Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): No positions are currently justified from the risk/reward point of view.

The S&P 500 fluctuated on Wednesday. For now it looks like a consolidation and a flat correction. But will the uptrend continue?

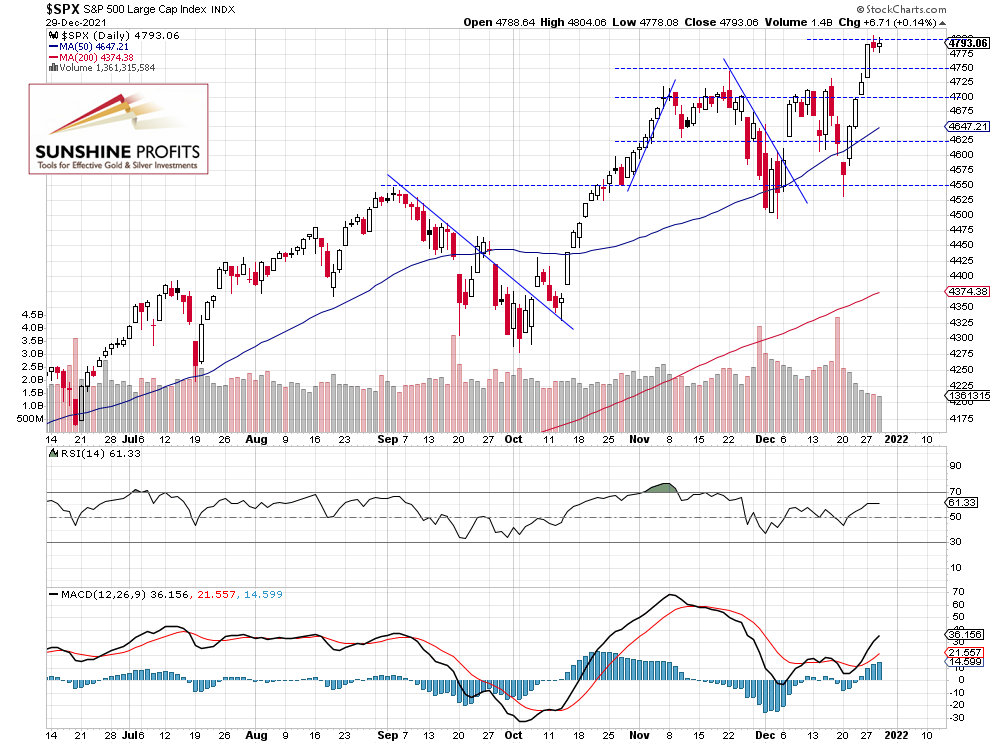

The broad stock market index gained 0.14% on Wednesday, Dec. 29 following its Tuesday’s decline of 0.1%. The market is fluctuating after the recent record-breaking rally. The S&P 500 index is now way above the local highs from November and December. Stocks broke above the consolidation and we had a Santa Claus rally. On Tuesday the market reached the new record high of 4,807.02. Now we may see some more consolidation or a downward correction. The S&P 500 index is expected to open 0.1% higher this morning.

On Dec. 3 the index fell to the local low of 4,495.12 and it was 5.24% below the previous record high. So it was a pretty mild downward correction or just a consolidation following this year’s advances.

The nearest important resistance level remains at around 4,800. On the other hand, the support level is at 4,740-4,750, marked by the previous highs. The S&P 500 broke above its two-month long consolidation, as we can see on the daily chart (chart by courtesy of http://stockcharts.com):

Futures Contract Extend a Consolidation

Let’s take a look at the hourly chart of the S&P 500 futures contract. It reached the new record high after breaking above the resistance level of around 4,740. In our opinion no positions are currently justified from the risk/reward point of view. (chart by courtesy of http://tradingview.com):

Conclusion

The S&P 500 index is likely to extend its short-term consolidation following the recent record-breaking rally. We may see a profit trading action and some more fluctuations along the 4,800 level. There have been no confirmed negative signals so far.

Here’s the breakdown:

- The S&P 500 will likely extend a short-term consolidation, we may see a downward correction at some point.

- In our opinion no positions are currently justified from the risk/reward point of view.

As always, we’ll keep you, our subscribers, well-informed.

Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): No positions are currently justified from the risk/reward point of view.

Thank you.

Paul Rejczak,

Stock Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care