Prepare yourself. March Madness could be here. No, I’m not talking about the college basketball tourney either.

Stocks will be hanging onto Jay Powell’s every word and every breath on Wednesday (Mar. 17) and scrutinize his thoughts on interest rates and inflation.

Pretty much, we’re the Fed’s hostages until this thing gets some clarity. Even if Powell says nothing, the markets will move. That’s just how it’s going to work.

Rick Rieder, BlackRock’s CIO for global fixed income, echoed this statement. “I think the last press conference, I think I watched with one eye and listened with one ear. This one I’m going to be tuned in to every word and the markets are going to be tuned in to every word. If he says nothing, it will move markets. If he says a lot, it will move markets.”

Jay Powell is the biggest market mover in the game now. What’s coronavirus anymore?

So far, it’s been a relatively tame week for the indices. The Nasdaq’s continued playing catch-up and has outperformed, while the Dow and S&P are still hovering around record highs.

The wheels are in motion for pent-up consumer spending and a strong stock rally. Plus, we have that $1.9 trillion stimulus package heating up the economy and an army of retail traders with an extra $1,400 to play with.

Inflation fears and surging bond yields are still a concern and have caused significant volatility for growth stocks. But let’s have a little perspective here. Plus, jobless claims beat estimates again and came in at 712,000. This is nearly the lowest they’ve been in a whole year. Last week’s inflation data also came in more tamer than expected.

But bonds yields still remain the market’s biggest wild card. Yes, yields are still at a historically low level, and the Fed Funds Rate remains 0%. But depending on how things go around 2 pm Wednesday (Mar. 17), yields could potentially pop again, reinvigorating the rotation into value and cyclical plays and out of tech and growth plays.

Time will tell what happens.

My goal for these updates is to educate you, give you ideas, and help you manage money like I did when I was pressing the buy and sell buttons for $600+ million in assets. I left that career to pursue one to help people who needed help instead of the ultra-high net worth.

With that said, to sum it up:

There is optimism but signs of concern. The market has to figure itself out. A further downturn is possible, but I don’t think that a decline above ~20%, leading to a bear market, will happen any time soon.

Hopefully, you find my insights enlightening. I welcome your thoughts and questions and wish you the best of luck.

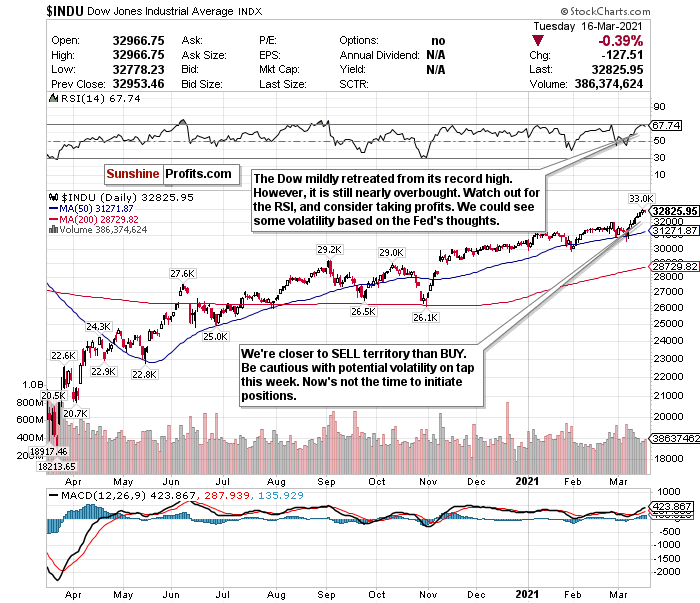

Is the Dow *Gulp* Overbought?

Figure 1- Dow Jones Industrial Average $INDU

Not much new to report on this. Except for that, it keeps ticking up towards overbought territory and hitting record highs. It seemed like Tuesday’s (Mar. 16) was its first down day in forever. I guess it was a needed pause, but it’s hard to consider a 127 point drop much of a breather.

