Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): long positions with entry at 4,225 price level, 4,010 as a stop-loss and 4,470 as an initial price target.

Stocks extended their downtrend yesterday, but they rebounded and closed positive. So was it an upward reversal or just another upward correction?

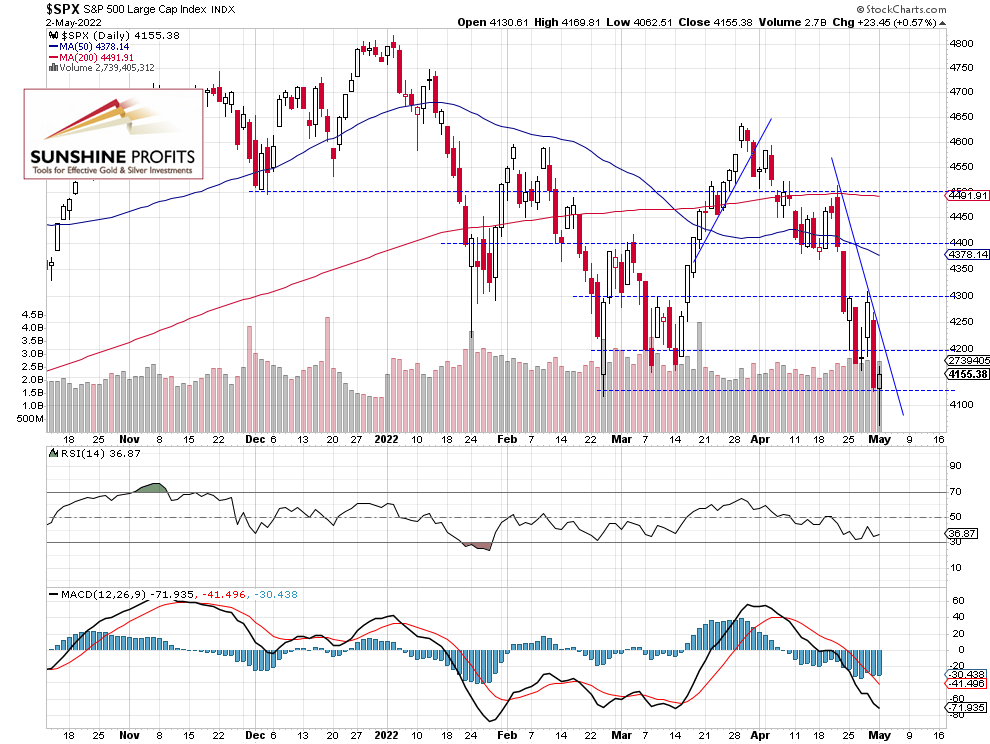

The S&P 500 index gained 0.57% on Monday after falling to the daily low of 4,062.51. It was the lowest since last year’s May. The market reacted to the quarterly earnings, poor economic data releases, Fed’s monetary policy tightening plans and Ukraine conflict. Stocks reversed their intraday decline and it may look like a more permanent reversal. However, there have been no confirmed positive signals so far. This morning the S&P 500 index is expected to open 0.2% higher and we may see a consolidation ahead of tomorrow’s important Fed’s interest rate decision release.

The nearest important resistance level is now at around 4,200-4,250. On the other hand, the support level is at 4,050-4.100, marked by the local low. The S&P 500 index extended its four-month-long downtrend, as we can see on the daily chart (chart by courtesy of http://stockcharts.com):

Futures Contract – Consolidation Following Bounce

Let’s take a look at the hourly chart of the S&P 500 futures contract. Yesterday it fell below the 4,100 level, but it quickly retraced the decline. This morning it is trading within a consolidation along the 4,150 level.

On Thursday before the opening of the cash market we decided to open a speculative long position (4,225 level) with the stop-loss level of 4,090 and the initial target profit level of 4,470.

Yesterday, due to an extraordinary volatility we decided to lower the stop-loss to the 4,010 level. There’s a potential support level of 4,050, marked by the local lows from May of 2021. (We move the stop-loss level only one time). We are still expecting an upward correction from the current levels. (chart by courtesy of http://tradingview.com):

Conclusion

The S&P 500 index will likely open 0.2% higher today and we may see a consolidation following yesterday’s rebound. There’s a lot of uncertainty concerning tomorrow’s Fed’s release. Friday’s and yesterday’s panic may suggest that at least a short-term bottom may be in sight.

Here’s the breakdown:

- The S&P 500 index extended its downtrend yesterday, but it closed higher.

- We moved our Thursday’s long position’s stop-loss level to 4,010 (one time only).

- In our opinion a speculative long position (from the 4,225 price level) is justified from the risk/reward perspective - we are still expecting an upward correction from the current levels.

As always, we’ll keep you, our subscribers, well-informed.

Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): long positions with entry at 4,225 price level, 4,010 as a stop-loss and 4,470 as an initial price target.

Thank you.

Paul Rejczak,

Stock Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care