Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): short positions with entry at 4,678 price level, with 4,720 as a stop-loss and 4,350 as a price target.

The S&P 500 index is at the 4,700 level again following Monday’s-Tuesday’s rally of around 200 points. Are new record highs inevitable?

For in-depth technical analysis of various stocks and a recap of today's Stock Trading Alert we encourage you to watch today's video.

Video Technical Breakdown is an addition to the STA, distributed along with the premium analysis, to keep you, our subscribers, well-informed with everything happening on the charts.

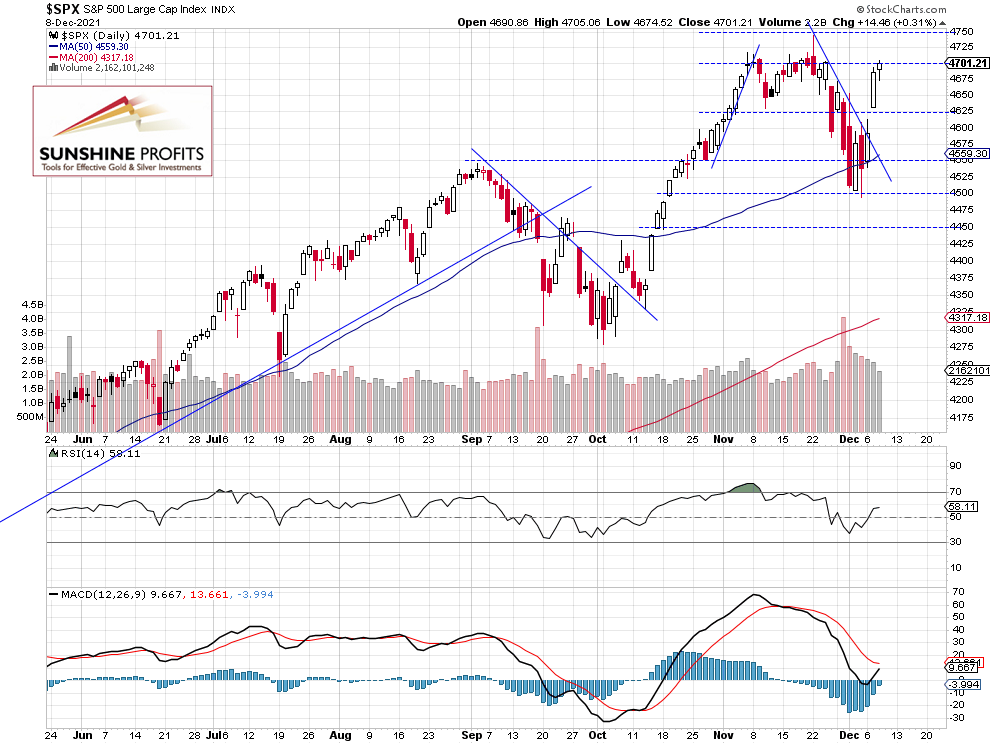

The S&P 500 index gained 0.31% yesterday, as it extended its recent rally. The market closed slightly above the 4,700 mark and it retraced almost all of its late Nov. – early Dec. decline. On Friday the index fell to the local low of 4,495.12 and it was 5.24% below the Nov. 22 record high of 4,743.83. This morning the index is expected to open 0.4% lower and we may see some more short-term profit taking action following the rally from last week’s low.

The nearest important support level remains at 4,700-4,750, marked by the record high, among others. On the other hand, the support level is now at around 4,610-4,630, marked by Tuesday’s daily gap up of 4,612.60-4,631.97. The S&P 500 is now at its previous consolidation, as we can see on the daily chart (chart by courtesy of http://stockcharts.com):

We are maintaining our short position

Let’s take a look at the hourly chart of the S&P 500 futures contract. It broke above the downward trend line on Monday and it rallied on Tuesday. The market is now close to our stop-loss level of 4,720. We’ve opened a short position on Tuesday, Nov. 23 at the 4,678 price level. (chart by courtesy of http://tradingview.com):

Conclusion

The S&P 500 index will likely continue to fluctuate following a relatively large short-term rally from Friday’s low. There have been no confirmed short-term negative signals so far and we may see an attempt at breaking above the 4,700 level.

Here’s the breakdown:

- The S&P 500 is expected to fluctuate and we may see some short-term profit taking action this morning.

- We are maintaining our short position from the 4,678 level.

As always, we’ll keep you, our subscribers, well-informed.

Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): short positions with entry at 4,678 price level, with 4,720 as a stop-loss and 4,350 as a price target.

Thank you.

Paul Rejczak,

Stock Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care