I don’t feel that we’re buyable at all right now. If you have exposure, HOLD and let it ride. Maybe start to consider taking some profits too.

The index could greatly benefit from the stimulus package due to all of the cyclical stocks it holds. I can definitely foresee some pops in the index as investors digest the unprecedented amount of money being pumped into the economy, coupled with reopening excitement. I also don’t think it will be quite as affected by the Fed’s announcement on Wednesday (Mar. 17). That type of talk is more relevant for the Nasdaq.

But you can’t expect the index to keep going up like this and setting records every other day. Plus, the RSI is almost 68 and showing overbought signs.

So, where do we go from here?

Many analysts believe the index could end the year at 35,000, and the wheels are in motion for a furious rally. But you could do better for a buyable entry point.

From my end, I’d prefer to stay patient, vigilant and find better buying opportunities.

My call on the Dow stays a HOLD, but we’re approaching SELL.

For an ETF that aims to correlate with the Dow’s performance, the SPDR Dow Jones ETF (DIA) is a reliable option.

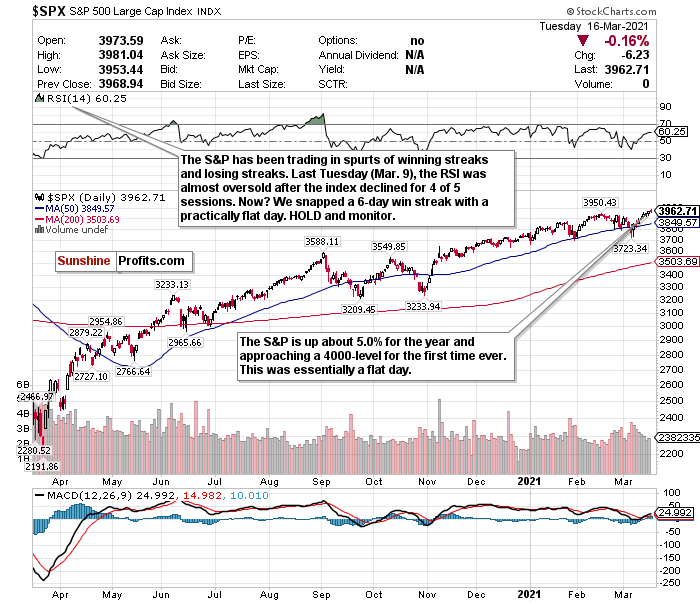

The Streaky S&P Has Been in a Good Mood

Figure 2- S&P 500 Large Cap Index $SPX

The S&P 500 is a complex index to call. It’s incredibly streaky and is between a rock and a hard place right now.

Before that wild reversal we saw about two weeks ago, on March 5, the index declined for 3 days in a row and in 5 of 6 sessions.

Before last Tuesday’s (Mar. 9) pop, it had also declined in 4 of 5 sessions.

Now? We’re right at about a record high, close to 4000, and snapped a 6-day winning streak with what was essentially a flat day- a decline of 0.16%.

See where I’m going with this? To me, this is not behaving like a buyable index. I feel like it’s best to be patient and monitor what happens.

I also think that we could meet some short-term resistance at the level we’re at right now. 4000 is a natural barrier until we get some clarity on the economy.

Unless I see some sort of buy or sell signal for the S&P 500, I think we’ll keep playing this streaky game.

HOLD for now, but be prepared to either BUY or SELL depending on its moves. For an ETF that attempts to directly correlate with the performance of the S&P 500, the S&P 500 SPDR ETF (SPY) is a great option.

