Trading position (short-term, my opinion; S&P 500 futures contract): In my opinion, the short-term outlook is neutral, and no positions are currently justified from the risk/reward point of view.

Stock prices continue sideways. Will they break to new highs, or is it a topping pattern?

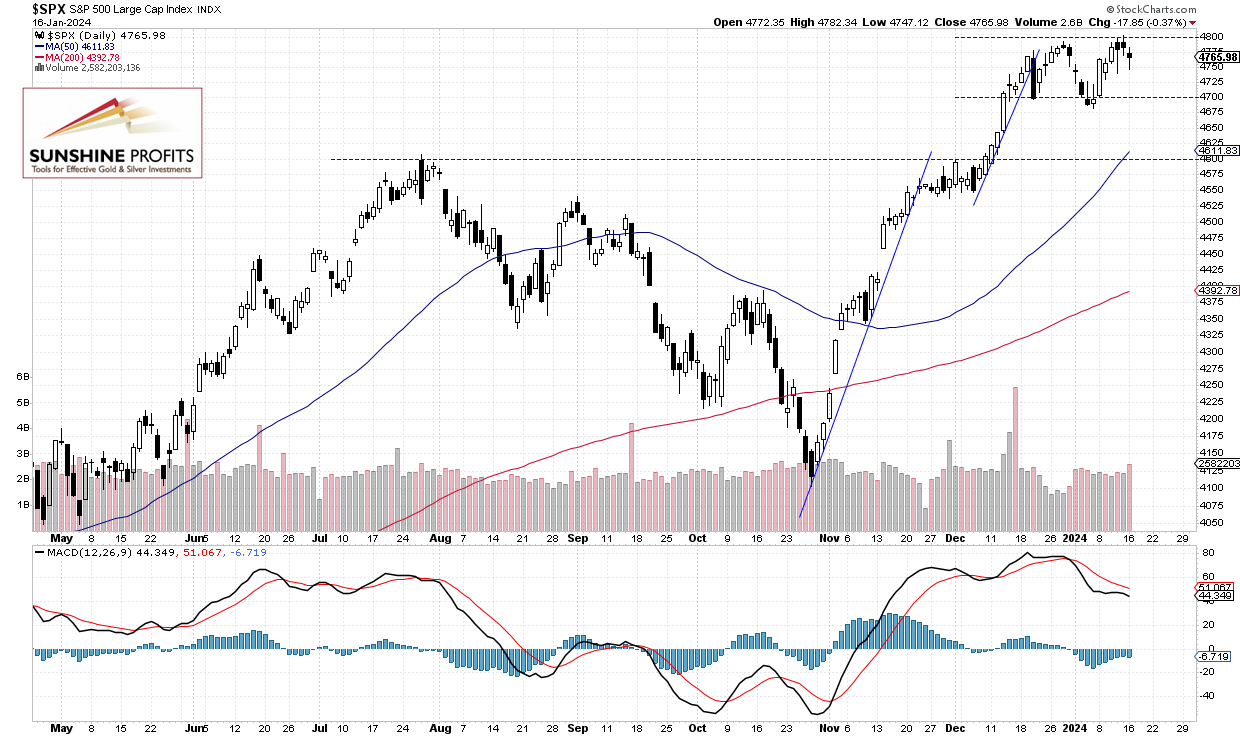

The stock market backed off from its recent local highs once again, as the S&P 500 index failed to break above the 4,800 level. It closed 0.37% lower yesterday, and this morning it may further extend a consolidation. On Friday, the market reached a new medium-term high of 4,802.40, before retracing some of the advance. As mentioned on December 21, “the likely scenario is a consolidation along 4,700-4800”, and despite the recent dip below 4,700, this prediction remains accurate.

Currently it looks like the S&P 500 index is going to further extend a consolidation following November-December rally. How can we capitalize on such trading action? It’s better to shorten the timeframe of the trades and look for buying opportunities at support levels and selling at resistance levels.

In late December and early January, the S&P 500 sold off, reaching its lowest point on Friday since December 13 - the day that marked a pivotal shift in the Fed’s monetary policy, and on Friday, the reached a new yearly high, getting closer to the January 4, 2022, all-time high of 4,818.62 again.

