Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): long positions with entry at 4,340 price level, with 4,440 as the stop-loss (take profit) and 4,740 as the price target.

The S&P 500 index extended its uptrend once again after breaking above the 4,600 level. However, today we will likely see some profit-taking action.

The broad stock market index gained 1.23% on Tuesday following its Monday’s gain of 0.7%. Stocks extended their uptrend on a potential Ukraine conflict ceasefire news yesterday. There’s still a lot of geopolitical uncertainty, but investors keep on jumping back into stocks. This morning the index is expected to open 0.3% lower and we may see some short-term profit-taking action.

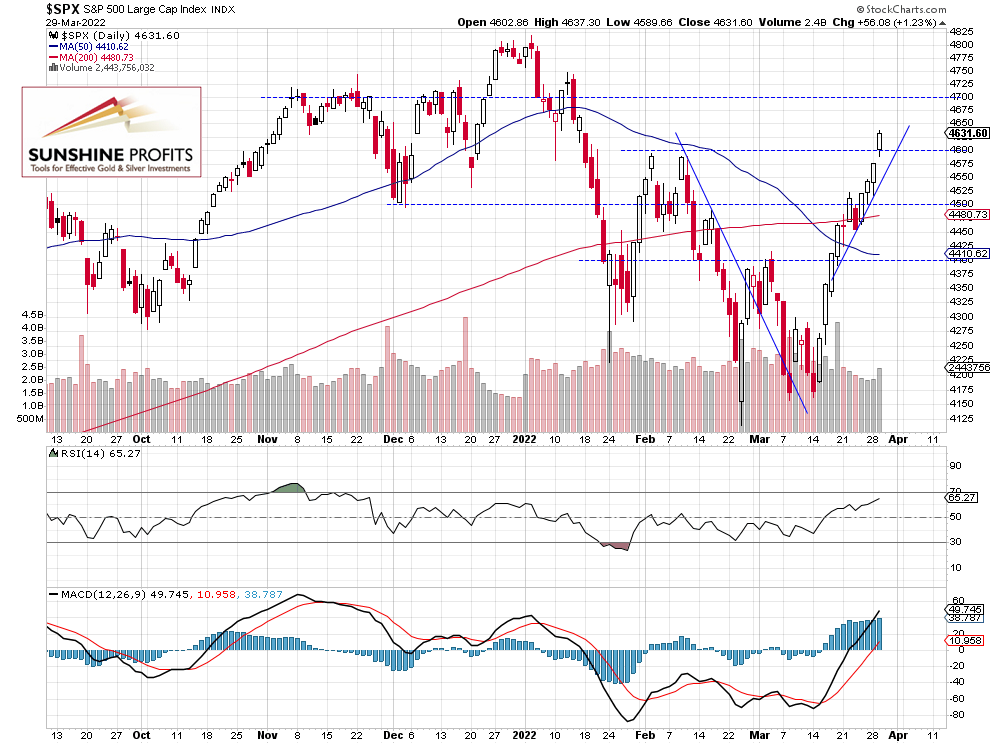

The nearest important resistance level is now at around 4,650-4,700. On the other hand, the support level is at 4,550-4,600, marked by the recent resistance level. The S&P 500 index broke above its January-February local highs along the 4,600 level, as we can see on the daily chart (chart by courtesy of http://stockcharts.com):

Futures Contract Remains Above its Upward Trend Line

Let’s take a look at the hourly chart of the S&P 500 futures contract. It is trading above the short-term upward trend line and above the 4,600 level. We can see some technical overbought conditions, however, there have been no confirmed negative signals so far.

We are maintaining our profitable long position from the 4,340 level. (chart by courtesy of http://tradingview.com):

Conclusion

The S&P 500 index will likely open 0.3% lower this morning and we may see some short-term profit-taking action. There have been no confirmed negative signals so far. However, there are some clear technical overbought conditions that may lead to a correction.

The market will be waiting for Friday’s monthly jobs data release. This morning we’ve got the ADP Non-Farm Employment Change release and it was as expected.

Here’s the breakdown:

- The S&P 500 index further extended its uptrend yesterday, but in the near-term some profit-taking action seems likely.

- We are maintaining our profitable long position (opened on Feb. 22 at 4,340).

- We are still expecting some upside from the current levels; however, it is time to get more cautious as there may be a downward correction at some point.

As always, we’ll keep you, our subscribers, well-informed.

Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): long positions with entry at 4,340 price level, with 4,440 as the stop-loss (take profit) and 4,740 as the price target.

Thank you.

Paul Rejczak,

Stock Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care