Trading position (short-term; S&P 500 futures; our opinion): no positions are justified from the risk-reward perspective.

Following Tuesday's indecision, stock bulls yesterday took over the reins before running out of steam. Is that an upcoming reversal, or a run of the mill breather? It's the latter, in my opinion. The daily indicators support the upswing to go on, and taking part in the unfolding stock move higher, is a question of risk-reward setup preferences.

Yesterday-presented fundamental realities are valid also today:

(...) Political uncertainties remain, the first presidential debate is over, and there is still no stimulus bill, while corona is getting worse overseas. New lockdowns are hanging in the air, with the U.K. and Israel leading the way. Then, the Fed hasn't done all that much lately, leaving the credit markets relatively unfazed. Continuing claims are trending lower only painfully slowly, and U.S. tensions with China haven't seen a turnaround.

The corona casedemic indeed isn't dying down, but the slow economic recovery goes on as yesterday's ADP non-farm employment change data beating expectations show. It's my opinion that today's ISM manufacturing won't really disappoint, and thus won't present a headwind for stocks.

But is this rough scenario of a measured rise in the S&P 500 prices standing up to scrutiny?

S&P 500 in the Short-Run

I'll start with the daily chart perspective (charts courtesy of http://stockcharts.com ):

The S&P 500 rebound goes on, and has finally picked up some volume yesterday. But isn't it negated by the significant upper knot? I think that yesterday's intraday highs will be challenged and overcome before too long. The bears can make another stand at the Feb highs, which correspond to yesterday's highs too - but I am not counting on that as I see base building at these levels as a more probable scenario.

Should it indeed unfold as described, such a sideways consolidation would offer an opportune entry point on the long side. And if we get a daily downswing or two at these levels, then it's even better.

The Credit Markets' Point of View

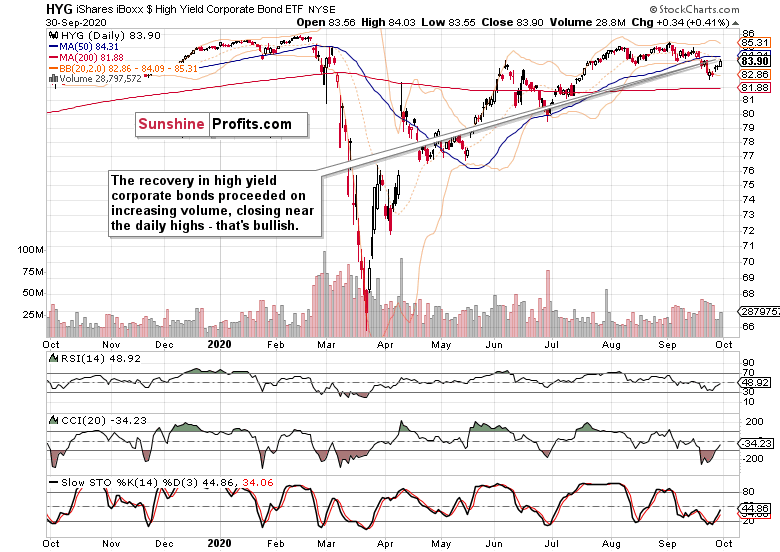

High yield corporate bonds (HYG ETF) speak in favor of the unfolding stock rebound, for yesterday's session has been marked by higher volume and also closed nearer the daily highs than the stock market's daily candle. Let's see this relative daily strength reflected in the below chart.