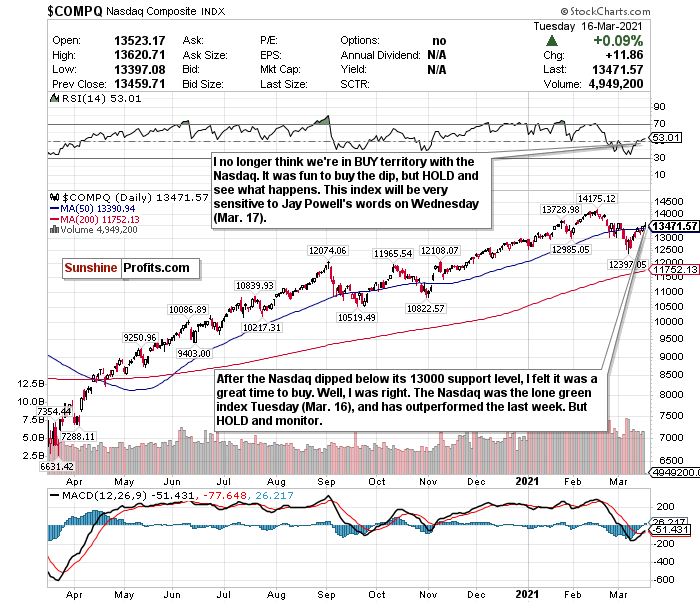

Nasdaq- Proudly Bought the Dip. But Watch What Powell Says.

Figure 3- Nasdaq Composite Index $COMP

I’m pretty proud that I bought the Nasdaq’s dip when it hit correction territory two weeks ago. If you bought it too (like I recommended Feb 24), I tip my hat. The nearly 7% gain seen since hitting correction territory last Monday (Mar. 8) is precisely why.

But we’re far from out of the woods. If there’s one sector that could be extra sensitive to Jay Powell, it’s this one.

Pay very close attention to the index and if it has manic swings. It could be a great BUY or SELL signal.

If the tech sector takes another big dip, though, don’t get scared, don’t time the market, and look for selective buying opportunities. Monitor the RSI and the 13000 support-level. If we see a significant drop again, it could be a strong buy signal, especially for sub-sectors such as cloud computing, e-commerce, and fintech.

I think you should now HOLD and let the RSI guide your Nasdaq decisions. See what happens over the next few sessions, research emerging tech sectors and high-quality companies, and consider buying that next big dip.

For an ETF that attempts to correlate with the performance of the NASDAQ directly, the Invesco QQQ ETF (QQQ) is a good option.

Beware of Inflation

Not to beat this same drum again, but this is the biggest market mover right now. Pay very close attention to Jay Powell on Wednesday (Mar. 17), and look for clues.

Hopefully, we get a more straightforward answer to this question- is inflation really coming back, or is all this fear overblown?

Consider what institutions and analysts are saying from both sides of the fence.

On the one hand, BoA, in a March 10 note, described inflation as “well-contained.” The bank also said that inflation fears would subside by the end of the year and expects CPI inflation to be well shy of the Fed’s 2% target and hit 1.7% by the year’s end.

On the other hand- have you filled gas lately?

January Consumer Price Index data also found that the cost of food eaten at home rose 3.7% from a year ago. This is over double the 1.4% year-over-year increase in all goods included in the CPI.

The Economic Research Service for the U.S. Department of Agriculture also believes that the food cost from grocery stores will rise 1 to 2% this year.

Plus, Moody’s Analytics chief economist Mark Zandi feels that investors have not fully grasped that inflation is “dead ahead” and are grossly underestimating its seriousness and effect on every sector in the market.

I have been calling out Jay Powell for weeks on this. I feel he is cavalier in his inflation thoughts, and I did not buy what he was selling a few weeks ago. Good for him that inflation hasn’t hit his magic 2% target yet. But he essentially admitted on March 4 what the worst kept secret in the book was- that we could see “temporary inflation.”

Let’s see what he says this time.

The Fed said they’d keep rates at 0% through 2023, but if inflation gets really bad, there’s no way this can be sustainable.

Pent-up consumer demand is great. Retail sales crushing expectations reflect this. However, rising bond yields coupled with $1.9 trillion heating up the economy and an aggressive (reckless?) Fed showing no signs of hiking interest rates is as strong a sign of inflation as you can get.

