Trading position (short-term; S&P 500 futures; our opinion): long positions (100% position size) with stop-loss at 3140 and initial upside target at 3550 are justified from the risk-reward perspective.

Upbeat news, upbeat - anywhere you look! Trump at the White House, stimulus talks progressing, and perhaps Powell will help reassure the markets some more later today. Stocks have risen, commodities doubly so, and bond prices plunged - that's exactly what you would expect to see whenever bullish spirits return in earnest.

That has been the core of my writings - since August, I've been warning against the autumn storms, and they arrived not in October as in the 2016 elections, but right at the beginning of September. Stocks declined over 10% from their highs, but I said this correction was no end of the stock bull market - it has much further to run.

Bull markets climb a wall of worry, and the kneejerk reaction to Trump testing corona-positive, is no exception. Look how fast was Friday's downswing erased, and where we are in Tuesday's premarket (S&P 500 futures are trading above 3385 as we speak).

There will be many more instances such as this hiccup - and stocks will be more than willing to look past. Mark my words, this bull market isn't going to end in 2020 - but perhaps it'll become finally broadly recognized as such still this year to the dismay of still much more numerous bears compared to the bulls. Sorry, no gloom and doom, no calls for a market crash, though I expect turbulences to go on till elections are over and done with.

Right now, we have signs aplenty that the stock upswing is ready to go on.

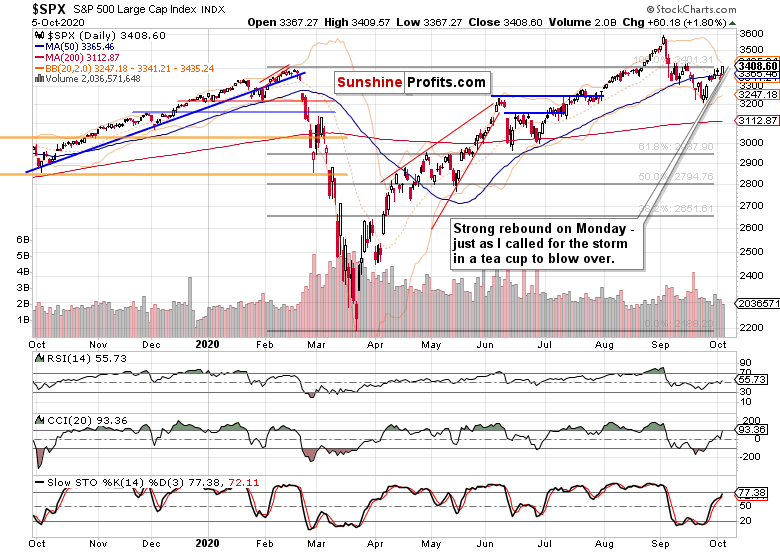

S&P 500 in the Short-Run

I'll start with the daily chart perspective (charts courtesy of http://stockcharts.com ):

The bulls filled in the void strongly yesterday, and I look for them to carry on and extend gains also today. Like it or not, the path of least resistance is still higher. Feb highs will be once again left in the dust, and rightfully so - in my September 30 article, I wrote that it's reasonable to expect the remaining S&P 500 downside to be relatively modest.

Credit Markets and the Dollar Weigh In

High yield corporate bonds (HYG ETF) perfectly illustrate the return of the bulls - closing at the daily highs and on respectable volume. Yes, after the false breakdown below the early September lows, the riskiest corporate bonds are rising again, with the August highs not far off. That's bullish for stocks, very bullish actually.

The ratio of high yield corporate bonds to all corporate bonds (PHB:$DJCB) confirms the bullish takeaway. While still trading below its early June high, it has reached the August highs, while stocks are still below their respective peak. That means the credit ratio is ready to help stocks rise further in the very short run - the momentum is there.

What about the beaten greenback? Not only that I called late in spring for it to roll over, but on September 11, I noted that:

(...) Barely recovering from yesterday's downswing attempt, they're wasting precious time to reach up beyond the 50-day moving average. The advantage of bullish divergences in the daily indicators, is slowly but surely being lost.

The bulls overcame that barrier, yet promptly run out of steam, and we are seeing the sideways-to-down trading working to reassert itself again now. My assessment of the dollar not standing in the way of further stock rally is nicely confirmed by both yellow and black gold. The reflationary efforts are working, and they simply come at a cost - to the world reserve currency.

S&P 500 Sectoral Overview

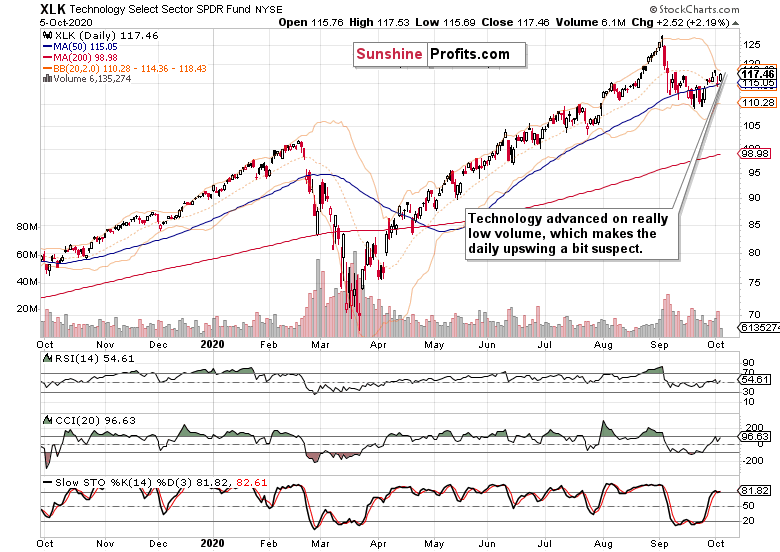

The daily upswing in technology (XLK ETF) isn't really convincing thanks to the very low volume. Is that a one-day occurrence only?

