Trading position (short-term; futures; our opinion): short positions (100% position size) with stop-loss at 3160 and initial downside target at 2940 are justified from the risk-reward perspective.

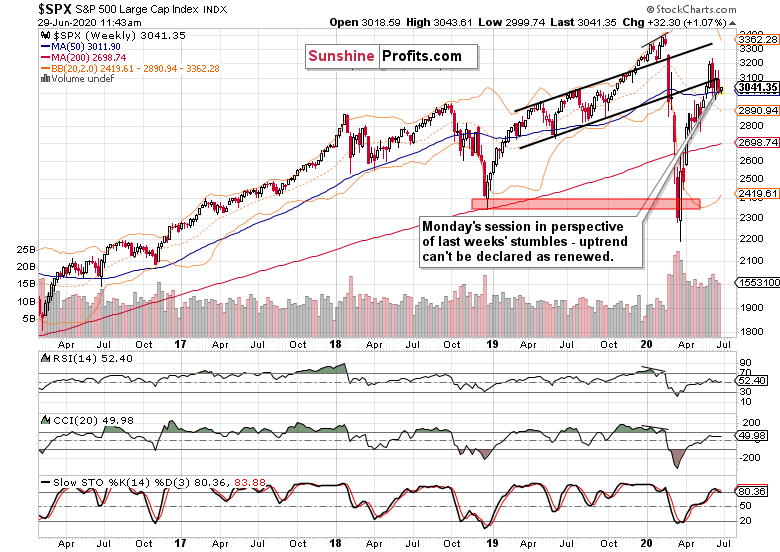

While stocks recovered from their opening dive below the 200-day moving average, let's do a quick check and put the move into perspectives.

That's this week's chart in progress, putting today's modest upswing into perspective. While the downside risks remains (I would highlight tomorrow's Powell testimony, Wednesday's ADP non-farm employment change, and especially Thursday's non-farm employment change - a cautious tone on corona recovery by Powell, or revealing the disconnect between the real economy and stocks by either of the remaining ones), the bulls haven't turned the tide yet - and the slowly but surely mounting corona fears on the ground aren't on their side.

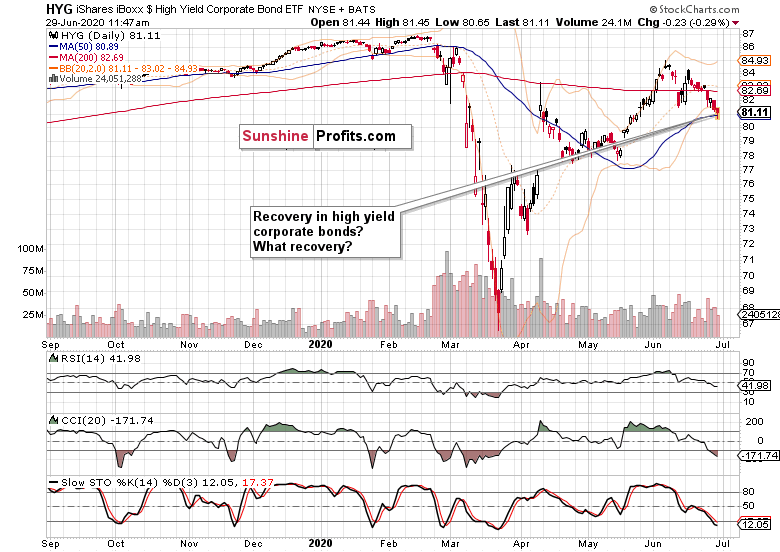

Credit market's key representative is lagging behind also today - and actually the moment it stopped declining, coincided with the intraday stock upswing. How sustainable is that unless junk corporate bonds turn around?

Please note that in the 7-day period ending on Wednesday, June 24, the Fed has again tightened its balance sheet. Unless we get a reversal on this wait-and-see approach, stocks are likely to struggle ahead.

Trading position (short-term; futures; our opinion): short positions (100% position size) with stop-loss at 3160 and initial downside target at 2940 are justified from the risk-reward perspective.

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits: Analysis. Care. Profits.