Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): long positions with entry at 4,335 price level, with 4,180 as a stop-loss and 4,550 as an initial price target.

Stocks fluctuated following their Monday’s panic sell-off and an over 4% intraday rally. It looks like some short-term bottom has been reached.

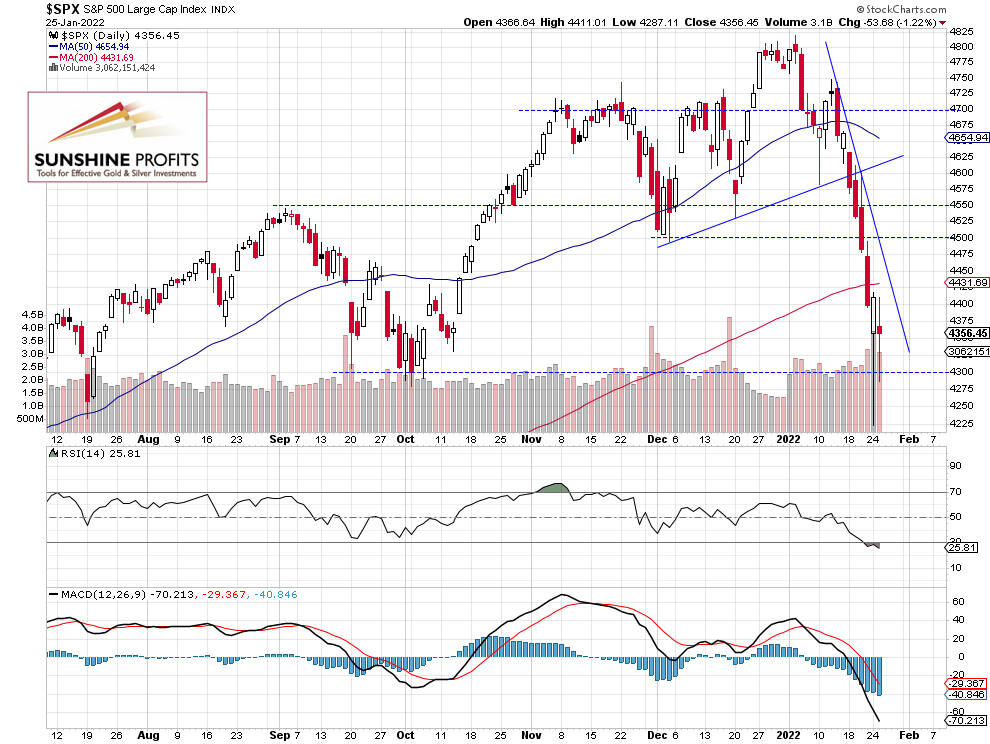

The S&P 500 index lost 1.22% on Tuesday, as it retraced some of its huge Monday’s intraday rally from the local low of 4,222.62. The market was 596 points or 12.4% below the Jan. 4 record high of 4,818.62. Investors reacted to further Russia-Ukraine tensions. We are now waiting for today’s FOMC Statement release and Thursday’s important U.S. Advance GDP release, plus Thursday’s quarterly earnings release from Apple (after the close). So, we will likely see more volatility.

Late December – early January consolidation along the 4,800 level was a topping pattern and the index retraced all of its December’s record-breaking advance. This morning it is expected to open 1.6% higher following yesterday’s Microsoft quarterly earnings release.

The nearest important resistance level is at 4,420-4,450, marked by the recent local highs. The resistance level is also at 4,500-4,550. On the other hand, the support level is at 4,300-4,350. The next support level is at 4,220-4,250. The S&P 500 continues to trade below a steep short-term downward trend line, as we can see on the daily chart (chart by courtesy of http://stockcharts.com):

Futures Contract – Our Long Position is Profitable

The S&P 500 futures contract broke above the 4,400 level this morning and it’s getting closer to the short-term downward trend line. For now, it still looks like an upward correction within a downtrend.

We decided to open a speculative long position yesterday before the opening of the cash market (4,335 price level). We are expecting a rebound from the current levels. (chart by courtesy of http://tradingview.com):

Conclusion

The S&P 500 index accelerated its sell-off on Monday before bouncing back above the previous closing price following a “V” pattern reversal. On Tuesday it remained below the 4,400 level, but today the index is expected to open 1.6% higher. For now, it still looks like an upward correction and we may see some further volatility.

The coming quarterly earnings releases (TSLA today after the session’s close and AAPL on Thursday, among others) remain a bullish factor for stocks, but there is still a lot of uncertainty concerning Russia-Ukraine tensions. Investors are also waiting for today’s Fed release and tomorrow’s U.S. Advance GPD number release.

Here’s the breakdown:

- The S&P 500 will likely open much higher this morning, but we may see some volatility ahead of the Fed news later in the day.

- Our speculative long position (4,335 price level) is justified from the risk/reward perspective.

- We are expecting a an upward correction from the current levels (around +5% from the 4.335 level – futures contract).

As always, we’ll keep you, our subscribers, well-informed.

Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): long positions with entry at 4,335 price level, with 4,180 as a stop-loss and 4,550 as an initial price target.

Thank you.

Paul Rejczak,

Stock Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care