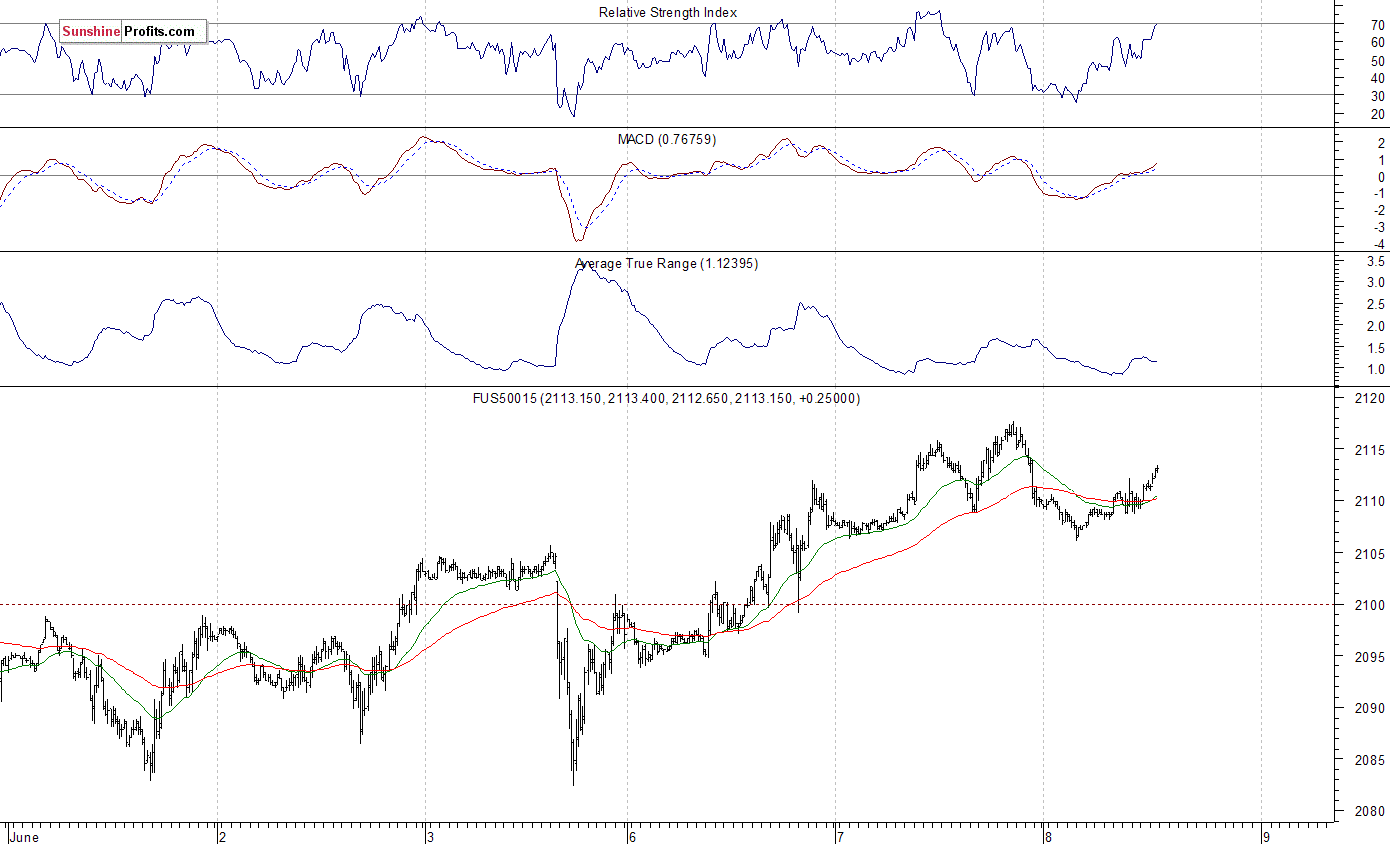

Expectations before the opening of today's trading session are slightly positive, with index futures currently up 0.1-0.2%. The European stock market indexes have been mixed so far. Investors will now wait for the Crude Inventories number release at 10:30 a.m. The S&P 500 futures contract trades within an intraday uptrend, as it retraces its yesterday's intraday move down. The nearest important level of resistance is at around 2,115-2,120. On the other hand, support level is at 2,100-2,105, among others. There have been no confirmed negative signals so far. However, we can see some short-term overbought conditions:

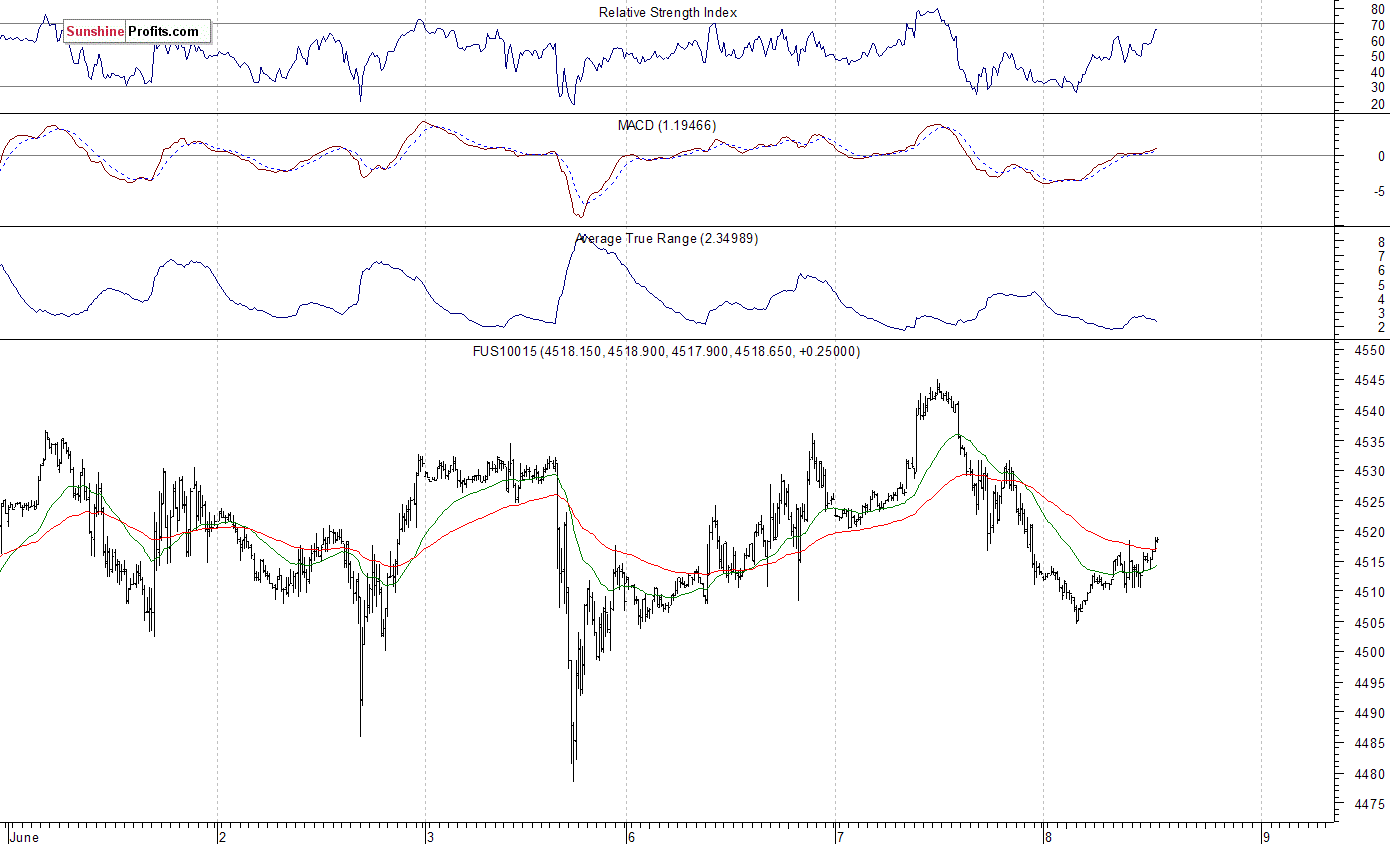

The technology Nasdaq 100 futures contract follows a similar path, as it rebounds after yesterday's decline. The nearest important support level is at around 4,500, and resistance level is at 4,530-4,550, marked by recent local highs. The market extends its short-term consolidation following May rally, as we can see on the 15-minute chart:

Concluding, the broad stock market continues to trade within a short-term uptrend, as the S&P 500 index gets closer to its last year's all-time high. There have been no confirmed negative signals so far. However, we can see technical overbought conditions that may lead to uptrend's reversal or downward correction. Therefore, we continue to maintain our speculative short position (opened at 2,093.94 - last Wednesday's opening price of the S&P 500 index). Stop-loss level is at 2,140 and potential profit target is at 2,000 (S&P 500 index). You can trade S&P 500 index using futures contracts (S&P 500 futures contract - SP, E-mini S&P 500 futures contract - ES) or an ETF like the SPDR S&P 500 ETF - SPY. It is always important to set some exit price level in case some events cause the price to move in the unlikely direction. Having safety measures in place helps limit potential losses while letting the gains grow.

Thank you.

Paul Rejczak

Stock Trading Strategist

Stock Trading Alerts