Five-year inflation expectations have also more than doubled from last year’s low and are now at around their highest levels since 2013.

“The rich world has come to take low inflation for granted. Perhaps it shouldn’t.” -The Economist.

As hedges against inflation, consider BUYING the SPDR TIPS ETF (SPIP), the Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF (PDBC), and the iShares Cohen & Steers REIT ETF (ICF).

Mid-Term/Long-Term

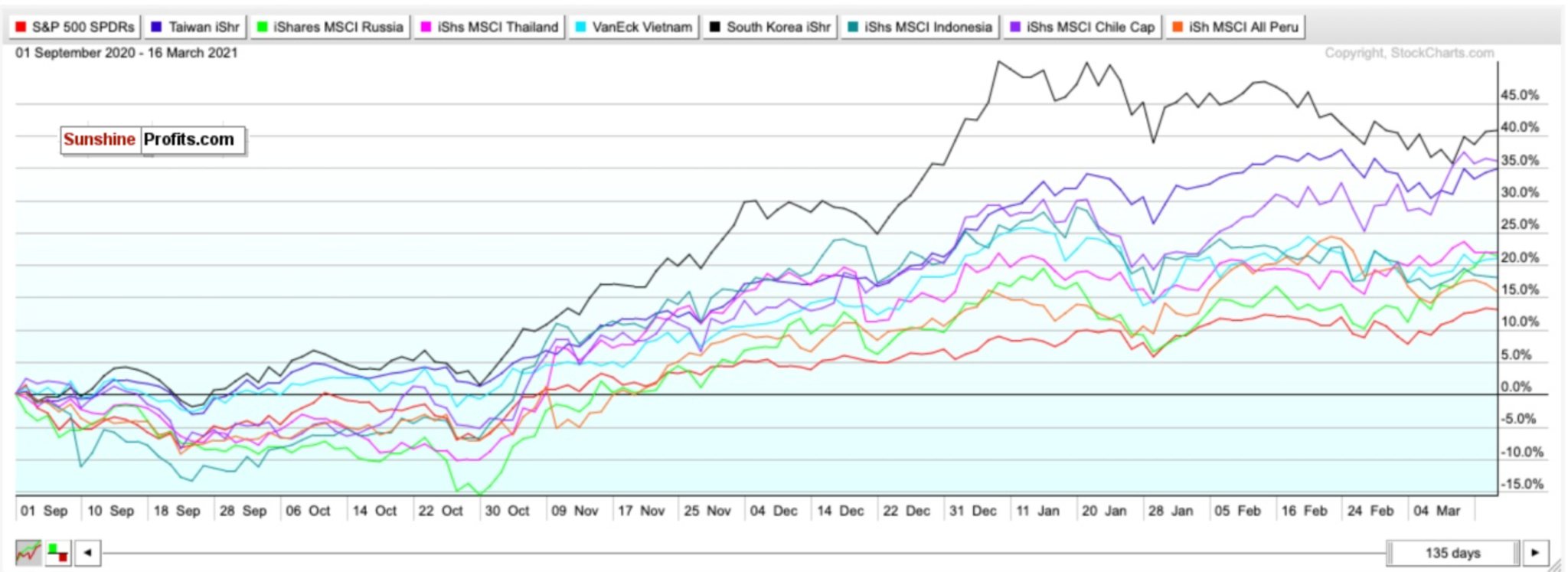

Add Emerging Market Exposure- Period

Figure 4- SPY, EWT, ERUS, THD, VNM, EWY, EIDO, ECH, EPU comparison chart- Sep. 1, 2020-Present

Since September, the SPDR S&P 500 ETF (SPY) has gained around 13.21%.

But if you compare that yield to that of my top emerging market picks for 2021, it has underperformed.

