Trading position (short-term, my opinion; S&P 500 futures contract): In my opinion, the short-term outlook is neutral and no positions are currently justified from the risk/reward point of view.

Stocks are about to open lower – more uncertainty as the S&P 500 trades along 4,000.

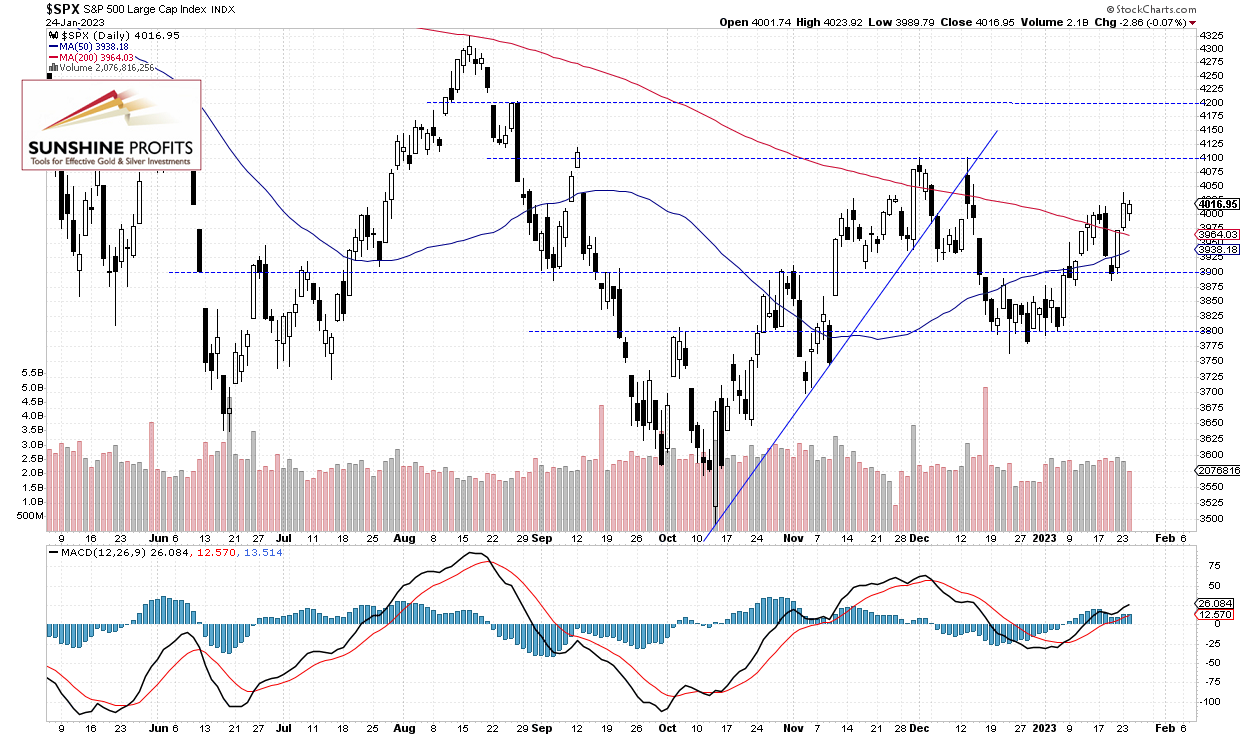

The S&P 500 index lost 0.07% on Tuesday following its recent advances and another breakout above the 4,000 level. Recently the sentiment improved after economic data releases, weakening U.S. dollar, among other factors. The S&P 500 bounced from its last Thursday’s local low of 3,885.54. On Monday it went the highest since December 14, and the high was at 4,039.31.

Today we’ll likely see a sell-off at the open, as the S&P 500 is expected to open 1.1% lower following yesterday’s Microsoft’s quarterly earnings release. So the index will get back below the 4,000 level. The S&P 500 continues to trade within a medium-term consolidation, as we can see on the daily chart:

Futures Contract Went Below 4,000 Again

Let’s take a look at the hourly chart of the S&P 500 futures contract. On Monday it extended a short-term uptrend, but this morning it is retracing some of the recent rally. The resistance level remains at 4,000-4,050.

Conclusion

The stock market will open much lower this morning on worse-than-expected earnings releases. However, we may see more uncertainty and a consolidation of the S&P 500 index. Today after the session’s close we will have a report from TSLA and tomorrow from INTC, among others.

Here’s the breakdown:

- The S&P 500 index is expected to get back below the 4,000 level this morning.

- Investors will be waiting for more earnings, economic data releases.

- In my opinion, the short-term outlook is neutral and no positions are justified from the risk/reward point of view.

As always, we’ll keep you, our subscribers, well-informed.

Trading position (short-term, my opinion; S&P 500 futures contract): In my opinion, the short-term outlook is neutral and no positions are currently justified from the risk/reward point of view.

Thank you.

Paul Rejczak,

Stock Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care