Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): No positions are currently justified from the risk/reward point of view.

It may be alluring to invest in the S&P 500 right now as it stays near its record highs. However, don’t trust your gut – it may be peaking as well.

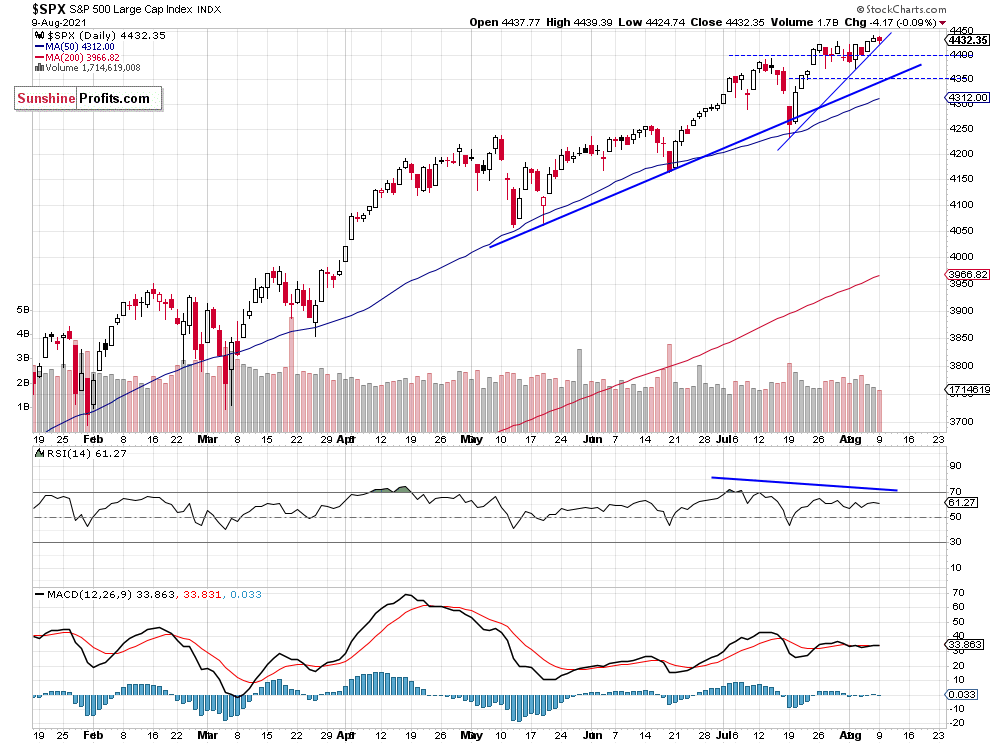

The broad stock market went sideways on Monday, as the S&P 500 index lost 0.1%. On Friday it reached yet another new record high at the level of 4,440.82 and yesterday’s daily high was at 4,439.39.

Friday’s better-than-expected Nonfarm Payrolls release led to a pretty mild bullish reaction of +0.2%. Does this mean that we are getting close to a downward reversal? The index remains above its upward trend lines and moving averages, but we can see some negative technical divergences that may signal a coming weakness. However, there have been no confirmed negative signals to date.

The broad stock market has slightly broken above its two-week-long consolidation on Friday. The nearest important support level is now at 4,430, and the next support level is at 4,400. The S&P 500 index continues to trade above its three-month-long upward trend line, as we can see on the daily chart (chart by courtesy of http://stockcharts.com):

S&P 500 Remains at Year-Long Upward Trend Line

The S&P 500 index continues to trade along its medium-term upward trend line. The market will most likely break below that trend line and trade sideways for some time. For now however it just keeps moving along the line, as we can see on the weekly chart:

Conclusion

The S&P 500 index slightly extended its over-eleven-year-long bull market last week, as it reached a new record high of 4,440.82 on Friday. Are we getting close to some medium-term high? The market seems overbought, but we haven’t seen any confirmed negative signals so far.

As always, we’ll keep you, our subscribers, well-informed.

Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): No positions are currently justified from the risk/reward point of view.

Thank you.

Paul Rejczak,

Stock Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care