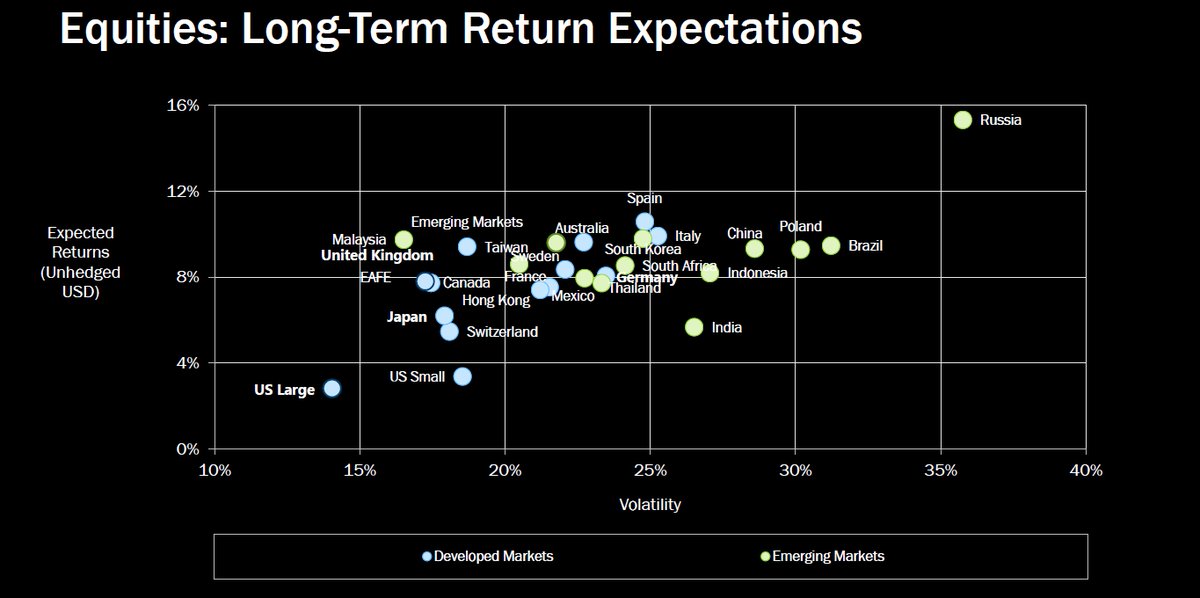

Consider this too.

With inflation on the horizon, a surge in commodity prices combined with shifting demographics could send other emerging markets upwards long-term. Plus, with birth rates plummeting during the pandemic in developed markets, it could mean long-term upside for emerging markets.

PWC echoes this sentiment and believes that emerging markets (E7) could grow around twice as fast as advanced economies (G7) on average in the coming decades.

For 2021, the following are my BUYs for emerging markets and why:

iShares MSCI Taiwan ETF (EWT)- Developing country, with stable fundamentals, diverse and modern hi-tech economy, regional upside without China’s same geopolitical risks.

iShares MSCI Thailand ETF (THD)- Bloomberg’s top emerging market pick for 2021 thanks to abundant reserves and a high potential for portfolio inflows. Undervalued compared to other ETFs.

iShares MSCI Russia Capped ETF (ERUS)- Bloomberg’s second choice for the top emerging market in 2021 thanks to robust external accounts, a robust fiscal profile, and an undervalued currency. Red-hot commodity market, growing hi-tech and software market, increasing personal incomes. Russian equities may also have potential upside north of 35%.

Figure 5- Equities: Long-Term Return Expectations Developed Markets/Emerging Markets

VanEck Vectors Vietnam ETF Vietnam (VNM)-Turned itself into an economy with a stable credit rating, strong exports, and modest public debt relative to growth rates. PWC believes Vietnam could also be the fastest-growing economy globally. It could be a Top 20 economy by 2050.

iShares MSCI South Korea ETF (EWY)- South Korea has a booming economy, robust exports, and stable yet high growth potential. The ETF has been the top-performing emerging market ETF since March 23.

iShares MSCI Indonesia ETF (EIDO)- Largest economy in Southeast Asia with young demographics. The fourth most populous country in the world. It could be less risky than other emerging markets while simultaneously growing fast. It could also be a Top 5 economy by 2050.

iShares MSCI Chile ETF (ECH)- One of South America’s largest and most prosperous economies. An abundance of natural resources and minerals. World’s largest exporter of copper. Could boom thanks to electric vehicles and batteries because of lithium demand. It is the world’s largest lithium exporter and could have 25% of the world’s reserves.

iShares MSCI Peru ETF (EPU)- A smaller developing economy but has robust gold and copper reserves and rich mineral resources.

