Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): No positions are currently justified from the risk/reward point of view.

The S&P 500 index went the lowest since April of 2021 yesterday, as it accelerated its short-term downtrend. Will we see some further declines?

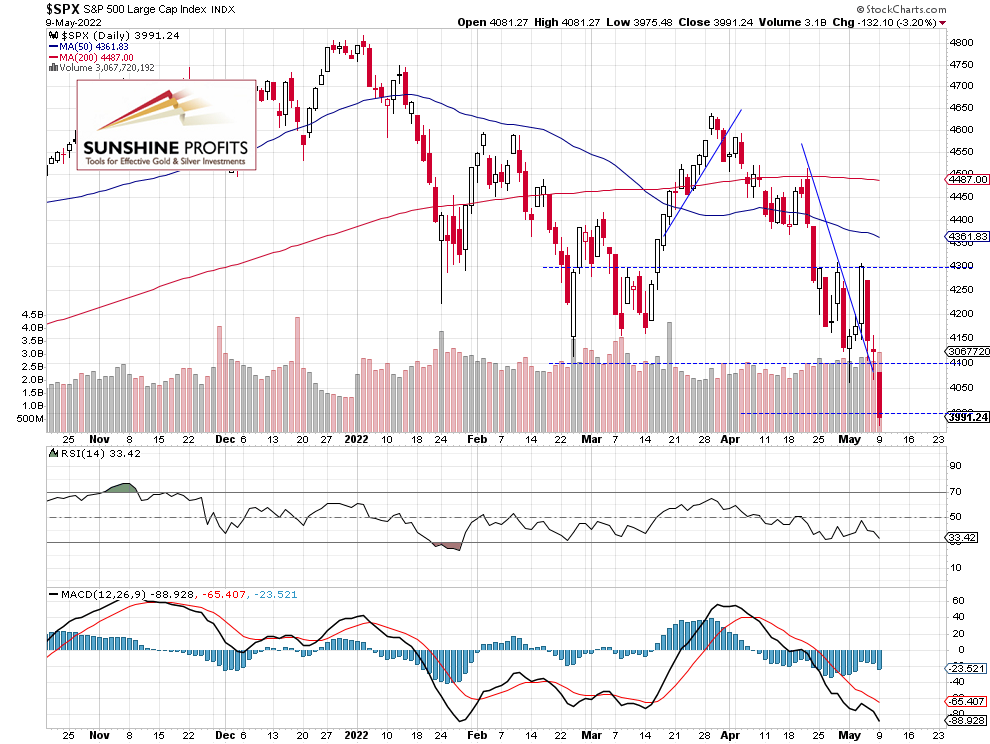

The broad stock market index lost 3.20% yesterday, as it went below the 4,000 level and it reached the new local low of 3,975.48. The S&P 500 was 843.1 points or 17.5% below the Jan. 4 record high of 4,818.62. Stocks were declining following fears of inflation rise, tightening monetary policy and the Russia-Ukraine war. This morning the S&P 500 index is expected to open 1.1% higher and we may see an upward correction.

The nearest important resistance level is now at around 4,050-4,100, marked by the recent support level. On the other hand, the support level is at around 3,950-3,975. The S&P 500 index broke below the short-term consolidation, as we can see on the daily chart (chart by courtesy of http://stockcharts.com):

Futures Contract Extended its Downtrend

Let’s take a look at the hourly chart of the S&P 500 futures contract. It broke below the 4,000 level yesterday, before bouncing back overnight. This morning it is trading closer to the previous local low.

Our speculative long position was closed at the stop-loss level of 4,010. Overall we lost 215 points on that trade. We are still expecting an upward correction from the current levels. However, the trade was closed because of a breakdown below the pre-set stop-loss level and we decided to avoid risk of a bigger loss and wait for another trade opportunity. (chart by courtesy of http://tradingview.com):

Conclusion

The S&P 500 index is expected to open 1.1% higher this morning, as the sentiment improved overnight. For now, it looks like an upward correction or a bounce within a downtrend. However, we may see some more long-lasting advance.

Here’s the breakdown:

- On Monday, the S&P 500 index broke below its previous lows and it was the lowest since over a year.

- Our long position was closed at the stop-loss level of 4,010.

- In our opinion, no positions are currently justified from the risk/reward point of view.

As always, we’ll keep you, our subscribers, well-informed.

Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): No positions are currently justified from the risk/reward point of view.

Thank you.

Paul Rejczak,

Stock Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care