Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): long positions with entry at 4,340 price level, with 4,020 as a stop-loss and 4,640 as an initial price target.

The stock market opened much lower yesterday, and at the end of the day it was higher. Did it finally reach the bottom?

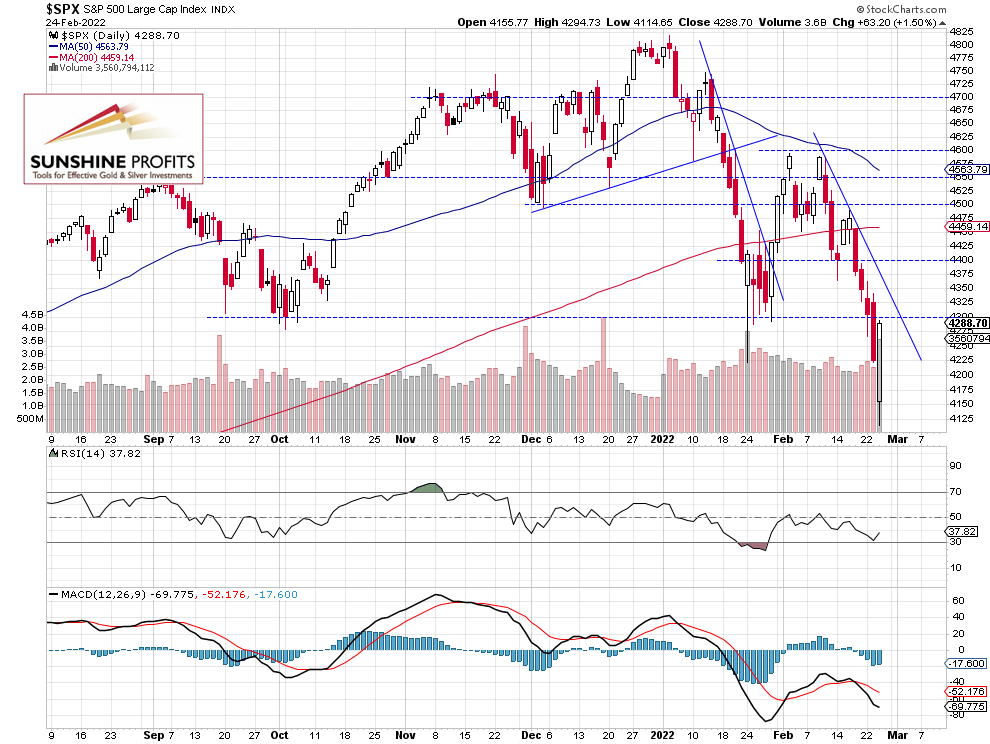

The S&P 500 index gained 1.5% after bouncing from the new medium-term low of 4,114.65 yesterday. It was 704 points or 14.6% below the January 4 record high of 4,818.62. The broad stock market’s gauge closed slightly below the 4,300 level after gaining 180 points from the daily low.

So the market sharply reversed its short-term downtrend. But will it continue the advance? For now, it still looks like an upward correction. This morning the S&P 500 index is expected to open 0.5% higher, but we may see some more volatility later in the day.

The nearest important resistance level remains at 4,300-4,350, marked by the recent local lows. On the other hand, the support level is at 4,200, among others. The S&P 500 index came back above the late January local low, as we can see on the daily chart (chart by courtesy of http://stockcharts.com):

Futures Contract Is at the 4,300 Level Again

Let’s take a look at the hourly chart of the S&P 500 futures contract. Yesterday overnight it sold off after breaking below the 4,200 level. The market bounced from our previous stop-loss level of 4,120. Due to an extraordinary volatility we decided to move the stop-loss down to the 4,020 level (one time only). We are still expecting an upward correction from the current levels (chart by courtesy of http://tradingview.com):

Conclusion

The S&P 500 index will likely open higher this morning and it may extend a short-term uptrend after bouncing from yesterday’s daily low. We’ve seen a short-term bottom, however there will likely be more volatility.

Here’s the breakdown:

- The S&P 500 index bounced from the new medium-term low yesterday after falling almost 15% from the early January record high.

- We moved our Tuesday’s long position’s stop-loss level to 4,020 (one time only).

- We are expecting an upward correction from the current levels.

As always, we’ll keep you, our subscribers, well-informed.

Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): long positions with entry at 4,340 price level, with 4,020 as a stop-loss and 4,640 as an initial price target.

Thank you.

Paul Rejczak,

Stock Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care