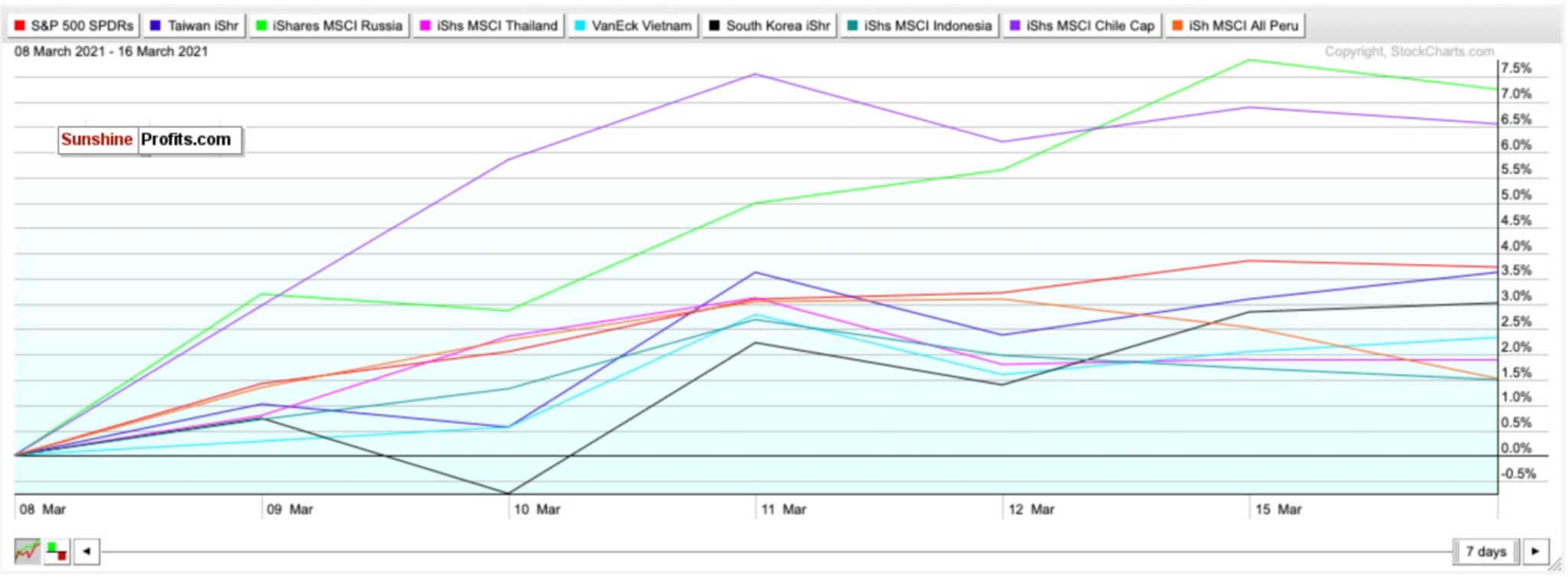

Let’s take a look at how these emerging markets performed in the last 7 sessions.

Figure 6- SPY, EWT, ERUS, THD, VNM, EWY, EIDO, ECH, EPU comparison chart- March 8-16

Commodities are once again the big story. In the last 7 sessions, Lithium, for example, a crucial battery metal, as tracked by the LIT ETF, has gained over 8%. Oil has been popping as well.

That’s why Russia and Chile have led the way with gains of 7.24% and 6.55%, respectively.

