Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): long positions with entry at 4,340 price level, with 4,020 as a stop-loss and 4,640 as an initial price target.

The S&P 500 reached above the 4,500 level following Monday’s consolidation. Will stocks continue their uptrend?

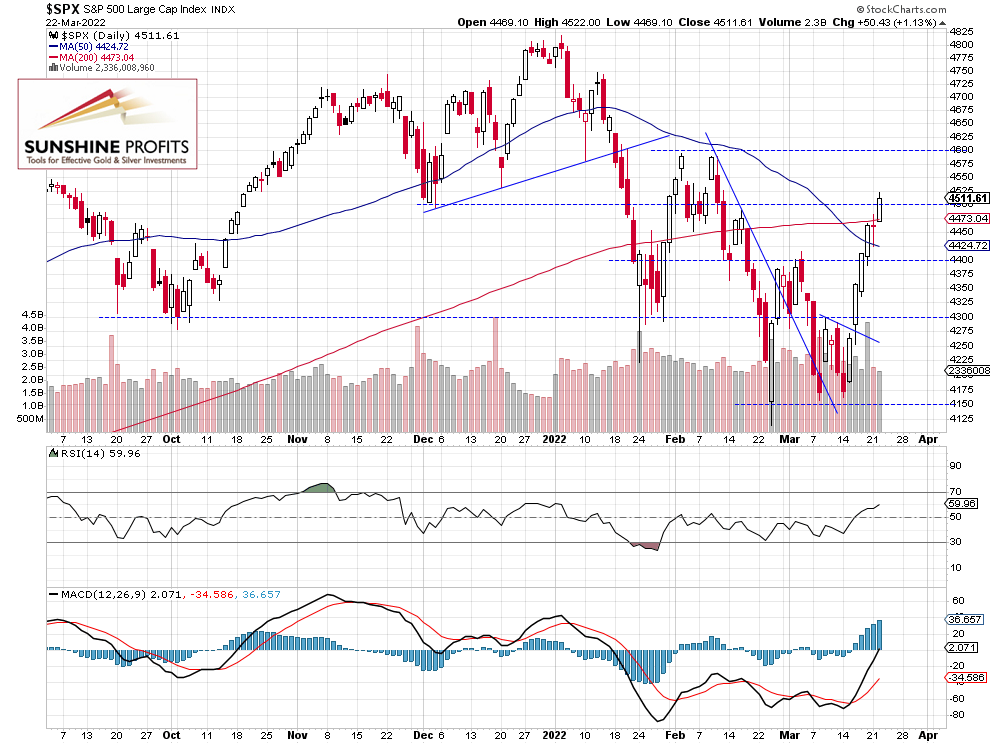

The broad stock market index gained 1.13% on Tuesday, Mar. 22, as it extended the uptrend from its last week’s Monday’s low of around 4,162. The S&P 500 index gained 360 points in a little more than a week. So will the uptrend continue despite some short-term overbought conditions? There have been no confirmed negative signals so far. However this morning the index is expected to open 0.5% lower and we may see a short-term profit-taking action.

There’s still a lot of uncertainty concerning the ongoing Ukraine conflict, but investors were recently jumping back into stocks despite that geopolitical uncertainty.

The nearest important resistance level is now at around 4,550-4,600, marked by the previous local highs. On the other hand, the support level is at 4,450, marked by Monday’s fluctuations. The S&P 500 index retraced more of its February decline, as we can see on the daily chart (chart by courtesy of http://stockcharts.com):

Futures Contract Got Back Below the 4500 Level

Let’s take a look at the hourly chart of the S&P 500 futures contract. Yesterday it broke above the 4,500 level and it was the highest since the early February. This morning the market is backing off slightly after the recent rally.

We are maintaining our profitable long position from the 4,340 level, as we are still expecting a bullish price action in the near-term (chart by courtesy of http://tradingview.com):

Conclusion

Stocks are expected to open lower this morning and we will likely see some profit-taking action. For now it looks like a correction within an uptrend. The war In Ukraine is still a negative factor for the markets.

Here’s the breakdown:

- The S&P 500 index extended its short-term gains on Tuesday, as it broke above the 4,500 level.

- We are maintaining our profitable long position (opened on Feb. 22 at 4,340).

- We are still expecting an advance from the current levels.

As always, we’ll keep you, our subscribers, well-informed.

Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): long positions with entry at 4,340 price level, with 4,020 as a stop-loss and 4,640 as an initial price target.

Thank you.

Paul Rejczak,

Stock Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care