Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): long positions with entry at 4,340 price level, with 4,020 as a stop-loss and 4,640 as an initial price target.

The S&P 500 extended its short-term uptrend on Friday after breaking above the early March local high. Will we see some profit-taking action soon?

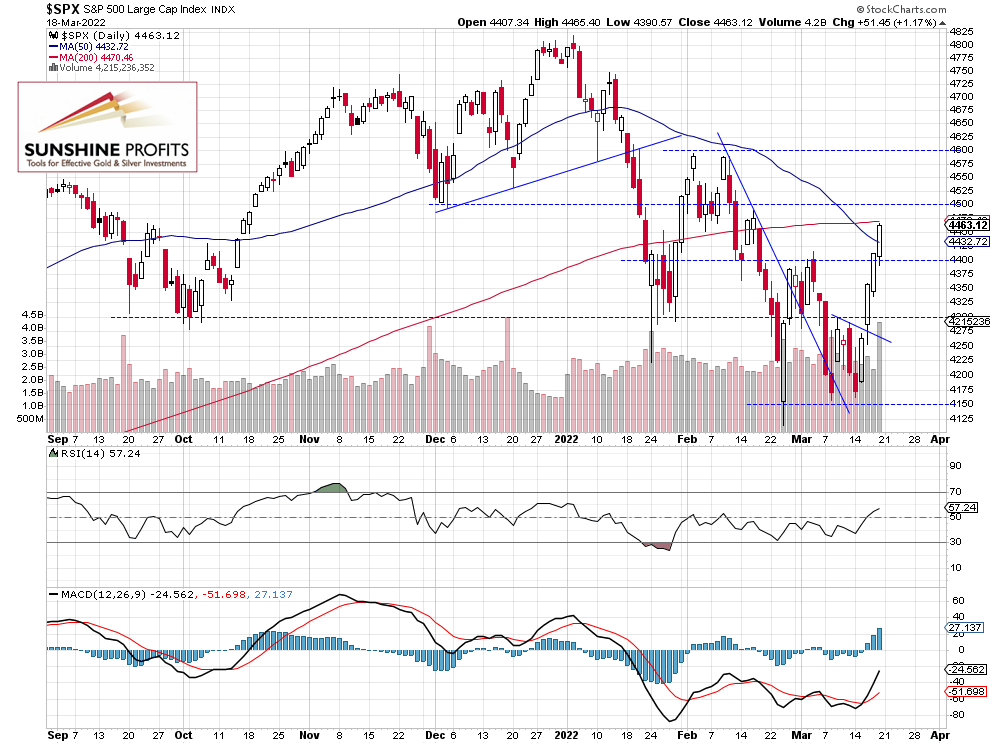

The broad stock market index gained 1.17% on Friday following its Thursday’s advance of 1.2%. Stocks extended their rally and since last Monday’s low of around 4,162, the index has already gained over 300 points. The market accelerated higher after the Wednesday’s FOMC interest rate hike. There’s still a lot of uncertainty concerning the ongoing Ukraine conflict, however, investors were jumping back into stocks despite that geopolitical uncertainty.

This morning the S&P 500 index is expected to open 0.1% lower. We may see a consolidation or some profit-taking action following the mentioned 300-point rebound from the last Monday’s low.

The nearest important resistance level is at around 4,500. On the other hand, the support level is at 4,400-4,415, marked by the previous local high. The S&P 500 index trades just below its early February consolidation, as we can see on the daily chart (chart by courtesy of http://stockcharts.com):

Futures Contract Broke Above the Previous High

Let’s take a look at the hourly chart of the S&P 500 futures contract. On Friday it broke above the early March local highs of around 4,400. It’s the nearest important support level right now. We may see a correction following the recent run-up. However, there have been no confirmed negative signals so far.

We are maintaining our profitable long position from the 4,340 level, as we are still expecting a bullish price action in the near-term (chart by courtesy of http://tradingview.com):

Conclusion

Stocks extended their uptrend once again on Friday, as the S&P 500 index broke above the previous local high. It rallied over 300 points from its last Monday’s local low, so we may see a consolidation or some profit-taking action soon. This morning the broad stock market’s gauge is expected to open 0.1% lower.

The war In Ukraine is still a negative factor for the markets.

Here’s the breakdown:

- The S&P 500 index rallied over 300 points from the last Monday’s local low; we may see a correction at some point.

- We are maintaining our profitable long position (opened on Feb. 22 at 4,340).

- We are still expecting an advance from the current levels.

As always, we’ll keep you, our subscribers, well-informed.

Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): long positions with entry at 4,340 price level, with 4,020 as a stop-loss and 4,640 as an initial price target.

Thank you.

Paul Rejczak,

Stock Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care