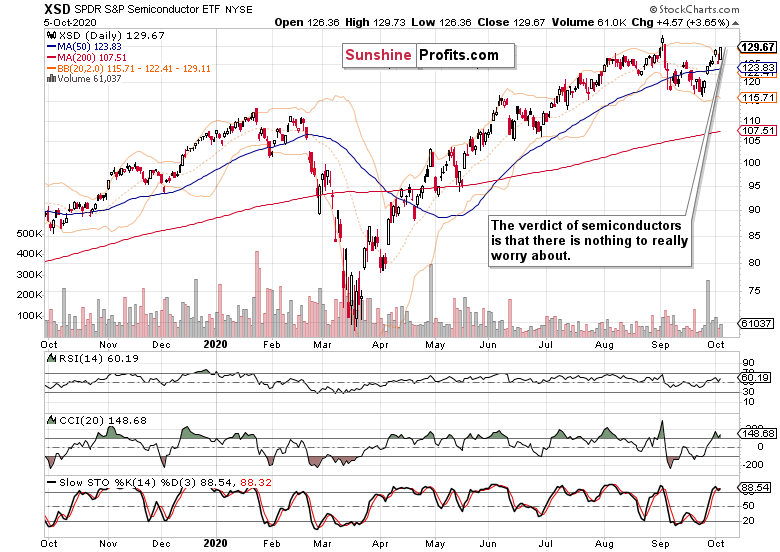

Semiconductors (XSD ETF) think so - their chart posture is stronger, and yesterday's upswing attracted higher relative volume. Intermarket analysis and the art of its interpretation is one of my favorite tools, and if it's worth its weight in salt, then it should show returning strength also in other key S&P 500 sectors.

Healthcare (XLV ETF) is surely doing fine, very fine actually. How long before its early September highs are history?

Financials (XLF ETF) have more work cut out for themselves - their underperformance continues. And I look for them to take more time before they catch up with vengeance. We're nowhere near that point - for now, they're stopping to be a drag on S&P 500 prices, which is encouraging given the corona fallout in bank loans and real estate that still hasn't hit the fan.

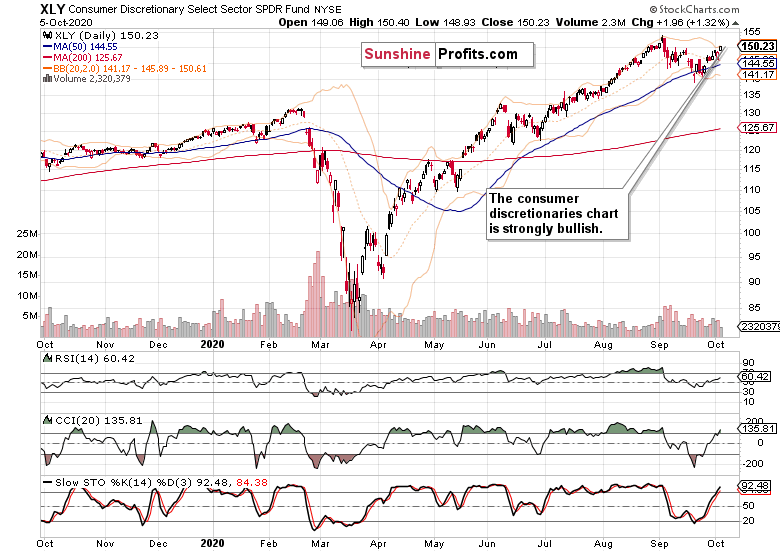

Consumer discretionaries (XLY ETF) are one of the best performing sectors, and look ready to overcome their early September highs just about when healthcare does the same.

Summary

Summing up, stock upswing is more likely to go on than not - the many signs come from credit markets, Russell 2000 and emerging market stocks. With commodities rising, dollar on the defensive and Treasury yields up, it's risk on again, and many asset classes stand to benefit. In stocks, I still look for technology to catch up a bit more, relatively speaking, but the even current sectoral overview sends reliable signals of the 500-strong index continuing its climb.

The above perfectly rhymes with my yesterday's parting words: the dollar continues treading water, and I fully expect (as I have been saying for months) that its 2020 top is in, which will facilitate via different avenues the gain in many risk-on trades, including stocks. The credit markets are supporting this notion, and once technology regains its luster, the S&P 500 fireworks would return. As for now though, that appears weeks away still, so a very measured grind higher remains the most likely scenario for the days and immediate weeks ahead.

Trading position (short-term; S&P 500 futures; our opinion): long positions (100% position size) with stop-loss at 3140 and initial upside target at 3550 are justified from the risk-reward perspective.

Thank you.

Monica Kingsley

Stock Trading StrategistSunshine Profits: Analysis. Care. Profits.