Remember. Chile is one of Latin America’s most robust economies and the world’s largest copper and lithium exporter. It could, in fact, have 25% of the world’s lithium reserves.

Regarding Russia, Boris Schlossberg, managing director at BK Asset Management, told CNBC’s “Trading Nation” that the rise in oil is very beneficial for Russia’s growth.

“It’s pretty clear that oil has really found a very, very strong consolidation of the $60 level ... if you’re a big believer that oil stays, these levels go higher. It’s very positive for Russia, very positive for the Russian economy.”

Schlossberg also looked at Goldman’s call for commodities to return 15.5% over the year as strong for Russia.

“Goldman’s thesis that commodities are entering into a very strong bull market because of infrastructure needs all across the world only helps Russia.”

Outside of the aforementioned country-specific ETFs, you can also BUY the iShares MSCI Emerging Index Fund (EEM) for broad exposure to Emerging Markets.

Long-Term

I remain convinced that the economic recovery is going better than expected as the progress in administering the vaccines improves. But it’s a blessing and a curse if it goes “too well.”

Continue to pay attention to complacency, overvaluation, bond yields, and especially inflation.

Once again- Jay Powell will move the markets.

Time will tell what happens. There could be more short-term swings. But the economic climate is reopening, and things look a bit sunnier than they did at this time a year ago.

I think we could see some more swings as the market figures out bond yields and inflation. We may be at the beginning of the end of the pandemic, and 2021 should be a big year for stocks despite some choppy waters.

Summary

I cannot stress this enough. Play volatility to your advantage, and do not try to time the market. There are some concerns, but the overall backdrop right now is favorable for stocks.

Do not get caught up in fear and most of all:

NEVER TRADE WITH EMOTIONS.

Consider this too. You can sit out and be scared and wait for the perfect buying opportunity all you want. But we are almost a year out from March 23rd, 2020- the day that the market finally bottomed. If you bought ANY of these index-tracking ETFs on March 23rd when it looked like the world was ending, here is how you would have fared: Russell 2000 (IWM) up 134.02%. Nasdaq (QQQ) up 89.01%. Dow Jones (DIA) up 79.43%. S&P 500 (SPY) up 79.84%.

Nobody knows “where” the actual bottom is for stocks. However, in the long-term, markets always move higher and focus on the future rather than the present.

For now, even though bond yields and inflation appear to have stabilized, I’m still a bit concerned. Powell could significantly affect this too.

This $1.9 trillion rescue deal may be a short-term catalyst for stocks. But it’s only prolonging the inevitable. Inflation will eventually return with a vengeance. Bond yields will ultimately rise even more as the GDP heats up, and debt will continue to grow.

But for now? Enjoy the ride. Just maybe avoid filling gas. It’s getting ugly out there.

To sum up my calls:

I have HOLD calls for:

- The Invesco QQQ ETF (QQQ),

- the iShares Russell 2000 ETF (IWM),

- the SPDR S&P ETF (SPY), and

- the SPDR Dow Jones ETF (DIA)

I also recommend selling or hedging the US Dollar and gaining exposure into emerging markets for the mid-term and long-term.

I have BUY calls on:

- The iShares MSCI Emerging Index Fund (EEM),

- the iShares MSCI Taiwan ETF (EWT),

- the iShares MSCI Thailand ETF (THD),

- the iShares MSCI Russia ETF (ERUS),

- the VanEck Vectors Vietnam ETF (VNM),

- the iShares MSCI South Korea ETF (EWY),

- the iShares MSCI Indonesia ETF (EIDO),

- the iShares MSCI Chile ETF (ECH),

- and the iShares MSCI Peru ETF (EPU)

Additionally, because inflation has already crept back; and I foresee it getting worse as early as mid to late 2021…

I have BUY calls on:

- The SPDR TIPS ETF (SPIP),

- the Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF (PDBC), and

- the iShares Cohen & Steers REIT ETF (ICF)

Thank you.

Matthew Levy, CFA

Stock Trading Strategist