Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): long positions with entry at 4,225 price level, 4,010 as a stop-loss and 4,470 as an initial price target.

The Fed’s interest rate decision led to rally in stocks yesterday. So is the month-long downtrend over?

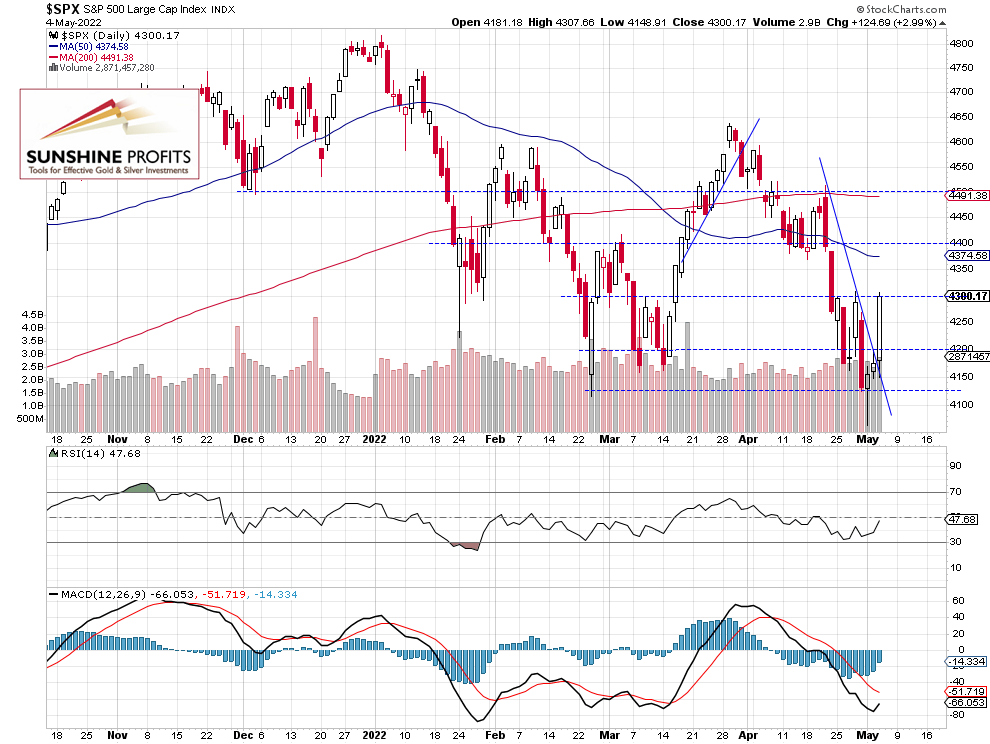

The S&P 500 index gained 2.99% on Wednesday, as it got back to the 4,300 level following the Fed’s monetary policy release. The market confirmed its short-term upward reversal after breaking above the 4,200 level. There’s still an uncertainty concerning weakening economy and the Russia-Ukraine conflict, however, yesterday’s trading session was very bullish and we may see more advances.

This morning the S&P 500 index is expected to open 0.6% lower, so we may see a profit taking action following yesterday’s rally. Investors will now wait for Friday’s monthly jobs data release.

The nearest important resistance level is now at around 4,300. On the other hand, the support level is at 4,200-4.250, marked by the recent resistance level. The S&P 500 index broke above its short-term downward trend line, as we can see on the daily chart (chart by courtesy of http://stockcharts.com):

Futures Contract Trades Along the Previous Local Highs

Let’s take a look at the hourly chart of the S&P 500 futures contract. Yesterday it retraced its recent decline, as it got back to the resistance level of 4,300. The market may see an attempt at breaking higher, however, first it will likely fluctuate following yesterday’s rally.

We are maintaining our profitable long position from the 4,225 level. We are still expecting an upward correction from the current levels. (chart by courtesy of http://tradingview.com):

Conclusion

The S&P 500 index is expected to open 0.6% lower following 3% rally. There’s still an uncertainty concerning tomorrow’s monthly jobs data release, but yesterday’s reversal will likely last.

Here’s the breakdown:

- The S&P 500 index rallied 3% on Wednesday, as it got away from the support area of around 4,100-4,200.

- In our opinion a speculative long position (from the 4,225 price level) is justified from the risk/reward perspective - we are still expecting an upward correction from the current levels.

As always, we’ll keep you, our subscribers, well-informed.

Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): long positions with entry at 4,225 price level, 4,010 as a stop-loss and 4,470 as an initial price target.

Thank you.

Paul Rejczak,

Stock Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care