This morning, the S&P 500 futures contract is trading 0.5% lower, indicating lower open for the S&P 500 index. There’s some uncertainty, as more mixed economic data and quarterly earnings releases are coming. Today, the important Retail Sales came in higher than expected at +0.6%, and the expectations were at +0.4% m/m. Investors will wait for some more important earnings reports next week. This week, we've seen some generally better-than-expected earnings from the largest banks.

The market may see more consolidation following November-December rally, as we can see on the daily chart.

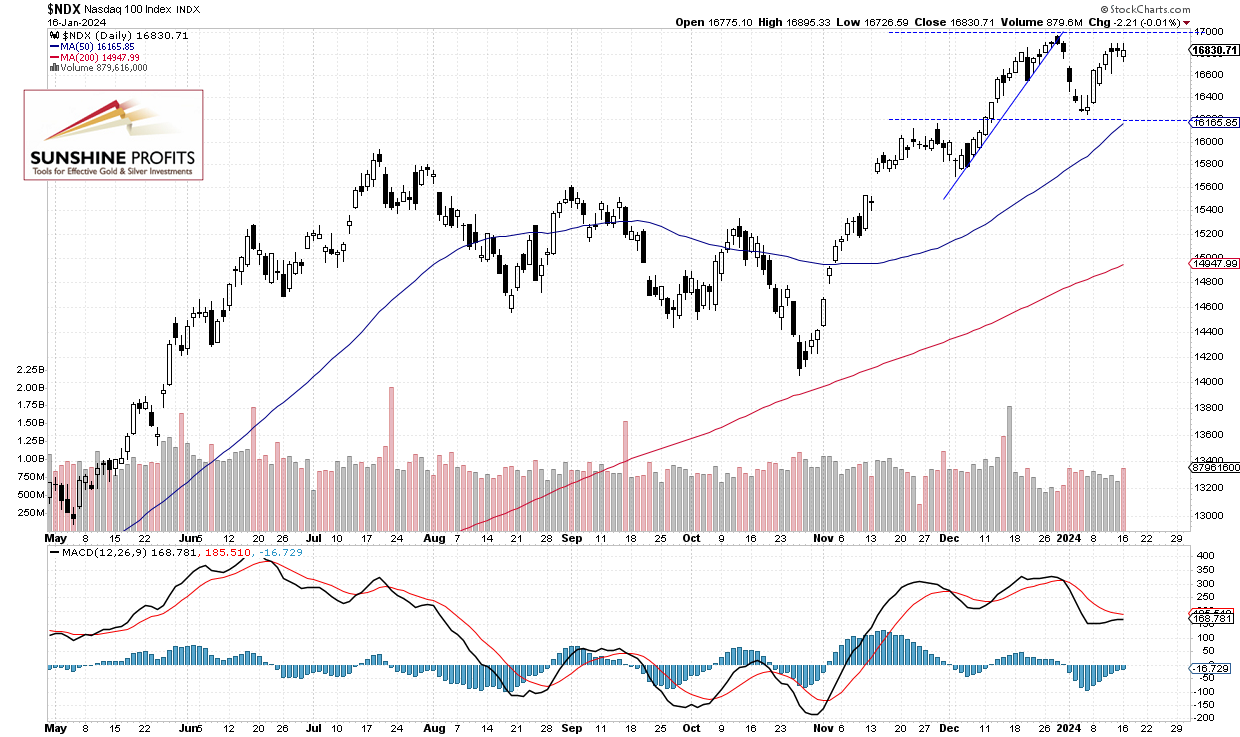

Nasdaq Remained Virtually Flat

Recently, the technology-focused Nasdaq 100 index was extending its uptrend, reaching a new all-time high of 16,969.17 on Thursday, December 28. On December 29, I wrote, “While it continues to trade above its month-long uptrend line, there are, however, short-term overbought conditions that may lead to a downward correction at some point.” Indeed, the market experienced a sharp sell-off then.

