Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): No positions are currently justified from the risk/reward point of view.

Stocks reached yet another new medium-term lows yesterday, but they closed just 0.1% lower. The market is set to bounce today – is this an upward reversal?

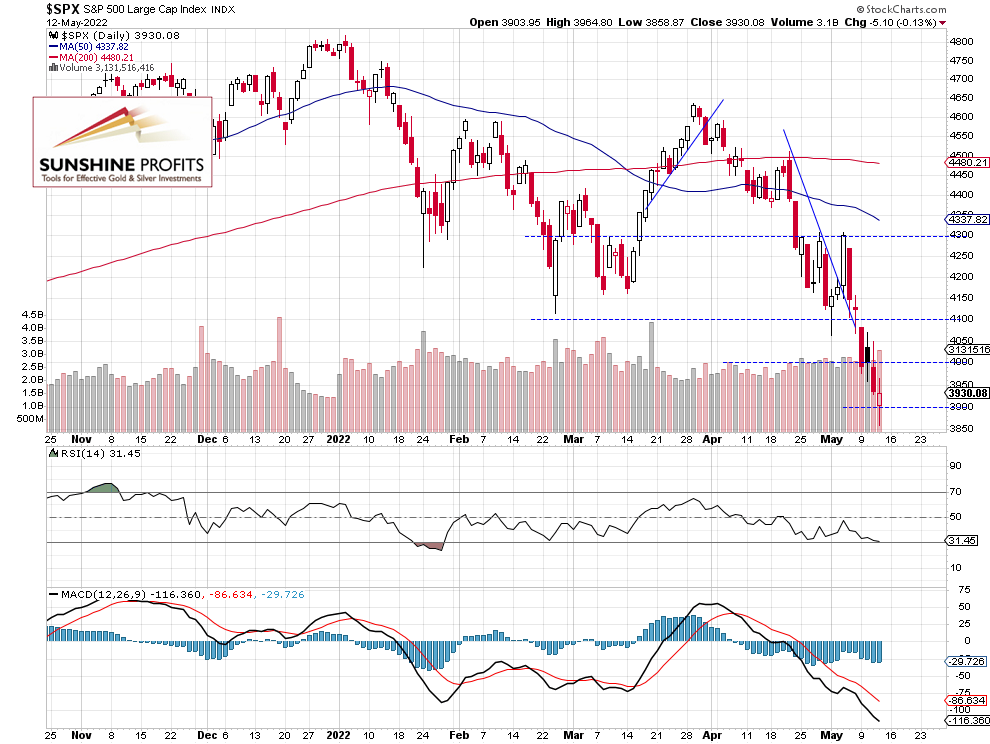

The S&P 500 index lost 0.13% on Thursday after going down to the new medium-term low of 3,858.87. It was 959.8 points or 19.9% below the Jan. 4 record high of 4,818.62. Stocks continued to decline following fears of inflation, tightening monetary policy and the Russia-Ukraine war. This morning the S&P 500 index is expected to open 1.5% higher after yesterday’s intraday rally and today’s global stocks markets’ advance.

The nearest important resistance level is at around 4,000-4,050, marked by the recent fluctuations. On the other hand, the support level remains at around 3,850-3,900. The S&P 500 index broke below the 4,000 level recently, as we can see on the daily chart (chart by courtesy of http://stockcharts.com):

Futures Contract Gets Closer to the 4,000 Level

Let’s take a look at the hourly chart of the S&P 500 futures contract. This morning it is trading just below the 4,000 level. It’s also at the short-term downward trend line.

In our opinion, no positions are currently justified from the risk/reward point of view. (chart by courtesy of http://tradingview.com):

Conclusion

The S&P 500 index will likely open 1.5% higher this morning. The stock market is set to bounce following yesterday’s intraday reversal. For now, it looks like an upward correction following the recent declines. However, it may also be a more sustained advance.

Here’s the breakdown:

- The S&P 500 index is expected to rally at today’s open; for now, it looks like an upward correction.

- In our opinion, no positions are currently justified from the risk/reward point of view.

As always, we’ll keep you, our subscribers, well-informed.

Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): No positions are currently justified from the risk/reward point of view.

Thank you.

Paul Rejczak,

Stock Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care