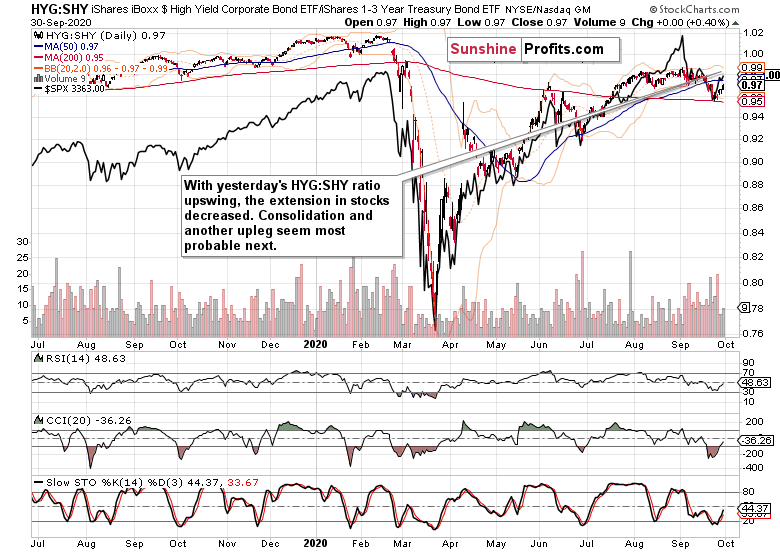

High yield corporate bonds to short-term Treasuries (HYG:SHY) have caught up a little with the stock market upswing. In this light, the $SPX pause is a healthy development. Will it last and power them both higher? I think it's more likely than not, and the examination of Treasuries supports this conclusion.

Market Breadth, Technology and the Dollar

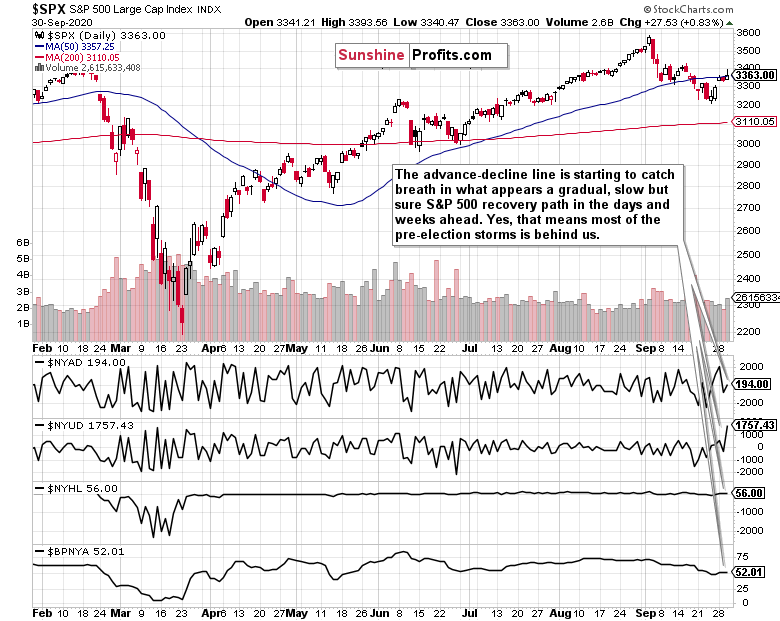

The advance-decline line has recovered a tad from its not so stellar Tuesday performance, which is a tentatively bullish sign. More than this obviously needs to happen, but the ground looks set for stocks to continue trading with a generally bullish bias. Generally bullish, that means a constructive swing structure - i.e. higher highs and higher lows.

Technology (XLK ETF) reflects the turning tide, and I see signs of rotation back into this leading heavyweight sector. Tech certainly looks slated to trade with a bullish outlook over the coming days and weeks - the current rebound doesn't bear the hallmarks of a dead cat bounce.

Finally, the dollar - the risk-off play. After its mid-September rebound, the greenback has pulled back recently. But I don't look for it to roll over just yet - another upswing is more probable than not. But will it fizzle out yet again? I think it will. But before doing so, it could coincide with, catalyze (have your pick) a temporary weakness in stocks that I am looking to take advantage of.

Summary

Summing up, given the risk-reward setup, I am not comfortable chasing stocks at these levels. I look for a more opportune chart setup that could present itself even at higher S&P 500 price levels than currently (futures trade at 3380 as we speak) but with stronger internals. Or more likely, after some sideways trading or a quick dip to offer a discounted entry. Yes, I look for a possible bear raid to fail - the put/call ratio doesn't give it much chance of success really.

Trading position (short-term; S&P 500 futures; our opinion): no positions are justified from the risk-reward perspective.

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits: Analysis. Care. Profits.