Last week on Monday, it bounced sharply, and later it continued the advance. On Wednesday, the Nasdaq 100 closed above the last Tuesday’s daily gap down of 16,687-16,758, which was a positive signal, and on Friday, it went as high as 16,900. However, the question of whether it will break the 17,000 mark remains open.

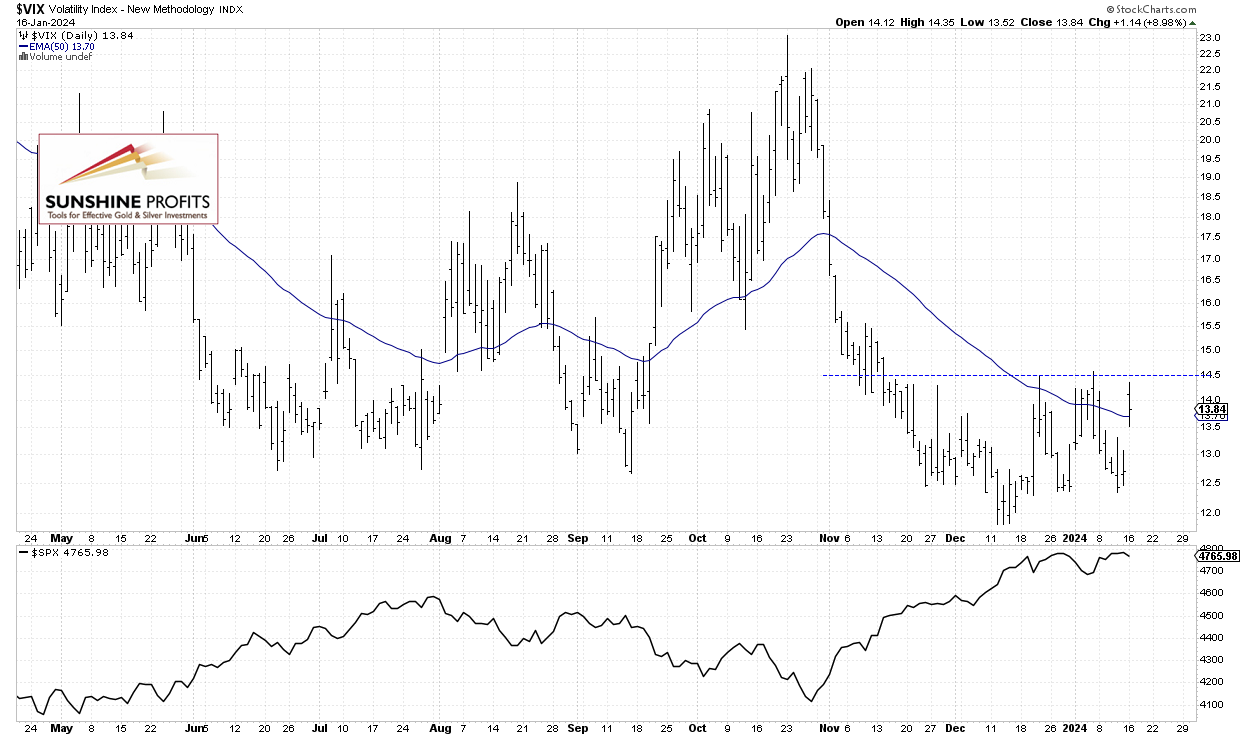

VIX Bounced Sharply

The VIX index, also known as the fear gauge, is derived from option prices. A week ago, it bounced down from the previous highs around the 14.0-14.5 level, which was a positive signal. It then traded along its local lows around 12.5, and yesterday, the volatility index sharply bounced following intraday uncertainty in the stock market.

Historically, a dropping VIX indicates less fear in the market, and rising VIX accompanies stock market downturns. However, the lower the VIX, the higher the probability of the market’s downward reversal.

