Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): short positions with entry at 4,435 price level, with 4,520 as a stop-loss and 4,200 as a price target.

The market is likely poised for a short-term correction. Thus, we are opening a speculative short position in the S&P500.

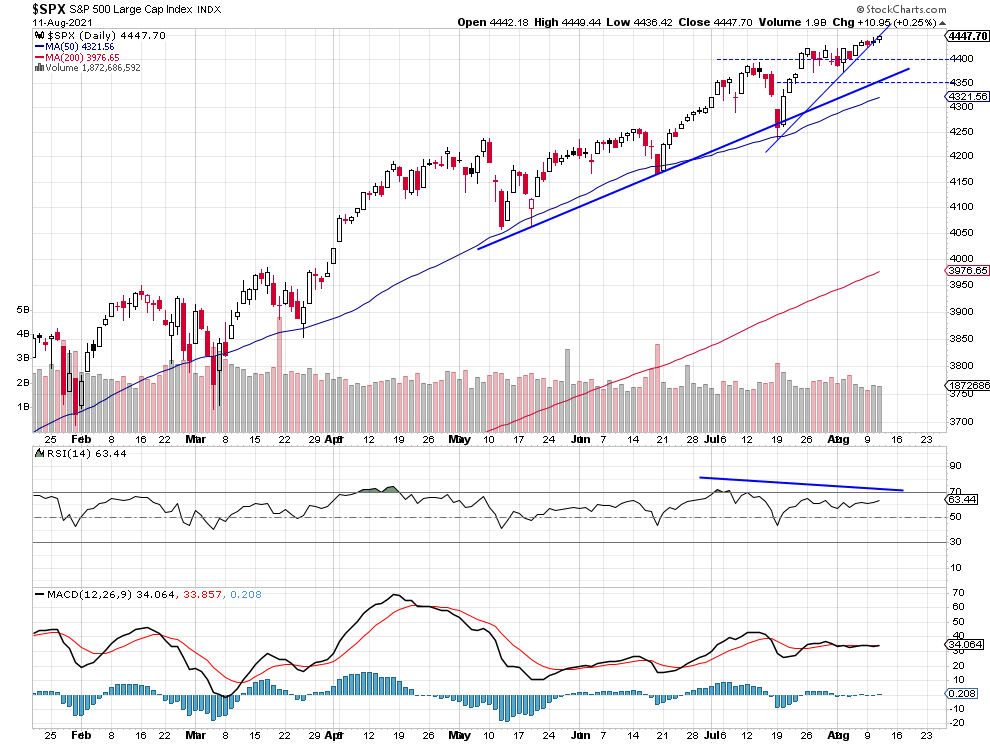

The index remains above its upward trend lines and moving averages, but we can see some negative technical divergences that may signal a coming weakness. However, there have been no confirmed negative signals to date.

The broad stock market broke slightly above its two-week-long consolidation on Friday. The nearest important support level remains at 4,430, and the next support level is at 4,400. The S&P 500 index continues to trade above its three-month-long upward trend line, as we can see on the daily chart (chart by courtesy of http://stockcharts.com):

Conclusion

The S&P 500 index has been slightly extending its over-eleven-year-long bull market in recent days. Yesterday it reached a new record high of 4,449.44. The market seems overbought and poised for a correction. Therefore, we decided to open a speculative short position this morning (4,445 price level). We are expecting a 5% correction from the current levels.

As always, we’ll keep you, our subscribers, well-informed.

Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): short positions with entry at 4,435 price level, with 4,520 as a stop-loss and 4,200 as a price target.

Thank you.

Paul Rejczak,

Stock Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care