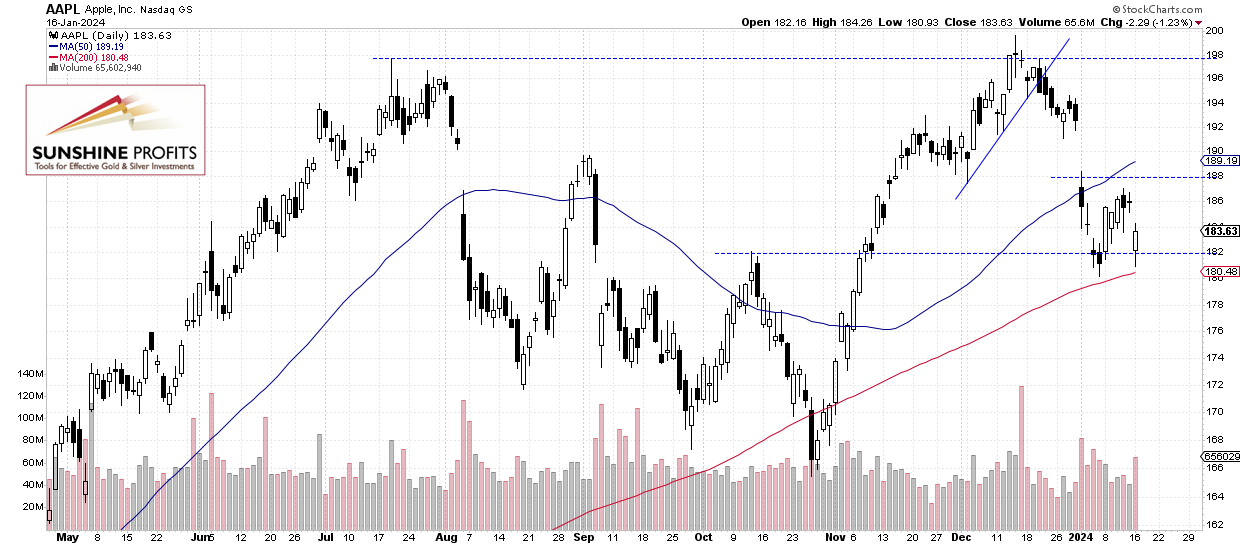

Apple Remains Relatively Weak

Let’s move on to an individual stock – Apple, which is one of the most important market movers. In the previous week, it experienced a sharp sell-off. The decline has been significant, suggesting a change in trend. On January 8, I wrote that “(…) the stock approached a potential support level of around $180.” and “The market may see a rebound here.”.

This prediction held true, however, yesterday, Apple sold off closer to that support again. It remains relatively weak compared to the surging Nvidia stock, the most recognized AI play, which rallied over 3% yesterday, reaching yet another new all-time high. As for Apple, a potential resistance level remains at $188-190.

Futures Contract Trades Along Local Lows

Let’s take a look at the hourly chart of the S&P 500 futures contract. On Friday, it approached its previous high of around 4,840 again. However, this level still stood as the important short-term resistance. Today, the market is trading along the support level of 4,780. The next support level is at 4,750-4,760.

Conclusion

Stocks are set to open 0.5% lower today, and the S&P 500 will extend its yesterday’s decline. However, the market may just continue trading within a month-long consolidation. It’s uncertain whether stocks will resume their medium-term uptrend or simply extend a consolidation following November-December rally. Investors will be awaiting more quarterly corporate earnings releases.

On December 21, I mentioned that “in a short-term the market may see some more uncertainty and volatility”, and indeed, there is a lot of uncertainty following an early-December rally and the breakout of the S&P 500 above the 4,700 level. There is still a chance of extending the medium-term uptrend, as no confirmed negative signals have emerged.

For now, my short-term outlook remains neutral.

I think that no positions are justified from the risk/reward point of view.

Here’s the breakdown:

- The S&P 500 remains relatively close to the 4,800 level, and it may see more attempts at reaching its 2022 all-time high of 4,818.62.

- It still appears more like a consolidation than the start of a new uptrend.

- Short-term uncertainty and volatility may favor trading based on support and resistance levels.

- In my opinion, the short-term outlook is neutral, and no positions are justified from the risk/reward point of view.

As always, we’ll keep you, our subscribers, well-informed.

Trading position (short-term, my opinion; S&P 500 futures contract): In my opinion, the short-term outlook is neutral, and no positions are currently justified from the risk/reward point of view.

Thank you.

Paul Rejczak,

Stock Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care